A tale of two travel sentiments: business remains negative while leisure still upbeat

With employees continuing to return to offices, ongoing vaccination progress, and the reopening of many international borders, the time would seem to be ripe for the return of business travel. Yet, even before the news of Omicron in recent days, there continued to be negative sentiment about the return of this segment whereas pandemic-era leisure travel sentiment remains buoyant.

In November 2021, STR undertook an online survey of its Traveler Panel—an engaged audience of travel consumers—to examine the fortunes of the industry at this uncertain time. The research gathered the views of nearly 600 global business travelers.

The latest data indicates that more consumers are less likely to travel for overnight business post-pandemic (44% in November 2021 vs. 39% in July 2021). Additionally among business travelers, net propensity to travel, which is the difference between those more likely and less likely to travel, stood at -30% in November 2021 after coming in at -27% in July 2021.

Analysis of business travel sentiment across different age groups reveals only a slightly less negative sentiment among younger business travelers compared with those in older age groups. The narrowing sentiment highlights that the views of younger and older audiences are converging. This may be due to increased confidence in traveling among older audiences because of vaccine success as well as decreased confidence among younger travelers, who are typically less risk averse—possibly due to fears of long-haul COVID, which is reported to be more prevalent in younger people.

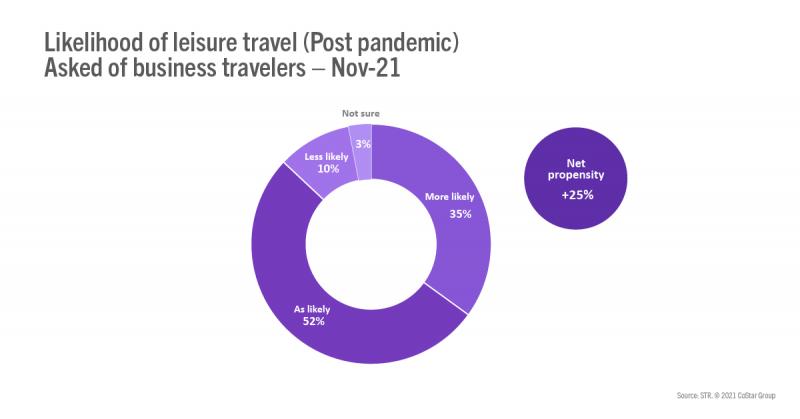

Confounding this pessimism is the optimism seen among the same group of travelers when asked about likelihood to travel for post-pandemic overnight leisure. When business travelers were asked about their likelihood to travel for leisure once the pandemic is over, 35% stated that they were more likely to travel for overnight trips. Their net propensity for leisure travel in November 2021 was +25%, which is the exact opposite of the propensity reported for business travel. So, while business travelers are not likely to travel for business post-pandemic, they can barely contain their enthusiasm when it comes to leisure travel post-pandemic. A recently released report from STR highlights a “post-pandemic tourism boom” among all leisure travelers.

Why such different sentiment?

One can speculate that the difference in sentiment has more to do with the companies for which business travelers work rather than the business travelers themselves. While consumers are eager to travel after being “locked down” for more than a year, businesses have enjoyed significant cost savings with reduced travel expenses, while still generally being able to deliver products and services, which has greatly benefited their bottom lines.

Additionally, some employees who traveled for business in the past are not yet allowed to travel due to corporate policies and concerns of corporate legal departments about duty of care if an employee contracts COVID-19 while traveling.

This is not to say business travel has stopped. Sales teams are already out traveling and visiting their clients before the competition beats them to it. Essential business travel is taking place. Business travel that has a less direct return on investment is most likely the travel that is not happening, and that type of travel is something that business travelers seem to be feeling will not happen post-pandemic.

