Lodging Industry Overview Year-end 2021

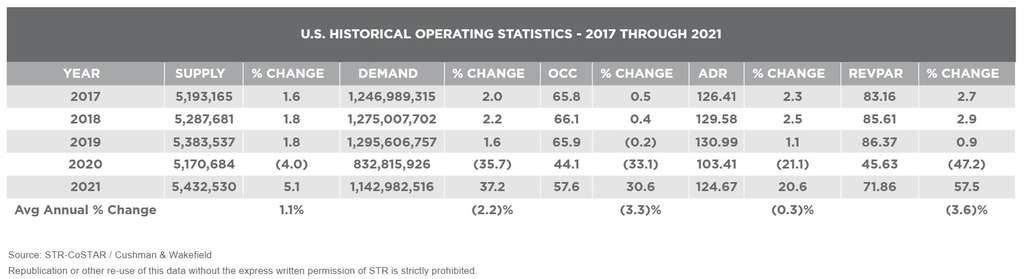

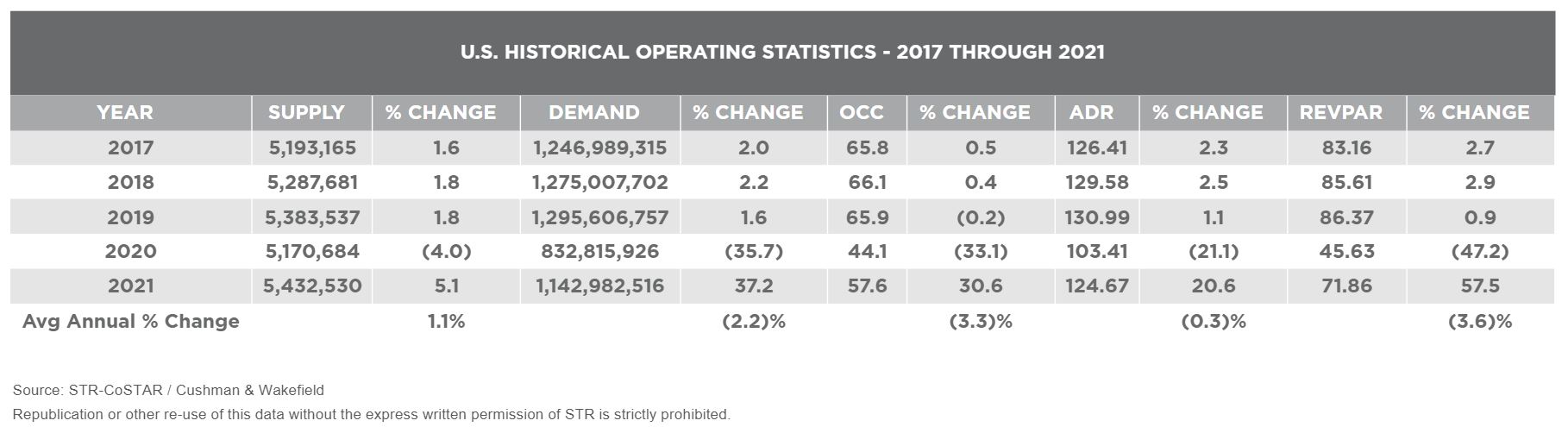

The year ended with substantial national gains in rate and occupancy from 2020 and provided confidence that the recovery will reaccelerate in 2022.

Year-End 2021: A Bumpy Road Leading to Somewhere Beautiful

The lodging environment in 2021 was head-spinning for investors and lenders. Following a breakneck recovery pace in the spring and summer when the roll-out of vaccines brought the much-anticipated return of hotel users, demand faltered in the fall and winter with the sequential hits from the Delta variant followed by Omicron.

