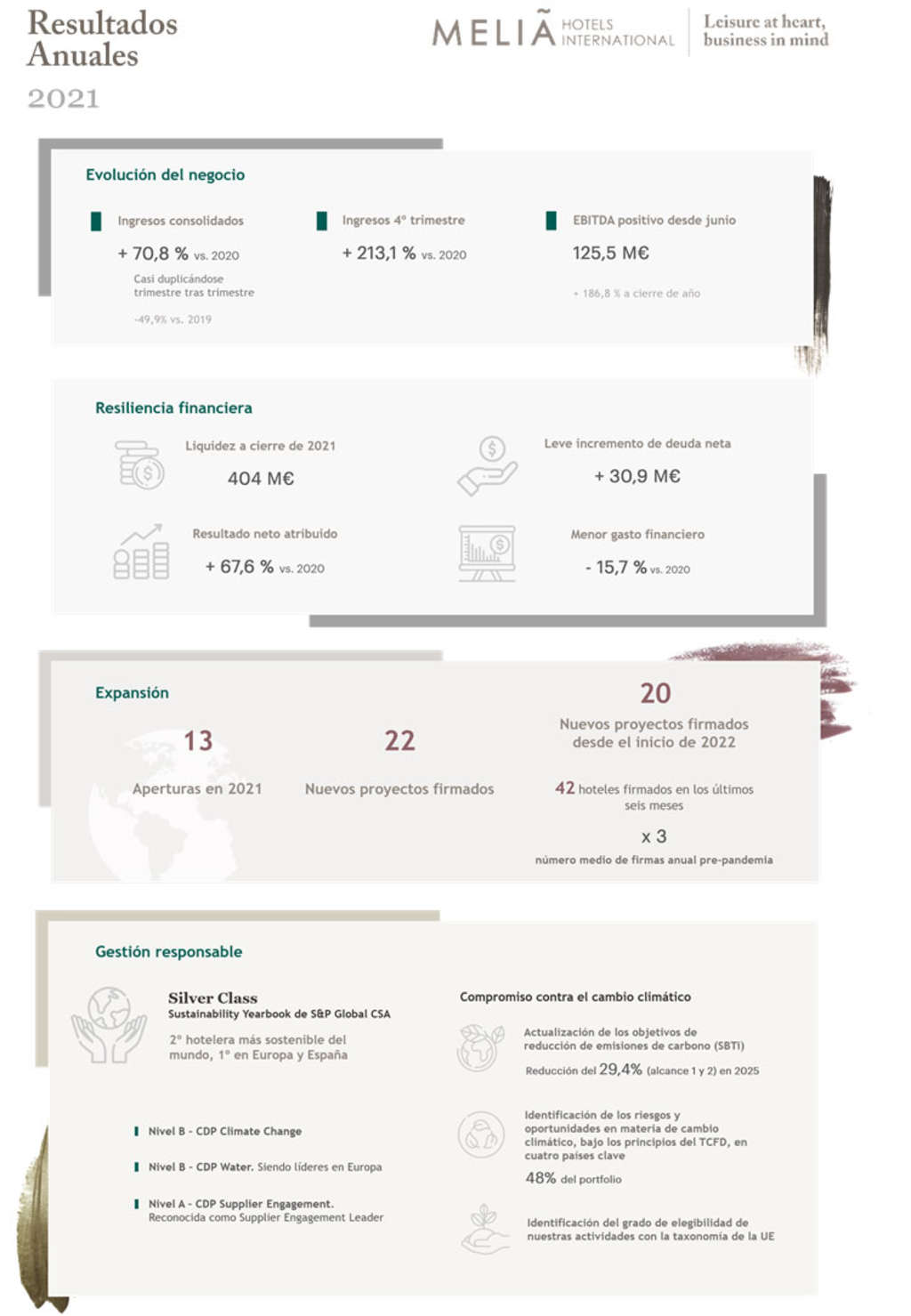

Meliá Consolidates a Positive Performance, Improving Revenue by +70.8%, EBITDA by +182.8% and Net Profit by +67.6% Compared to 2020

- 94% of its hotels were already opened at the end of the year after Covid-19 (62.9% more rooms available than in 2020)

