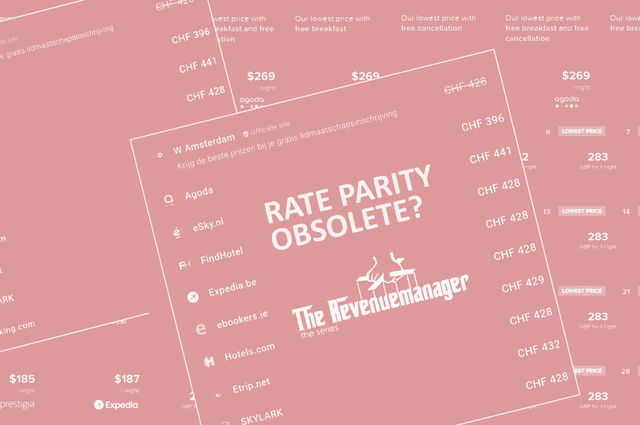

Is Rate Parity Obsolete?

16 experts shared their view

The discussion around the pros and cons of rate parity has been around for almost a decade now. Regulations on the issue are, at best, patchy, with some countries where RP clauses are strictly prohibited (such as France, Austria, Italy, and Belgium), partially prohibited (Germany and Sweden), announced (Switzerland), or still unregulated (US and Latin America). With lower volumes of booking coming from OTAs during the pandemic, moreover, the debate about rate parity became even more heated: some properties decided to work in wide rate parity to avoid OTAs' dimming and improve their online visibility at the expenses of direct revenue, while other ones preferred to openly break rate parity on their top-performing channels. Both the OTAs and major hotel brands complicated the issue even further when they began offering out of parity “member only” rates, hidden behind an easily obtained loyalty program password. With so many different approaches and fragmented regulations, how should hotels deal with rate parity, especially after the whole industry has been severely hit by COVID-19?

At first, offering a lower rate on the hotel's website sounds like a great idea. Guest looks for the hotel, sees various rates in Google search results, finds the lowest rate, and proceeds to the hotel's direct channel to book a room. In reality, most of the guests do not search for a specific property and instead look for all available hotels in a particular destination. OTAs appear first in search results and conveniently offer different hotel options. Moreover, OTAs built a large customer base through loyalty programs and partnerships (credit card points redeemable on Expedia, for example). Also, OTAs can help drive customers to the hotel's website. The "billboard effect" suggests that hotels can receive a boost in reservations through their website due to being listed on the OTAs. These are some clear benefits for hotels to partner with OTAs. Rate parity is either a requirement or desirable best practice for such a partnership to be successful.

What if the hotel sends OTAs higher rates? OTAs monitor rates in real-time, and once the lower rate is discovered, either cut off the property from its platforms or place the hotel very low in search results. Consequently, hotels risk missing out on revenue opportunities by being out of parity with OTAs.

What about OTAs? Do they always display rates the hotel sends them correctly? Not at all. Suppose the hotel offers the same rate for all channels. In that case, it does not automatically ensure rate parity as OTAs always try to find creative ways to provide lower rates and undercut the hotel's direct channel. One example is offering a discounted rate on the OTA mobile app (this way, the disparity is not visible in Google search) by sacrificing the portion of a commission. Hotels need to monitor rates on OTA channels constantly (invest in a rate shopping BI). Rate parity is a two-way street.

Rate parity ensures a consistent brand image for the hotel and its products in the consumer's eyes through pricing. It allows hotels to benefit from OTAs' marketing efforts and customer base. On the other hand, price transparency shifts focus from value to price and constrains effective revenue management. The balanced approach would be maintaining rate parity across all channels and creating value-focused channel-specific bundled packages to drive revenue and shift share from OTAs to direct channels.

Did hotels become less reliant on OTAs due to the COVID19 pandemic? OTAs consistently outspend hotels on marketing and technology. I expect OTAs to continue playing an essential role in hotel distribution.