Hotel markets were more sensitive than expected to the COVID-19 impacts in 2021. The vaccine roll-out and concomitant easing of government restrictions resulted in unanticipatedly strong performance in the spring and summer. Travelers eagerly sought out drive-to vacations. Demand in 2021 was primarily leisure-driven with modest gains in business and convention activity. Viral surges in the fall and winter suppressed these positive trends. Extended-stay and limited-service hotels, as well as lodging in drive-to leisure destinations, demonstrated the greatest resilience in 2021, with markets and properties setting new RevPAR (revenue per available room) records. Hotels reliant on business, meeting and group travel continued to lag, particularly in large urban cores and suburban corporate locations. Nevertheless, 2021 ended with substantial national gains in rate and occupancy from 2020 and provided confidence that the recovery will reaccelerate in 2022.

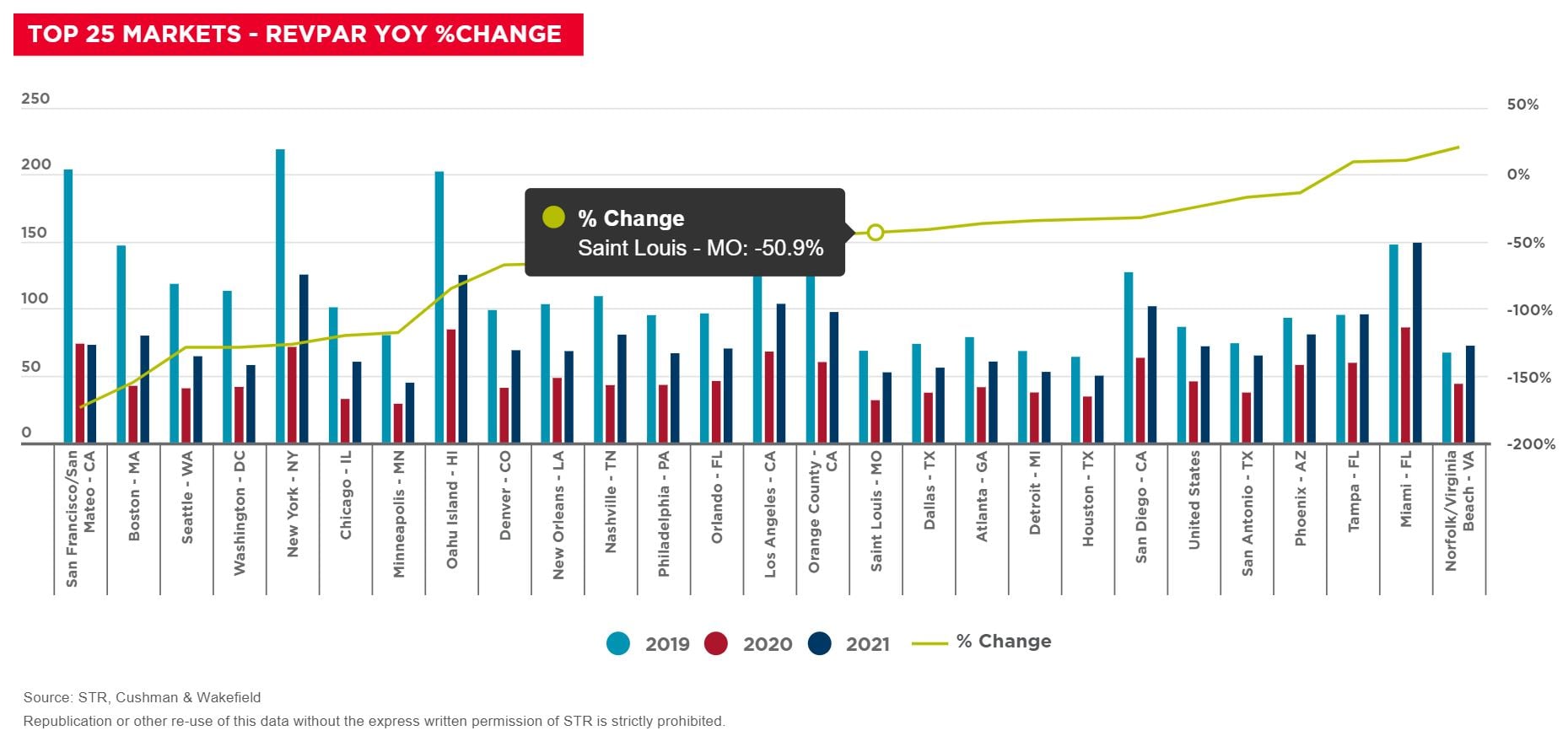

STR Top 25 Markets

Hotel owners and operators have stratified into the haves and the have-nots. Leisure markets, including coastal-oriented areas, Las Vegas, and snow resorts rebounded with record-high seasons and stronger shoulder and low periods, as work and school-from-home flexibility and drive-to travel prevailed. The performance of the top 25 markets reflected the contrast between leisure and business/convention markets, as shown in the following chart.

