Market Recovery Monitor - 1 October 2022

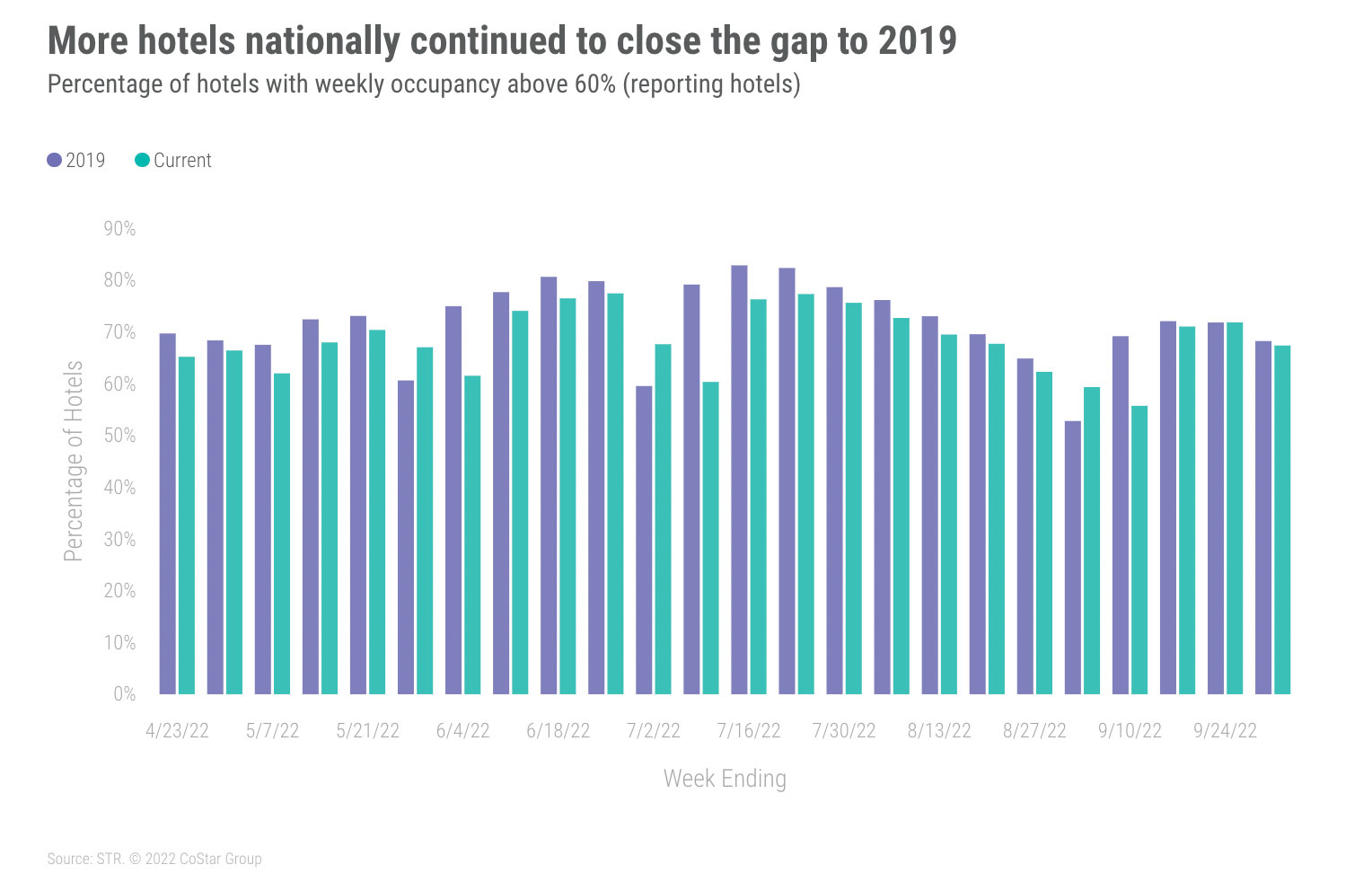

U.S. hotel performance was affected by two significant demand-influencing events during 25 September to 1 October 2022—Rosh Hashanah and Hurricane Ian. The religious observance was mostly responsible for a fall in U.S. room demand, which was down 5.1% week on week (WoW) with the largest declines occurring on Monday and Tuesday. The hurricane impact could be seen Tuesday through Thursday in Florida, Georgia and Alabama then continued into the weekend in North and South Carolina. Demand dropped 7.9% in those areas from Tuesday onward. Overall, U.S. weekly occupancy fell to 66.4%, 3.5 percentage points (ppts) lower than a week prior but 4.7ppts higher than a year ago. Nominal average daily rate (ADR) fell 5.5% WoW to US$150, 16% higher than the 2019 comparable and 14% above a year ago. Adjusting for inflation, real weekly ADR was equal to 2019, and the measure has been above 2019 for three consecutive weeks. Nominal revenue per available room (RevPAR) decreased 10% week on week to US$99, up 13% from the comparable week of 2019 and 23% higher than a year ago. Real RevPAR was 2% less than in 2019.

In the markets where demand wasn't affected by the hurricane, Rosh Hashanah brought down weekday (Monday-Wednesday) and group travel, particularly in key markets. Weekday demand was down 8.5% WoW among the 21 major markets outside of the southeast with group demand accounting for 79% of the loss. The largest week-on-week decreases in total weekday demand were seen in key convention