Kalibri Labs - Market Kalibration January 2020

Brand.com Costs Continue to Decrease

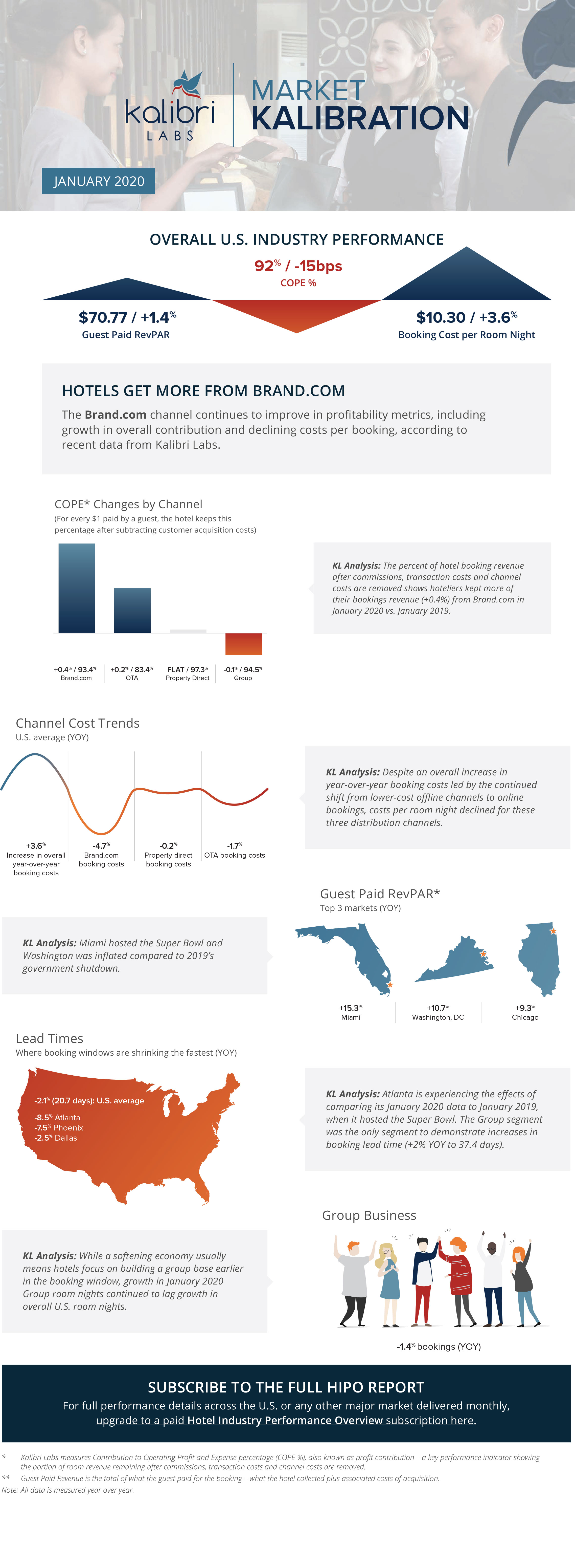

The Brand.com channel continues to improve in profitability metrics, including growth in overall contribution and declining costs per booking, according to recent data from Kalibri Labs. Looking at January 2020 data, the percent of business booked through Brand.com channels increased 10.4% year over year to 25.8%, while the cost per room night booked through Brand.com declined 4.7% to $7.92, making it one of the lowest cost of acquisition channels.

The Contribution to Operating Profit and Expense percentage (COPE %)* from the Brand.com channel was 94.3%, up 0.4%. This means that for every $1 paid by a guest, the hotel kept roughly 94 cents after subtracting customer acquisition costs.

Brand.com Performance

Channel Demand | +10.4%

COPE by Channel | +0.4%

Channel Acquisition Cost | -4.7%

Other Notable January Trends

Super Shifts: The largest impact in January was felt by the Super Bowl, which took place February 2 after a weeklong NFL-themed event in and around Hard Rock Stadium in Miami Gardens, Florida.

The impact of Super Bowl 54 moving from Atlanta in 2019 to Miami in 2020 was drastic and, since Miami is a high-end market (Hotel Collected RevPAR in Miami is traditionally more than double that of Atlanta's), the event affected averages across the U.S. The shift from a relatively lower RevPAR market to a higher RevPAR market, and the fact the Super Bowl fell on February 2 in 2020 vs. February 3 in 2019, likely elevated January's results overall. Miami experienced a 15.3% year-over-year increase in Guest Paid RevPAR, to $197.63, while Atlanta experienced a 12% decline in Guest Paid RevPAR, to $81.42.

Guest Paid RevPAR** top 3 growth markets (YOY)

+15.3% | Miami

+10.7% | Washington, D.C.

+9.3% | Chicago

Coronavirus Coming:

January's results do not show an effect of coronavirus, which began making an impact in early February, but it is expected that international hub markets will be affected first and greatest. Recent changes in cancellation policies by the airlines could lead to more cancellations and a shorter booking window.

The Shutdown Effect: The government shutdown lasted from December 22, 2018, to January 25, 2019, and is likely a driver behind big gains in Washington, D.C. - occupancy and all ADR metrics were up in January 2020.

*Kalibri Labs measures Contribution to Operating Profit and Expense percentage (COPE %), also known as profit contribution - a key performance indicator showing the portion of room revenue remaining after commissions, transaction costs and channel costs are removed.

**Guest Paid Revenue is the total of what the guest paid for the booking - what the hotel collected plus associated costs of acquisition.

*** All data is measured year over year.

About Kalibri Labs

Kalibri Labs evaluates and forecasts revenue and cost of acquisition performance in the digital marketplace. Our next-generation HummingbirdPXM platform is the only hotel benchmarking and reporting solution driven by AI and machine learning. HummingbirdPXM is built on a robust database of daily transactions and cost of acquisition data gathered weekly from almost 35,000 hotels. Using advanced algorithms, the platform enables owners and operators to determine a hotel's optimal business mix and manage resources to achieve it. Kalibri Labs unpacks the composition of RevPAR to describe market demand by rate category and channel assisting hotel owners and operators to develop strategies that improve profit contribution, which leads to higher asset values. Tapped regularly by the real estate and investment community, the Kalibri Labs database supports hotel transactions and financial restructuring by brokers, lenders, appraisers, and financial consultants. For more information, visit www.kalibrilabs.com.

Jason Q. Freed

330-221-6068

Kalibri Labs