The chart is ranked by RevPAR percentage change between 2019 and 2021, while the bar represents the RevPAR amounts in 2021. While almost all the markets showed improvement in 2021 relative to 2020, with readily accessible leisure destinations showing greater gains, particularly in the second half of the year, RevPAR in 2021 still lagged 2019 performance in most markets.

Resort markets were top performers in 2021. RevPARs in Norfolk/Virginia Beach, Tampa and Miami exceeded 2019 levels. Major commercial and convention cities such as Boston, Washington and New York showed more modest gains. San Francisco’s performance faltered. The market’s RevPAR in 2021 was below that of 2020, as tech companies continued to support remote work policies and conventions were postponed.

On a national basis, RevPAR is expected to recover to 2019 levels by 2023. This will largely be driven by occupancy whereas average daily rates are not expected to recover until 2025. This four-year upcycle is shorter than the post-GFC recovery when it took five years to recover.

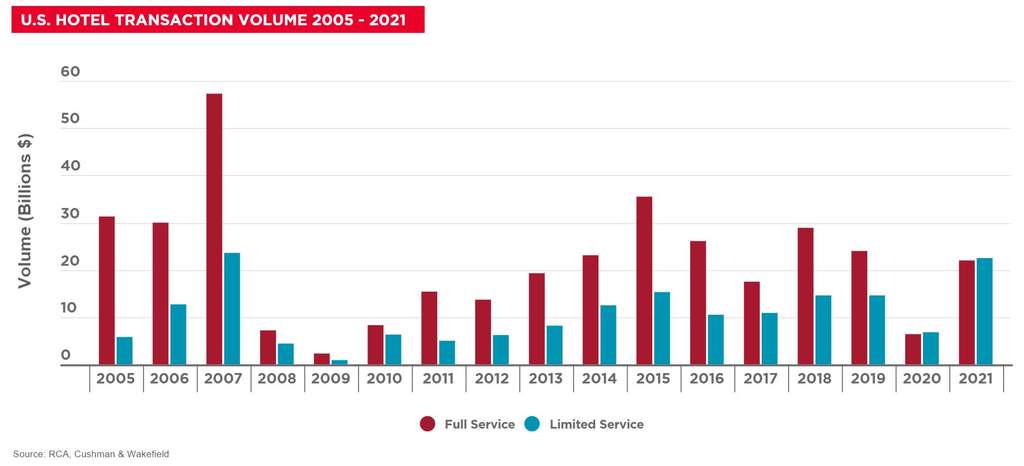

Hotel Transaction Overview

The ample equity amassed beginning in the second quarter of 2020 through 2021 for hotel acquisitions continues to drive property sales which were robust, buoyed by the purchase of Extended Stay America, which included the brand and 563 properties. Hotel sale volume in 2021 is viewed by industry participants as a turning point, with over 120 single property transactions.

