In Trend Reversal, Big City Markets Lead US Weekly Hotel Performance

Miami Hotels Achieve Pandemic-Era Highs in Occupancy, Rate

U.S. hotels in big city markets, which struggled more than other destinations in the pandemic and have been a drag on weekly performance far more often than not, provided a lift to the overall industry in the post-Thanksgiving week.

Occupancy in the top 25 markets rose to 58% in the week, increasing to 63% from Tuesday through Saturday. Weekend occupancy for the top 25 markets was stronger at 71%, which was 94% of the level achieved in 2019.

Hotels booked more rooms but at slightly lower rates in a somewhat typical post-Thanksgiving week that favored the top 50 largest markets, led by Miami.

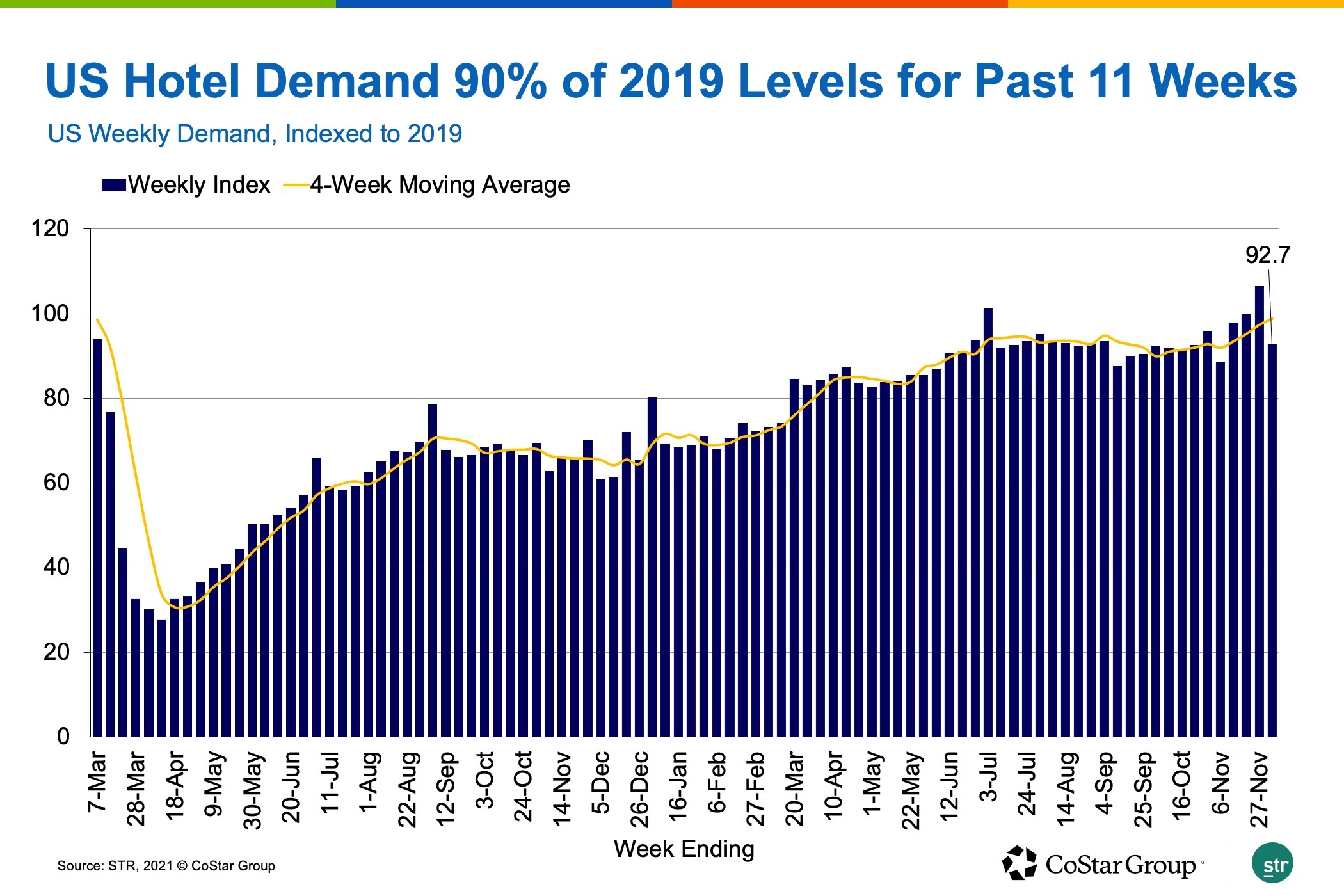

After topping 53% occupancy over the holiday week, which beat a record set in 2018, the U.S. hotel industry booked 54.8% of rooms — 9% fewer rooms than it did in the same week in 2019.