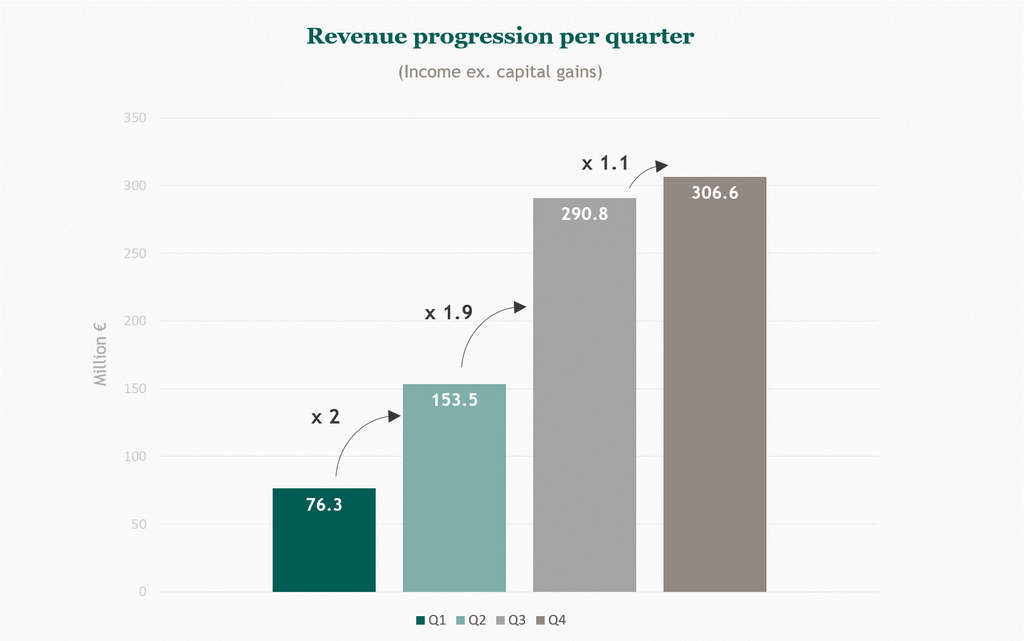

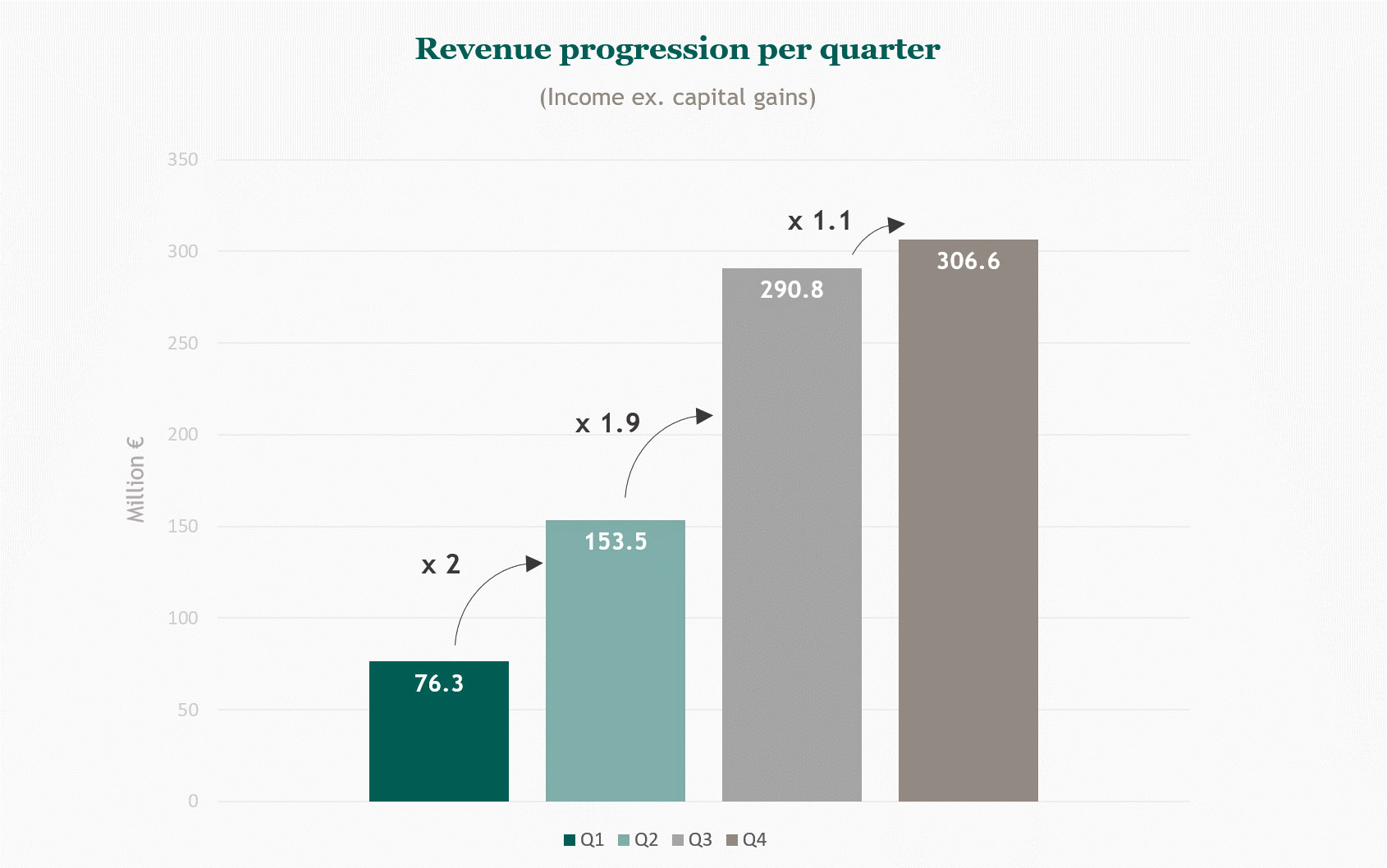

- In spite of the Omicron variant, revenue growth of +213.1% in the 4th quarter compared to 2020 confirms the resilience of demand and upward trends

- The successive waves of the virus and restrictions on mobility meant that the market recovery had its ups and downs, marked by the absence of international travel

Business indicators:

- Revenues increased by +70.8% compared to 2020, reaching €902.4 million (-49.9% vs 2019)

- The average daily rate increased by 9.7% compared to 2020 and 1.8% compared to 2019

- EBITDA was €125.5 million, +186.8% more than in 2020

- Melia.com channelled 51% of sales over the year, consolidating the company's leadership in distribution.