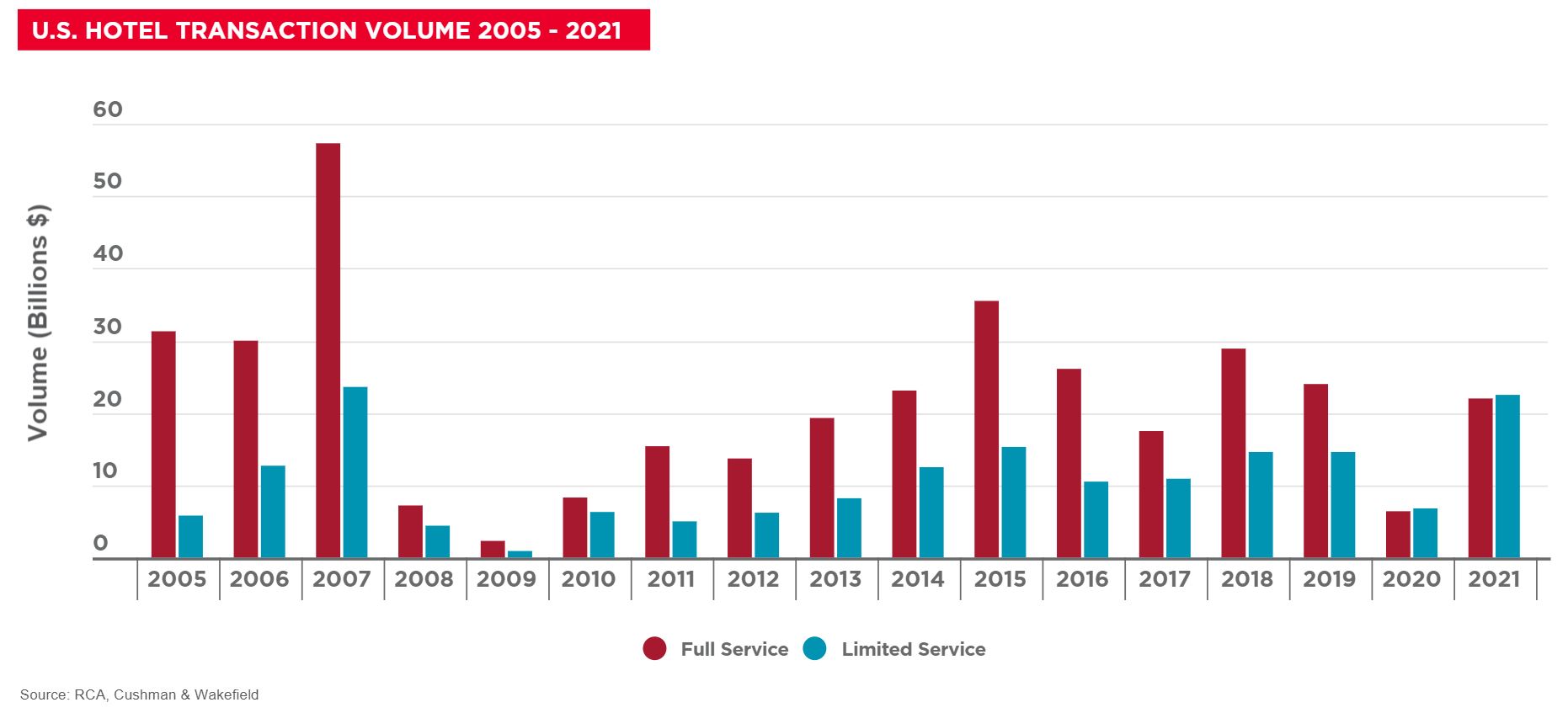

While distressed hotel sales remained elusive as work-out strategies appeased lenders and owners, resort and select-service hotels were actively brought to market. Large single transaction sales have been the most efficient transactions to execute for all parties. The trend of sales volume is summarized in the following chart.

Because the spring and summer of 2021 showed that the room revenue recovery can be robust, the competition for hotel assets remains fierce. The confluence of a positive net income trend, available and well-priced debt, favorable yields and ample equity are driving pricing for desirable assets, particularly newer select-service and resort product. The investment thesis for acquisition is supported by a slowdown in new construction—as construction materials and labor costs soar—and scarce financing for new projects.

