2nd Update Corona Impact on Website vs OTA Bookings

On the 6th March we published numbers around the first impacts of Corona on OTA vs Website bookings. What an unpredicted turn things took since then. Yes - we expected things to be bad, but really this bad?

With our partner Hotelnetsolutions from Berlin, who empowers over 2000 Hotels predominantly in the German speaking areas with a CRS technology and who we work together for over 6 years on all online marketing aspects like Google, trivago and tripadvisor, we looked at some more numbers over the last few days.

What did we look at this time?

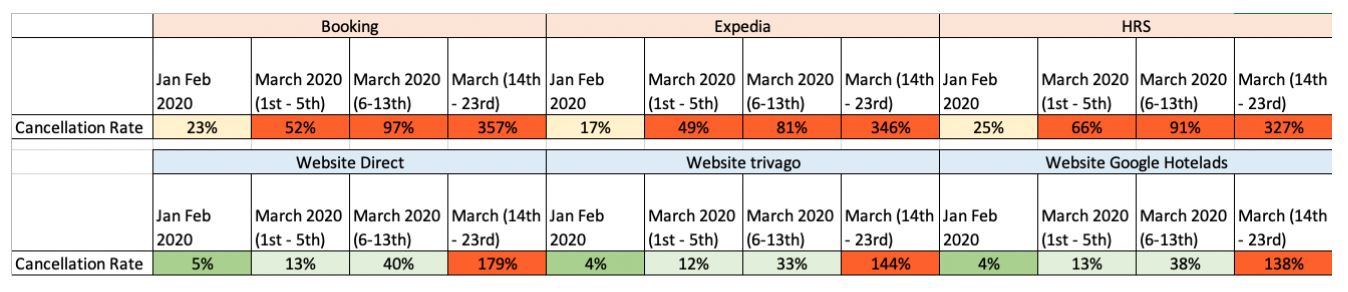

Cancellation Rates - we wanted to see how cancellation rates developed further. Especially after the lock down things seemed to get worse. And indeed - numbers are devastating.

Look at the chart below:

Cancellations across channels sky rocket. After the lockdown of the US and many countries in Europe on the 14th March - numbers exploded. On OTA's Hotels saw 4 cancellations coming in on 1 booking at the time. On hotel websites roughly 1,5 cancellations on 1 booking.

Conclusion 1

If we stick to absolute numbers, we can see that hotels were dealing with more cancellations than bookings in the last 2 weeks. Again hotel website bookers are much less extreme and more loyal than OTA bookers. Still the blow on the bottom line of hotels is significant, with a much bigger impact from OTA customers.

Conclusion 2

Again there is little to no difference between Metasearch bookers to normal website bookers. The trend seems to be robust and while many people try to classify Metasearch clients similar to OTA clients, it seems obvious that this is not the case, but that by catching Metasearch clients to your website, you are also able to keep them closer to your brand with a higher customer lifetime value.

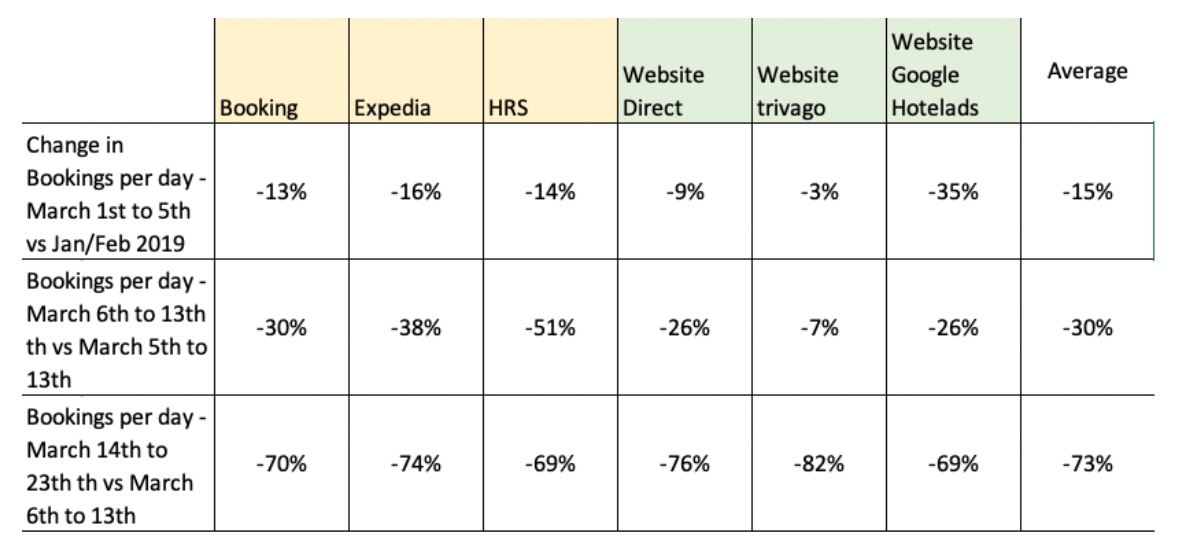

Booking volume - this time we looked at the average bookings per day in the respective time period and compared it to the week before. The we compared this to the same period the year before to understand seasonal impacts. The change in the below chart reflects the growth/decline to the day period before and is considering the seasonal changes year over year:

