US full-service hotels operating expense trends | Smith Travel Research

Smith Travel Research recently released its 2009 Hotel Operating Statistics (HOST) report. While reviewing a 10-year history of full-service hotels’ expenditures and revenues, several questions come to mind: How effectively has this segment of the hospitality industry been managing profitability during poor and strong economic cycles? During market downturns, how were expenses managed while revenues declined? Was profitability maximized during robust economic periods?

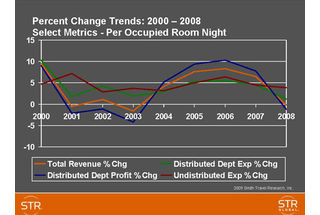

As illustrated in the chart below, total revenue (including food and beverage) during the last recession declined 8.8 percent from 2000 to 2001. However, gross operating profit declined 13.8 percent. From this 10-year snapshot, it appears GOP declines at a faster rate than total revenue. But during recovering and healthy economic times, hoteliers have increased operating profit at a stronger rate than total revenue.

In 2005, total revenue grew 11.7 percent, while GOP increased 16.4 percent. 2008 finished at a 4.7-percent decline in total revenue, while GOP decreased 7.5 percent during the same period.

When looking at HOST expenses on a per-occupied-roomnight perspective, distributed (rooms, food and beverage, telecommunications) and undistributed (administrative and general, marketing) expenses predictably behave differently. Undistributed expenses have remained the most stable in terms of growth rates (ranging from a low of 2.9 percent to a high of 7.2 percent) as operators appear to reduce, but not eliminate, sales positions to pursue what demand there is in the market.

During the last recession in 2001-2002, per occupied room, distributed operating expenses, the most variable of hotel expenses, still were growing at a higher rate than total revenues. (See chart below.) In the current recession, operators will be required to evaluate how much they’re discounting room rates and other services versus how much they’re spending (or not spending) on staff, expendable supplies and in-room amenities.

Historical HOST time series remind us that when we discount our products and services, related operating expenses for those revenue-producing sources should be closely monitored for reasonableness during poor economic times. Don’t forget: The wider the gap in growth rate between total revenue and distributed departmental operating expenses (when distributed expense growth rates are higher than total revenue growth rates), the harsher the impact on a hotel’s profitability.

About STR

STR provides premium data benchmarking, analytics and marketplace insights for the global hospitality industry. Founded in 1985, STR maintains a presence in 15 countries with a corporate North American headquarters in Hendersonville, Tennessee, an international headquarters in London, and an Asia Pacific headquarters in Singapore. STR was acquired in October 2019 by CoStar Group, Inc. (NASDAQ: CSGP), the leading provider of commercial real estate information, analytics and online marketplaces. For more information, please visit str.com and costargroup.com.