Global Hotel Investment Sentiment Survey Shows Positive Trading Expectations for EMEA Hotels

Focused on Core German Cities, London & Paris

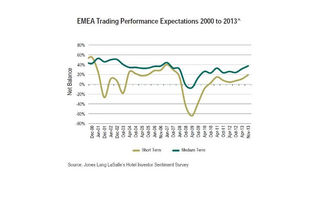

Jones Lang LaSalle Hotels & Hospitality Group (JLL H&H) has released the results of their Global Hotel Investment Sentiment Survey and its good news for hotels in the EMEA region with trading expectations remaining positive both for the short term (six months) and medium term (two years) with investors feeling more confident than they did earlier this year.

Of the 31 cities tracked, 21 are expected to show growth in performance over the next

six months, rising to 28 when looking to the medium term. Investor sentiment is highest for cities in Germany (Munich, Frankfurt and Hamburg) which continues to benefit from robust underlying market fundamentals, followed by London and Paris.Capitalisation rate requirements are expected to remain relatively steady over the next

six months, increasing marginally to 7.2% compared to 7.1% in April 2013 – reflecting an optimistic, yet cautious approach from investors.Jon Hubbard, CEO Northern Europe at JLL H&H says: "We have already started to see

rising interest from institutional investors keen to tap into the hotel market as they provide higher returns than alternative real estate options. Alongside this institutional interest, we continue to see HNWI and Sovereign Wealth Funds looking to acquire trophy assets in key cities throughout Europe.""In terms of investors' target strategies for the next six months, nearly 50% of

investors are primarily focusing on acquisitions, and are broadening their search to markets such as Dublin, Manchester and Barcelona. This acquisition focus has fallen 11.4% since the last survey, which is somewhat surprising but may reflect that with increased volumes transacted in 2013, some investors will be focused on managing assets acquired." Continued Hubbard.Some of the weakest results are in markets in Southern Europe, with investors

anticipating trading performance to decline in Lisbon, Milan and Madrid over the next six months. These results reflect the continued economic uncertainty in Southern Europe which has a detrimental impact on domestic tourism.However Barcelona is bucking this trend. Improved economic conditions and a recovery

in global travel led to a strong uptick in occupancy during 2010, fuelling double-digit RevPAR growth. Although growth slowed the following year, it has remained in positive territory ever since, despite the deepening economic crisis in Spain. The city has done well considering hotel supply has increased by more than 70% over the last 10 years.Christoph Härle, CEO Continental Europe at JLL H&H said "These results are

compounded by the improvement in trading performance expectations by our survey respondents. In our previous report short term trading expectations, although positive, were rather cautious, with a positive net balance sentiment of 7.5%. Just six months later, investors are more optimistic, with a 31.7% positive net balance for the short term and 58.5% during the medium term, making Barcelona one of the top 10 cities in terms of investor confidence, just a few places behind London and Dubai."Expectations for leveraged IRRs in Barcelona have fallen slightly over the last six

months and at 12% they are 1.7% below the EMEA average, reflecting investors' positive view of the market. Survey respondents expect capitalisation rates to average at 7.1% in the short term, which is lower than the long term average of 7.7% meaning investors are willing to pay higher prices for assets in the Spanish city."Another instance where the market is at odds with initial expectations is in London

where short term trading expectations are strong as the post-Olympic boom and a rise in consumer confidence continues to have a positive effect on hotel performance. With hotel supply expected to grow circa 8.0% over the next two years, potentially forcing hoteliers to cap average rates, one might expect the medium term outlook to be more pessimistic, however, the survey results show that investors are more hopeful about trading expectations in the UK capital." Added Härle.About JLL

For over 200 years, JLL (NYSE: JLL), a leading global commercial real estate and investment management company, has helped clients buy, build, occupy, manage and invest in a variety of commercial, industrial, hotel, residential and retail properties. A Fortune 500® company with annual revenue of $20.8 billion and operations in over 80 countries around the world, our more than 111,000 employees bring the power of a global platform combined with local expertise. Driven by our purpose to shape the future of real estate for a better world, we help our clients, people and communities SEE A BRIGHTER WAYSM. JLL is the brand name, and a registered trademark, of Jones Lang LaSalle Incorporated. For further information, visit jll.com.