Indian Hotel Sector – Recovering the Lost Ground

The recovery of travel demand in India is gathering steam, thanks to the relaxation of restrictions, positive travel sentiment, and the resumption of scheduled international flights, which has resulted in a significant increase in flight and hotel bookings in the country. Just last week the Delhi International Airport was in the news for displacing the Dubai airport as the world’s second busiest airport in March 2022, as per a study by the global travel data provider, Official Airline Guide. This, however, is not an isolated case. Total air traffic in the country increased by over 38% in March 2022 compared to February 2022, and by more than 44% year-on-year. In fact, as per media reports, air traffic in April 2022 has been around 10 million, almost 96% of the traffic in April 2019.

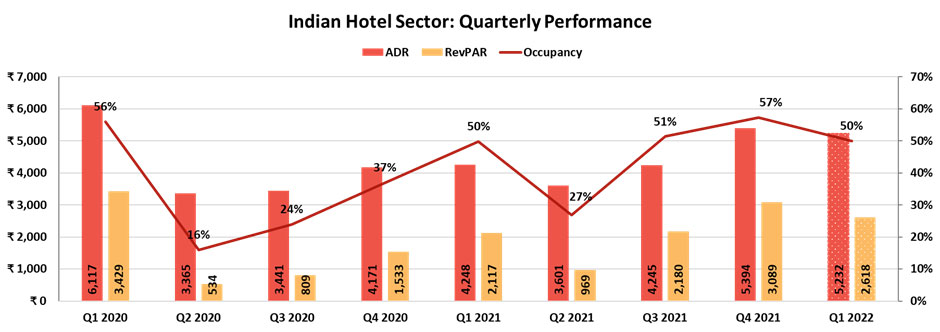

The upbeat travel sentiment has been a harbinger of good news for the Indian hotel sector as well, with nationwide hotel occupancy breaching the 60% mark in March 2022 – a first since the onset of the pandemic – as several markets outperformed their pre-pandemic occupancy for the month. Leisure markets continue to drive the recovery, but commercial markets are slowly catching up thanks to the resurgence of corporate travel as well as large events and conferences. For instance, the start of the IPL season in Mumbai in March pushed the city’s occupancy to pre-pandemic levels for the month. As a result, the city along with Goa were the key hotel markets in the country, with occupancy of over 75% during the month. Mumbai, along with Pune, also saw the greatest increase in occupancy in Mar 2022 compared to the previous year.

The strong recovery in demand is also driving steady increases in average room rates, which are gradually approaching pre-COVID levels in the majority of the markets. In March 2022, the average rates in India were in the range of INR 5400-5600, representing a year-on-year increase of 37-39% but still 12% lower than in March 2019. However, some markets, particularly those in the leisure sector, have outperformed their pre-pandemic average rates. Even smaller leisure markets in the country, such as Haridwar and Corbett, as well as hill stations in Himachal Pradesh, Uttarakhand, and Jammu & Kashmir, to name a few, are experiencing all-time high occupancy and ARRs. Goa, for example, outperformed pre-pandemic levels of performance in March 2022, with occupancy and average rates for the month being 4 percentage points and 22% higher, respectively, than in March 2019. Jaipur and Chandigarh are two other markets where average rates are 5% and 3% higher than pre-pandemic levels, respectively. Mumbai's average rates, meanwhile, have increased by 62-64% year-on-year in March 2022, but are still 20% shy of pre-pandemic levels.

We expect this momentum to carry over into the upcoming summer vacation season, which, when combined with the slower hotel supply growth, will help the Indian hotel sector to cross the pre-pandemic performance levels by the end of this year. The only threat to this growing momentum is the rising COVID cases in a few cities as well as the inflationary pressures, which may dampen traveler sentiment and impact the sector’s profitability in the short to medium term.

Mandeep S Lamba

President (South Asia), New Delhi

+91 (124) 488 5552

HVS