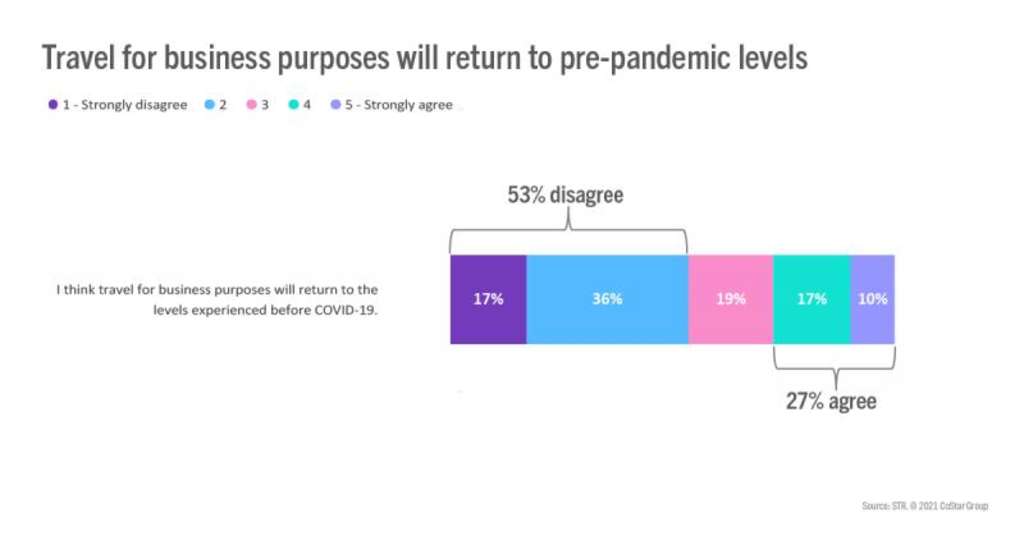

When asked more generally about whether travel for business purposes will return to pre-COVID-19 levels, over half disagreed. This high level of disagreement is particularly notable because respondents tend to respond toward agreeable, according to acquiescence bias. On the positive side, more than one-quarter of business travelers agreed that travel for business purposes will return to levels experience before COVID-19, so there is some hope.

A new opportunity?

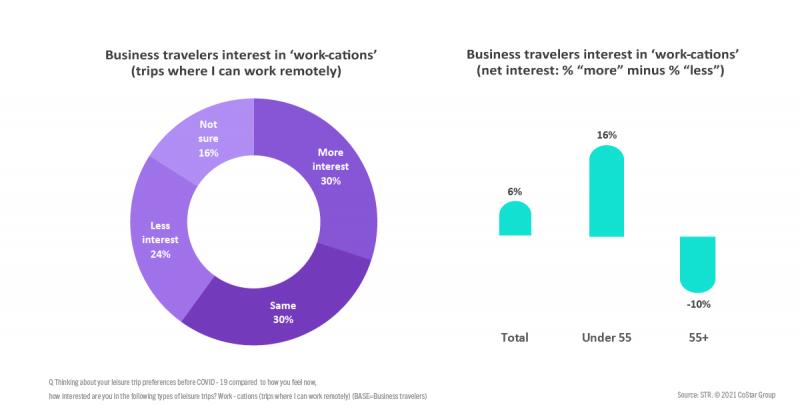

A phenomenon that gained strength during the pandemic and one that may offer some positive news for the travel industry is the “work-cation.” There was positive sentiment about the concept of being able to work while traveling among business travelers surveyed. Almost one-third (30%) of business travelers stated that they would be more interested in a “work-cation” compared with pre-pandemic times, resulting in a net positive interest score of 6%. Among younger business travelers, interest was more than twice as high with a net positive of 16%.

While the “work-cation” will not come close to replacing traditional business travel, it is one of many new opportunities that could be pursued as the world adjusts to new ways of doing business. Where business travel ends up remains to be seen. With so much of the employed population having been confined for months working from home and countless online meetings, the hope is that traveling to meet and interact with colleagues and clients again will resume in new forms and with renewed vigor. We will continue to explore hypotheses and trends in further COVID-19 traveler trends research and blog posts.

NOTE: This research was undertaken in early November 2021 before the Omicron variant emerged. As a result, respondents’ views do not represent the newest situation around COVID-19.

For more industry information each day, follow us on LinkedIn, Facebook, and Twitter.

For further insights into COVID-19’s impact on global hotel performance, visit our content hub.

About STR

STR provides premium data benchmarking, analytics and marketplace insights for the global hospitality industry. Founded in 1985, STR maintains a presence in 15 countries with a corporate North American headquarters in Hendersonville, Tennessee, an international headquarters in London, and an Asia Pacific headquarters in Singapore. STR was acquired in October 2019 by CoStar Group, Inc. (NASDAQ: CSGP), the leading provider of commercial real estate information, analytics and online marketplaces. For more information, please visit str.com and costargroup.com.