London’s Outlook: An Analysis by Hotel Class

When booking a hotel room, guests are considering more factors than ever in deciding which property to call home in their destination. One of the many considerations is price, and by extension hotel class, which leads us to this latest analysis of occupancy on the books in London. Examining future occupancy levels by class allows for a better understanding of the traveler booking rationale for the upcoming months.

Merry Christmas and not such a Happy New Year

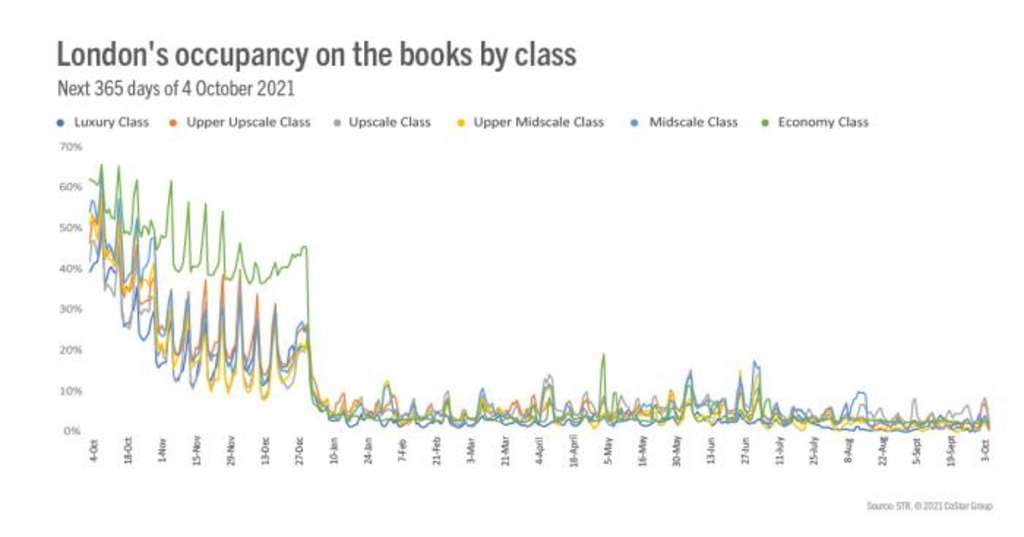

The short-term outlook for London is positive as summer ends and the industry transitions into the typically slower autumn and winter months. Leading bookings in the short-term are Economy class properties, with occupancy as high as 66% over the reporting period. The lead-up to Christmas is also showing glimmers of hope with bookings spiking across mid-December. This is likely due to increased confidence in city breaks given the success of the U.K.’s vaccination program as well as the destination’s attractive retail offerings, which will be well-received in the lead-up to the holidays.

For now, however, the picture lacks promise entering 2022 across all class types. During the second week of January, occupancy on the books drops drastically, particularly for Economy and Luxury class hotels. For this period, Upper Upscale and Upscale hotels stand out from the crowd with slightly higher levels of bookings, but with occupancy only peaking at 10% for the week of 10 January, there is not much excitement for any class. Of course, we know that booking windows have significantly shortened because of the pandemic, so as long as the pandemic situation remains manageable, there will be an uptick in future months.

