As business travel advances, consumers indicate combination trips will lead further gains

Nearly two years have passed since STR published its first business travel recovery blog under the headline, “Waiting for Business Travel to Return.” Now 11 months into 2022, the wait for that return has been over for some time although further gains are needed to reach pre-pandemic levels. According to consumers, those gains are on the way with combination business/leisure trips representing the biggest increase.

The current state

A key barometer of business travel, weekday hotel occupancy (Monday-Wednesday) has improved in the post-summer months with September and October producing levels just four percent below the 2019 comparables.

The latest U.S. Travel Forecast provided by Tourism Economics projects continued improvement in domestic business travel, and in a report from the Global Business Travel Association, travel managers estimated their company’s domestic business travel volume has recovered to 63% of pre-pandemic levels.

Consumers concur with improved business travel expectations

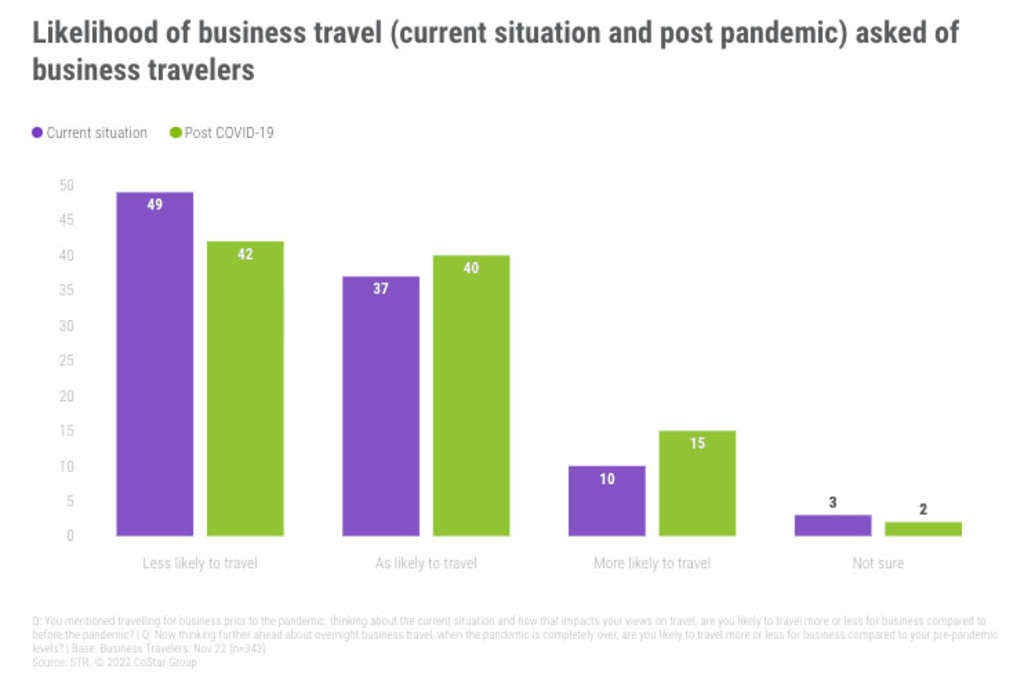

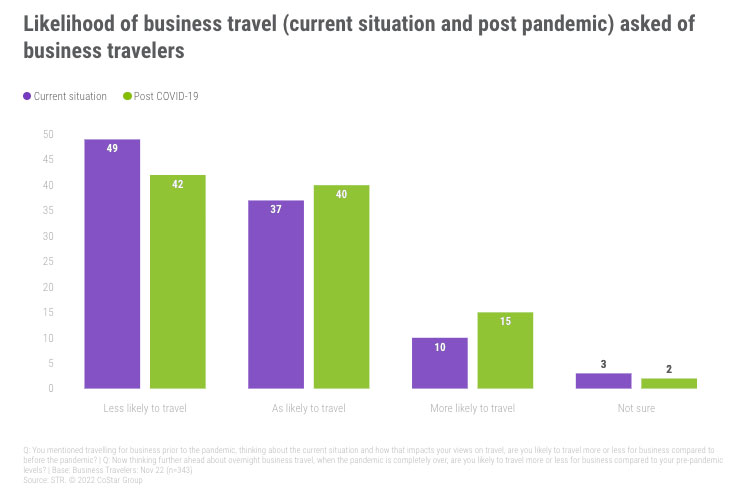

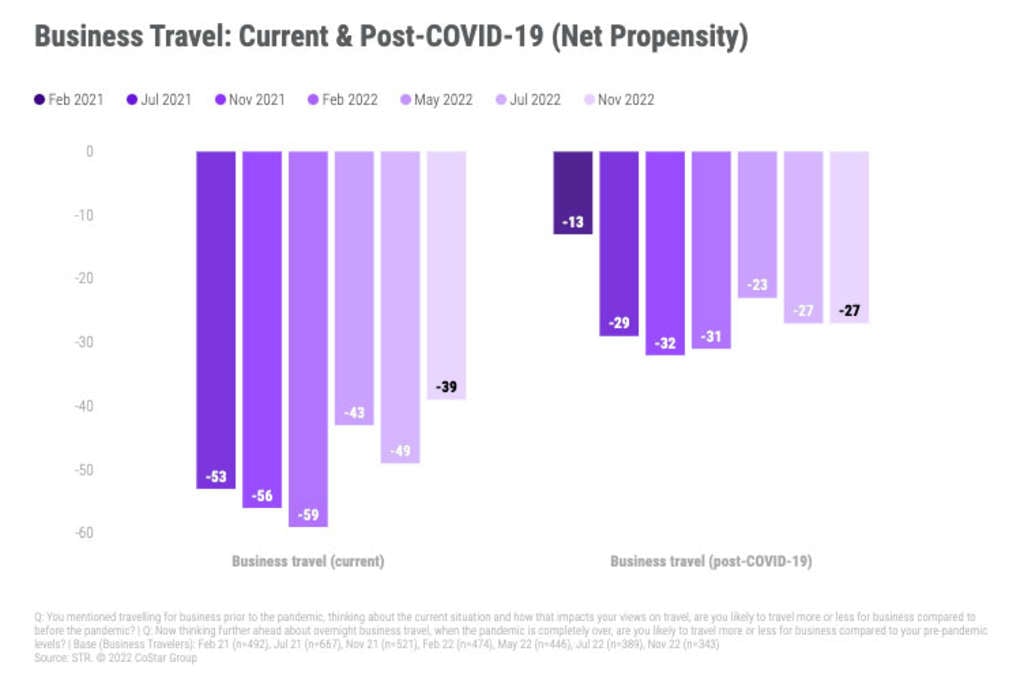

STR’s consumer research conducted in November 2022 produced telling insights into the prospects for business travel around the world. When more than 300 global business travelers were asked to think about their likelihood to travel for business both now and when the pandemic is “over,” results showed improved sentiment—although net propensity is still in negative territory. The difference between those more and less likely to travel is -39% for business travel today and -27% for business travel post-pandemic. A notable 10-percentage-point increase in sentiment for today (i.e. current situation) coupled with a stabilized long-term outlook bodes well for the continued return of the segment. The current business travel sentiment is at the best level of the pandemic-era.

What will business travel look like moving forward?