Compared to 2010 — a year like 2021 because of calendar make up and the rebuilding after the Great Recession — U.S. hotel occupancy was 10% higher for the week.

Average daily rate dipped by 0.6% week over week, after achieving a 14% premium over 2018 and 2019 in the holiday week. Still, with the higher occupancy, U.S. hotel revenue per available room increased 3% from the previous week.

Average daily rate in the top 25 markets was also the highest it has been since the start of the pandemic. ADR was more than 95% of what it was in 2019, as it has been for the past three weeks.

RevPAR was up 12% week over week in the top 25 markets.

Miami, which hosted the international contemporary art fair Art Basel, led the nation with 82% hotel occupancy for the week — the highest weekly percentage since the start of the pandemic, with record-setting daily occupancy on Tuesday, Wednesday and Thursday. Weekend occupancy in Miami surpassed 90%, also a pandemic-era high. More than one-third of Miami hotels reported weekly occupancy above 90% with another third between 80% and 90%. Eleven hotels reported ADR above $1,000 for the week, with the market average at $374 and the weekend topping $422 — both pandemic-era highs.

Week over week, top 25 market ADR rose 8%, driven by the strong growth in Miami. Excluding Miami, weekly ADR increased by 3%, better than the national average. However, without Miami, this week’s absolute ADR in the top 25 markets did not set a record, but was higher than the previous two weeks.

The New York City hotel market had the week’s fourth-highest occupancy at 71%. Excluding Sunday and Monday, occupancy was 77%, the second-highest five-day level since early 2020. Weekend occupancy soared to 86%, also the second-highest of the pandemic era. There is little doubt New York is on the rebound, but the market still has ground to gain. In 2019, weekly occupancy topped 90%, while in 2010 it was 82%.

At the other end of the spectrum, the Myrtle Beach hotel market reported the lowest weekly occupancy at 35%.

