Why Is Feasibility Analysis Important?

Assessing Project Financial Feasibility

The financial feasibility study (FFS) determines if or confirms that a project is potentially profitable, it including financial and scenario analysis and an investment appraisal. It should include a cost-benefit analysis of the project throughout the project's entire economic life, as most costs are incurred post construction from operation of the facilities.

For hotel development projects, the findings are converted into a stream of revenue and expense until the end of the asset's economic life based on:

- Qualification of the local hotel demand and competitiveness of all existing and pipeline hotels in the market to estimate the annual occupancy rate (OCC) and the average daily rate (ADR) per room;

- A projection of the OCC and ADR to estimate the annual net operating income (NOI), commonly over a five- to ten-year period; and

- Conversion of the projected NOI using a weighted cost of capital (WACC) discounted cash flow procedure or net present value calculation to determine the internal rate of return (IRR).

Life-cycle cost analysis (LCCA) is used to identify the costs associated with a project in every step of development over its useful economic life, including disposal. It takes into account the initial capital cost as well as operational, maintenance, repair, upgrade and eventual demolition, landfill and/or recycling costs.

LLCA typically considers only the economic costs of a product, not social or environmental factors. It is commonly used by investors to determine a project's return on investment (ROI) until exit.

As used for sustainable development, whole-life costing is life-cycle cost analysis that considers the environmental, social and economic dimensions of sustainability in assessing the costs of an asset over its whole life. However, a universally accepted standard approach to value and calculate the costs of the social and environmental factors of sustainable development has not been established.

Issues with Feasibility Studies

Developers commonly question the usefulness of feasibility studies and view them to be ineffective at predicting the performance of development projects. They are generally undertaken merely to reach a conclusion based on the required return on investment (ROI) provided by the developer.

Many developers have already decided on the location, product, concept and design when contracting the feasibility analysis. They are commonly used simply to rubber-stamp their projections and to satisfy lenders, operators and investors.

The time constraints for the production of feasibility studies are usually very tight and the fees charged for them low. The time and price pressures as well as the questionable usefulness of feasibility analyses are the key reasons why more is not invested in producing more sophisticated and reliable studies.

Primary research is labor-intensive and requires a sophisticated research methodology and staff. This make it cost more than the clients are generally willing to pay.

The reliance on secondary data, automated writing programs, boilerplate templates, preexisting text, and previous feasibility studies are commonly accepted ways for developers to save time and money. The drawback to this approach is that it produces less accurate and reliable feasibility studies than primary research.

The consultants who produce feasibility studies have little incentive to improve their approach to feasibility study nor are they held accountable for inaccuracies. Property developers generally do not either challenge or review the studies or ask for revision or amendment to make them more appealing to the end-users.

Feasibilities studies generally neglect sustainability in their development projects due to the concern of developers about the cost. They fail to understand the positive effect the implementation of sustainable development principles has on the return on investment along the property life cycle and project value chain, notwithstanding the social and environmental impacts.

Feasibility Analysis of Sustainable Development Projects

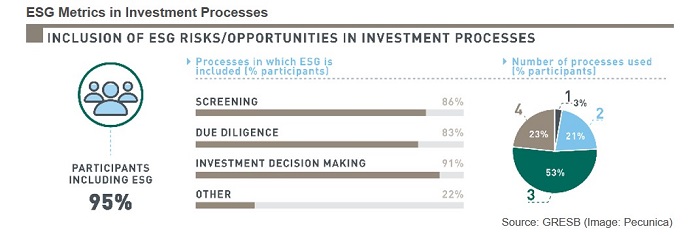

Developers adopt sustainability strategies to identify opportunities to benefit from improved environmental, social and economic (ESG) performance. ESG analyses include financial feasibility analysis as well as social and environmental impact assessments.

ESG metrics are incorporated into feasibility studies in deciding whether to initiate a project. Sustainability in property development projects must be adopted upon project conceptualization.

ESG analyses are used to guide project planning and design. Developers, lenders and financial investors may support ESG analyses during project planning and design to understand the project's risks and commercial feasibility.

The highest return on the investment can be realized when sustainability development principles are implemented in the project design. This ensures that the sustainability issues of the various stakeholders are considered for their feasibility assessment throughout the project's whole-life cycle.

Sustainability is taken into account during the implementation and operation of the project. The return on investment (ROI) is realized by the developer, operator and investors along the value chain.

Architects and designers must be consulted for the implementation of sustainable development principles. Their advice influences the success of a project for all stakeholders and is essential for attaining the goal of sustainable development.

Besides impacting social and operational performance, ESG performance has a significant impact on the cost of capital. ESG factors are considered in the decision-making and portfolio management of investors, as they correlate with low volatility and stability in return on capital employed.

Financial investors evaluate ESG data made available from project developers when conducting their due diligence, often through external technical advisors. For this, they incorporate material ESG criteria into their internal rate of return (IRR) analyses and net present value (NPV) calculations.

For sustainable development, feasibility analyses must consider the respective sustainability issues of all project stakeholders. It calls for the collaboration between all parties to produce sustainable and high-performance properties throughout their extended life cycle.

Copyright © 2020 Pecunica LLC. All rights reserved.