How can hotels forecast and manage revenue given the volatility of travel?

Leadership from Chaos’ London 2021

On October 12th, leaders in the field of revenue management gathered in London at Leadership from Chaos, to discuss and debate the latest news and trends, and set the industry agenda on existing practices and future strategies.

OTA Insight’s Chief Commercial Officer and Co-founder, Gino Engels, spoke on the panel session: “Time Bomb or Saviour? Can we inject our way out of this crisis?” where he provided analysis on the recovery of the UK and Europe’s travel and hotel industry, supplemented with OTA Insight data to fully illuminate the situation.

In this post we summarise Gino’s thoughts on the status of travel and hospitality in the UK and Ireland, and in some cases Europe as a whole, and its prospects moving in to 2022.

Demand Recovery

Business and corporate travel

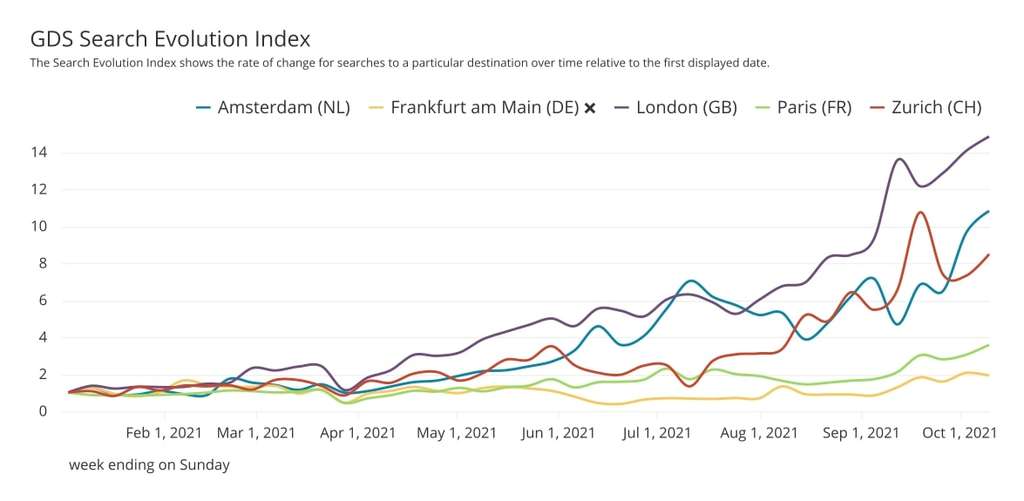

Using OTA Insight’s predictive intelligence solution, Market Insight, we observed Global Distribution System (GDS) searches, which gives a good indication on the state of corporate travel. We compared data up to October 10th from the start of the year for Europe's leading financial centres, which displayed marked growth.

London saw a 14-fold increase in GDS searches, equivalent to a 1400% jump, Amsterdam at just under 10 times and Zurich at 7. However, Paris and Frankfurt are lagging slightly behind with 3- and 2-fold raises, respectively, which demonstrates that it is still very much market dependent.

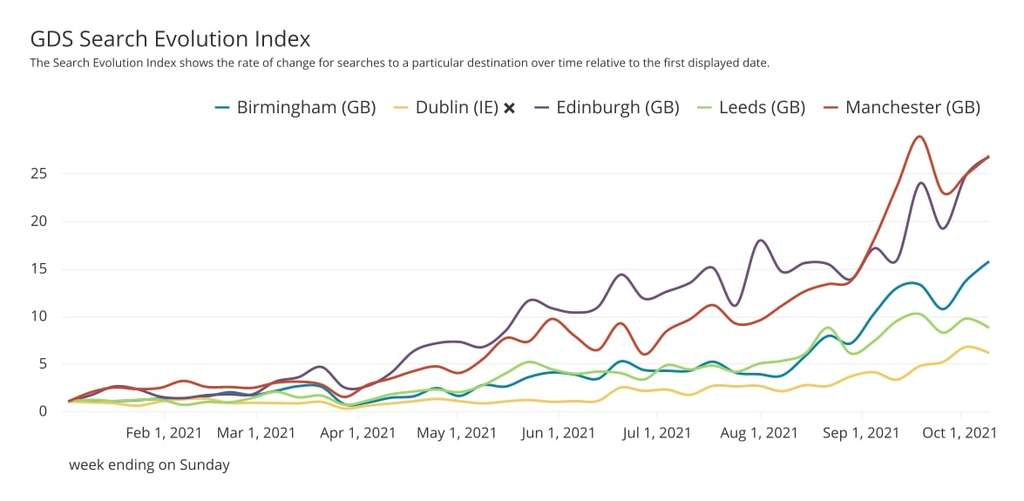

There are clearly promising signs for corporate travel but it’s by no means a complete recovery in Europe yet. There is still some way to go. If we zoom in on the UK and Ireland’s GDS data, we see that there has been a pronounced increase in GDS search volume from the beginning of the year to present day. Manchester and Edinburgh’s GDS search is up 27 times or 2700%, Birmingham 16, Leeds 9, and Dublin 6. From this we can infer that corporate travel across the UK and Ireland is making positive steps toward recovery.