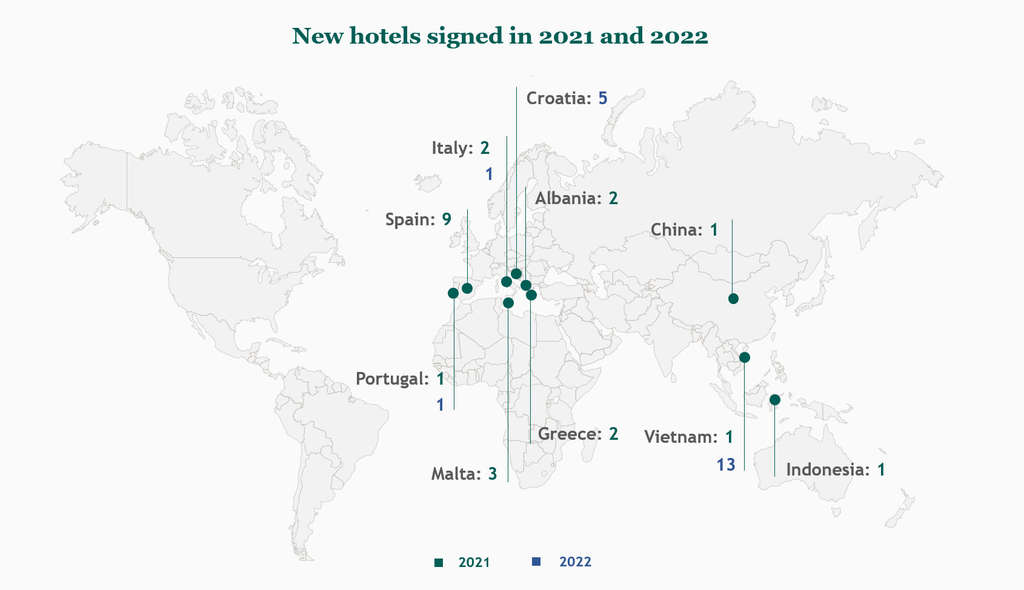

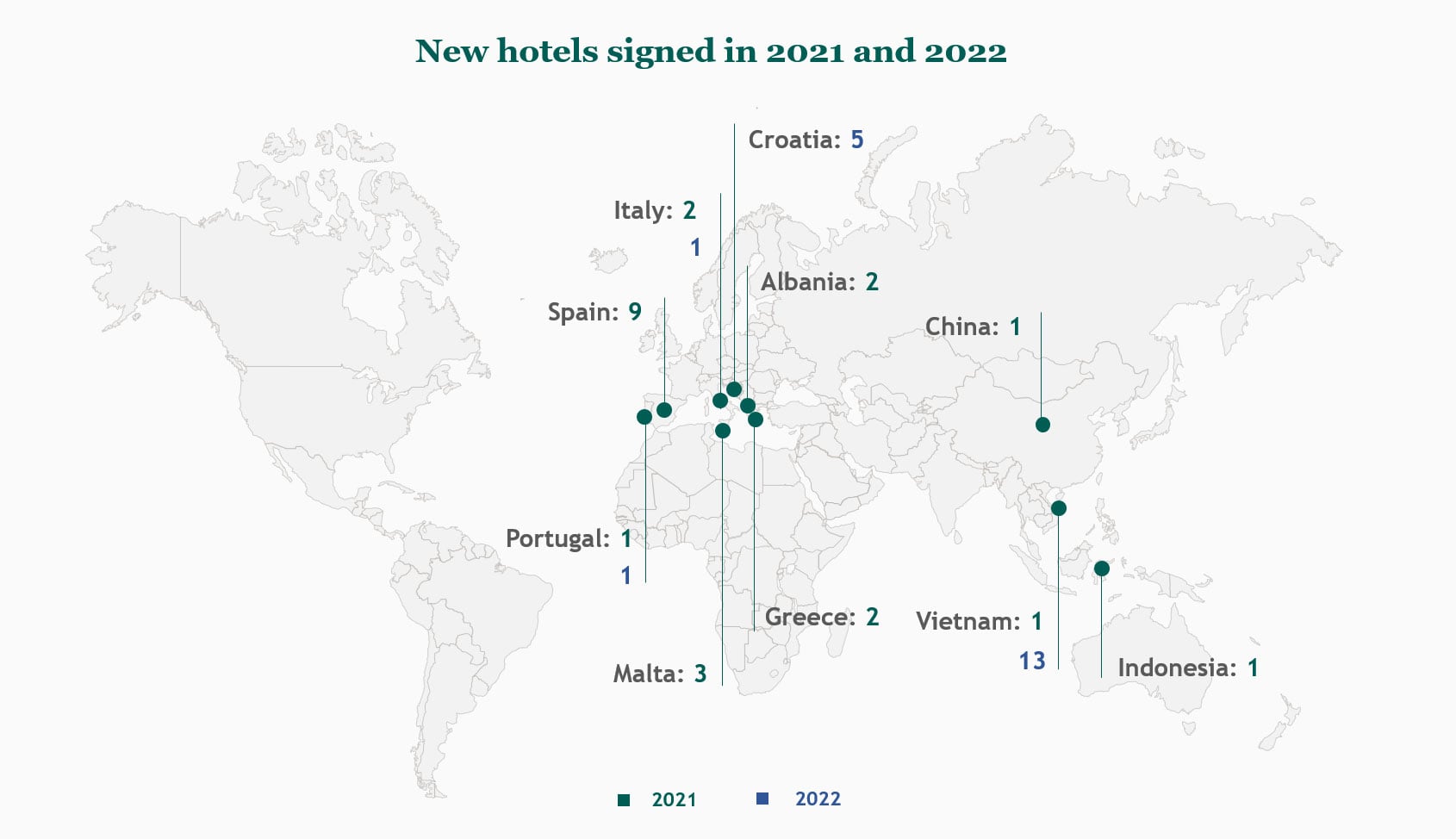

- In the last six months, Meliá has added a total of 42 hotels and 10,912 rooms (managed or franchised hotels), and has opened 13 new hotels

- The company has recently announced a strategic alliance to add 12 luxury hotels in Vietnam, where it is already the second biggest hotel chain

Financial management:

- Net debt pre-IFRS-16 (€1,285.9 million) increased by €30.9 million throughout 2021

- Financial result improved by 15.7&

- Available liquidity stood at €404 million as of December 31

- One of the company's top priorities is to reduce debt by different means, among which it does not rule out asset disposals in addition to the one carried out in June.

- Excluding financial covenants, the debt only includes about 300 million with mortgage guarantee.

Responsible management (ESG):

- Meliá was in 2021 the second Most Sustainable Hotel Company in the world according to Standard & Poors Global

- S&P Global highlights the progress made in transparency, rigour, and management of ESG risks, as well as compliance with the Recommendations of the Good Corporate Governance code

- The company has intensified its commitment to reducing emissions, aligning itself with the recommendations of the Task Force on Climate-related Financial Disclosures (TFCD)

Outlook 2022:

- Although visibility is still low, Meliá confirms the impact of Omicron on January and first half of February, but foresees a strong recovery from March onwards

- Reservations have grown every day in recent weeks and are approaching 2019 levels, especially in holiday resorts and cities considered "bleisure" destinations

- Bookings for the summer exceed 2019 levels, and at a higher average price (thanks to the strong demand, the Group's commitment to its brands, its distribution channels, its loyalty program and its orientation towards the luxury segment)

- In line with WTTC forecasts, European travel bookings for Easter and the summer exceed 2021 levels by 250% and 80% respectively

