The Global Hotel Industry: Big, Beautiful and Branded? Part Two

Warwick Clifton, Research Director, presents a summary of hotel group activity from The Global Hotel Group and Brand Analyses, which analyses over 2,100 hotel groups representing over 60,000 hotels in over 180 countries globally. www.globalhoteldata.com

Part one of this article presented initial findings regarding how hotel group supply has developed over the last two decades, this second part concentrates on the extent of market penetration the hotel groups have achieved globally.

Global Market Penetration

We analysed the extent to which the global hotel industry had been penetrated by the hotel groups in terms of the proportion of total room stock that was affiliated to the hotel groups.

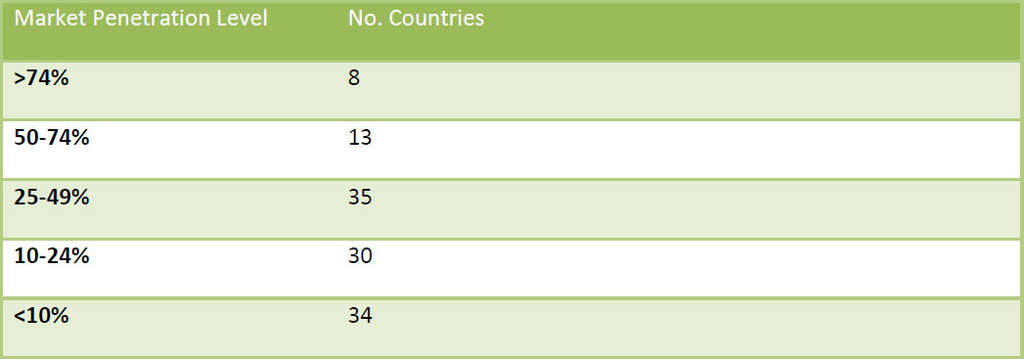

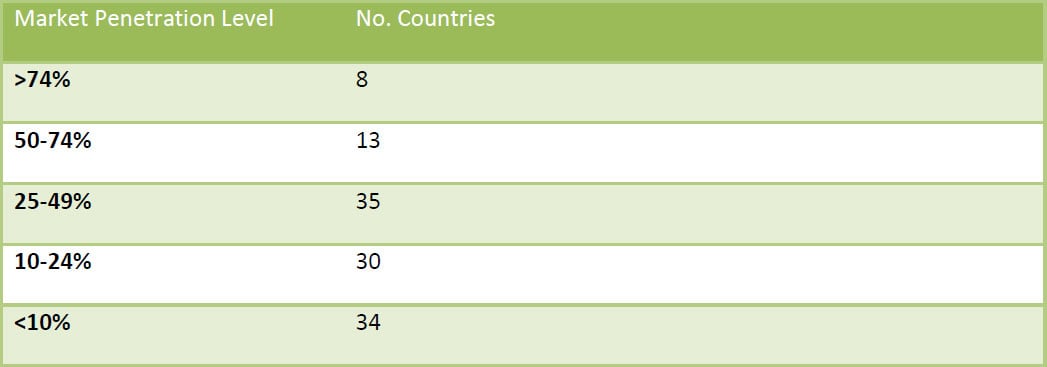

For the purpose of this paper it was necessary to use secondary sources to gain comparable data on total hotel room stock (independent unaffiliated and group affiliated) for each country. However, it was not possible to source reliable, comparable data for every country in the world for which The Global Hotel Group & Brand Analyses cover, but it was identified that 120 countries (this included all the key hotel markets globally) had suitable data for comparison with the Hotel Group data derived from the aforementioned The Global Hotel Group & Brand Analyses. The proportion of total hotel room stock that was group affiliated was then measured in percentage terms and the countries were categorised. The global average level of market penetration by Hotel Groups (based on Number Bedrooms) was 37.8%.

Table seven shows the number of countries in each market penetration banding. This shows that only 17.5% had group penetration levels of over 50%, and 53% had group penetration levels of less than 25%.

Table Eight shows a sample of the countries which were in each market penetration banding.

Key Findings to date

This paper has presented evidence of increased levels of market concentration. The big are getting bigger, generally at the expense of the independents and the smaller indigenous and regional groups. This concentration has generally occurred due to M& A activity and diverse development activity which has "swallowed up" many independents via franchising. Growth activity within the groups has generally been positive whilst the picture for the independents globally, has been negative. This growth has generally been facilitated through

"Hard" branding in line with franchising growth which has been favoured by financial markets.

