2022 Hunter Conference Takeaways

Contributions by Janet Snyder, Adam Lair, Eric Guerrero, Neil Flavin, Lauren Hock, Janet Ott, Heidi Nielsen, and James Rebullida.

As we get ready to close out the first quarter, the Hunter Conference offered the industry’s latest perspectives on where we find ourselves today and predictions about how the rest of 2022 may play out. Highlights of what we heard at the event are captured here.

Transaction volume is expected to remain high, and equity returns are under pressure

Many interested parties remain in the market ready to buy, both at an institutional level for portfolios and at a private level for individual deals. Moreover, interest in full-service assets is starting to rise. This should support another active transaction market during the next three quarters. Because of high pricing, buyers are scrutinizing the specifics of each deal even more than usual. Even optimistic underwriting is struggling to hit guidance on many deals, with some buyers looking at 7% to 8% cap rates on year-two NOI. With interest rates on the rise, inflation and staffing shortages affecting margins, and pricing not cooling off, equity returns are being compressed.

As forbearance is ending and PIP requirements are being more strictly enforced, more owners are likely to sell. Owner reserves were depleted during the pandemic, and business levels have not been strong enough to replenish them, particularly in light of rising operating costs and existing debt commitments. As a result, many investors are looking to take advantage of more distressed sales this year. Finally, buyers may also look to purchase newly built hotels that are priced at a premium compared to what they cost to build a year or two ago, but well below what they would cost to build in today’s environment.

Corporate and group travel is returning, but not quick enough for many, and staffing remains a concern

As we emerge from the winter, each week is bringing a rise in corporate transient travel and group bookings. However, midweek travel remains well below pre-pandemic levels. Cautious optimism on the recovery of the midweek period was noted, but the current state of the midweek market remains a concern. Staffing continues to be a major issue, and many owners are scratching their heads about how to overcome it without altering margins for good going forward.

Thursday and Sunday nights, which used to be a challenge for hotels to fill, are now stronger than the historically strong Monday through Wednesday nights. These nights are lifting off of the strength of weekend travel, as travelers are able to work remotely during these shoulder days. The rise of this “bleisure” segment (the blending of business and leisure travel) is changing the market. Travelers in this new segment prefer a larger room footprint, and hotels with innovative furniture and fixtures and refreshed design aesthetics may be best suited to capture this segment. Additionally, hoteliers are leveraging underutilized space in the hotel to accommodate their needs, rethinking and expanding programming to create inclusive and “collectible" experiences.

Other evolutions in travel as we exit the pandemic include the expansion of wellness travel and travelers’ focus on hotels and brands that are best aligned with their personal values, such as carbon neutrality and social issues.

New construction is difficult in light of rising costs and supply chain challenges

Developers are facing a challenging environment, with contractors’ prices escalating and supply chain challenges causing unforeseen roadblocks to the normal timeline. While developers are itching to build again, new construction requires more due diligence than ever, and many are looking at replacement cost and deciding whether to buy existing properties instead. Rising material and labor costs and supply chain issues are causing developers to review their budgets even more frequently than normal, as what pencils out one day may not do so a few months later.

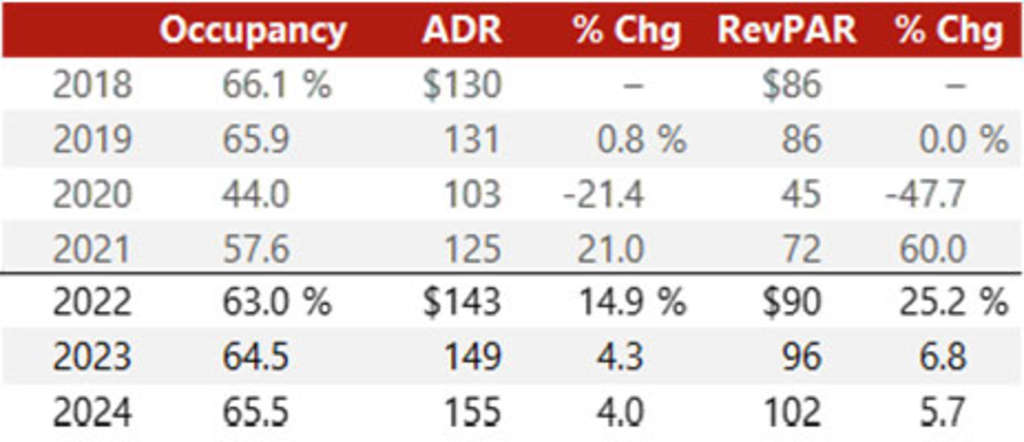

Our latest forecast reflects 2022 RevPAR surpassing the 2019 level

We updated our U.S. forecast in early March 2022 to reflect the increase in ADR that occurred in late January and February. ADR this year should move RevPAR above the 2019 level, with occupancy lagging.

We look forward to seeing you at the upcoming AAHOA conference, AHLA’s ForWard Conference, and the NYU Investment Conference. We will keep you updated on the latest takeaways from these important gatherings.

Rod Clough

President of HVS Americas

+1 214 629 1136

HVS