Conclusion

We can see that until the lockdown on the 14th March that the website bookings decline on a smaller degree than the OTA bookings. With the lockdown nevertheless numbers drop across channels, as people simply can't travel anymore and no more differences can be found across channels. This seems kind of logical considering that travel simply stopped.

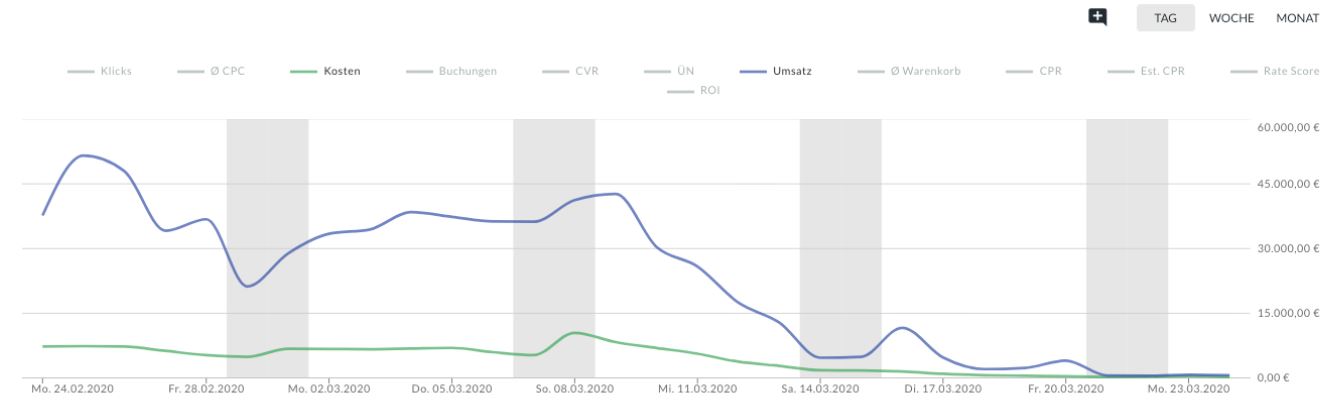

Demand - how did demand develop?

Last but not least we looked at the traffic stats across Google, trivago and tripadvisor. Below you can see a graph from our portal, pulled from a large German hotel chain that runs all their marketing campaigns via our system (all Metasearch, plus Google Adwords):

The blue line being online revenue and the green line costs (marketing spends). While on a normal day in March spend was at around 8,000 EUR a day, it declined to practically zero (300 EUR) a day. A decline of 96% within 3-4 days!

What a dramatic impact and just a data driven approach confirming the reality in many hotels - empty beds.

Take Aways

While 2 weeks ago there was still hope that we face a decline but not a hit, we now see that we are at a stale mate. The economy has stopped and money stopped circulating. While we could see that website bookers are the most loyal ones even in time of crisis, channel doesn't matter anymore if there is no demand.

Still we should keep in mind that there will be day x when the wheel starts turning again and I can only recommend to be ready. Use this stand still to reflect, maintain, improve and launch a new distribution strategy. Liquidity is low, but this should not lead us into wrong conclusions. In 2009 after the financial crisis, we were hoping for the solution in variable commission costs with OTA's. Years later with a rising economy, we saw distribution costs exploding and dependency on OTAs increasing.

With years of economic growth hotels gradually shifted business away from OTAs into their own channels for a lower cost. Hotels that did this with a significant impact were more profitable than others and might also survive this crisis better than others. Still we should make sure to learn our lesson of 2009 and also learn from the last two weeks: that OTAs deliver volume, but also a fragile reality and an opportunistic partnership that might not be there when you actually need it.

A big thank you again to Pardis Tehrani (CEO hotelnetsolutions) and his team. We again digged into this for some hours the last days to get this data available for you. Being the German market leader on online distribution for hotels in Germany, the data provided is huge (several millions of transactions counted) and highly relevant and representative.

Ulli Kastner

CEO myhotelshop

myhotelshop.com