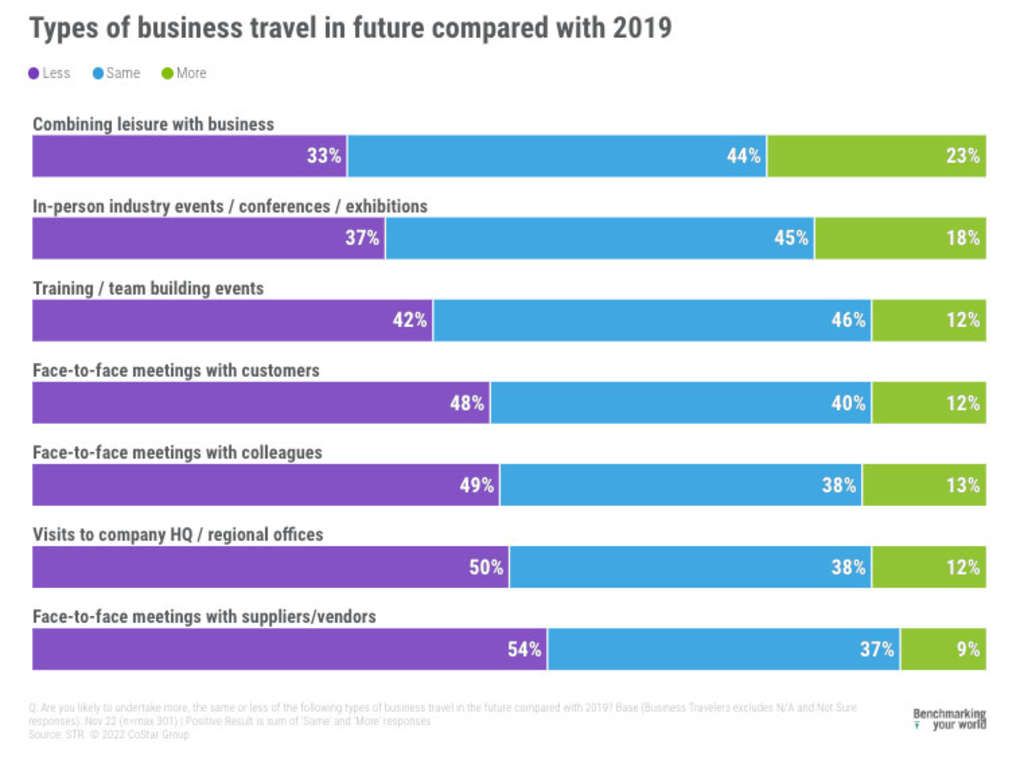

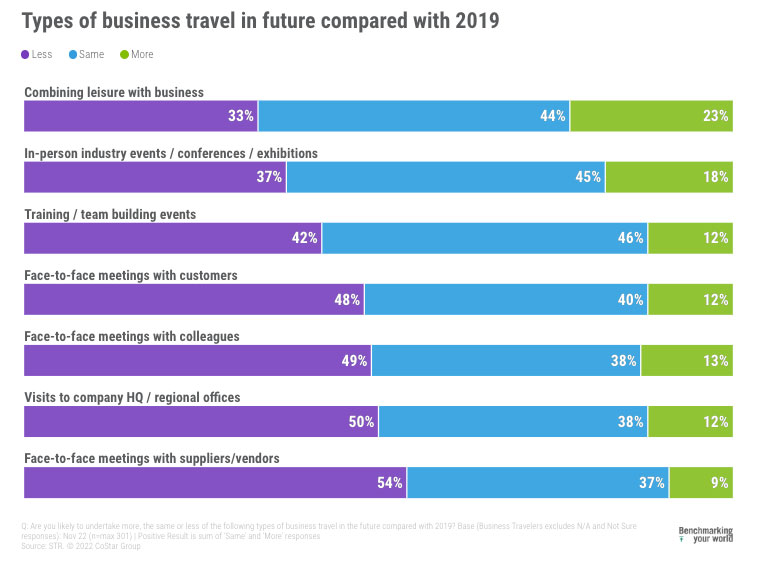

Combination business/leisure trips top the list as the type of business travel consumers are most likely to take. Two-thirds expect to take the same or more combo trips compared with 2019. Industry events are a close second among business travel consumers. The strength of industry events is supported in STR’s Market Recovery Monitor - 12 November which shows group demand in recent weeks topping 2019 levels.

Training and team building events rank high with 58% expecting to take the same or more of these types of trips compared to 2019. The increase in remote workers could be influencing this need for teams to gather and may become a more significant business travel segment in the future.

Face-to-face interactions were not as strong as the group interactions. Travel to meet with customers, colleagues and visits to company HQs ranked after the group travel types with more than half planning to travel at the same or greater levels.

The softer showing for face-to-face meetings is possibly being influenced by the looming recession as corporate travel budgets shrink and/or the ability to conduct this type of business at group events may be replacing one-on-one meeting trips.

The lowest ranked type of business travel was for individual meetings with suppliers/vendors as roughly half are planning this type of travel at the same or greater levels compared with pre-pandemic times. Worker adaption and use of video technology makes conducting these types of meetings an attractive alternative, which may explain why the need to travel for this type of business travel is currently perceived least positively.

Will flexible work policies induce more demand for travel?