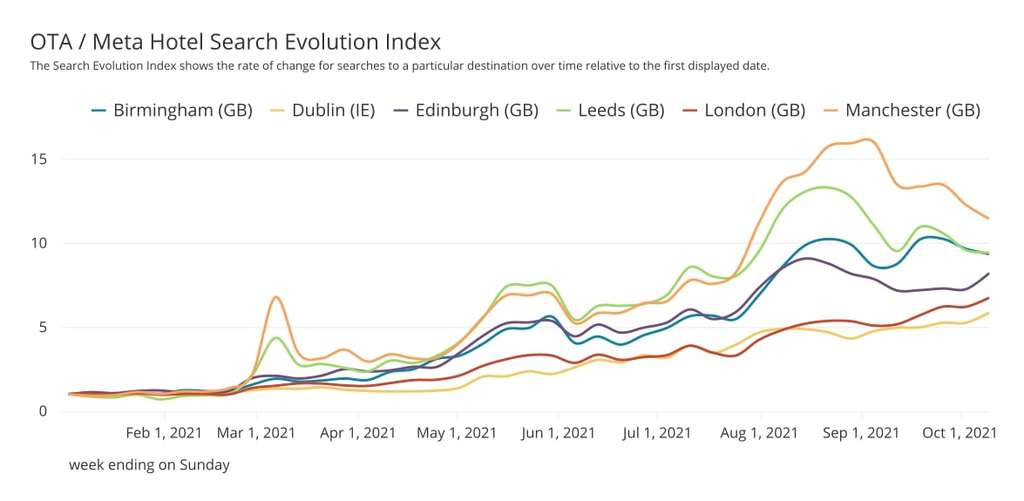

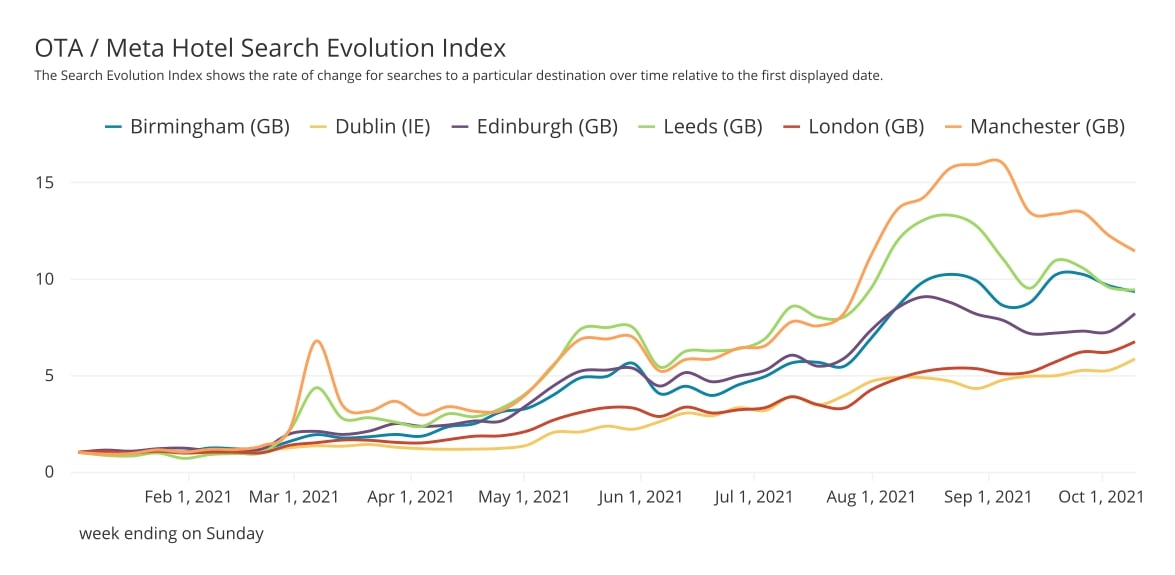

Leisure travel

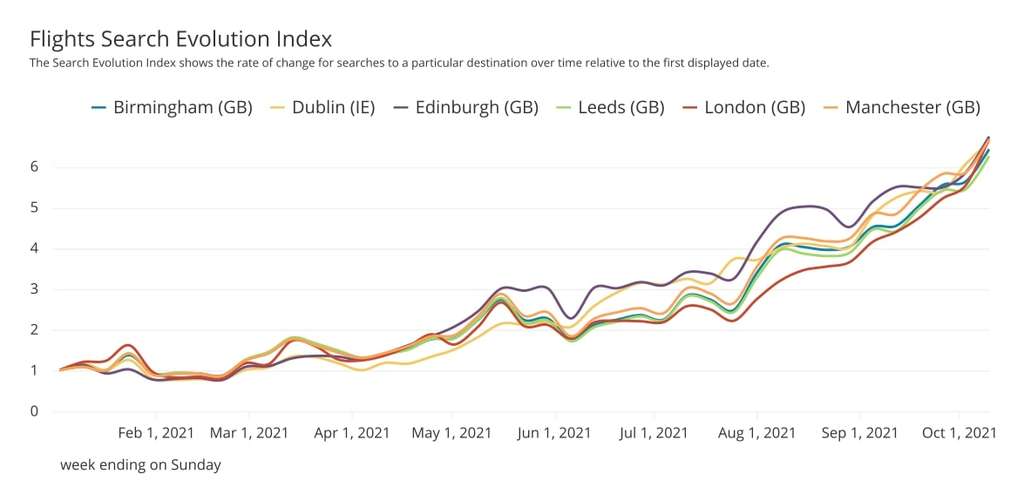

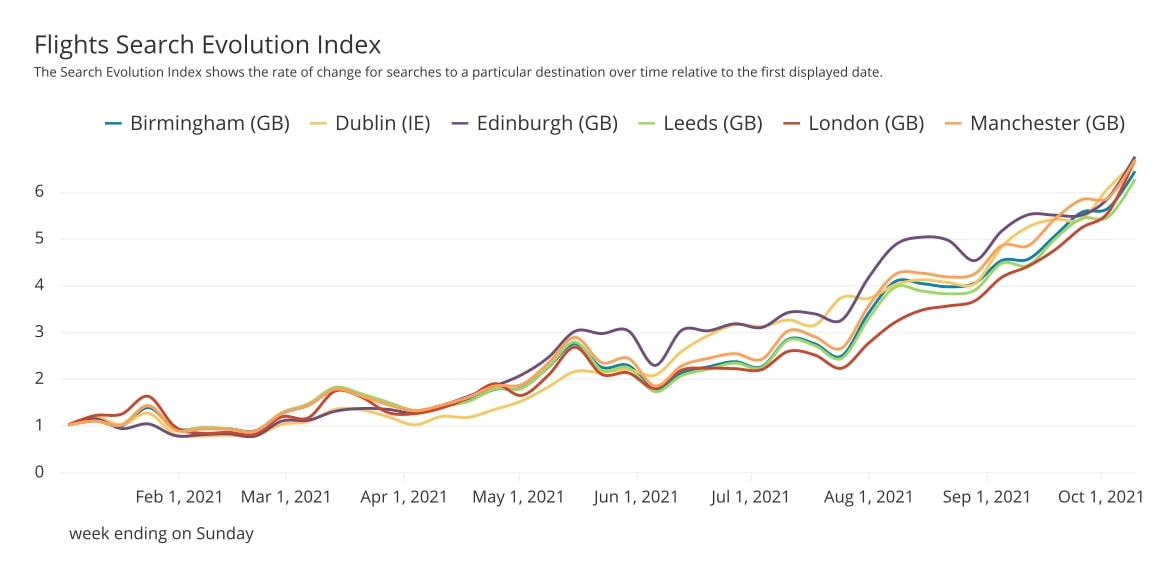

At a regional scale, in the UK and Ireland, there is an equally distinct pattern of improvement from the start of the year, when looking into the leisure travel segment. By examining flight search evolution in Market Insight from the start of the year until October 11th, we can see that most key travel destinations in the region have been tracking at a similarly positive rate. Manchester, London, Dublin and Edinburgh have had the largest increase at 6.7 times the volume of searches compared to January 2021, and Leeds the lowest still at 6.3 times and then Birmingham in the middle at 6.4 times.

Then looking at the OTA/Meta hotel search evolution in Market Insight, the positive upward trend continues: Manchester up 11 times or 1100%, Leeds 9, Birmingham 9, Edinburgh 8, London 7, and Dublin 6.

International versus domestic demand (short-haul vs. long-haul)

2020 proved to be a disastrous year for domestic and international tourism. However, the data clearly shows that when tourists were allowed to travel domestically, they did so, booking accommodation and providing much-needed revenue for the industry.