The hotel transaction process has also evolved during the pandemic, with a growing share of trades being handled directly by principals or through a quiet brokerage process. Hotels that are coming to market allow sellers to recycle capital more productively. Many of the hotels being offered are due for major renovations and Product Improvement Plans (PIP) which presents an additional investor challenge for hotels that may be not yet fully recovered, motivating the disposition of these assets. Groups of properties from the same seller are now routinely offered for sale with acquisition flexibility. A buyer can bid on one or more of the assets.

The distribution of buyers in 2020 was dominated by private capital, as uncertainty limited available assets buyers. However, institution buyers returned in 2021 as did REITs, which were both active buyers and sellers. Overseas buyers were less present. The following chart, based on RCA data, shows the distribution of hotel buyers.

The current liquidity in capital markets is unprecedented with investors rushing to place dollars and has resulted in downward pressure on yields and competitive bidding on those hotel assets that come to market. Despite the impact of the Delta and Omicron COVID-19 variants on travel, hotel transaction volume in Q4 2021 reached approximately the same level seen in Q4 2019. There remains a bifurcated preference among investors for drive-to resort and distress/deep-value opportunities. Extended stay assets are also favored among many investors due to their cash flow resilience during the pandemic and efficient operating models. Transaction volume in 2022 is widely expected to exceed 2021 as many more traditional full-service and urban hotels head to market; however, uncertainty around the trajectory of COVID-19 and possible future waves—and the downstream effects such as the delay in return to the office policies by major companies—has also delayed the dispositions of many of these assets anticipated to come to market in early Q1 2022.

Hotel debt markets are likewise buoyed by favorable capital markets and search for yield as more and more lenders entered/re-entered the hotel lending market in 2021. Primarily led by debt funds and transitional lenders, life companies, money center and regional banks all began lending in 2021. In the securitized markets, the single-asset, single-borrower execution (SASB) gained tremendous traction for those properties that qualified. Hotel CMBS, which may be the slowest lending class to recover, started showing signs of life in Q3/Q4 2021 and is anticipated to be increasingly liquid in 2022.

Overall, the amount of capital available for hotel product continues to exceed the supply of hotels for sale, sustaining the expectation of strong pricing. The damper on hotel transaction activity remains the lack of inventory for sale. Buyers and brokers continue to hope the increasing pricing pressure from well-funded investors will fuel the availability of assets and transactions are expected to be robust in the second half of 2022.

Hotels Aren’t What They Used to Be and That’s OK

The face-off between hospitality and technology, which has been apparent in the lodging industry for several decades, has amplified during the pandemic. The institutionalization of the hospitality industry was established on face-to-face interactions to the benefit of the guest. As E.M. Statler proclaimed in 1927, “Life is service – the one who progresses is the one who gives his fellow men a little more – a little better service.” In the past 100 years, the entrenched culture of the human touch in all encounters has informed every aspect of the business, from the design of the arrival and the location of the front desk, to the training of line employees in guest acknowledgement. But what happens when this precept meets a pandemic that is revolutionizing the giving and receiving of service in all daily encounters? New hotel operating practices are being established both in social behavior and with the rapid adoption of technology in 2020 and 2021. These practices are long overdue with the increasing economic prominence of hotel guests raised on computers and the internet, and the more recent perceptions of personal safety and sanitation. The opportunities are dramatically streamlining costs and sustaining hotel values while also transforming the essence of high-touch hospitality that has historically directed the industry.

Cushman & Wakefield’s hospitality consulting and valuation practice has the benefit of working with lodging properties across the U.S. at all rate levels and every type of location. The shifts in the adoption of technology are not uniform but can be useful as best practices for many properties. Owners and operators have also been supported by most of the major brands in rolling out new breakfast prototypes to help with these challenges:

- Daily housekeeping is quickly fading as the expectation of guests has changed across price segments. With staffing and wage pressures, operators have indefinitely expanded what was the safety protocol of reduced housekeeping in the initial months of the pandemic into a standard operating procedure. The potential for additional fee for on-demand housekeeping service is contextualized as consistent with the shift in airline revenue structures where seat assignments and baggage fees are now established revenue sources.