cities, including Anaheim (-21%), San Francisco (-19%), New York City (-13%) and Washington, D.C. (-13%). Despite the declines, weekday occupancy in the 21 markets was 71%, down 6.6ppts from a week prior. Eleven markets, including Boston, NYC, San Francisco, and D.C. reported weekday occupancy at or above that level with Boston and NYC above 80%. After the Rosh Hashanah observance (Thursday-Saturday), occupancy in the 21 markets combined increased to 76%, down 1.2ppts WoW. Boston, Denver, Los Angeles, and New York saw occupancy above 80% for those days with most above 70%.

Given the impact in group demand from the religious observance, it’s not surprising that Luxury and Upper Upscale hotels in non-hurricane impacted markets saw the largest decline in weekly occupancy followed by Upscale. Large (300+ rooms) urban Luxury and Upper Upscale hotels saw weekday occupancy decline 11ppts WoW. Weekday occupancy was down to a lesser extent in all other chains scales. For the full week, occupancy changes ranged from -5.7ppts in Luxury and Upper Upscale to flat in Economy.

Overall, occupancy for markets not impacted by Hurricane Ian reached 67.3%, down 3.3ppts from the prior week. Like the 21 major markets, weekday occupancy showed the sharpest decreases on Monday and Tuesday (-5.3ppt WoW) due to the religious observance. The remaining days saw occupancy fall 2.5ppts WoW. Among markets, Boston and NYC stood out as full week occupancy surpassed 80%. Albuquerque also shined over the weekend with occupancy of 90%, +19ppts, with the start of the International Balloon Festival.