However, much of the growth that is shouted from the rooftops by any of the hotel groups is actually a composite of

"Brand churn" increasingly prevalent in developed hotel markets, meaning that even though the hotel and room stock affiliated to individual groups/brands change increasingly regularly, the actual growth in total hotel group hotel and room stock is much more conservative.

Co-operation between hotel groups via franchising has resulted in more 3rd party use of brands and this is a trend that is set to continue as increasingly complex structures of operating hotels are used. This will potentially result in numerous hotel groups working together and sharing the risks and returns through separate real estate ownership, branding, management, master franchising and asset management.

In terms of the hotels themselves, it is anticipated that there will continue to be Sub-segmenting/niching of sectors. As markets mature, and groups seek to differentiate themselves it is likely that new "Category Killers" will emerge and that features and functions of completely different segments will be overlaid to create new composite sectors. Such developments in recent years have included the extended stay and Boutique/lifestyle sectors which are now offered at a variety of market levels and in differing locational types which are fundamentally distant from where the sectors originated from.

So, is this the end of the road for the independents? Can they compete with the resources, both physical and intellectual, that the groups possess? The answer is "No" to both questions.

For the foreseeable future, there will be markets which the independents can compete within head to head with the group hotels and there are some markets in which the independents can out-play the groups (evidenced by how many of the groups are trying to create softer brands for certain markets).

What does the future hold?

Generally, the future looks relatively rosy despite economic uncertainty. We anticipate continued growth of the branded "Budget" concepts, this is evidenced by the fact that this is one of the predominant hotel forms in the "pipeline". It is finding new opportunities through property conversions in urban locations in developed markets as well as penetrating at relatively early stages of market lifecycles in less developed economies (witness China and India).

There has been enormous growth in the 4/5* resort market, in both urban and resort locations and this trend is set continue albeit at a slower pace.

Also, as discussed earlier, category killer brands and combinations will continue to emerge just to confuse matters further for both industry commentators and consumers alike. The pipeline will continue to focus on the market extremes with the budget, luxury resort and boutique/lifestyle sectors likely to see the fastest growth in the short-term.

Despite these opportunities, the groups will need to continue to fight, both with each other and the independents for both investment and consumers. Despite having experienced major growth in the last two decades, these findings show that market concentration levels are still relatively low compared to other "retail" industries, with no single group having a significant market share.

However, the groups are not going to have it all their own way. Hotel Consortia continue to make some inroads and a newly invigorated and "harder" Best Western is an example which offers the independents some degree of protection and weaponry against the onslaught of the groups. There is also evidence of an increased public appetite for "individual and experience" hotels and this may result in "hard branded" hotels being less attractive. This is already addressed by numerous groups who have recently launched "collections" of independent hotels as ancillary offerings to their "branded" portfolios.

Despite this the groups will certainly see major growth in the years to come. Key features are likely to be:

- Growth of the BRIC markets. Not only as hosts, but as players (e.g. HNA and Jin Jiang) and perhaps most importantly, as consumers domestically and internationally as the burgeoning indigenous middle classes continue to expend their wealth.

- Continued inflation of the Middle East "Bubble"

- Further concentration

Data taken from The Global Hotel Group & Brand Analyses - A Joint venture between Global Hotel Research Limited & Centre for Hospitality & Retailing, Leeds Metropolitan University.

- On-line database and analyses

- Subscription service

- Published findings

- The source of supply data & analysis

A significant new research Project analysing The Global Hotel Industry, then and now, resulting in usable, comprehensive and reliable market analysis primarily concentrating on:

- The Players

- The Products

- The Brands

What is it?

- An independent and unbiased source of timely, accurate and detailed analyses

- Hotel Market analysis and data by Hotel, Hotel Group and Hotel Brand

- A bespoke information service..... Not a one size fits all solution:

- You choose your desired format

- Report or

- On-line, searchable, fully interactive database

- You choose the level of detail you require

- You choose your geographical region/s of interest e.g. An individual country or continent or the world

The analyses provide the most accurate mapping of this often fragmented and complex industry to date.

Innovative approach to the collection, collation, categorisation and analysis of the markets to produce this suite of comprehensive analyses.