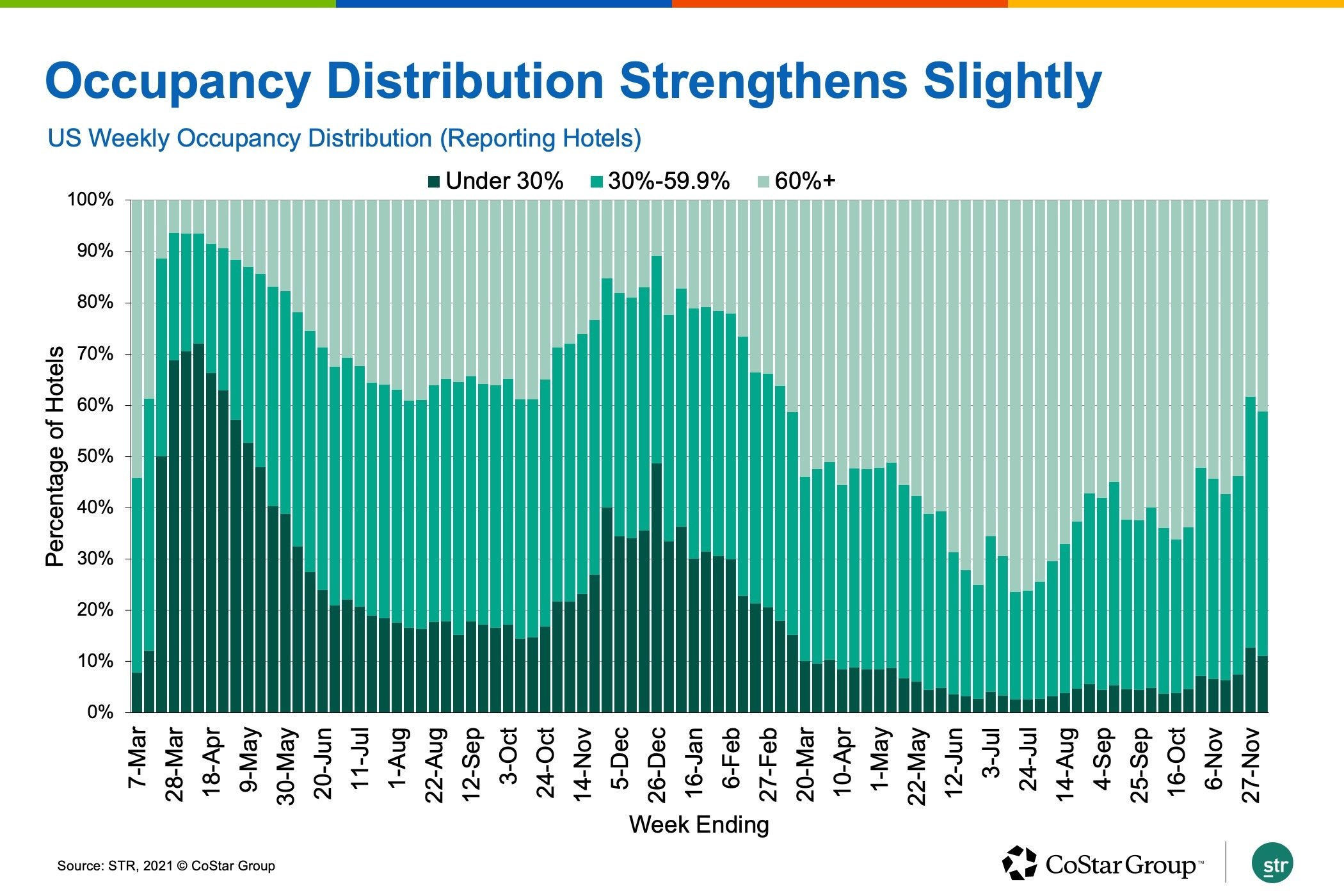

Overall, 79% of U.S. markets reported occupancy under 60%, compared with 64% at that level in 2019 and 93% in 2010.

Hotel occupancy in many markets is nearing seasonal lows, but 68 markets achieved higher occupancy than they did in the same week of 2019.

After three weeks in which weekly ADR was higher than in the comparable weeks of 2019, ADR dropped to just below the 2019 level. On an inflation-adjusted basis, real ADR was 7% below what was recorded in 2019.

Weekly RevPAR rose after two weeks of declines, but for the industry overall was 10% lower than what it was in 2019.

In the top 25 markets, RevPAR was 20% lower than in the comparable week of 2019 and 24% lower when excluding Miami.

