U.S. Hotel Development Cost Survey 2020

Introduction

In 2019, the national lodging market reached new heights, with hotels reporting the highest occupancy and ADR levels ever recorded. Similarly, hotel development continued at a steady pace, with new hotels opening to a burgeoning market and new and exciting projects continuously being moved through the development pipeline. Since the start of the COVID-19 pandemic, government restrictions, travel and group cancellations, and an overall fear of traveling have caused an unprecedented drop in travel and tourism demand in the country and around the world, which has resulted in substantially lower occupancies and average rates. The impact of COVID-19 on the supply pipeline has been twofold. While projects under construction generally still remain under construction, developers are now much more cautious in undertaking future hotel projects. Additionally, some hotels have suspended operations (temporarily or permanently), causing a decrease in supply in many submarkets. Even as we approach the end of the year, travel demand remains subdued, and it is more evident that while a recovery is on the horizon, the new reality is that it will likely be one that is slow and steady until individuals are comfortable traveling again and economic conditions improve.

HVS has tracked hotel development costs for over three decades, collecting data from actual hotel cost budgets during our assignments. This 2020 survey reports per-room hotel development costs based on data compiled by HVS from hotel projects proposed or under construction during the 2019 calendar year. The data reflect nine product categories: budget/economy, limited-service, midscale extended-stay, upscale extended-stay, dual-branded, select-service, full-service, and luxury hotels, as well as redevelopment projects. Additionally, in light of the current reality that the industry faces as a result of COVID-19, we also explore the impact that the pandemic may have on the hotel development cycle so that owners and developers can make informed decisions as they plan new projects in the years ahead.

The HVS U.S. Hotel Development Cost Survey sets forth averages of development costs in each defined lodging product category. The survey is not meant to be a comparative tool to calculate changes from year-to-year, but rather, it reflects the actual cost of building hotels across the United States in 2019. As will be discussed, the median and averages set forth in this survey are greatly affected by the types and locations of hotels being developed at this point in the development cycle. Our goal in sharing this publication is to provide a basis for developers, investors, consultants, and other market participants in evaluating hotel development projects. Given that development costs for hotels are dependent on a multitude of factors unique to each development and location, this report should not be relied upon to determine the cost for actual hotel projects or for valuation purposes, but rather, it is intended to provide support for preliminary cost estimates, as well as to show a comparison across the various hotel categories.

New Supply-and-Demand Dynamics Will Affect Hotel Development

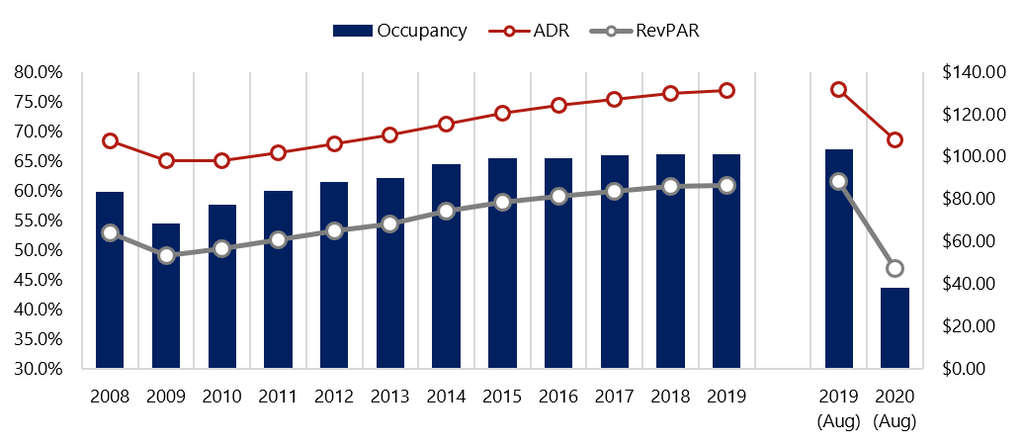

The year 2019 served as another period of growth for hotel occupancy and average daily rate (ADR). STR reported national year-end 2019 occupancy and ADR at 66.1% and $131.16, respectively. In the year-to-date period through August 2020, both metrics were reported at 44.4% and $107.17, respectively. This calculates to a -34.3% and -18.8% decrease in occupancy and ADR, respectively, when compared to same year-to-date period in 2019. For this period, RevPAR is down -46.6% when compared to 2019, illustrating the precipitous drop in hotel performance as a result of COVID-19 and reduced travel.

Exhibit 1: U.S. Occupancy, Average Rate, and RevPAR

The pandemic has affected different markets in various ways. Urban/resort destinations such as Boston, Chicago, Minneapolis/St. Paul, New York, Hawaii, San Francisco, Seattle, and Washington D.C. have experienced the steepest drops in RevPAR, compared to the prior year (in excess of -60% as of August 2020). In contrast, the RevPAR decline in secondary and tertiary markets has been -41% as of the same period. This comes as no surprise, as most urban destinations have been most affected by the pandemic given their higher reliance in business travel, group travel, and international travel. Furthermore, ongoing social unrest in some urban destinations has also negatively affected travel.

Similarly, because of this more pronounced impact in urban destinations, supply growth in primary markets has turned negative in 2020, as some hotels have had to temporarily suspend operations. As of August 2020, while the change of supply registered -8.7% in primary markets, the rest of the country has realized only a moderate decrease in supply at -2.0%. The decline has been even more pronounced in destinations like Miami, New York, Hawaii, Orlando, and San Francisco. The above destinations have had either very strict government travel restrictions related to COVID-19 or are highly dependent on group or international travel; these factors have resulted in more temporary closures of hotels at these destinations.