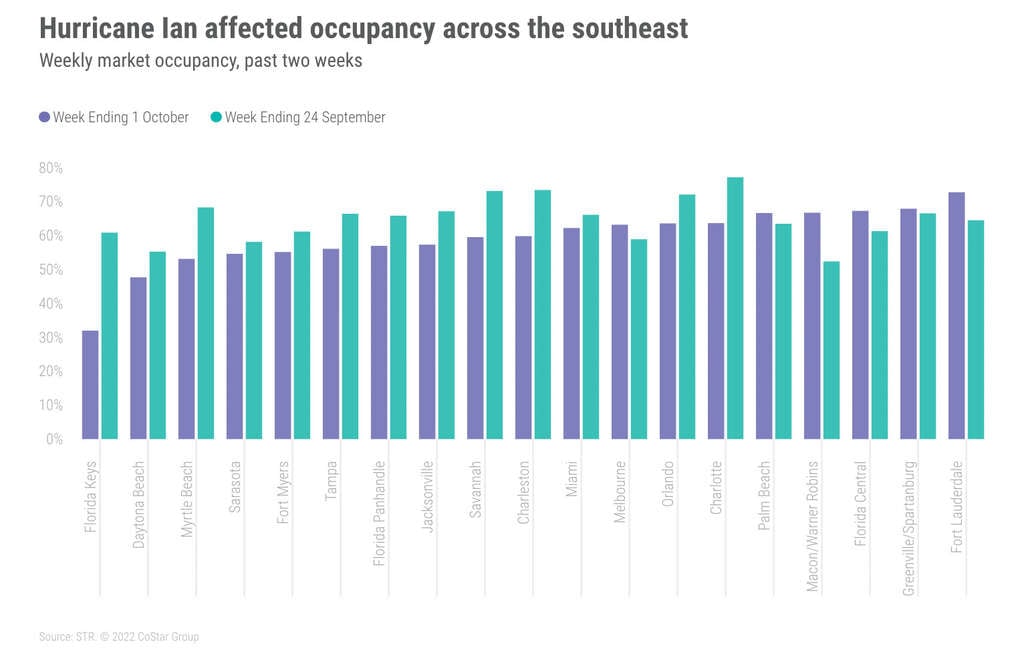

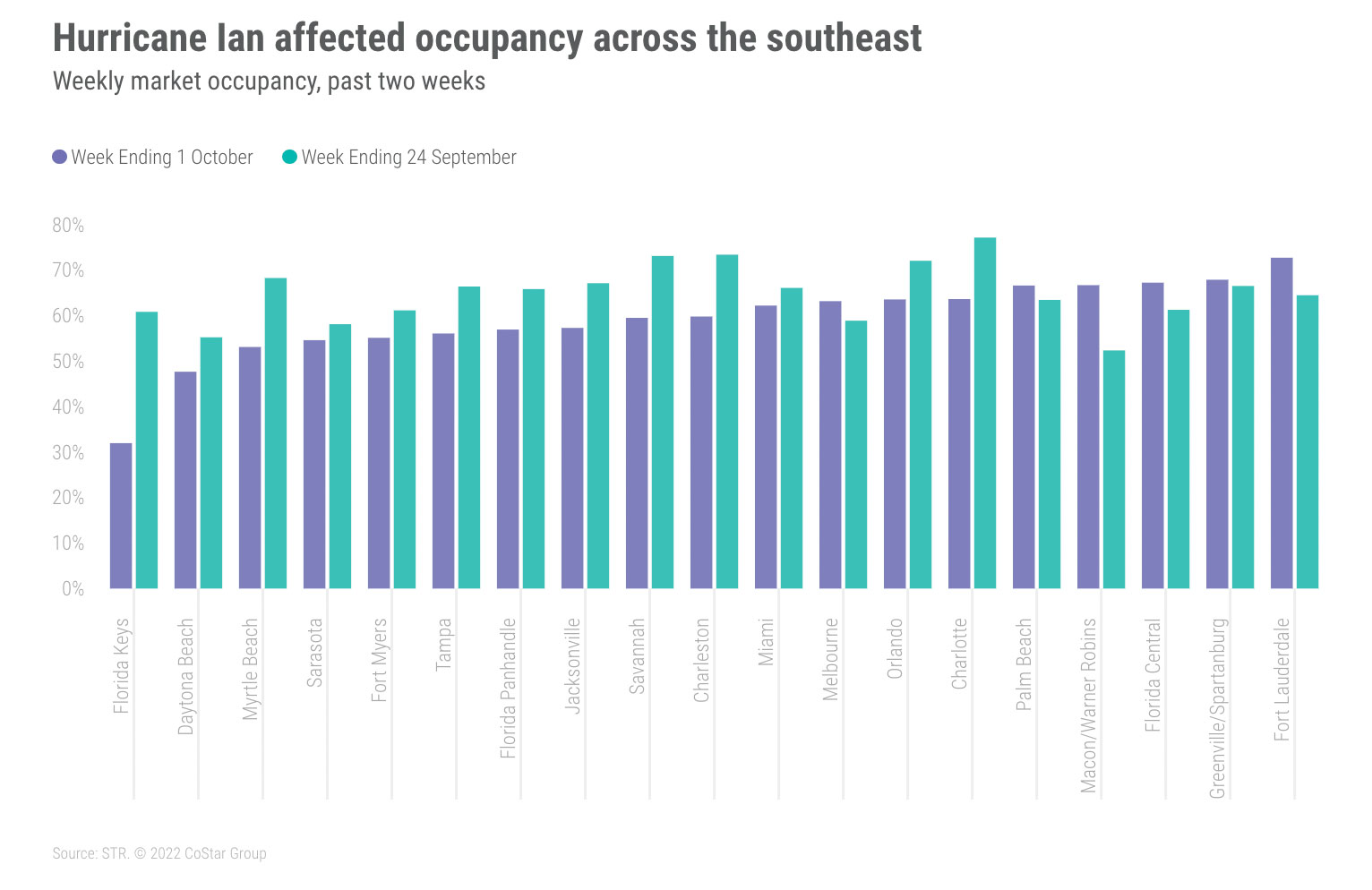

In Hurricane Ian impacted markets, demand was bifurcated. As expected, most markets in the direct path of the hurricane saw drops in occupancy, while others benefited by those fleeing the storm. For this week’s analysis, we have defined “direct markets” based on the Florida counties listed on FEMA’s disaster declaration that are eligible for individual and public assistance. Impacted markets in South Carolina and North Carolina were based on those closest to landfall. All other markets used for this analysis will be referred as “indirect markets.”

All but four Florida markets (Florida Central, Fort Lauderdale, Melbourne, and Palm Beach) saw occupancy fall from Tuesday to Saturday. Occupancy in direct markets fell 7ppts WoW over the five days with the largest decreases seen in Jacksonville (-19ppts) and Tampa (-15ppts). Submarkets in those two markets saw significant declines, with the worst coming in Jacksonville Beaches (-34ppts) followed by Clearwater, Tampa CBD/Airport, and Daytona Beach—which all saw occupancy fall 20ppts or more. Fort Myers, the most impacted market, saw occupancy drop 5ppts over the five days. Not surprising, several submarkets in the disaster declaration area saw sharp gains in occupancy led by Kissimmee East. Occupancy in three submarkets (Ocala, Fort Piece/Port St. Lucie, and Tampa East) surpassed 80% Tuesday through Saturday. Occupancy in 10 of the 29 submarkets in the path of the hurricane saw Wednesday occupancy above 80%.

In South Carolina and North Carolina, sharp occupancy decreases were seen from Thursday to Saturday with occupancy falling 29ppts WoW in Charleston and Myrtle Beach. Columbia also reported a steep decrease over those days (-26ppt). Savannah, listed early on as a potential landfall target, also saw a large retreat in occupancy (-28ppts) during the days leading up to landfall.