- Breakfast buffets are contracting in favor of grab-and-go options. When the pandemic hit, hotels closed their breakfast offerings, whether complimentary for select-service brands or not. Even with the relaxation of local regulations, hotels have shifted the breakfast models, with reduced items and the elimination of self-service hot items. The combination of staffing challenges, supply chain issues, and pandemic behavior has allowed operators to streamline the service and the associated costs.

- The use of QR codes for menus and ordering is quickly becoming the norm in standalone and hotel restaurants. The use of this technology is critical in the current environment where full staffing is rare. Guests are less resistant to the change in service in response to the reduced interactions established during the pandemic. This change is embraced differently depending on age and ability but is expanding rapidly as part of the post-pandemic shifts.

- Self-check-in is being heavily promoted by hotel operators and embraced by guests. While the use of phones for registration and electronic room key was being rolled out prior to the pandemic, this technology has gained traction. We are working on several smaller independent properties in urban locations which have shifted entirely to self-check-in and eliminated the costly front desk.

- The use of robots is still evolving. Robotic cocktail mixers have become standard for larger bar operations in Las Vegas but robots that deliver those cocktails or linens are still more of a novelty than utilitarian. And as room service is being phased out in many hotels, the use of robots to deliver meals is less compelling. Housekeeping robots are still an evolving vision.

- Sonder Hotels, one of the many brands that emerged in the last decade, positions itself as a technology company and not a lodging company, embodying all interactions electronically from reservations to check-out with minimal person-to-person interaction. The hotel room is delivered as a commodity product and the interactive hospitality element of the experience is no longer the focus of the business.

The need to respond to the social practices of the pandemic requires hotels to change decades-long operations. Personal safety concerns, the growing challenges of employees, higher wages and supply chain disruptions are resulting in major changes in hotel services and in the acceptance of these changes by guests. Part of the industry’s hospitality is now adapting to guests seeking out low-touch hotel experiences that make them comfortable. Because of the concerns in the initial months of the pandemic, guests have retrained their expectations of hotel services.

Our observations are that these changes are most successful in limited-service and select-service products. In response to the feedback of their guests, luxury hotel operators have had to maintain high service levels including room service but with social distancing protocols.

The changes in service delivery were spurred by personal safety concerns and guest acceptance, then accelerated by higher labor costs and the challenges in hiring. The reduced operating costs of the new protocols helps to offset the higher payroll and are critical to supporting the long-term values and profitability of hotels.

We expect that hotel operations will continue to evolve as public health changes impacts travel. The rapidity of the service changes and their acceptance by guests provide a positive framework for the future of hospitality and supporting profitability over the long-term.

Summary and Outlook

The unexpectedly strong performance of the U.S. Lodging Market in the spring and summer of 2021 provided investors and lenders with greater confidence that recovery is possible and will likely be robust over the next few years. Despite the challenges posed by the pandemic, travel remains a priority for many. The Delta and Omicron surges were reminders that external risks will remain and trends are not linear. However, the industry’s responses with operational and technology changes, and the expectation of travelers to continue to travel, provides assurance for continued recovery. While there are likely to be additional bumps along the way, industry participants remain soberly optimistic.

About Cushman & Wakefield

Cushman & Wakefield (NYSE: CWK) is a leading global commercial real estate services firm for property owners and occupiers with approximately 52,000 employees in nearly 400 offices and 60 countries. In 2023, the firm reported revenue of $9.5 billion across its core services of property, facilities and project management, leasing, capital markets, and valuation and other services. It also receives numerous industry and business accolades for its award-winning culture and commitment to Diversity, Equity, and Inclusion (DEI), sustainability and more. For additional information, visit www.cushmanwakefield.com.

Jeffrey S. Brown

Senior Managing Director – National Practice Leader Hospitality & Gaming | Valuation & Advisory

Cushman & Wakefield