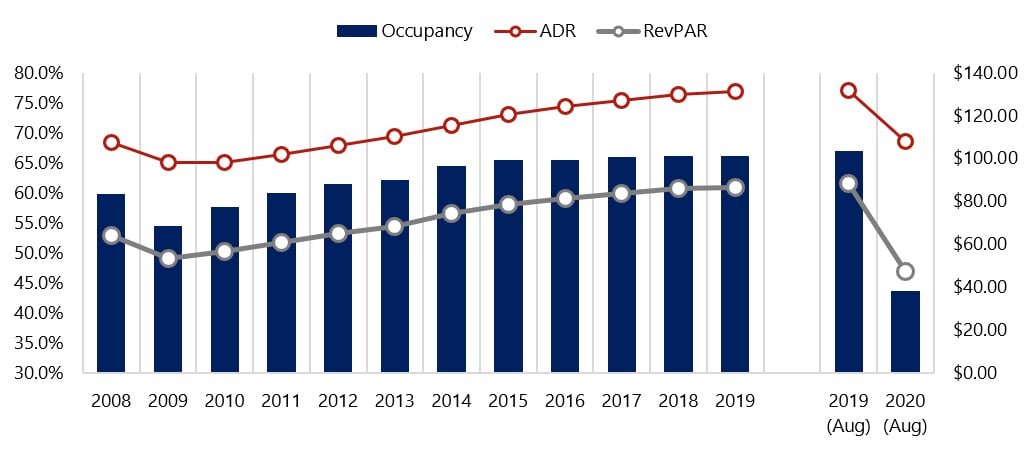

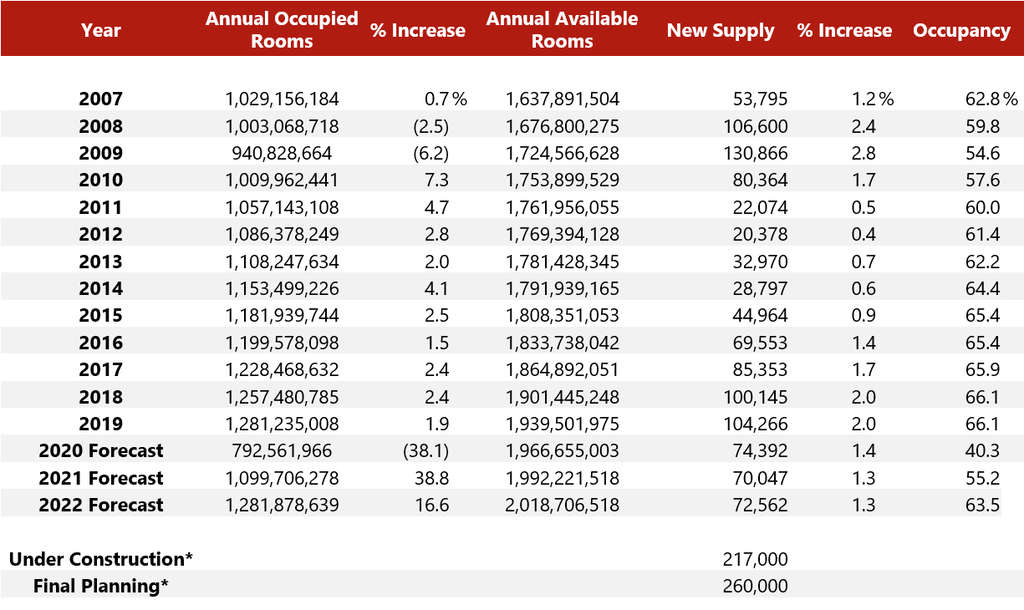

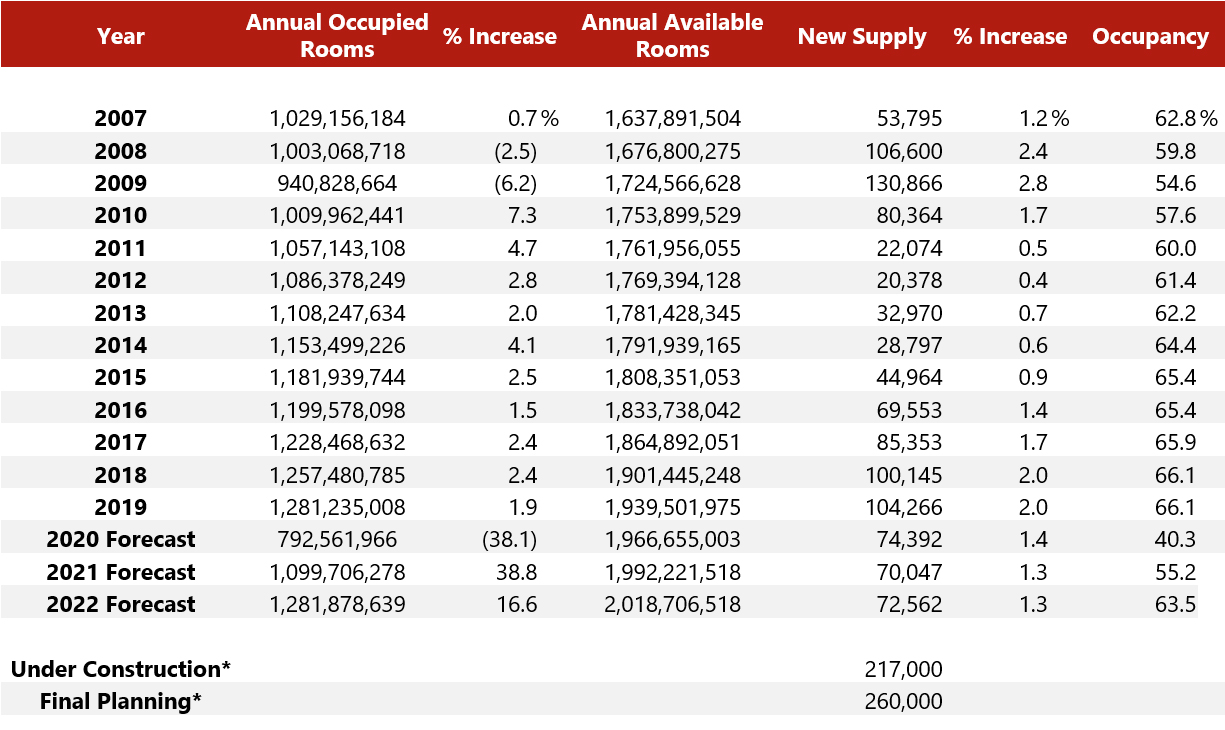

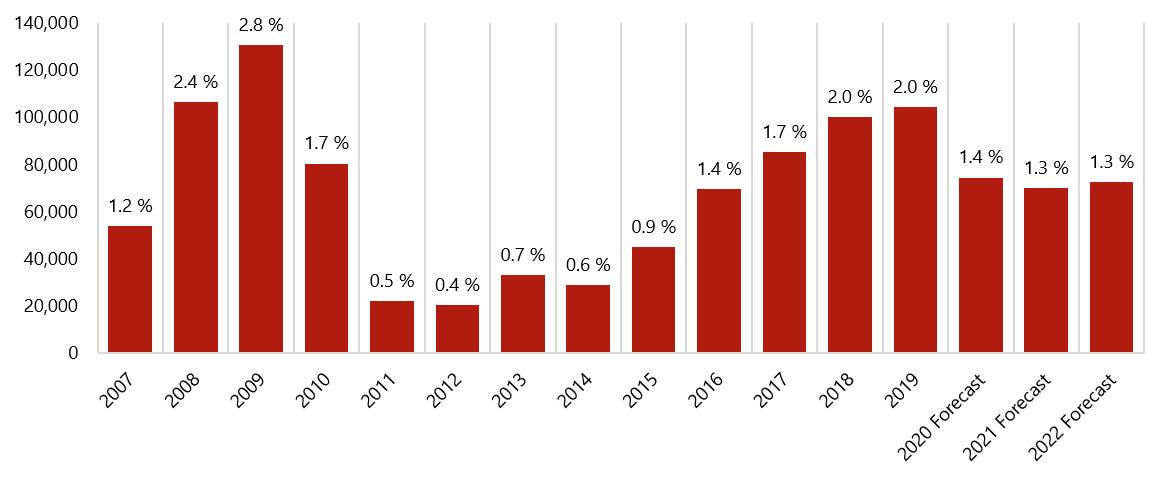

Going forward, occupancy data will be influenced by changes in supply, which in turn will be influenced by not only the anticipated opening of new hotels already under construction, but also by those that have suspended operations (either temporarily or permanently). Based on available data from various sources, the following table illustrates historical supply data, coupled with our forecasts for 2020 through 2022. For the sake of consistency and in order to truly understand supply growth from the opening of new hotels, we used historical total room inventory data through 2019; thus, the data exclude hotels that may have temporarily suspended operation as a result of COVID-19.