Indirect Florida markets had mixed results given the uncertainty of the storm. The Florida Keys saw the largest decrease in occupancy, falling 29ppts in the week with decreases exceeding 33ppts from Wednesday to Friday. Miami fared better with occupancy falling only 4ppts during the week. Indirect markets in Georgia and Alabama saw occupancy rise with Macon/Warner Robins seeing growth of 17ppts Tuesday through Saturday. While none of the occupancy gains were particularly strong, all markets in Alabama rose, except Birmingham, which was flat. Certain submarkets, however, saw solid week-on-week occupancy gains including Mobile (7ppts) Montgomery (5ppts), and Dothan/Enterprise (3ppts).

While still early in the recovery process, it appears hotel supply across direct markets was not impacted severely, except in Fort Myers, where this week’s room count was down by 6,000 rooms (45% of total inventory) as compared with a week prior.

ADR in and out of the hurricane impacted markets saw the same weekly decrease (-5.5% WoW). In Florida, six submarkets saw ADR decrease by more than 10% WoW including Orlando International Drive, Clearwater, St. Petersburg, Fort Myers Beach/Sanibel, and Jacksonville Beach. Tallahassee also saw a big fall (-33% WoW), but the prior week also included a college football boost to demand. On the flip side, 11 submarkets reported ADR increases of more than 10% WoW from Tuesday through Saturday with four (Ocala, Bradenton/Airport, Gainesville, and Tampa North) seeing growth of more than 20% WoW. Even with the large growth, ADR in those four markets averaged US$136.