Gabriel Escarrer Jaume, Executive Vice President and Chief Executive Officer: “Our 2021 results show clear signs of recovery in the industry, with a very significant increase in our revenues quarter after quarter despite the impact of Omicron in December and in the first 45 days of 2022 and they also show our resilience, the result of our prudent management during the pandemic and the strengths that we aim to consolidate in a new roadmap for the recovery stage. These results also highlight our commitment to our brands, online distribution and our loyalty programme, as well as our focus on the thriving luxury segment. This commitment has also driven our growth by positioning us as a “safe haven" for the management of independent hotels and smaller hotel chains at a time of growing competition and market consolidation. This can be seen by the addition of 42 new hotels over the last 6 months, all of them under management or franchise agreements. The almost 11,000 rooms added in these new agreements practically triple the average number of rooms added in the pre-Covid years of 2018 and 2019."

"As we present these results, the travel industry is still suffering from the impact of the Omicron variant. Although Omicron is far more contagious, international health experts affirm it will help lead to a rapid recovery from the pandemic and a new stage of “living with the virus", which is already allowing an easing of travel restrictions and encouraging a strong rebound in demand. On the other hand, although any assessment at this time would surely be premature, given the reduced relevance of the Russian and Ukrainian feeder markets for our hotels and destinations, we trust that the war will have a limited impact on our performance, and will not overshadow the expected boom in demand as we continue to emerge from the pandemic."

"With the greatest possible prudence, as the latest WTTC analysis points out, I am sure that if there are appropriate conditions for safe international travel without any restrictions, the tourism industry could reach pre-pandemic levels by 2022 on a global level, and that Meliá Hotels International will be among the “winners" in this new stage of growth".

The results of Meliá Hotels International for 2021 confirm the gradual recovery of the business and confirm the prudent and effective management carried out by the company over the last two years, the worst ever in the history of the travel industry. Revenues grew to €902.4 million, an increase of +70.8% compared to the previous year, with improvements quarter after quarter and positive EBITDA from June onwards. EBITDA reached €125.5 million, +186.8% higher than 2020, and even grew in the 4th quarter, in spite of the impact of the Omicron variant in December. The Consolidated Attributable Result also improved by +67.6%.