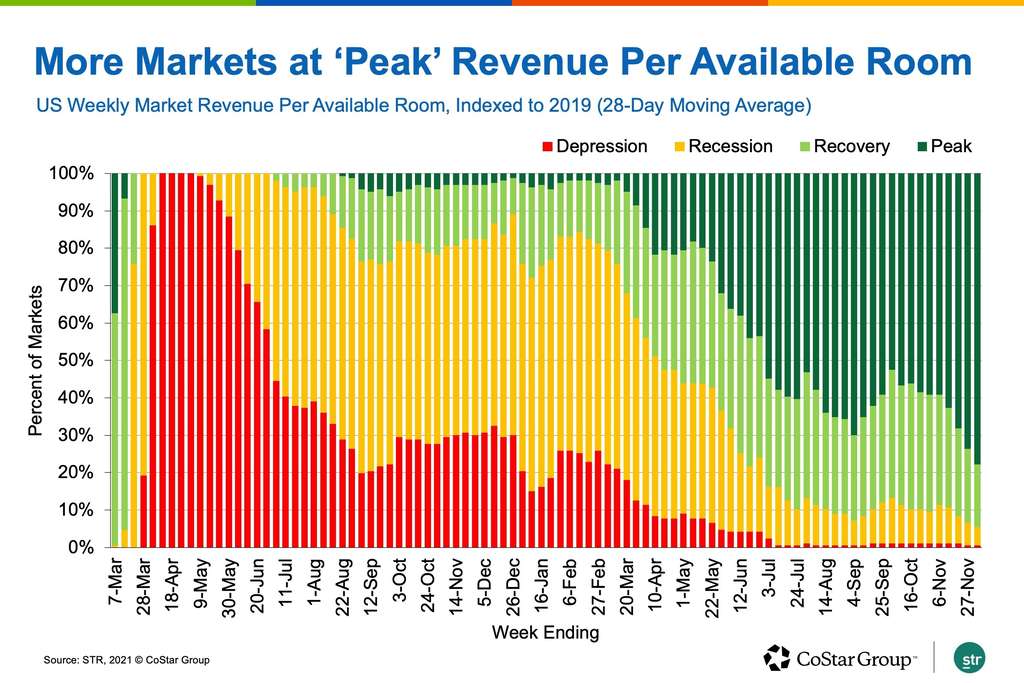

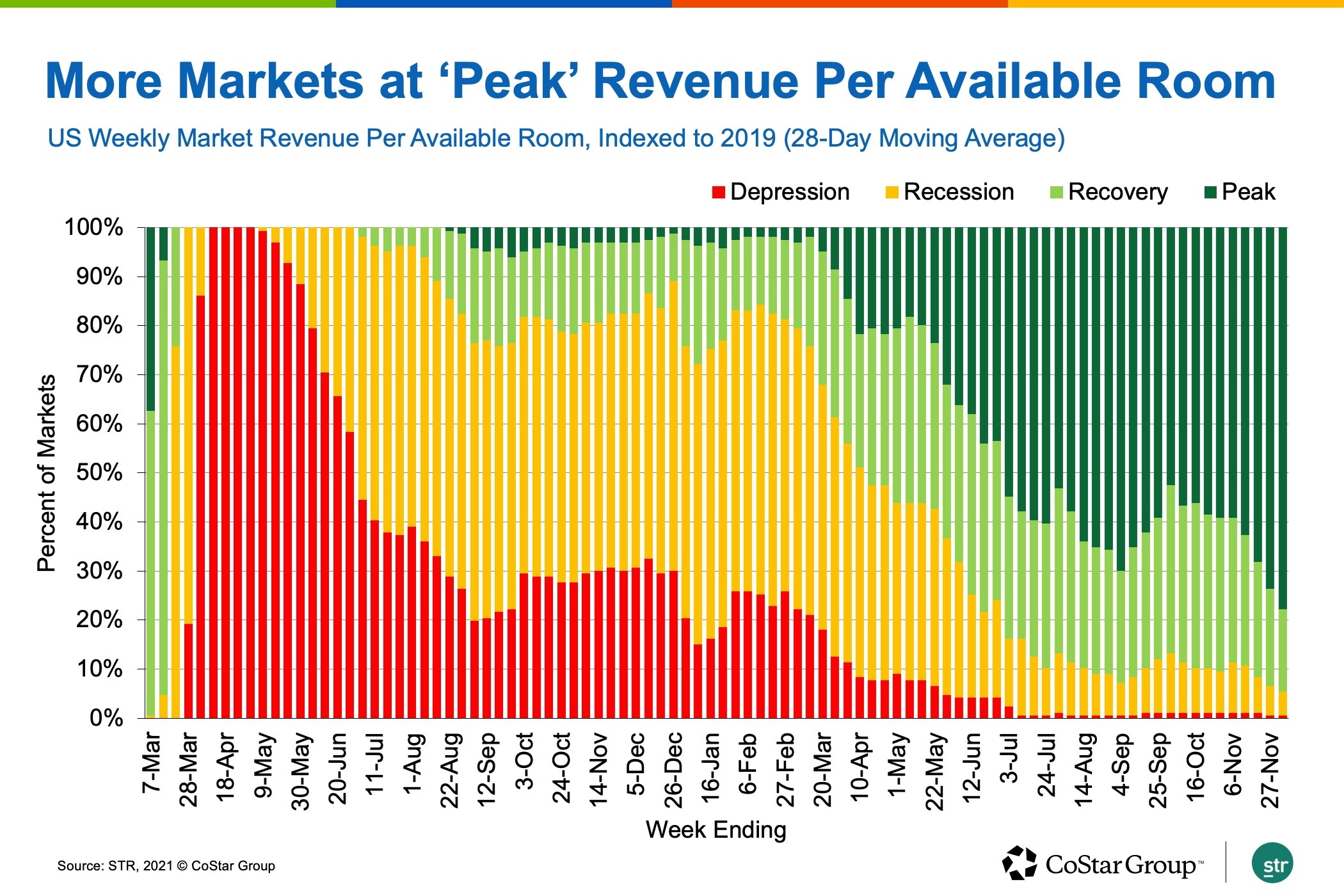

Over the past 28 days, RevPAR has averaged 1% higher than 2019 levels. As a result, 78% of markets were categorized as having “peak” RevPAR — higher than 2019 levels, according to the Market Recovery Monitor by STR, CoStar’s hospitality analytics firm. That marks the highest percentage of “peak” markets this year, but that percentage is likely to drop as the record-setting Thanksgiving week lapses from the 28-day time frame.

Only nine markets were in “depression,” with RevPAR less than 50% of 2019 levels, or “recession,” with RevPAR between 50% and 80% of 2019 levels. On an inflation-adjusted basis, 64% of markets were at “peak,” which is the most since the start of the pandemic, and 10% were in “recession” or “depression.” The remainder were in “recovery,” with RevPAR between 80% and 100% of 2019 levels.

About STR

STR provides premium data benchmarking, analytics and marketplace insights for the global hospitality industry. Founded in 1985, STR maintains a presence in 15 countries with a corporate North American headquarters in Hendersonville, Tennessee, an international headquarters in London, and an Asia Pacific headquarters in Singapore. STR was acquired in October 2019 by CoStar Group, Inc. (NASDAQ: CSGP), the leading provider of commercial real estate information, analytics and online marketplaces. For more information, please visit str.com and costargroup.com.