Outside Florida, the largest declines were seen in the beach markets of South and North Carolina (>10% WoW). Savannah also saw a similar decrease as did Charlotte and Columbia. Macon/Warner Robbins and Greenville/Spartanburg reported the largest weekly ADR gains (+10% WoW) outside of Florida but even with the growth, ADR in Macon/Warner Robbins was under US$100 and Greenville/Spartanburg at US$117.

Luxury and Upper Upscale weekday ADR in non-hurricane impacted markets saw the largest decrease in the measure, dropping -15% and -10% week on week, respectively. Weekend ADR was still down for Luxury (-3% WOW) but up for Upper Upscale (+1.4% WoW). For the full week, all chain scales in non-impacted markets saw weekly ADR drop in the week ranging from -11% WoW in Luxury to -1.3% WoW in Economy.

The RevPAR decline in impacted and non-impacted markets were somewhat similar (-12% WoW and -10%). As to be expected, the largest RevPAR decline was seen on weekdays due to Rosh Hashanah (-14%). Weekend RevPAR decreases moderated to -6% with non-impacted markets seeing even better results (-3% WoW).

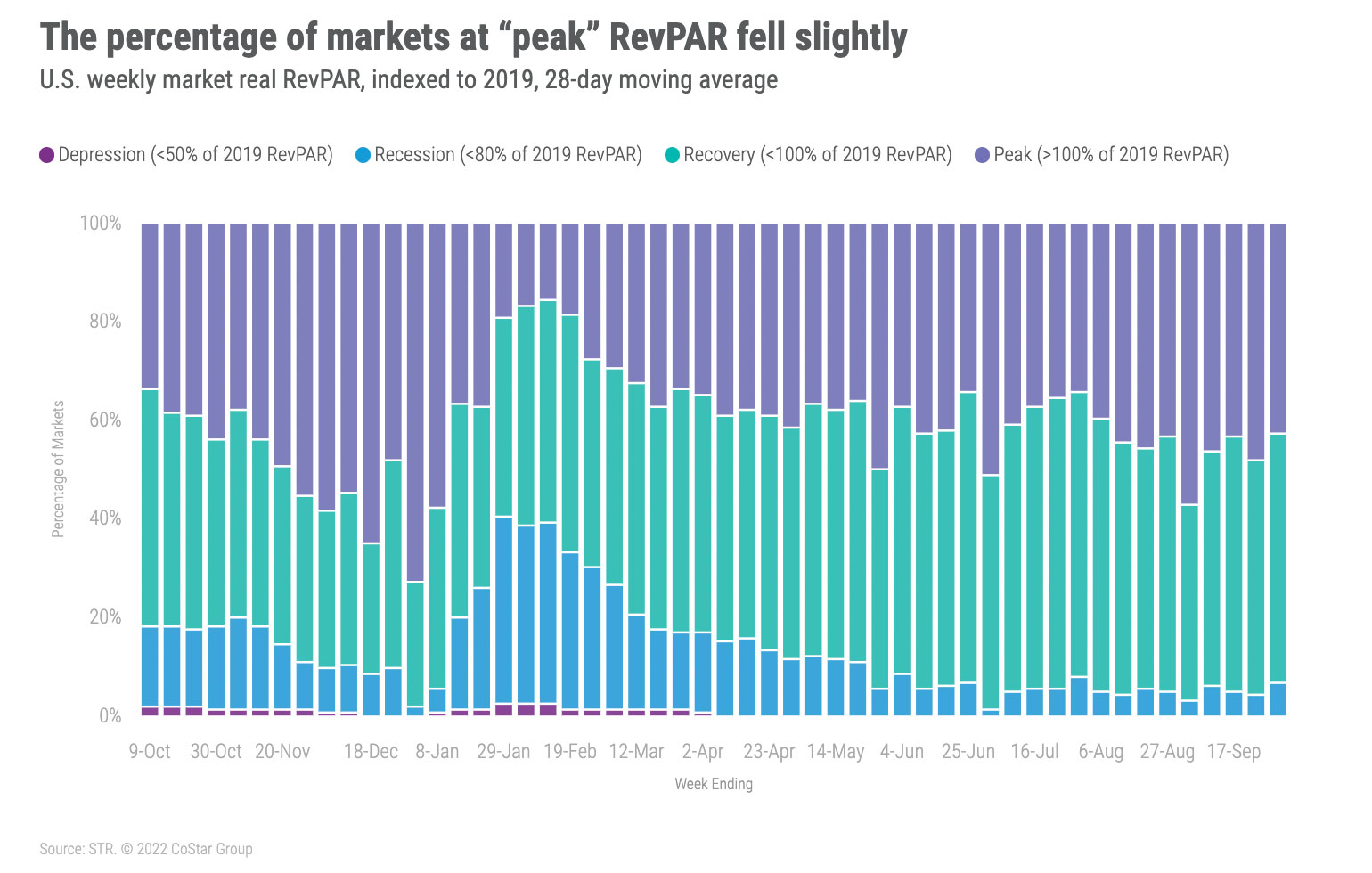

Over the past 28 days, 43% of the 166 STR-defined markets had real RevPAR above 2019, down from 48% a week ago. Most markets (51%) are in “recovery” as real RevPAR was between 80% and 100% of 2019. Eleven markets, including New Orleans, San Francisco, and Washington, D.C. remained in “depression” with real RevPAR between 50% and 80% of the 2019 value.

