Hotel Lenders and Investors at Ease With Direction of Investment Market

Lower interest rates, revenues that are outpacing expense growth and below average supply additions are combining to give lenders and investors a greater comfort level with the U.S. lodging investment market, according to the 2012 edition of Hospitality Investment Survey, published by PKF Hospitality Research, LLC (PKF-HR), an affiliate of PKF Consulting USA, LLC (PKFC).

"Double-digit profit growth, coupled with the low cost of capital and limited supply growth, make hotel real estate an attractive option to commercial real estate investors"

"Double-digit profit growth, coupled with the low cost of capital and limited supply growth, make hotel real estate an attractive option to commercial real estate investors," said Scott Smith MAI, vice president in the Atlanta office of PKFC. "Investors acknowledge the existence of all the economic uncertainties, but the industry fundamentals are strong enough to overcome these concerns."

Smith noted that the optimistic attitude appears to be somewhat bifurcated. "Institutional investors and private equity funds are showing a bias towards full-service and resort hotels in the major markets, where profit growth has been the greatest," Smith added.

On the other end of the lodging spectrum, transaction activity involving limited-service assets outside the major markets is extremely slow. Survey results show that there currently is a significant gap between the price a buyer is willing to pay and what a seller is willing to accept. However, as market conditions start to improve in secondary and tertiary cities, Smith said he anticipates that investors will look more favorably at those markets and property types for higher yielding opportunities.

Investment Criteria Eases

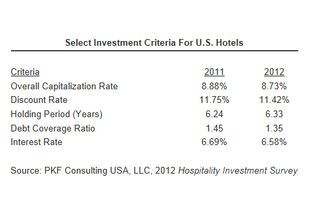

Lenders report a year-over-year easing of investment criteria, with the overall capitalization rate (OAR) dipping 15 basis points from 8.73 percent, the lowest in the past 15 years.

"Historically low interest rates and the expected improvement in property level net operating income (NOI) are causing capitalization rates to contract in all segments," said Bill Morton, associate in the Indianapolis office of PKFC. "In fact, cap rates for recent transactions in high barrier-to-entry markets have sunk as low as 5.0 percent."

The survey also revealed that discount rates, or un-leveraged internal rates of return (IRR), declined by 33 basis points to 11.42 percent. "This further demonstrates investor expectations of improved market fundamentals and less risk," Morton noted.

Financing Has Stabilized

Hospitality bankers and mortgage companies responding to the Hospitality Investment Survey reported that mortgage terms have remained virtually the same from 2011 to 2012. During this period, the loan-to-value ratio declined by 80 basis points, while interest rates, on average, fell just 0.1 percentage point, and little change was reported for the average loan term (year of balloon) and amortization period.

"Lenders remain cautious," Smith stated. "The loan-to-value ratio appears to be stabilized in the mid-60 percent range. This is lower than the level experienced during the prosperous period from 2005 through 2007, but similar to the long range average."

The 2012 Hospitality Investment Survey also identified the increasing use of Small Business Association 504 loans, a program most frequently offered by local and regional banks to investors purchasing limited-service properties in secondary markets. The availability of financing for the construction of any type of new hotel remains very scarce.

Favorable Future

Investments in the hospitality industry will continue to become more attractive due to the expected continued improvement in industry performance and the continued availability of cheap capital. With capitalization rates hovering near record low levels, current owners will eventually benefit from a rise in property values.

The 2012 Hospitality Investment Survey presents the results from surveys of active hotel owners, equity investors, and debt providers concerning the criteria used for hotel transactions that have, or will occur during 2011 and 2012. The six-page report contains tables that show the current and historical averages of a dozen critical investment measurements, including capitalization rates and mortgage terms by property type.

Copies of the 2012 Hospitality Investment Survey are available for purchase in PKFC's online store at www.pkfc.com/store, or by calling (855) 223-1200.

About CBRE Group, Inc.

CBRE Group, Inc. (NYSE:CBRE), a Fortune 500 and S&P 500 company headquartered in Dallas, is the world's largest commercial real estate services and investment firm (based on 2023 revenue). The company has more than 130,000 employees (including Turner & Townsend employees) serving clients in more than 100 countries. CBRE serves a diverse range of clients with an integrated suite of services, including facilities, transaction and project management; property management; investment management; appraisal and valuation; property leasing; strategic consulting; property sales; mortgage services and development services. Please visit our website at www.cbre.com.