Originally published on Amadeus Insights

Amadeus Mobility Business Intelligence data reveals important changes in car rental behavior and how this impacts the travel industry

In April, research from Amadeus identified a growing demand for car rental services, with net-bookings in March up 53% compared to 2019. And in exploring the key trends that will impact travelers this summer, an increased interest in car rentals was attributed to conscious travel – a stronger desire to choose transport options that allow for a greater degree of personal safety.

As we head further into summer, car rentals continue to be a favored form of transportation. As of July, the latest Amadeus Mobility Business Intelligence data reveals that several destinations experienced sold-out messages, an ongoing trend from June. If we focus on the top 10 destinations without available rates in July, demand is clearly strong in the U.S., as Orlando, Los Angeles, New York, Miami and Las Vegas all make the list. Top of that list is Hawaii’s Lihue, with a sold-out message appearing for 53% of searches.

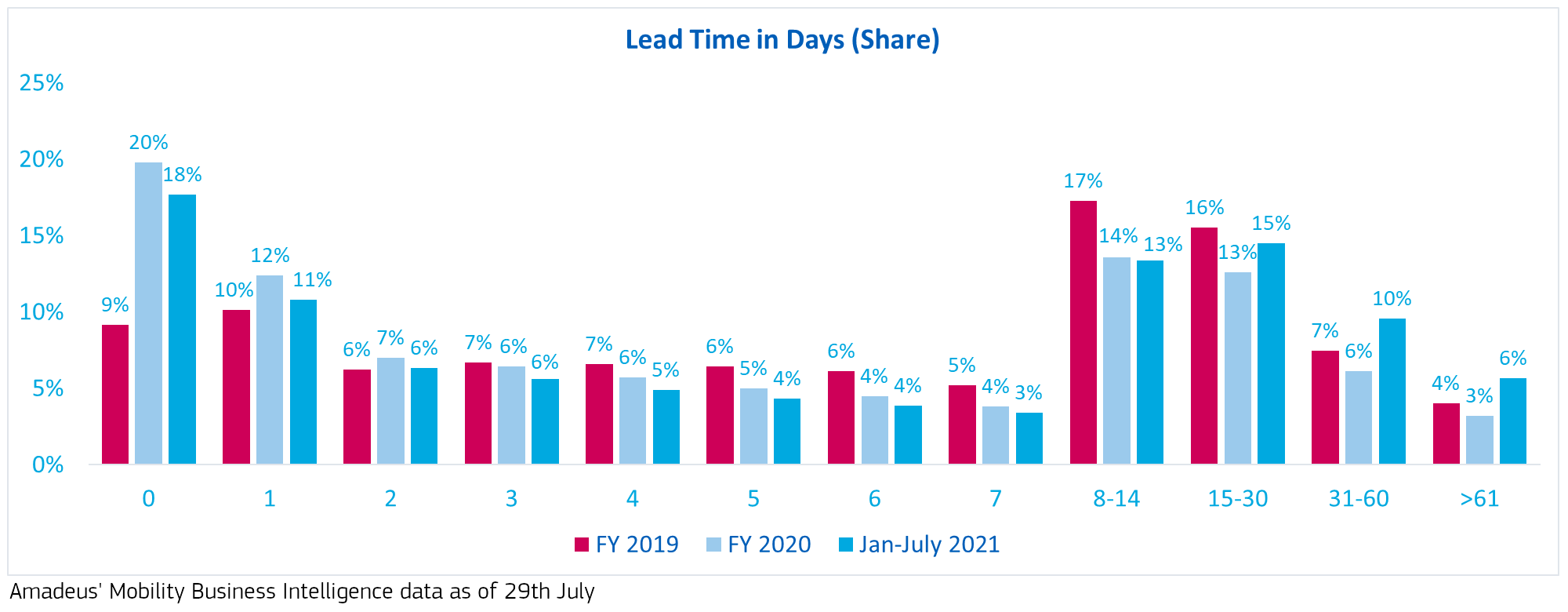

Another interesting trend to keep an eye on is car-rental booking windows. In 2020, during the height of the pandemic, 28% of bookings were made with 24 hours of the rental start date, and 75% within seven days. With more travelers returning to the roads, that window has now lengthened. As of July 29th, 57% of bookings are made within the seven-day window, a slight increase from 52% in 2019. Bookings 31+ days in advance are also higher than in 2019, suggesting travelers are also planning further in advance.

In order to fully understand traveler behavior, it helps to build a complete picture of their journey. To do so, we’ve compared these trends with air search and bookings and Amadeus Demand360® forward-looking hotel occupancy data. Amadeus Search and Travel Agency data confirms regional differences in behavior, with air bookings almost doubling between the months of February and March in the U.S. For Europe, this similar growth pattern occurred later – in May.

In hospitality, we’ve seen steady increases in demand, particularly across the U.S., with Independence Day weekend hitting highs of 68% occupancy in top markets. In line with car-rental bookings, hotel bookings are stronger in leisure markets such as Hawaii and Florida. Global lead time trends for hotels, according to Amadeus Demand360 data from 25 July 2021, expose further insights into traveler behavior. More bookings are now made in a one-week window than in 2019, with 26% of people still reserving a hotel on the day of arrival. In contrast to car rentals, this does currently mean that less hotel bookings are made further than one week in advance. However, hotel booking lead time has improved over 2020, suggesting that the confidence to book hotels further out is growing

Implications for travelers

Equipped with the knowledge that demand for rentals is strong, travelers should look to book as early as possible. Not only will this maximize chances that providers will still have the widest choice of rentals available, but it could also prevent paying higher prices as supply becomes limited.

Implications for travel agents

With 66% of travelers eager for the same or more advice from travel agents during the pandemic, paying attention to booking behavior is key for this group. With this data, travel agents can more easily offer guidance on what, when, where or how to book upcoming trips. For example, if a traveler is looking to visit a destination with limited rental options, agents could proactively offer an equally safe and easy alternative, such as an Amadeus Transfer.

Implications for car rental providers

Regularly reviewing and analyzing traveler and market data should be an integral part of any car-rental provider’s recovery strategy. In doing so, it becomes easier to foresee and adapt to market or traveler changes, and make smart, informed business decisions. For example, from this insight we now understand that travelers are choosing to book car rentals further in advance and are favoring certain – typically leisure- markets over others. The implication of this for a provider might be reviewing fleet availability for future dates and shifting supply to areas with greater demand. On top of this, keeping an eye on leading indicators for regions where demand is returning sooner, as seen across North America, could help providers to anticipate increasing interest in other regions.

If you’re looking for regular access to car rental booking behavior to obtain greater visibility into your market, visit Amadeus Mobility Business Intelligence to find out more.