Around the Globe

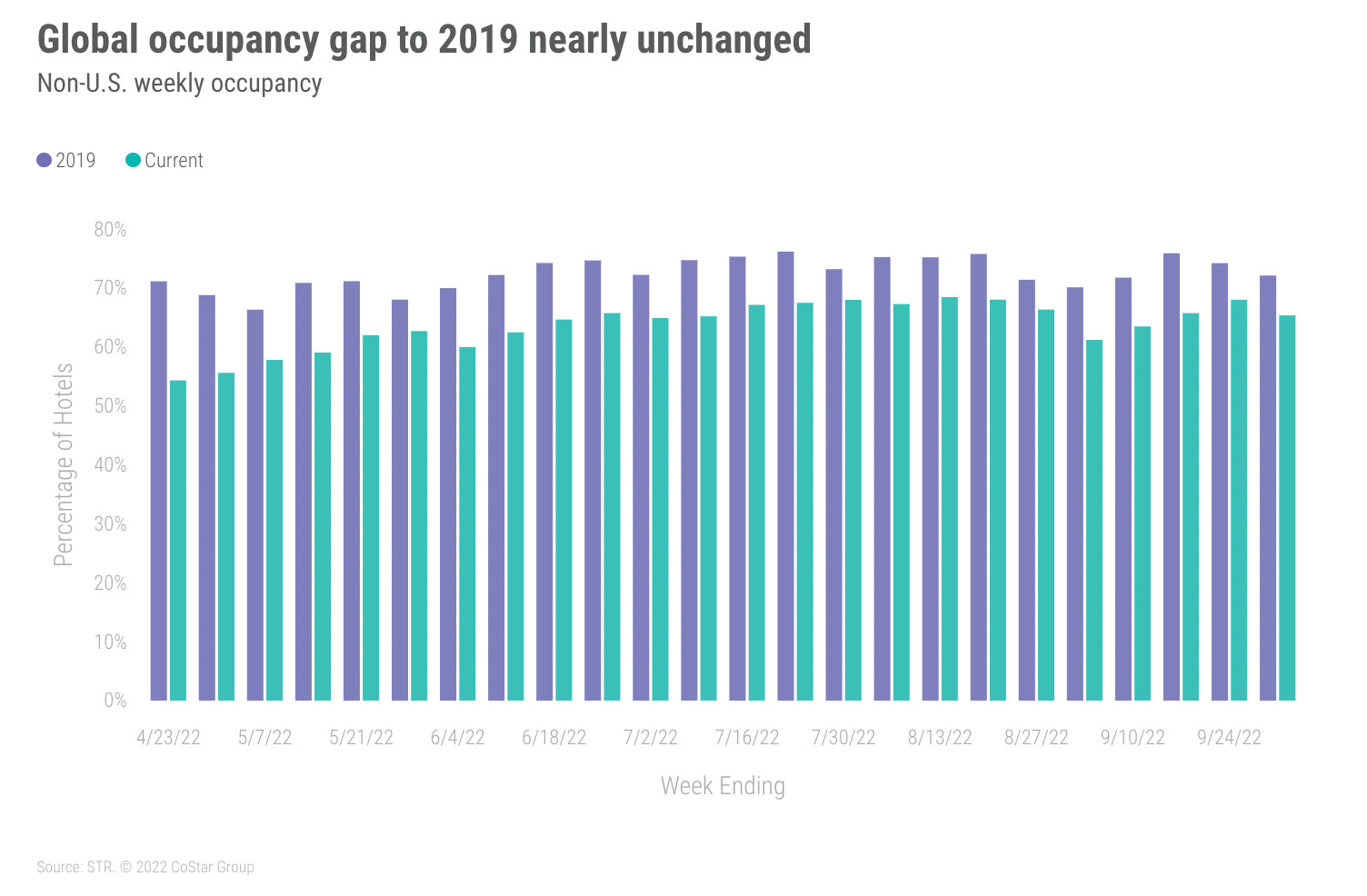

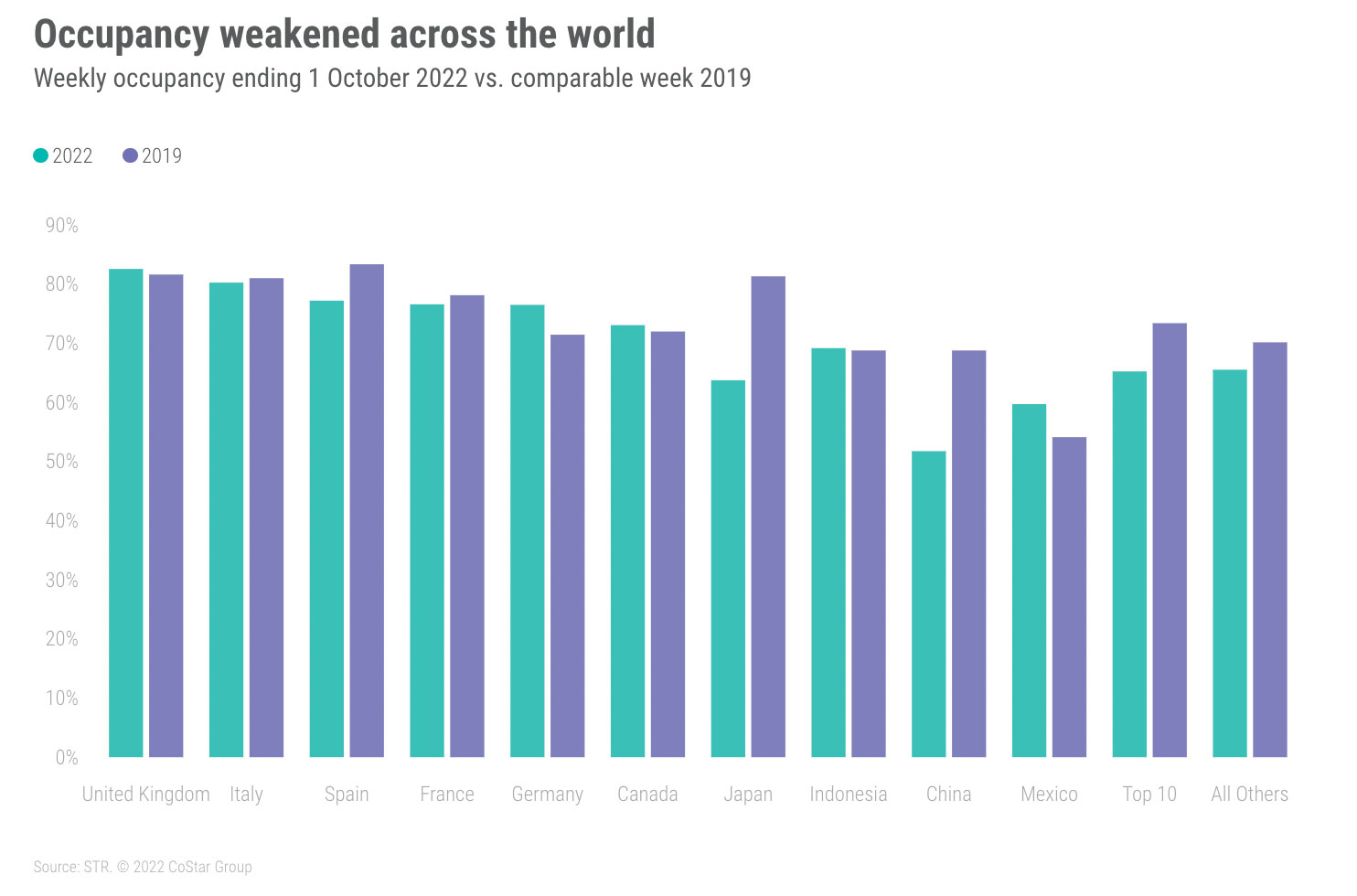

After three weeks of gains, global occupancy, excluding the U.S., fell 2.6ppts to 65.4%. That was 6.8ppts behind the comparable week in 2019. ADR increased 0.2% WoW to US$144, well ahead of 2019 levels, driven by strong demand recovery and inflationary impact. All but two of the 10 largest supply countries (U.K. and Indonesia) saw a drop in weekly occupancy. The most significant decline was in China, where occupancy fell 5.6ppts to 52%. In all, 73 of the 103 countries tracked on a weekly basis saw a week-over-week decrease in occupancy.

Singapore reported a 7.4ppts increase in occupancy compared with the previous week, coupled with a 42.1% uptick in ADR. This was driven by the Singapore Grand Prix, which took place on 2 October. Monaco also benefited from hosting its annual Yacht show, which supported a 101% uptick in ADR compared with the previous week. Ireland continued to report strong occupancy levels