The importance of events

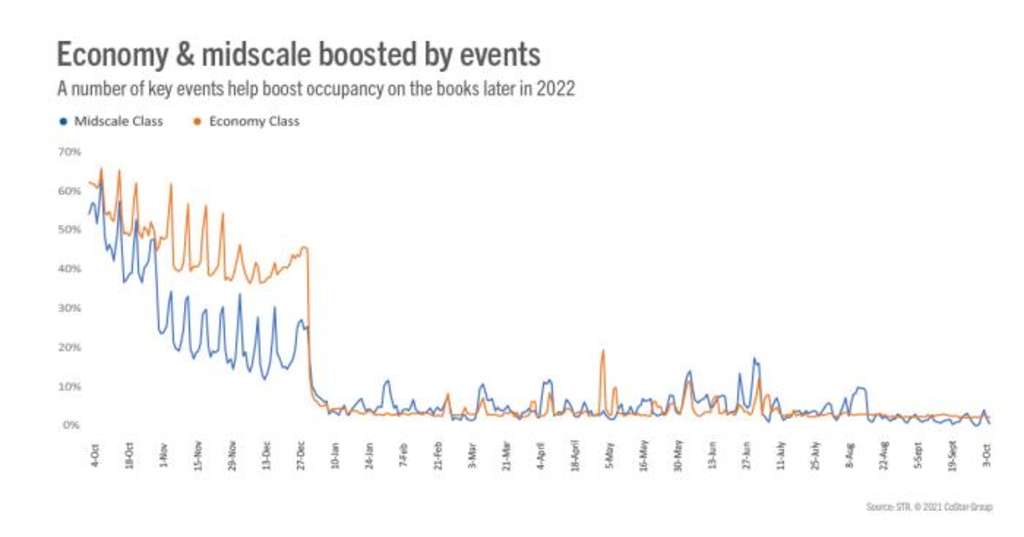

Despite the low levels for the first part of 2022, events remain a crucial source of bookings for all classes. Large-scale performances, such as Peter Kay’s charity gig on 29 April and ABBA’s long-awaited return on 4 June, are resulting in increased levels of occupancy on the books further into 2022. We can see that event goers currently favor Economy and Midscale properties, with these classes experiencing several spikes in demand. Given that guests travelling for events tend to stay for less time, and price is a key deciding factor, this trend is somewhat to be expected.

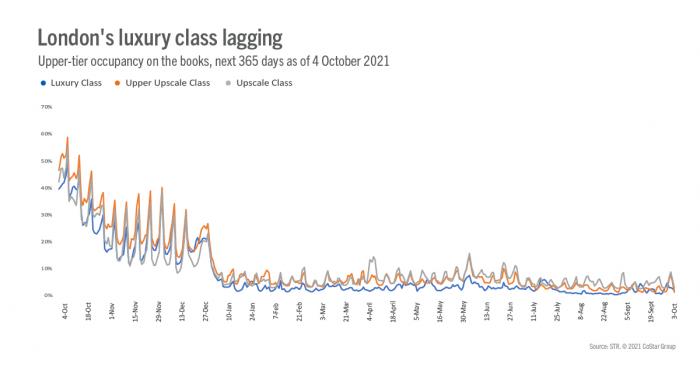

Luxury lagging, Upscales are on the up

The class with the least to show in occupancy on the books is Luxury. With a significant number of high-end travelers not spending given the current complexities of overseas trips, London’s luxury hotels are struggling to acquire business as we move into 2022. As noted in a recent STR research piece, price is also the second most considered factor in the booking process currently, which therefore indicates that many individuals are less likely to pay premium rates to stay at London’s high-end establishments.

Another key takeaway from this analysis is that Upper Upscale and Upscale properties are posting the strongest levels across the full 365-day period. Not only do we see each class achieving occupancy on the books of up to 30% in the run-up to Christmas, they are also seeing a number of spikes in bookings throughout the early months of 2022.

This overview of the London market highlights how much performance can vary by class. As guests become more involved in their booking decision-making process, difference in levels by class are likely to increase. However, by understanding these trends, hotels can position themselves more effectively to obtain the highest possible returns from their market.

About STR

STR provides premium data benchmarking, analytics and marketplace insights for the global hospitality industry. Founded in 1985, STR maintains a presence in 15 countries with a corporate North American headquarters in Hendersonville, Tennessee, an international headquarters in London, and an Asia Pacific headquarters in Singapore. STR was acquired in October 2019 by CoStar Group, Inc. (NASDAQ: CSGP), the leading provider of commercial real estate information, analytics and online marketplaces. For more information, please visit str.com and costargroup.com.