Exhibit 2: Historical and Proposed New Supply

Supply growth typically lags the market because of the time it takes for projects to become feasible, obtain financing, and be developed. The pace of growth in new supply following the 2009 downturn slowed substantially to an annual average of 0.6% from 2011 through 2015. In the early post-recession years, hotel revenue, net operating income (NOI), and values declined to a level that did not support new construction. Once RevPAR and NOI reached a point supporting feasibility, it took several years for projects to obtain financing and be constructed. The pace of new supply increased to 1.7%, 2.0%, and 2.0% in 2017, 2018, and 2019, respectively, reflecting the resurgence of hotel openings in those years, as illustrated above. Supply growth peaked at 2.0% in this most recent cycle (and 2.8% in the cycle prior to this one, ending in 2009).

The 2.0% increase in supply in 2019 represented approximately 104,000 new hotel rooms; new supply growth resulting from new hotels is projected to increase by 1.4% by year-end 2020, and then to moderate to 1.3% in 2021 and 2022, per STR. Prior to the onset of COVID-19, STR had initially projected new supply to grow by 2.0% in 2020; the revised forecast for 2020 suggests that a number of hotel developments will not reach completion this year.

According to the American Hotel & Lodging Association (AHLA), as of July 2020, 217,000 new hotel rooms were under construction across the country, reflecting hotels likely to open in the next 18 months. Additionally, at the same time, 260,000 rooms were in the final planning stages and expected to begin construction within the next twelve months. Similar to the last recession of 2008/09, lower revenue, NOI, and estimated values may result in some projects being placed on hold until revenues levels once again support the feasibility of development.

Exhibit 3: U.S. Change in Supply over Time

Given the pace of new supply growth, it is important for market participants, including hotel developers, lenders, and consultants, to exercise caution and discipline when considering new projects. During recessionary years, the pace of new development slows significantly because of two factors that we would like to highlight further.