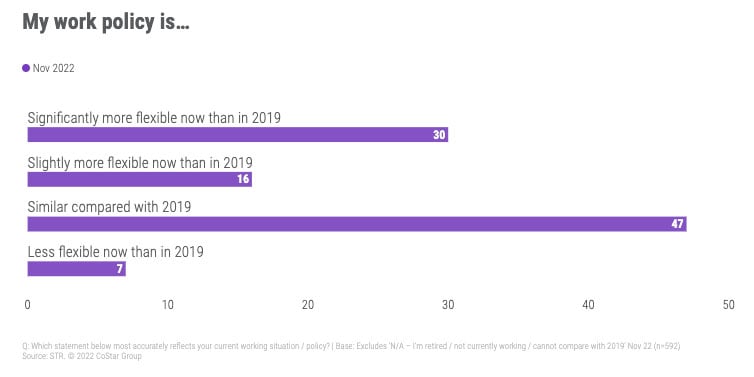

To help understand the impact of flexible work policies on travel, consumers were asked how their work policy has changed compared to 2019. Just under half (46%) of consumers stated they had more flexibility now regarding when and where they work. A similar percentage stated their work policy was similar to 2019 and a slight 7% stated they had less flexibility.

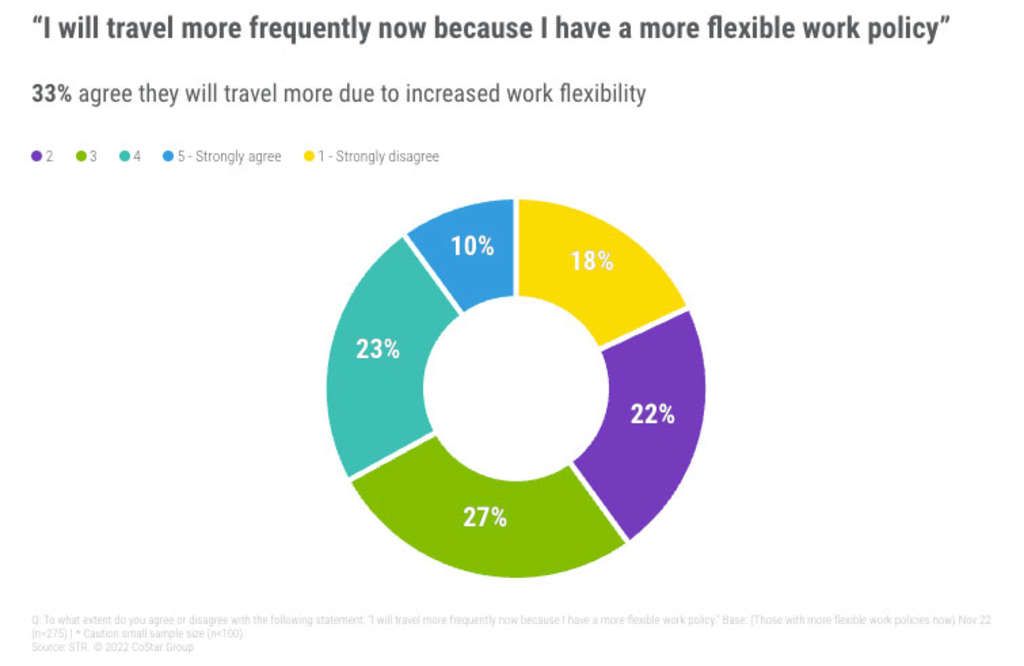

Does more work flexibility mean more travel?

A more flexible work policy resulted in one-third of workers agreeing that they will travel more while a higher proportion (40%) disagreed and indicated that they will not travel more. So, while workplace flexibility has increased, it will not necessarily result in increased travel for most workers. The modest but significant segment of 33% who do plan to travel more are the opportunity segment for hotels to attract. Quality internet connections and working space are key amenities when appealing to these flexible work policy travelers.

Opportunity and challenges ahead

The pandemic did not reduce business travel at the level predicted by some industry leaders. While the segment is not completely back, significant forward progress has been made. With the changes in work policies and a looming recession, there are certainly challenges ahead. However, as the pandemic fades and lasting changes to business travelers and their workplace remain, hoteliers are presented with a landscape filled with opportunities to engage with business travelers in both traditional and previously unseen ways.

About STR

STR provides premium data benchmarking, analytics and marketplace insights for the global hospitality industry. Founded in 1985, STR maintains a presence in 15 countries with a North American headquarters in Hendersonville, Tennessee, an international headquarters in London, and an Asia Pacific headquarters in Singapore. STR was acquired in October 2019 by CoStar Group, Inc. (NASDAQ: CSGP), the leading provider of commercial real estate information, analytics and online marketplaces. For more information, please visit str.com and costargroup.com.