DLA Piper 2013 U.S. Hospitality Outlook Survey reveals "the show must go on"

Hospitality executives remain bullish on industry despite political gridlock in Washington

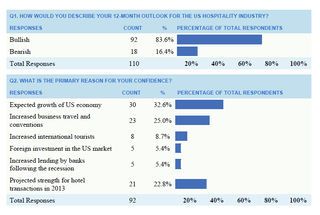

Despite political gridlock in Washington, DC, and some concerns about economic growth, an extraordinary number of US hospitality executives expect their industry to perform well in 2013, according to DLA Piper's 2013 Hospitality Outlook Survey, which was revealed today at the Americas Lodging Investment Summit. With that in mind, US hospitality industry executives are also optimistic that market conditions have created especially good opportunities for investors on the hunt to buy hotels in 2013. The survey, measuring the attitudes and perspectives of top executives within the hospitality industry, reveals that 84 percent of respondents describe their 12-month outlook for the US hospitality industry as "bullish," the highest recorded since 2011 when 88 percent of respondents described themselves as bullish. This is the fifth consecutive year that DLA Piper has conducted its research on behalf of the hospitality industry.

According to respondents, fueling their optimism is confidence that the broader US economy will continue its steady, albeit modest, growth. Others cite increased growth in business and convention-related travel, as well as projected strength for hotel transactions.

Taking a look at the operational side, most of the people surveyed expect hotel real estate values to rise at least somewhat in 2013. Respondents also have a broad expectation that hotel operators will succeed at boosting room rates.

On the other hand, a few things are tempering executives' enthusiasm, primarily political gridlock in Washington. When the survey was conducted in December, more than half of respondents believed that the "fiscal cliff," if not averted, would be a significant deterrent to deal making in 2013. Even after a deal was reached, many respondents said the deal had failed to decisively solve the country's fiscal problems.

"Enthusiasm for the hospitality industry remains high, however the tense situation in Washington and its possible effects on the hospitality industry remain top concerns," said Sandra Kellman, global co-chair of DLA Piper's Hospitality and Leisure practice. "Looking ahead, it is clear that the industry has an 'on-with-the-show' mentality given projected strength for hotel transactions, the price of US hotel assets rising and gaining momentum, and hotel operators potentially raising rates."

According to DLA Piper, the survey yielded a number of other interesting conclusions, including:

- 84 percent of respondents describe their 12-month outlook for the US hospitality industry as "bullish," up from 80 percent in 2012.

- 82 percent of respondents expect hotel asset values to trend upward or slightly upward in 2013, compared to 47 percent of respondents in 2012 who noted that they expected hotel assets to rise in the year ahead.

- In a slight drop, 85 percent of respondents believe market conditions have created good buying opportunities for well-capitalized investors, down from 91 percent last year.

- The upscale market remains the most attractive opportunity, say respondents. The midscale market remains their second-most attractive opportunity.

- While private equity is once again seen by most executives as the most active type of hotel investor in 2013, the portion of respondents who insist foreign investors will lead the way has doubled, to 20 percent.

- Commercial lenders will be the most active type of lender, say 43 percent of respondents, up from 34 percent last year.

- Respondents believe Brazil remains the most attractive opportunity for outbound US investors. The future World Cup host received 35 percent of the votes, with China placing second, at 25 percent.

- Spain has replaced Italy as the European country most likely to experience economic problems—43 percent of respondents cite it, while only 16 percent cite Italy, a near-reversal of last year's numbers.

- Among the 16 percent of respondents who describe themselves as "bearish" about the hospitality industry, just over half cited the struggling US economy as the top concern.

This information is intended as a general overview and discussion of the subjects dealt with. The information provided here was accurate as of the day it was posted; however, the law may have changed since that date. This information is not intended to be, and should not be used as, a substitute for taking legal advice in any specific situation. DLA Piper is not responsible for any actions taken or not taken on the basis of this information. Please refer to the full terms and conditions on our website. Copyright © 2013 DLA Piper. All rights reserved.

About DLA Piper (www.dlapiper.com) | DLA Piper is a global law firm with 4,200 lawyers located in more than 30 countries throughout the Americas, Asia Pacific, Europe and the Middle East, positioning it to help companies with their legal needs anywhere in the world. In certain jurisdictions, this information may be considered attorney advertising.

Josh Epstein

Media Relations

212.776.3838

DLA Piper LLP (US)