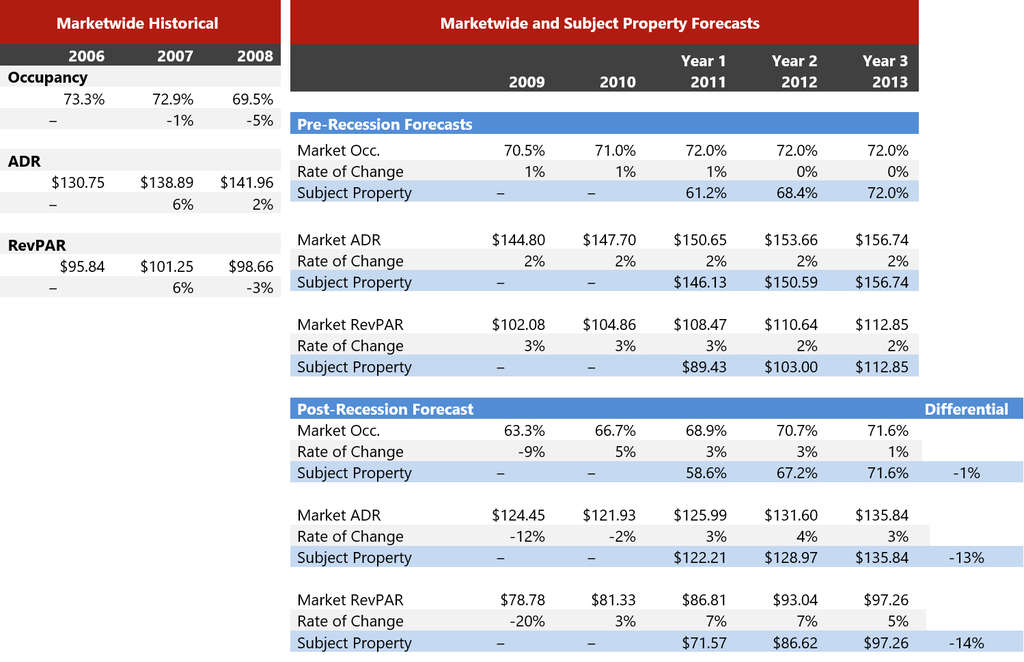

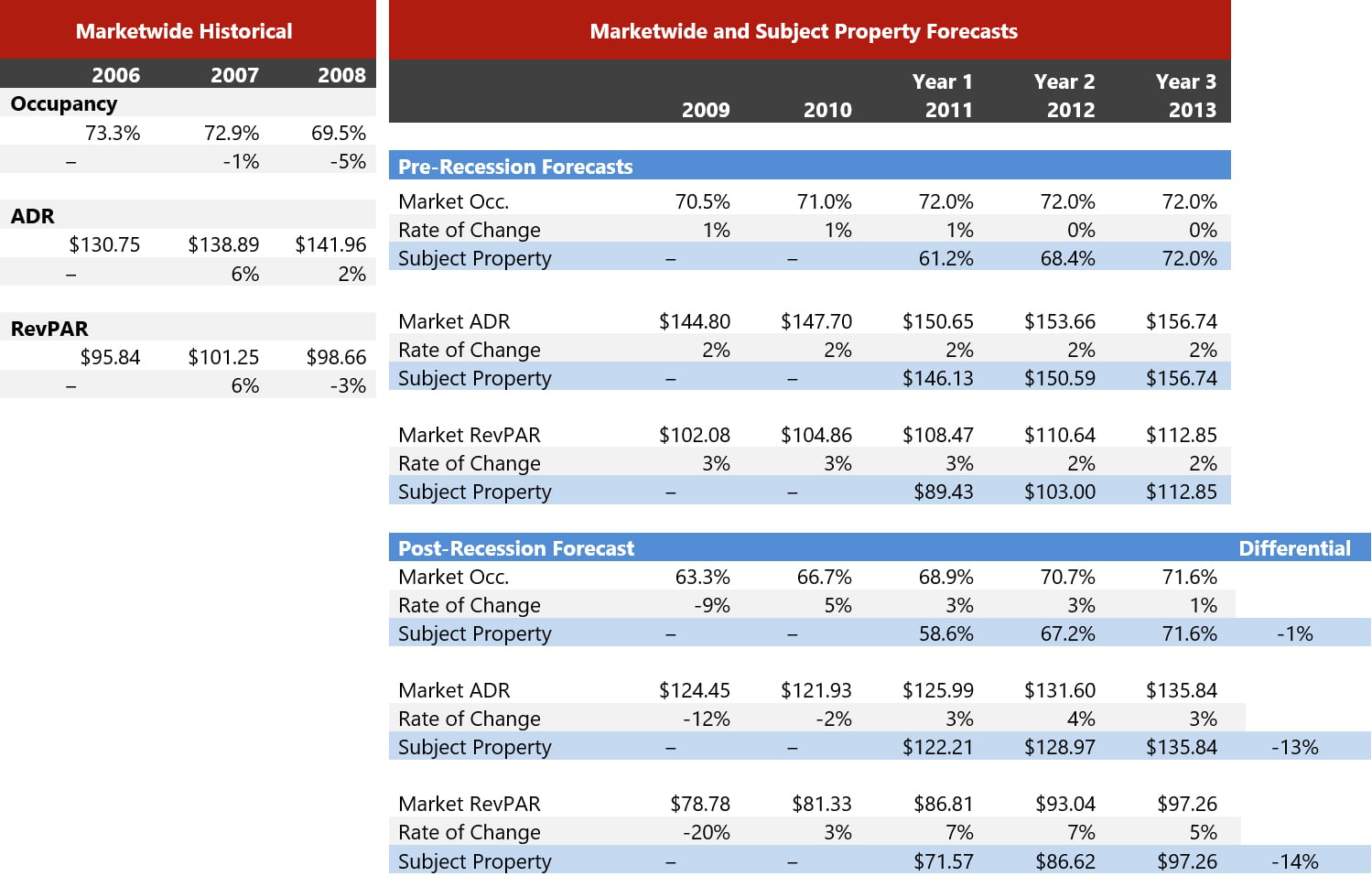

1. Changes in Feasibility: Because a proposed hotel will open two to three years or more into the future, it is often believed proposed projects are automatically immune to the challenges that the industry may be facing at the current moment. The reality is that when occupancies and ADR levels decrease, this affects future forecasts for the market and subsequently the subject property. Specifically, changes in ADR levels tend to have a more pronounced impact on the anticipated revenue levels of a development, and any unforeseen decreases in ADR may negatively impact feasibility. To illustrate this point further, we have created a hypothetical scenario illustrating how an abrupt change in market conditions, such as the recession of 2008/09, affects revenues levels of a hotel five years out.

In the example below, we use actual occupancies and rates from the 2006-2008 period for the San Diego market. Pre-recession, a hypothetical proposed hotel anticipated to open in 2011 and expected to perform at the market-average level by the stabilized year may have been forecast to achieve a stabilized occupancy of 72% with an ADR of $156.74 and a RevPAR of $112.85 by 2013.

However, post-recession, taking into consideration the actual performance of the market in 2009-2010, that same hotel opening in 2011 would now be anticipated to achieve a similar 72% occupancy (rounded) level by the stabilized year, but with an ADR of $135.84 and a RevPAR of $97.26. In this hypothetical scenario, while occupancy recovered by the stabilized year, the subject property's stabilized RevPAR was 14% lower than originally anticipated (prior to the recession). As illustrated below, the negative and unexpected changes in the market's ADR in the years of 2009 and 2010 affected the opening and stabilized levels of the subject property's RevPAR from 2011 through 2013.

Exhibit 4: RevPAR Differential Calculation

The 14% lower RevPAR by the stabilized year, as illustrated above, would also result in lower revenue levels at the proposed hotel and ultimately a lower "when complete" and "when stabilized" valuation. In this scenario, and in any new development facing a similar environment, in order for the development of the hotel to be remain feasible, construction costs must remain below the new valuation levels that incorporate any changes in the market's occupancy and ADR as a result of the new market conditions. While the above example was presented using historical occupancy and ADR data for San Diego from 2006-2013 only to illustrate the impact to future forecasts when a market unexpectedly turns, the reality is that markets are being influenced in various and unique ways during COVID-19. Some markets, as mentioned earlier, like urban or convention destinations, are being affected more than others, while secondary and tertiary markets have realized a less pronounced impact. Thus, the importance of completing proper due diligence and updating any forecasts for a proposed hotel to fit the latest dynamics of a market and competitive set is key to determining its feasibility.

2. Financing:

In the years that follow a recession, financing for new developments often becomes more challenging to obtain due to risks involved with new construction, coupled with lenders' uncertainty as to the future of the industry. Construction financing generally does not become available again until the market has recovered, and lenders turn to higher-risk investments in order to improve their returns. This limited availability of capital reduces the number of hotel projects that are able to obtain financing and continue with development during a recessionary period. Furthermore, even when capital is available, it is often at much lower loan-to-cost ratios and higher interest rates. Nevertheless, unlike the financial challenges faced in 2008/09, government efforts have thus far succeeded at maintaining the smooth functioning of capital markets. It does remain to been seen if these efforts will continue to be successful in the year ahead, as it becomes more likely that liquidity challenges will remain, and the recession may first deepen before the recovery begins in earnest.

While the aforementioned factors pose challenges for new hotel development, many visionary developers remain optimistic during times of crises. Hotel development can often take three to five years to come to fruition, and as evidenced in the years immediately following the Great Recession, new supply is typically slow to enter the market following a period of correction. The limited number of hotels that are built during recessionary times creates less competition for existing and proposed hotels when the recovery and expansion arrives. Additionally, in this COVID-19 period, we are facing an environment where some hotels may permanently suspend operations. As such, projects that are able to continue construction or open in the coming years will be able to benefit from a new wave of demand that inevitably arrives after each recession. Even if a hotel is not anticipated to open in the next two to three years, recessionary periods are often the best times to move a project forward through the lengthy pre-development process, which may involve market/feasibility studies, entitlement efforts, architecture, design, brand/operator searches, and pre-construction. Moreover, construction costs can often decrease during a period of correction and deflation, which could improve project feasibility if developers have the wherewithal to begin their projects during a slowdown.