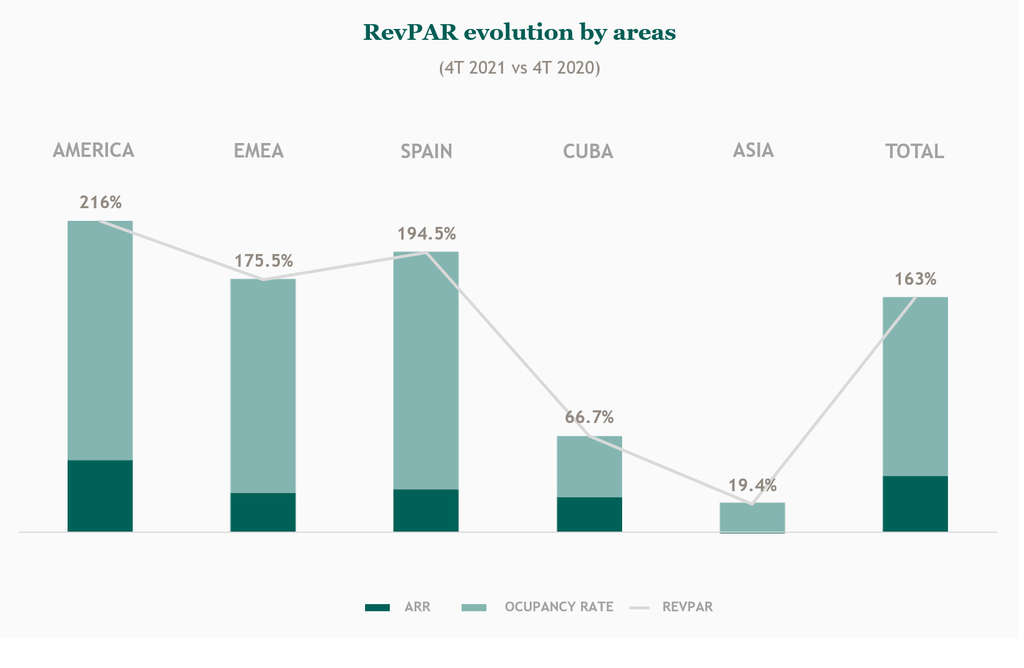

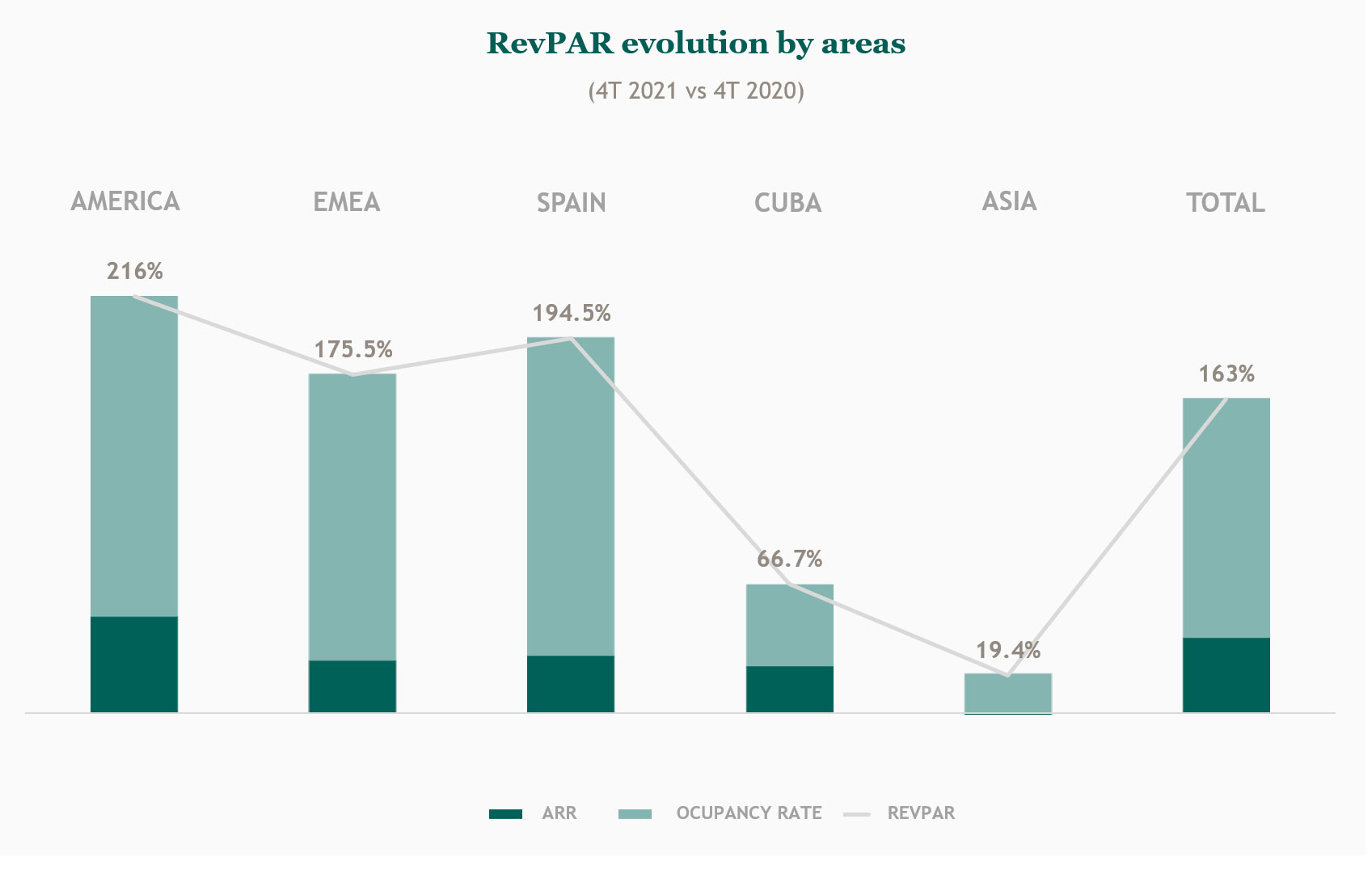

The company had +62.9% more rooms available than in 2020, with only 6% of the global portfolio closed for reasons related to Covid at the end of the year, compared to 21% at the end of the previous year. Average occupancy improved by 1.7 percentage points for the year as a whole, after a boost in the 4th quarter that improved by 22.3 percentage points compared to 2020, despite the strong impact of Omicron in December. Average daily rates also increased by +9.7% for the year as a whole, and by +1.8% compared to 2019 (pre-Covid). These increases took RevPAR for the 12 months to €39.40, +14.9% higher than in 2020. In the 4th quarter itself, RevPAR stood at €47.80, up +163% compared to the same period in the previous year.