at 86.8%, yet this was 3.8ppts behind the prior week. That dip was normal as the market remained 3.4ppts ahead of the comparable week in 2019. The same trend was seen in Ireland’s ADR, which fell 5.5% WoW but maintained a 27.3% premium over 2019. Northern Europe again saw the highest occupancy (82%) of any subcontinent, up 0.7ppts WoW. The Caribbean had this week’s lowest occupancy (48%) as most countries saw a sharp decrease likely related to Hurricane Ian and the end of the holiday season.

Over the past 28 days, 17% of non-U.S. markets remained in “Recession” (real RevPAR indexed to 2019 between 50 and 80) while 4% were in “Depression” (real RevPAR indexed to 2019 under 50).

Big Picture

Looking only at markets that were not impacted by the hurricane, this week unfolded as expected given the religious observance, which resulted in limited group and conference travel this week. The observance also mitigated the impact of the hurricane in key convention cities, including Miami and Orlando. We expect Yom Kippur (4-5 October) to also hold back group and business travel for the week ending 8 October. Thereafter, we anticipate an uptick in weekday travel, supplemented by increased leisure travel due to the numerous K-12 school fall breaks, which peak during the week ending 15 October. Over the next several weeks and likely months, we will track the rebuilding efforts in and around Florida and its impact on the hotel industry’s performance.

About STR

STR provides premium data benchmarking, analytics and marketplace insights for the global hospitality industry. Founded in 1985, STR maintains a presence in 15 countries with a corporate North American headquarters in Hendersonville, Tennessee, an international headquarters in London, and an Asia Pacific headquarters in Singapore. STR was acquired in October 2019 by CoStar Group, Inc. (NASDAQ: CSGP), the leading provider of commercial real estate information, analytics and online marketplaces. For more information, please visit str.com and costargroup.com.