Macro Environment

As can be expected, hotel demand is highly correlated with the national GDP. After increasing at an annual rate of 2.9% in the fourth quarter of 2019, real GDP is forecast to decrease by -5.2% by year-end 2020, with a rebound of 2.8% in 2021, according to the U.S. Congressional Budget Office. COVID-19 has had a deep impact on many sectors of the U.S. economy. The national unemployment rate stood at 8.2% as of August but is anticipated to continue to improve in the coming months, as some sectors of the economy are expected to continue strengthening. While there is an ongoing rebound in economic activity resulting from the induced lockdowns, recent data suggest that the road to recovery is now anticipated to be a slower one. Despite an optimistic stock market, other threats continue to loom, including rising tensions between the U.S. and China, ever-increasing deficits and levels of government debt, recent increases in permanent layoffs in various industries, and lower bond yields that continue to signal that investors remain cautious of the future. The upcoming presidential election also has signs of being volatile and highly disruptive, adding to the ongoing uncertainty. Lastly, the significant fiscal and monetary stimulus provided at the start of COVID-19, and which benefited hotels through forbearance, PPP loans, and Economic Injury Disaster Loans, continues to fade as time passes. It remains to be seen how the aforementioned factors will play into the speed of the economic recovery and ultimately its impact on hotel development.

Another key factor is the outlook for inflation, as it is likely to have an impact on hotel ADR and development costs over time. While much uncertainty remains, recent aggressive monetary and fiscal actions completed to stimulate the economy, coupled with the Federal Reserve's recent policy stance toward average inflation targeting in order to make up for periods of low inflation, may suggest that higher inflation is on the horizon. However, stubbornly weak inflation since the Global Financial Crisis (despite economic growth during that time), coupled with the now much weaker economic conditions, suggest that a period of deflation in the near term is more likely before any noticeable inflation arises.

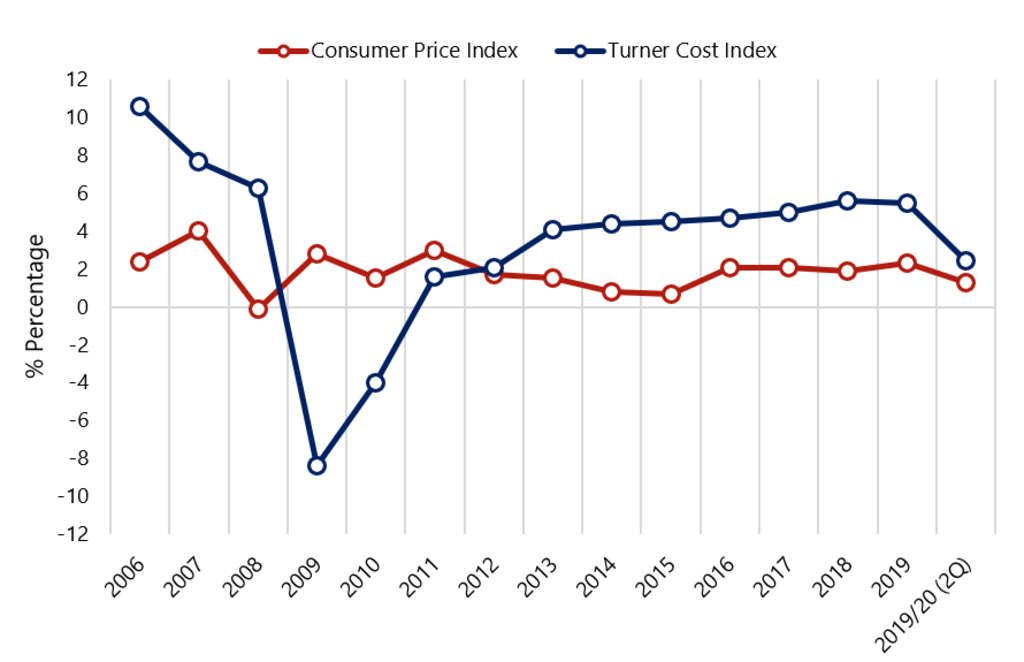

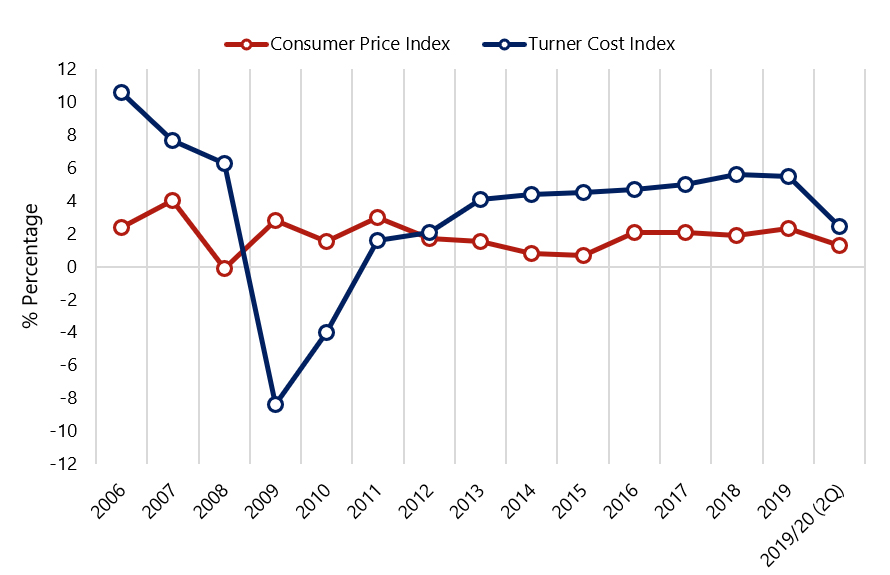

In terms of inflation related to development costs, according to the Turner Building Cost Index, which has tracked costs in the non-residential building construction market in the United States since 1967, the index increased by 5.5% in 2019 and by 2.4% in the 2019/20 trailing twelve months ending in June 2020. The Turner Building Cost Index is determined by the following factors on a nationwide basis: labor rates and productivity, material prices, and the competitive condition of the marketplace. The index had increased year-over-year since 2011, significantly outpacing inflation since 2012. However, the first decrease in the index since 2010 occurred in the second quarter of 2020. As of the second quarter of 2020, Rider Levett Bucknall (RLB), which also provides a quarterly construction cost report, reported a rise in its construction cost index of approximately 4.2% in the 2019/20 trailing twelve months ending June 2020, noting that construction costs peaked in 2019 and have decreased in 2020. The change in the Turner Construction Cost Index compared with the change in the Consumer Price Index (CPI) during the same period is illustrated in the following graphic.

Exhibit 5: Percentage Change in Consumer Price Index Vs. Turner Cost Index

As shown above, the gap between general inflation and construction inflation has narrowed significantly in 2020, reminiscent of the dynamic experienced in 2008-2009, with both metrics illustrating contraction. The recent decrease in construction costs arrives as a welcome relief for developers, who have faced ever-increasing construction costs that have well exceeded inflation for nearly a decade.

