By: Katie Moro, VP Data Partnerships, Hospitality, Amadeus

Trends and data. Perhaps the two most discussed words of 2020. Every hotelier is asking, “What is happening in my market? How do I manage my business during this time?” To say that hoteliers have been seeking information to help build effective strategies goes without saying.

To support hoteliers on an earnest journey to uncover new trends and understand market changes, we’ve been discussing trends across the globe during the progression of COVID-19. Perhaps the most impactful trend shift has been around booking lead times.

How much do changes in booking lead times impact your business?

A critical factor for capturing available demand is understanding where and when travelers are booking. Historical year over year trends are irrelevant as travel regulations and guidelines shift frequently. Instead, hoteliers must seek to understand changes in the context of the COVID-19 market impact and compare it to the same time last month or last week.

As an example, trends show that lead times have shortened to well within a week of arrival. Consider the following statistics from US market performance in the last six months:

43% of transient reservations are booked on the day of arrival. (That’s double the amount from the same time one year ago.)

91% of the transient reservations are booked within 30 days of arrival.

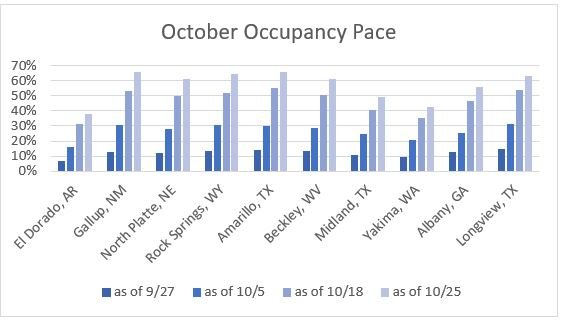

In October, all US markets experienced a 120% increase in occupancy compared to what was booked for the month at of the end of September, climbing from an average of 18% to 40%.

The following chart demonstrates the impact of the last data point. The graph shows week-over-week performance for the US markets that experienced the most significant 30-day occupancy growth.

Let’s put this data into context. Let’s assume I am a hotelier in Amarillo, TX receiving monthly market data updates. On September 27th, I receive my market data and build a plan for the upcoming month based on a known 14% occupancy at that time. Moving through October, there’s likely to be a shift in demand based on the traveler segment and seasonality. How does this 14% metric as of September 27th help me halfway through October? Without regular updates, I can’t see that occupancy increased to over 50% by the middle of October. By the last week of the month, the market is up to 66% occupancy. Without this visibility, I can’t make effective decisions to staff and run my business.

But the question must be addressed. Is all data created equal?

The direct answer is, “No.” When evaluating data sources, hoteliers must understand where the information is coming from and how effective it will be to help inform rate and distribution strategies. Only accurate, timely insight will be useful for making informed, real-time decisions.

When considering the source of the information you use to build your strategy, consider the following:

How current is the information you are using to establish your rate, channel, and marketing strategies?

If you are not basing your decisions on actual forward-looking pace data that is current, you are making decisions that will negatively impact your performance. You need access to information that is refreshed multiple times a week to account for changes resulting from very short booking lead times. Ask yourself, “Am I preparing for weekly benchmarking meetings with outdated information?”

What is the source of this data? Is it actual on-the-books market insight or a forecast?

Many data providers are using web crawlers and site scraping tools to gather market data. Is this current, relevant, and accurate insight? Is the information provided a forecast, or is it actual market booking data?

What is the depth of insight?

The number of data points collected will influence the clarity of the insight to enable your decision making. Does the data represent a comprehensive cross-section of branded and independent properties? Does that data cover various segments within the market? Perhaps most insightful, can you establish a competitive set mix to represent the truest opportunity to influence your strategy?

Is this actionable with other critical business systems?

Ensure your market insight can integrate with your Revenue Management and Property Management systems to help guide effective processes and eliminate the need to re-enter data.

Your trusted source for industry-leading forward-looking market insight

Amadeus Demand360® is the only business intelligence solution that provides actual forward-looking occupancies for your hotel and your selected competitive sets. The data provided is updated twice per week and occupancy information represents actual rooms sold, including market segment and channel statistics, so you know who is traveling and how they are booking their reservations. If you want to know what is happening in your market contact us today.

For more best practices on leveraging data to build an effective marketing strategy, please visit our Planning for Hospitality Recovery resource center.

All US market statistics cited in this article are sourced from Amadeus Demand360® Business Intelligence solution.