[Infographic] American’s On The Move - 35% of Extended Stay Travel Due to Relocation

New HotelPlanner Data Identifies Latest Industry Trends in Long Stay Accommodations

West Palm Beach, FL -- Extended stay travel is in high demand now more than ever before and for good reason.

HotelPlanner.com, the leading online provider for group travel and extended stay bookings, released the results of a new survey highlighting the latest industry trends within the U.S. extended stay hotel marketplace.

The nationwide survey was conducted in September 2016 to identify both shifts and trends in consumer behavior from guests who booked an extended stay.

A Changing & Evolving Marketplace

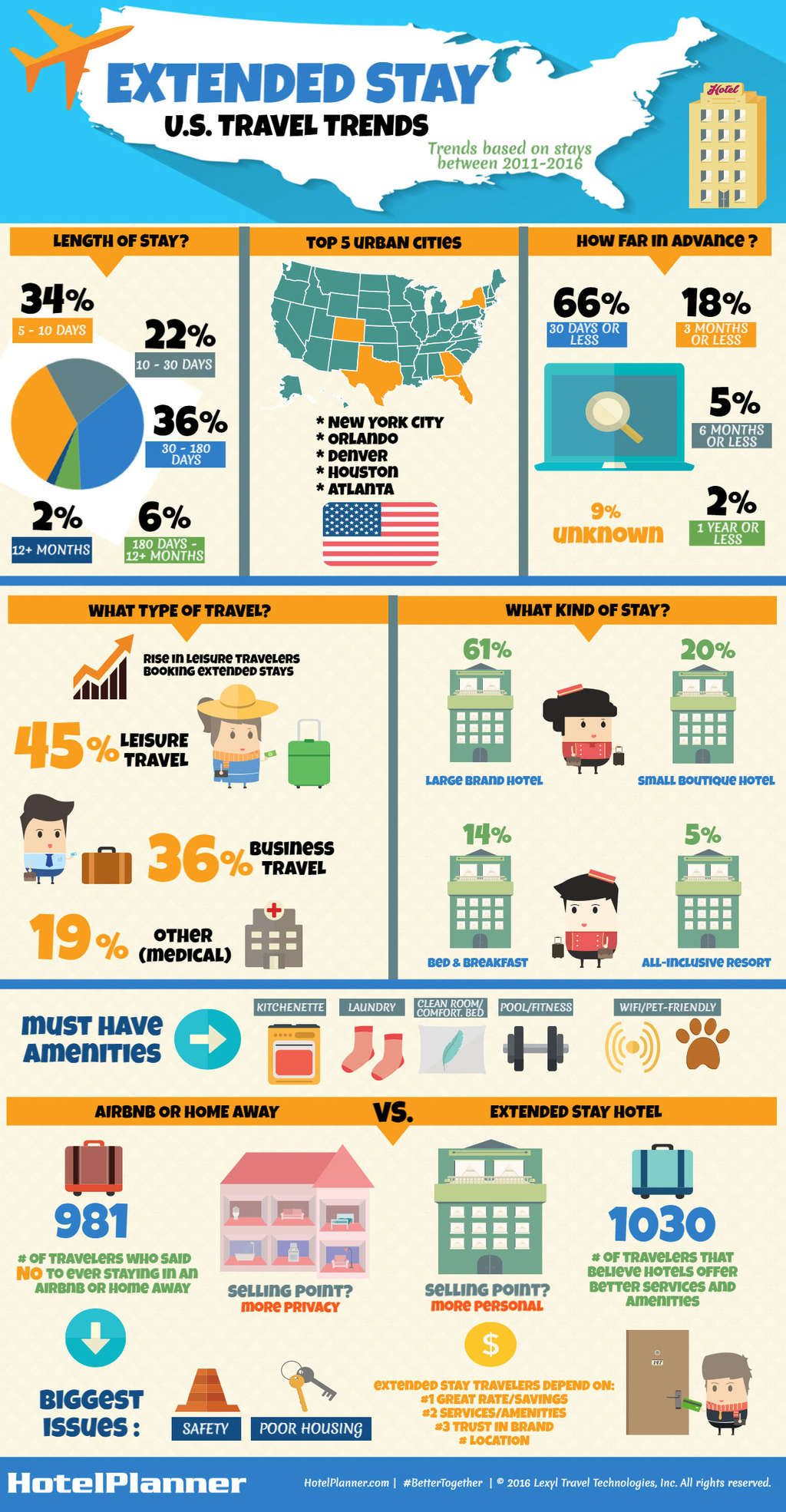

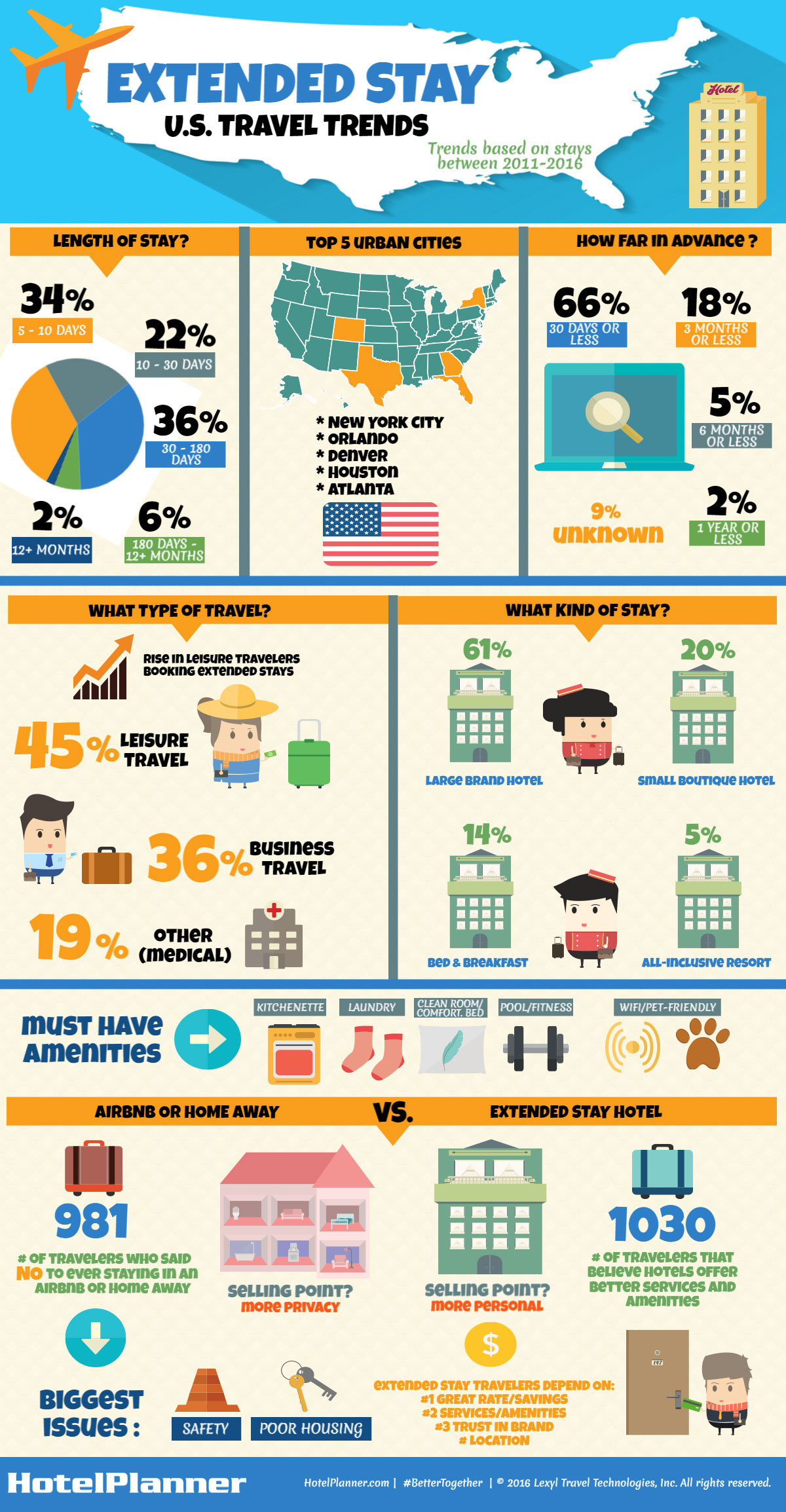

On average, an extended stay is considered five nights or more. Based on the survey, 34 percent of North American travelers booked an extended stay lasting between 5 to 10 days, while 36 percent stayed between 30 to 180 days. According to HotelPlanner's data, these percentages are an ever increasing shift compared to previous years due to:

-

Travelers putting more trust and value into extended stay reservations -

Travelers booking longer stays with less notice

This is most notably due to busy schedules, unforeseen circumstances, and on many occasions, the ability to obtain last-minute hotel discounts. In the past, bookings were made three or more months in advance. Current findings however, support that well over half (66 percent) of travelers booked their stay in 30 days or less.