In 2020, as a result of COVID-19, developers have encountered disruptions with supply chains resulting from the government lockdowns. While construction remained an "essential business" during the pandemic, delays in the receipt of materials have delayed the openings of some hotels. As an example, many materials or FF&E arriving from China or other regions experienced delays as those countries also dealt with their lockdowns and labor restrictions of their own. The cost of some materials, such as lumber, also increased significantly, rising over 100% in the summer of 2020, followed by equally rapidly decelerating prices that began in the fall, largely attributed to an increase in new home construction demand following the lockdowns, coupled with homeowners completing home improvement projects of their own. Supply concerns may remain in place as we navigate the winter months and what may or may not become renewed restrictions associated with a second wave of the virus, which has started to take place in other regions of the world.

Hotel Development Cost Categories

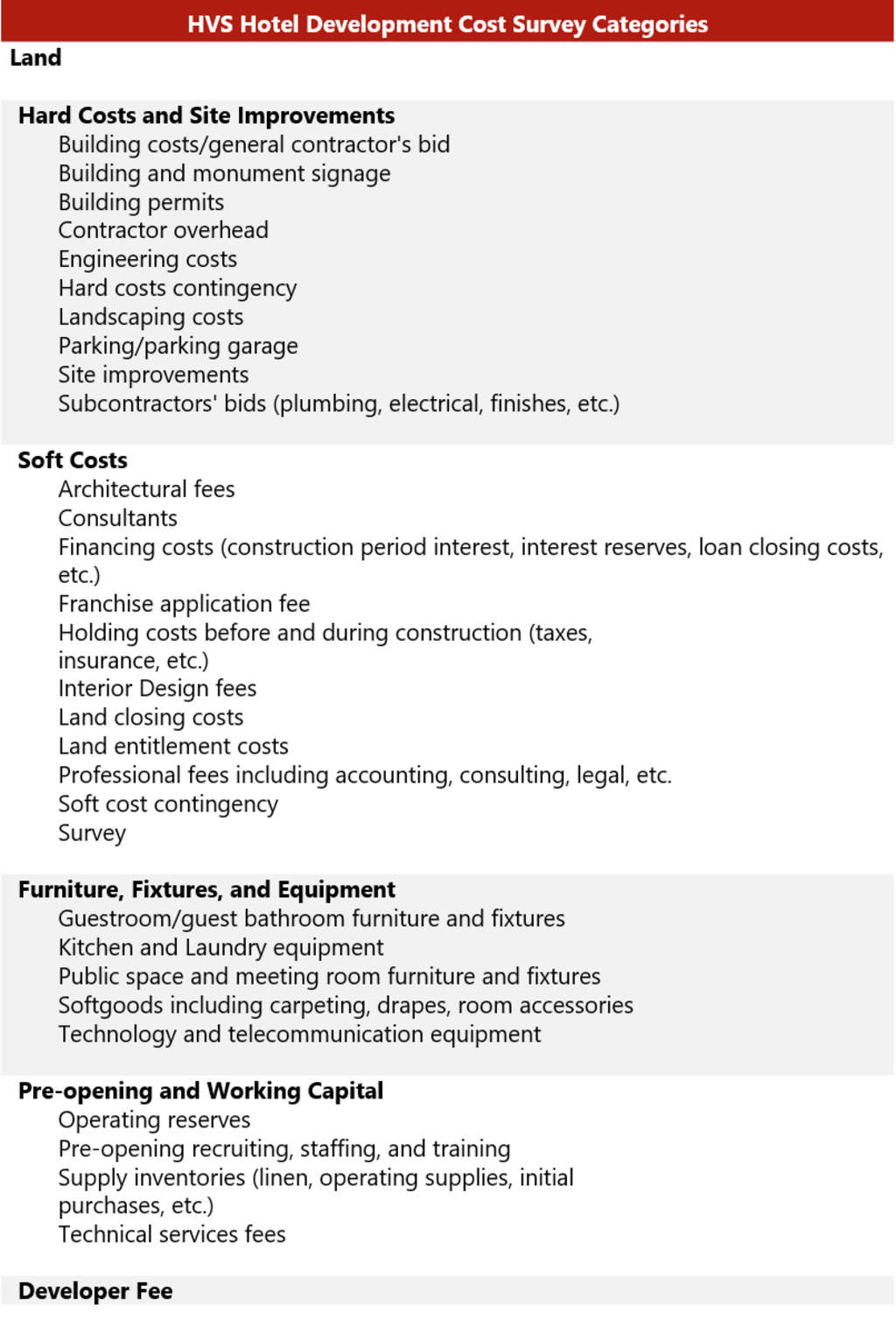

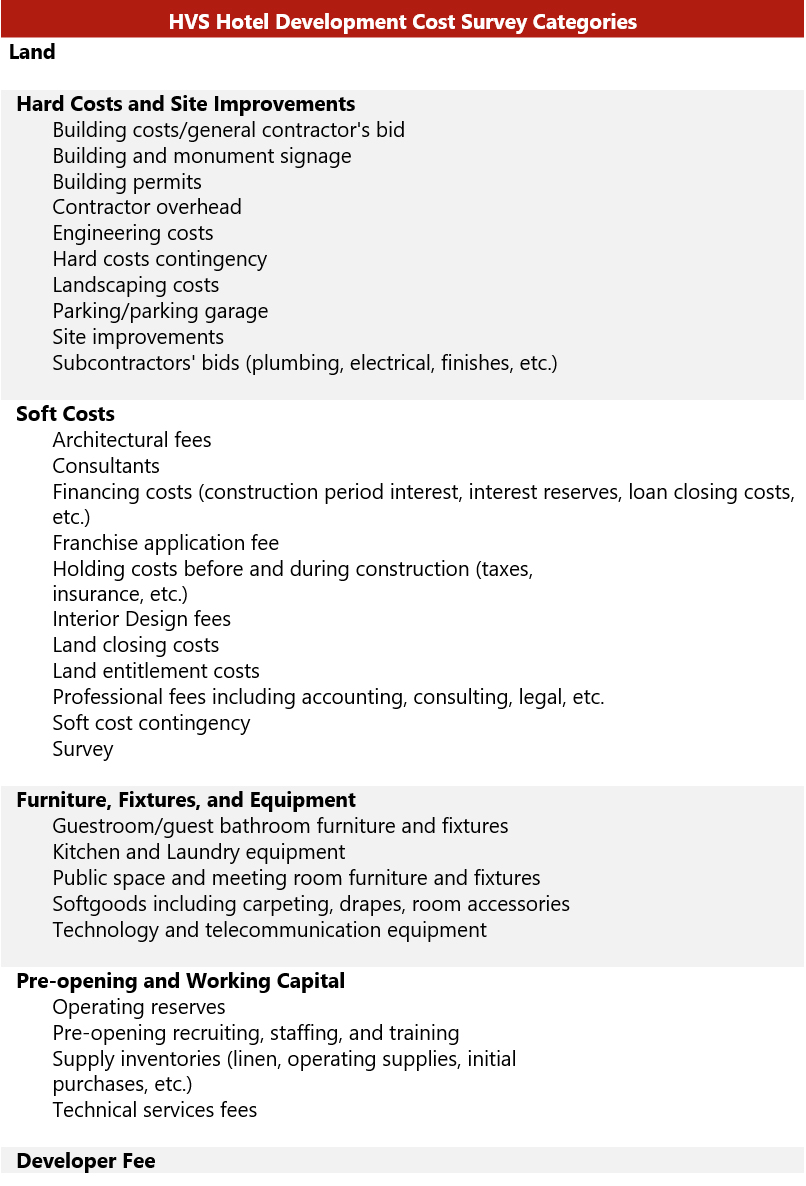

Evaluating the completeness of a hotel development budget can often be challenging, as different line items are used, and some components are unintentionally omitted. HVS has been at the forefront of assisting developers and industry participants make sense of hotel development costs through the consistent presentation of these costs. Based on our experience in reviewing actual developers' budgets, as well as preparing the annual HVS U.S. Hotel Development Cost Survey, we have developed the following summary format for hotel development budgets, which forms the basis for the presented cost categories. We find that these categories are meaningful for hotel professionals when undertaking an analysis relating to hotel feasibility, and they provide a basis from which to analyze proposed projects. The following illustration shows the six categories defined by HVS, as well as the typical items associated with each category.

Exhibit 6: HVS Hotel Development Cost Categories

The categories are not meant to be all-encompassing but do reflect the typical items in a development budget. In construction accounting, development budgets are generally presented in far greater detail than for general investment analysis.

Data Collection and Sample Size

In 2019, HVS collected actual hotel construction budgets across nearly all 50 states. While not every construction budget was captured (due to a variety of reasons, including incomplete data, skewed data, or development attributes), our selection includes complete and reliable budgets that form the basis for this year's survey. The budgets included projects that reflected both ground-up development and the redevelopment of existing buildings throughout the United States. This year, the top states most represented in the survey were Arizona, California, Colorado, Florida, Georgia, Illinois, New York, and Texas, illustrating where the bulk of hotel development is occurring in the country. Furthermore, as can be expected, construction costs vary greatly in different parts of the country. In this sample, the highest construction costs per key were undoubtedly for projects located in California, with a few luxury developments in other states, particularly South Carolina, Georgia, Texas, and Illinois. Conversely, the lowest costs per room were evident for economy and limited-service hotels in sunbelt states; Texas, in particular, had the highest representation in these categories.

We also examined the lodging product-tier breakdown of our data to further determine the most popular types and brands of hotels that were developed in 2019. The limited-service category was the most represented out of all categories, with brands such as Avid, Fairfield by Marriott, Hampton by Hilton, Holiday Inn Express, La Quinta by Wyndham, and SpringHill Suites by Marriott highly represented within the category. This was followed by the full-service category, with brands such as AC Hotel by Marriott, Delta by Marriott, Hilton, Embassy Suites by Hilton, and Tapestry Collection by Hilton also highly represented. The most popular brand developed overall was Home2 Suites by Hilton, falling within the midscale extended-stay category.

Per-Room Hotel Development Costs

The averages and medians below reflect a broad range of development projects across the United States, including projects in areas with low barriers to entry and in high-priced urban and resort destinations.