2021 once again demonstrated the significant competitive advantage of digitalisation, thanks to which Meliá Hotels International has positioned itself as a leader in distribution, channelling 51% of all centralised sales through melia.com. This also helped maintain its commitment to preserving average rates, as reflected in the evolution of RevPAR (Revenue Per Available Room), for which the improvement in average rates partially offset the irregular patterns in occupancy. Along with sales and distribution, Meliá's commitment to digital transformation also includes Front and Back-Office processes, aiming to optimise our personalised customer service through the use of new technology.

In financial matters, the company managed to secure more than enough liquidity to face such a difficult year, closing the year with a liquidity level of €404 million. Net Financial Debt pre-IFRS16 stood at €1,285.9 million at the end of December, an increase of €30.7 million over the year. Meliá still considers controlling and reducing debt as a top priority, an objective to which asset sales at the end of the first half of the year for a net amount of €170 million made a significant contribution. The company is still considering additional disposals in 2022 to accompany the expected recovery in revenues.

With regard to expansion, the company has gradually resumed its growth, opening 13 new hotels between January and December 2021, 7 of them in European cities (Barcelona, Liverpool, Frankfurt, Newcastle, Avilés, Amsterdam and Luxembourg), 1 in China, and 5 resorts in Phuket in Thailand, Rhodes in Greece, Benidorm and Mallorca in Spain, and Marrakech in Morocco. The company continued to add new hotels, with 21 new hotels with more than 4,800 rooms added in 2021, most of them in Mediterranean resort destinations in Spain, Greece, Sicily, Albania and Croatia, in addition to Indonesia and China, under its Sol by Meliá, Innside by Meliá, Affiliated by Meliá, Meliá Hotels & Resorts and Meliá Collection brands.

In the first two months of 2022, the company has continued to grow, with agreements such as the one signed with the Vinpearl group, the largest hotel owner in Vietnam, which will add 12 luxury hotels in the country to the portfolio in 2022 under the joint brand “Meliá Vinpearl". This strategic alliance will add more than 3,900 rooms. When added to the 12 hotels Meliá already has in operation and in preparation in the country, this will make it the second largest hotel company in Vietnam, with 24 hotels and 6,900 rooms. Meliá also affiliated 5 hotels in Croatia, a Meliá Collection Hotel in Tuscany in Italy, a hotel in Portugal and a large resort in Vietnam, bringing the number of hotels added from January 2021 to date up to 42 hotels with more than 10,900 rooms.

Outlook 2022

The impact of Omicron and the removal of travel restrictions continue to condition the speed of the recovery, although an improvement in global activity is expected as of March. WTTC analysts point out that 2022 could see travel revenues above those of 2019. In resort hotels, the number of bookings that have already been made point towards a recovery or even an improvement in RevPAR compared to 2019, given the excellent evolution of prices caused by high demand, the company's focus on the premium and luxury segments, its online distribution capacity and its loyalty program.

In Spain, although first quarter of 2022 started with poor visibility and a strong impact of Omicron in January and first half of February, the WTTC names the country the most popular destination for European travellers (with an increase in arrivals from other European countries in the first quarter of +320% compared to the previous year) and we trust there will be a rapid recovery from March. Despite the impact of Omicron on cancellations in January and February, especially by groups, conventions and congresses, positive results have been seen in ski resort hotels, and there has been a gradual improvement in bookings for the Canary Islands, one of the top destinations in the winter season, after the withdrawal of travel restrictions by the United Kingdom and Germany.

In EMEA (Europe, Middle East and Africa) the evolution of the business depends largely on the level of travel restrictions. Germany was affected in January and February by the cancellation or delay until the second semester of many trade fairs, but has seen a certain reactivation for March which we hope will be consolidated after the first hints of a relaxation of restrictions made recently by the government. In Italy and France, the strong restrictions that remain in place have led to an increase in cancellations, especially by groups, although we trust there will be a rapid recovery from March, after the peak of Omicron infections is over. On the other hand, hotels in East Africa have been strongly recovering their activity, thanks to the positive evolution of the pandemic and the safe conditions that iconic hotels such as Meliá Serengeti, Meliá Zanzibar or Gran Meliá Arusha are offering.

In America, Omicron is also behind an increase in cancellations by travellers from Canada and the United States to Mexico and the Dominican Republic, as well as the postponement of events planned for the first quarter to the third or fourth quarters of 2022, and even 2023. A large number of requests continue to be received for this later period, pointing towards intense activity in the second half of the year and next year.

In Asia-Pacific, China began 2022 with a situation similar to the end of 2019, but various outbreaks in several cities have led to closures and restrictions. The country expects a strong recovery in demand after the Chinese New Year. In the countries in Southeast Asia in which Meliá operates hotels (Vietnam, Thailand, Indonesia, Malaysia and Myanmar), forecasts for the first half of the year are similar to the end of 2021, with an almost total focus on the domestic market and expectations of opening up to international markets in the second half of the year.