Domestic travel still needs to be top of mind for hoteliers, but slowly the tide is slowly turning. With the gradual removal of international travel restrictions, there is now a much more positive outlook, even for some long-haul destinations

Using our free data tool, Global Market Insight, we can look at the top 5 countries searching for flights and hotels for a destination. For example, recently, the US announced it would be easing its coronavirus travel restrictions and reopening to passengers from the UK, EU, and other nations from November.

In July, we saw that 75.9% of all flight searches to Orlando were coming from within the US. Fast forward to October 11th and the United Kingdom is now top with 48% of all flight searches. An obvious indication of international travel picking up.

However, the more common trend is that short-haul regional travel is resuming at a far greater rate. On July 1, the European Union made its vaccine passport available for all EU citizens and residents in a bid to restore freedom of travel across member states, which certainly helped.

- If we take Amsterdam, the top three countries searching for hotels in the Dutch capital are UK (17%), Germany (15%) and France, and Italy (both 9%).

- In Porto, Portugal it is Spain (31%), Brazil (12%) and France (10%).

- In Krakow, Poland it is the UK (36%), Norway (7%) and Germany, Italy, and France (all 6%).

We must take it market by market though - there are still large variations across Europe and in some destinations, domestic travel is dominating. For example, in Edinburgh, Scotland 71% of all hotel searches are from within the UK and Hamburg. And in Germany, 77% of all hotel searches are within the country of Germany.

Common trends, different markets

So what trends are we able to reveal at this point? This is an incredibly difficult question to answer. After the past eighteen months, the hospitality industry may look at the idea of complete recovery with a large dose of skepticism for some time. It is dependent on several factors, many of which are out of our industry’s control. The factor: vaccination rate of a nation, as this enables the economy to reopen, travel to resume, and hotels to operate and function properly.

The good news is that in large swathes of Europe hotel and flight searches are now increasing week over week. In September, European nations dominated the top rungs of Bloomberg’s Covid Resilience Ranking for a third month. Ireland took the top spot with about 90% of its adult population fully vaccinated.

As part of our free Global Market Insight tool, there is a recovery trend panel, which is a search evolution index, tracking flight and hotel search volumes for the last 6 months. If we pick out a few cities in Europe we can see that:

- Flight and hotel search volume for Paris has increased 7.4 times since the beginning of April - equivalent to a 740% rise.

- Berlin has had a 10-fold increase in hotel search volume and a 7.6-fold increase in flight search.

- Vienna has had a staggering 13-fold increase in hotel search volume, or 1300%, and a 10-fold increase in flight search volume.

Overall, the data tells us that Europe is well-positioned for recovery, epecially when we compare to a couple of cities further afield. In America, hotel search volume for New York has increased 2.6 times and flight search volume has increased 3 times. Bangkok has had a 1-fold increase in hotel search volume and a 1.6-fold increase in flight search volume.

Summary

Domestic demand evidently returned, and in some destinations, surpassed pre-pandemic levels. How long will this last? Well, that all depends on the recovery of travel, both regionally (short-haul) and globally (long-haul). But ultimately that’s just speculation. We can try and guess as much as we like, but no one has a crystal ball with the answers.

The closest thing we do have is a predictive demand solution, powered by forward-looking data. At a time when previous demand trends and historical analysis cannot be relied upon and entire segments of the market are barely operating; real-time data that can forecast shifting demand patterns is vital to drive revenue.

Thankfully as shown by the data above, regional short-haul European travel is starting to see a resurgence. Hotel and flight searches are now increasing week-over-week. The increase in longer length of stay and lead times also indicate less concern around cancellations – another sign of renewed traveller confidence. The balance between domestic and international travel may in fact be starting to shift.

The key to success? Utilise forward-looking datasets, such as flight and hotel demand, GDS search, lead times, and average length-of-stay as a holistic method to judge demand trends for your market. In turn, you can then optimise your hotel revenue and avoid losing business to your competitors - whether this comes from domestic travellers or international.

About Lighthouse

Lighthouse (formerly OTA Insight) is the leading commercial platform for the travel & hospitality industry. We transform complexity into confidence by providing actionable market insights, business intelligence, and pricing tools that maximize revenue growth. We continually innovate to deliver the best platform for hospitality professionals to price more effectively, measure performance more efficiently, and understand the market in new ways.

Trusted by over 65,000 hotels in 185 countries, Lighthouse is the only solution that provides real-time hotel and short-term rental data in a single platform. We strive to deliver the best possible experience with unmatched customer service. We consider our clients as true partners—their success is our success.