"Extended stays are changing and evolving for the better in the mindset of travelers as an extension of home," stated Tim Hentschel, CEO of HotelPlanner.com. "It is with the drive of the hospitality industry that has continued to invest in creating an extended stay experience beyond the traditional narrative."

An Increase in Leisure Travel

Extended stays provide both business and leisure travelers the opportunity and affordability to get the most out of their long term stays for various needs. In the hotel sales market, HotelPlanner experienced their biggest increase in 2015 in long term stay reservations (37 percent), with 2016 well on its way to surpass last year's numbers. The demand for long stay accommodations is gaining traction in more ways than one. Within the U.S. hotel marketplace, the majority of extended stay demand has remained relatively business-related. This includes:

-

Company relocation -

Corporate incentive travel -

Training programs

-

Work crews -

Military and government

Leisure travel on the other hand, has seen consistent growth in extended stay bookings in recent years. According to HotelPlanner's data, over 44 percent of extended stays booked by leisure travelers was a result of:

-

Moving (35 percent) -

Medical reasons/visiting relatives in the hospital (17 percent)

-

Home remodeling (4 percent)

An increase in public awareness, especially among leisure travelers, has been largely affected by the proactive shift extended stay hoteliers continue to do through new services, amenities, and relocations.

Expansion and Innovation

Leading the extended-stay hotel market and changing the narrative are properties such as:

-

Best Western Plus® -

Homewood Suites by Hilton® -

InterContinental's Candlewood Suites® -

WoodSpring Hotel's WoodSpring SuitesSM and Value Place®

Eighty-five percent of extended stays booked through HotelPlanner are in the U.S. with the most in-demand cities being New York City, Orlando, Denver, Houston, and Atlanta, in that order. Extended stay openings across the U.S. are popping up in areas like Atlanta, Cincinnati, Kansas City, Pittsburgh, and Richmond due to the rising demand of travelers seeking to stay in larger, livelier destinations. Besides new locations, these chains are also bringing innovation in service and in-room amenities with mid to upscale guestrooms complete with full sized kitchens, expanded living spaces, to laundry and grocery services.

Travelers surveyed shared their motivation behind choosing an extended stay property, as well as "must have" amenities:

-

Kitchenette (44 percent) -

Clean room/Comfortable bed (35 percent) -

Wifi/Pet-Friendly (10 percent) -

Laundry (6 percent) -

Pool/Fitness Center (5 percent)

"From business to leisure, travelers desire the types of amenities and services catered for their specific needs and when it comes to extended stays, this means offering personal touches not found in alternative lodging," continued Tim Hentschel.

Competition in the Lodging Industry

With the emergence of alternative lodging like Airbnb or HomeAway, travelers have more options to choose from to best accommodate their extended stay needs. From those surveyed, 79 percent of travelers have never used a rental property over a hotel, but those who had raised interesting questions and concerns over whether such companies are offering enough to keep extended stay travelers interested in the long run. Additionally, 981 of respondents who answered no to using an Airbnb or Home Away were asked for additional feedback which ranged from issues of safety to poor housing conditions. While alternative lodging can offer guests more privacy, extended stay hotels are creating better ways of engaging travelers on a more personal level to garner their trust.

Tim Hentschel notes: "Even with the competition in the extended stay market that exists today, hotels are still ahead of the curve when it comes to offering more welcoming amenities and services starting from the moment a guests walks in until check-out."

Extended stay travel continues to rise in popularity and demand and while the U.S. hotel industry continues to push forward with new innovations and expansions, the more travelers will be willing to confide in brands that can offer personalized services in the most popular destinations nationwide.

Methodology: The HotelPlanner.com survey results are based on an online survey was conducted between September 6 to 20, 2016 of 1,242 U.S. based extended stay customers who booked from 2011-2016. The margin of error is ± 2.60% at a 95% confidence level.

About HotelPlanner

HotelPlanner, a leading travel technology company that combines proprietary artificial intelligence agents (HotelPlanner.ai) and a 24/7 global gig-based reservations and customer service network. Hotel planner's technology is behind the accommodation provision for millions of meetings, weddings and sporting events each year.

Claudia Flores

HotelPlanner.com