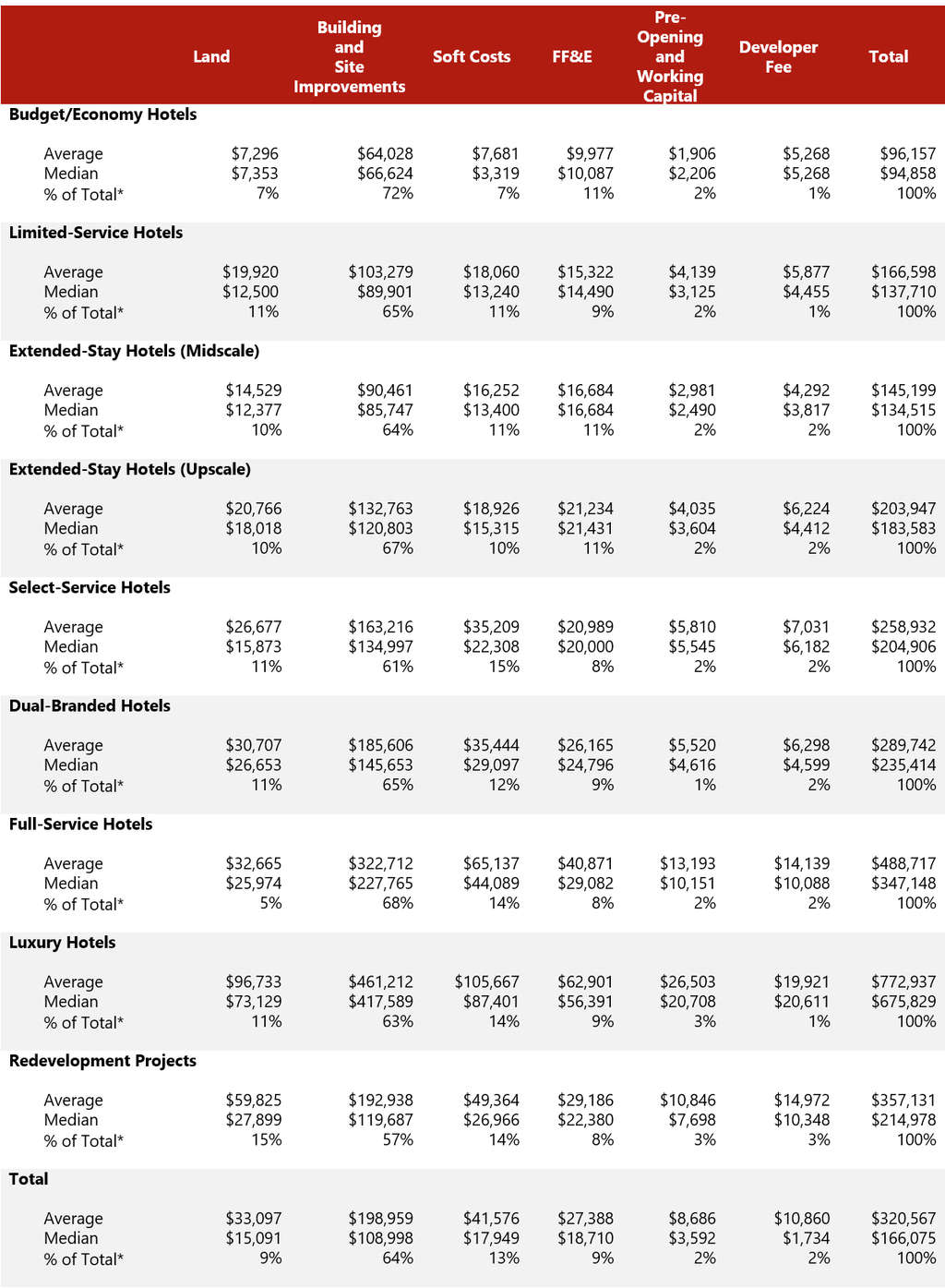

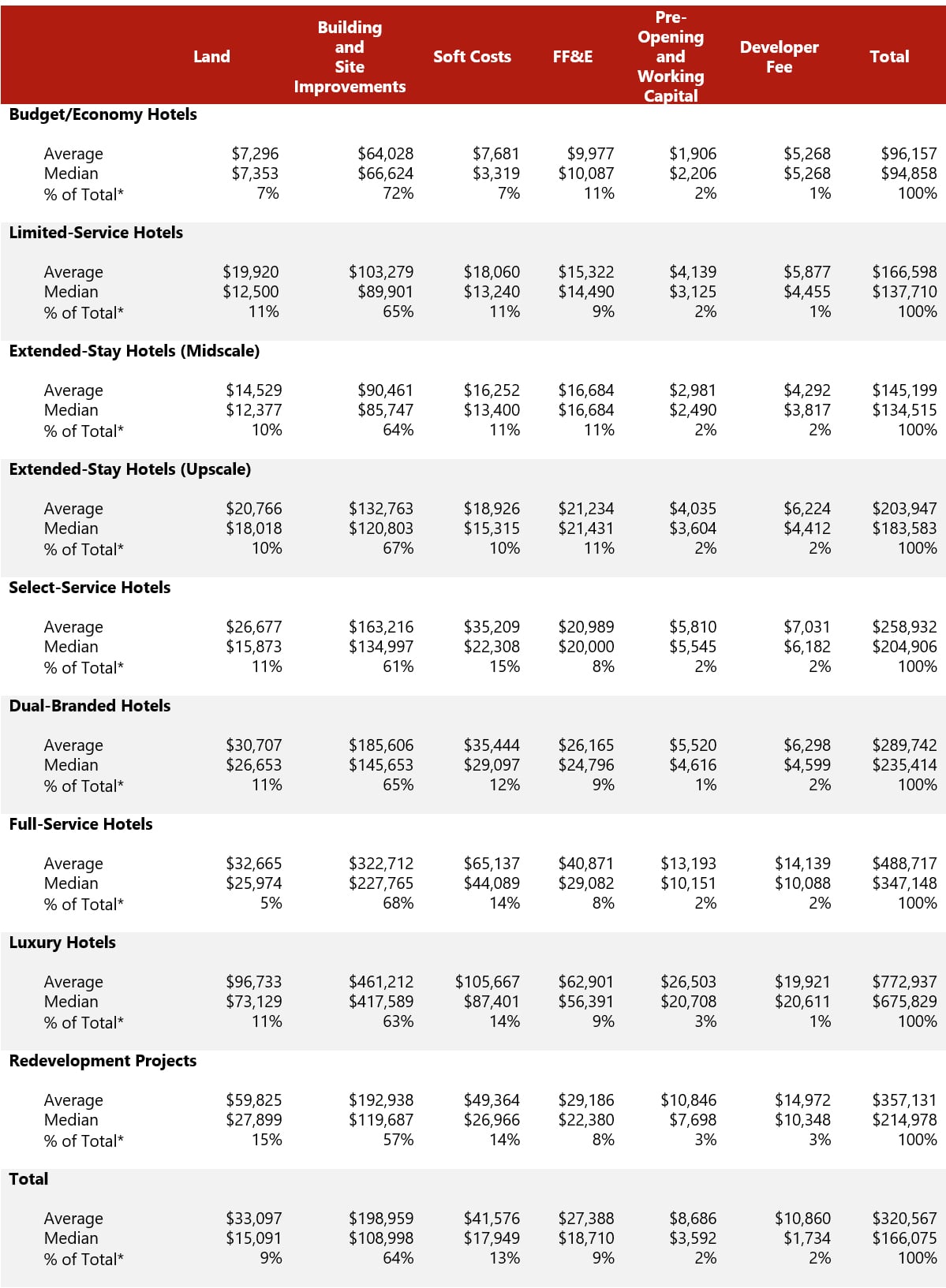

Exhibit 7: Hotel Development Cost Per Room Amounts

As illustrated above, budget/economy hotels had a median development cost of $95,000 per room in 2019. The most popular brands in this category included Microtel and My Place hotels. However, as has been the case in previous years, this was the category with the least development activity in our survey, as the land and construction costs necessary to develop this product are not typically justified by the revenue potential; thus, new construction of economy hotels is often not feasible.

Limited-service and midscale extended-stay hotels illustrated median costs per room in the mid-$130,000s and included the popular brands previously highlighted. The median cost for hotels in the upscale extended-stay category was $184,000 per room and was most represented by the Staybridge Suites, Residence Inn by Marriott, and Homewood Suites by Hilton brands.

Select-service hotels, including brands such as Hyatt Place, Cambria, Courtyard by Marriott, and EVEN, reflected a median cost of $204,000. The cost to develop full-service hotels was $140,000 higher per room than select-service hotels, with a median cost of nearly $350,000 per room.

Lastly, the median cost to develop luxury hotels was recorded at $675,000 per room. Similar to the economy category, this category reflected the lowest number of developments given the mathematics of making luxury projects feasible across the country with such high development costs. We also note the number of hotels under development was lower than the prior year's survey, illustrating a slowdown in development in the luxury segment.

In Conclusion

The budgets analyzed in this survey are provided directly by the developers, owners, and lenders on both ground-up and conversion hotel projects during the course of an entire year. The results of the survey combine the data from actual construction budgets organized across a variety of product types. The results also comprise unique hotel projects that cannot be replicated by the inherent nature of hotel development. As such, we would caution developers on relying on the information to estimate costs for a specific project, as a multitude of factors affect a hotel's development budget. Thus, we recommend that users of the HVS U.S. Hotel Development Cost Survey consider the per-room amount in the individual cost categories only as a general guide for that category. Construction and FF&E design and procurement firms are the best sources for obtaining hard costs and FF&E costs for a specific hotel project. It is also advised that developers consult more than one source in their hotel development process to more accurately assess the true cost of development. Additionally, cost should always be adjusted for inflation over the development timeline given that the typical hotel development process can last three to five years. Lastly, we recommend that the projected performance of the proposed hotel be revisited periodically during the development process.

All individual property information used by HVS for this cost survey was provided on a confidential basis and deemed reliable. Data from individual sources, brands, or regions are not disclosed.

Other contributors:

Suzanne R. Mellen, MAI, CRE, FRICS, ISHC

Lizzette Casarin

Kathryn Lutfy

Astrid Clough McDowell