Who Are Project Stakeholders?

Identifying Project Stakeholders

A project stakeholder is any individual or group that can affect, be affected by or believe to be affected by a project during its life cycle and/or its output and can influence its success. A development project has multiple stakeholders with varied and often conflicting interests.

A project participant is any person that is directly involved in the development process, often as a party to the project management plan. Developers, lenders, operators and investors are the key participants in development projects.

Developers are commonly the property owners. The operators may be the owner-operator, a hotel management company or franchisee. The investors may be the owner-operator, a REIT, a holding company or an individual direct investor.

Every property development project involves different activities and requires interaction among numerous parties from the public and private sectors. These parties have different functions, provide different skills, may have decision-making power over the project and influence its realization, operation and success.

Numerous third-party service providers are engaged by the project participants. These include consultants for the feasibility studies, general contractors and subcontractors for property construction, operators and asset managers on behalf of the investors, and appraisers to value property for developer project exit and sale.

Other stakeholders have different levels of influence and different types of interests and risks in the projects. They include local governments, taxing districts, surrounding communities and their prominent citizens, politicians, existing hotels, and local businesses.

The success of a property development project depends primarily on the developer's ability to effectively coordinate and lead the process. For this, the developer must balance the demands of all stakeholders and manage their engagement during each distinct phase of the property's life cycle.

Sustainable development creates shared value for all stakeholders. For the stakeholders to benefit from sustainability, they must understand and adopt the applicable sustainability principles along the value chain.

Justifying Development Projects

Sustainability is the carrying out of economic activity without depleting resources or having harmful impacts now or for future generations. Sustainable development anticipates financial profit for the project participants as well as the creating of shared value for all stakeholders.

The business case justifies a project's undertaking. Business justification is usually based on the estimated cost of development and implementation against the risks and the anticipated business benefits and savings.

Business justification is generally based on the anticipated financial benefit to the project participants along the project value chain. This is typically measured in terms of financial performance and economic benefit.

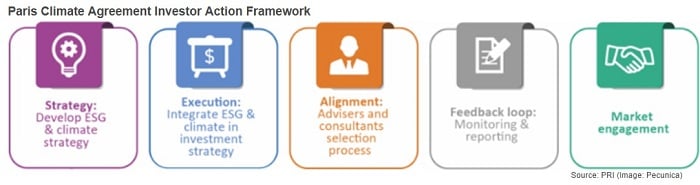

Environmental, social and corporate governance (ESG) factors can have a significant impact on corporate financial performance. Increasingly, lenders and investors demand that the companies they finance or invest in consider environmental and social factors in their business.

ESG factors are considered at different stages of investment analysis and business valuation. The terms and conditions of loans and investments may be linked to ESG key performance indicators (KPIs).

Creating shared value is the business model used to accelerate the achievement of sustainable development goals (SDGs). Companies are creating shared value (CSV) when using policies and operating practices to synchronize the progress of the economy and society while enhancing their competitive advantages and profitability.

Corporate social responsibility (CSR) has an ethical responsibility focus on doing right by the community and the environment while making a profit for shareholders. It requires ethical behavior in all parts of the business process and is commonly viewed to coincide with creating shared value.

In 2011, the European Commission (EC) defined CRS as "the responsibility of enterprises for their impacts on society". Moreover, the World Economic Forum declared in 2017 that "society is best served by corporations that have aligned their goals to serve the long-term goals of society".

Measuring Sustainable Development

Development generally has a significant environmental, social or economic impact on all stakeholders. Various tools are used to measure the impacts for developers, lenders, investors, personnel and the communities where the development takes place.

Sustainable development has led to the use of triple-bottom-line accounting to provide stakeholders with a full accounting of the costs and benefits through the adoption and application of sustainability principles in the business. The triple-bottom-line approach measures the sustainability impact on the three pillars of sustainable development: society (people), the environment (planet), and the project's financial performance (profit).

The business case is concerned with the economic benefit to be realized from engaging in a business activity. The business case for sustainable development addresses the economic reasons for pursuing CSR strategies and policies.

Sustainability reporting is used by companies to report on the environmental, social and economic impact that their business has on all stakeholders, commonly through an integrated sustainability reporting framework. Some companies include social and environmental accounting information in their annual reports and other investor communications, while others report on ESG metrics separately in sustainability reports.

Businesses that use the triple-bottom-line approach are benefiting from the transparency of their reporting, with a proven positive relationship between corporate responsibility and financial performance. The inherent difficulty with this approach is in the measuring of sustainability and recognition of shared value.

The Global Reporting Initiative (GRI) established an international independent framework of principles and performance indicators for organizations to measure and report on their corporate social responsibility (CSR) or environmental, social and governance (ESG) performance. GRI guidelines currently constitute the most accepted and widely spread standard for sustainability reporting.

A major issue with sustainability reporting is the lack of an objective or comparable way to measure the ESG key performance indicators (KPIs). There is no international standardized and comprehensive framework for ESG reporting.

Copyright © 2020 Pecunica LLC. All rights reserved.