Finally, Cuba has been affected by the tightening of measures regarding foreign visitors, although a significant growth in activity is still expected compared to the first quarter of 2021. Meliá also expects a positive impact as a result of all the improvements made to several hotels during the pandemic.

Responsible management

In 2021, Meliá once again excelled in the Corporate Sustainability Assessment made by Standard & Poors Global, which once again named it the second most sustainable hotel company in the world, and the number one chain in Spain and Europe (Silver Class). The company's strategic focus on sustainability is even stronger in the new post-Covid business environment due to greater demands from society regarding the role companies have to play in the recovery. This has been accompanied by a so-called "regulatory tsunami" from 2022 in the European Union, designed to boost the competitiveness of companies in the new global context of a green and digital transition. That is why Meliá worked on making significant progress in 2021 in the three 3 dimensions of sustainability.

Environment, Society and Governance

In the environmental dimension, the company adapted to the new and more demanding global commitments to combat climate change, assuming more ambitious objectives in reducing emissions to help limit global warming. For the tenth consecutive year, we also participated in the CDP Climate Change assessment of climate change and environmental management, obtaining a B rating (A is the highest rating), as well as in the CDP Water Index, achieving the highest rating in Spain and Europe. We also kept up our commitments and investments in energy efficiency, with the implementation of new energy-saving technology, and we continued to explore opportunities in the circular economy and the reduction of food waste, among others.

The Company also highlights the efforts made to align climate change management with the recommendations of the Task Force on Climate-related Financial Disclosures (TFCD), supported by the Global Financial Council, to encourage companies to inform their stakeholders about the risks and opportunities related to climate change and how they are managed. The accompanying analysis has allowed Meliá to define a roadmap focused on mitigating the risks associated with climate change and exploring long-term opportunities. The company has also incorporated into its strategy the requirements defined by the new European Taxonomy on sustainability.

In a social arena which has been affected by the context caused by the pandemic, progress focused on preserving the jobs of our employees and their health and safety, as well as their training and development. The Company received the Top Employers 2022 certification, which recognizes companies for their talent management, acknowledging their contribution to excellence in the work environment in Spain, Mexico and the Dominican Republic, which account for 46% of the group's total workforce, focusing also in other matters of the highest priority for the Meliá Stakeholders, such as ethics, integrity, transparency, safety, health and the protection of human rights, an area in which we have set ourselves the goal of reviewing and align our approach with the European Due Diligence Directive. Finally, after the suspension caused by the pandemic, the company hopes to reactivate social projects in 2022 in areas such as social and workplace integration, training and learning, and philanthropy at a local level.

Governance is an area in which the S&P Global CSA gives us the best rating in the industry thanks to our progress in transparency, rigour and the management of ESG risks, and the way we have integrated this into our global Risk Map. We have also continued to reinforce the solidity of our governance model, ethics and transparency. In 2021 the company increased the proportion of female members on its Board of Directors to 36.36%, exceeding the 30% recommendation, and with the aim of reaching 40% in 2022. We also defined objectives linked to compliance with the recommendations of the Good Governance Code from the Spanish CNMV, achieving 75% compliance with the recommendations in 2021, and setting a target of 85% for 2022.

The Executive Vice President and CEO of Meliá, Gabriel Escarrer, summarises the company's commitment to make sustainability a key driver of value creation in the core business as follows: “we have a triple objective: to be financially viable, socially beneficial and environmentally responsible."

About Melia Hotels International

Rooted in Mallorca (Spain), with a global footprint, Meliá Hotels International has evolved over seven decades into one of the world's leading hospitality groups. Today, we are proud to be recognized as Europe's most sustainable hotel company by S&P Global, and as a Top Employer Large Enterprise 2025, reflecting our unwavering commitment to excellence, innovation and responsible tourism.With a portfolio of over 400 hotels across key destinations worldwide, we deliver differentiated guest experiences through our nine distinct brands: Gran Meliá Hotels & Resorts, ME by Meliá, The Meliá Collection, Paradisus by Meliá, Meliá Hotels & Resorts, ZEL, INNSiDE by Meliá, Sol by Meliá, and Affiliated by Meliá. Each brand is designed to meet the evolving expectations of our guests, while staying true to our Mediterranean roots and values.Our strategic focus on sustainability, talent development, and digital transformation continues to position Meliá as a benchmark in the global hospitality industry, driving long-term value for our stakeholders and creating meaningful experiences for millions of travelers around the world. . For more information, please visit www.meliahotelsinternational.com