First-quarter 2022 revenue of €701 million up 85% like-for-like

Revpar Up Every Quarter Since Q2 2021

Sébastien Bazin, Chairman and Chief Executive Officer of Accor, said: "Accor's performance in the first quarter of 2022 confirms the clear upturn in business across all regions and the renewed momentum in tourism, food services and entertainment. These results are notably driven by our market dynamics in Europe, the Middle East and the Americas as well as the strong demand for our Luxury and Lifestyle hotels, and domestic travel. Such underlying trends, combined with borders reopening give us confidence that our performance will continue to improve month after month, with prices already above 2019 level. Our brands are attractive, ideally positioned, and the augmented hospitality ecosystem we have built over the past years is attracting an increasing number of guests and owners. In the coming months, we will continue to focus our efforts on accelerating the development of our network, promoting our brands as well as attracting and retaining more and more customers."

Accor’s business has rebounded sequentially every quarter since Q2 2021. The outbreak of the Omicron variant caused only a brief hiccup in January, and the recovery seen in February gained further momentum in March. This rebound reflects both the sustained increase in the number of business and leisure domestic guests, and border reopenings which accelerated the return of international travelers. It was accompanied by a sharp increase in prices, which are now above 2019 levels for the last 4 months in a row across the Group, driven by demand and exacerbated by inflation.

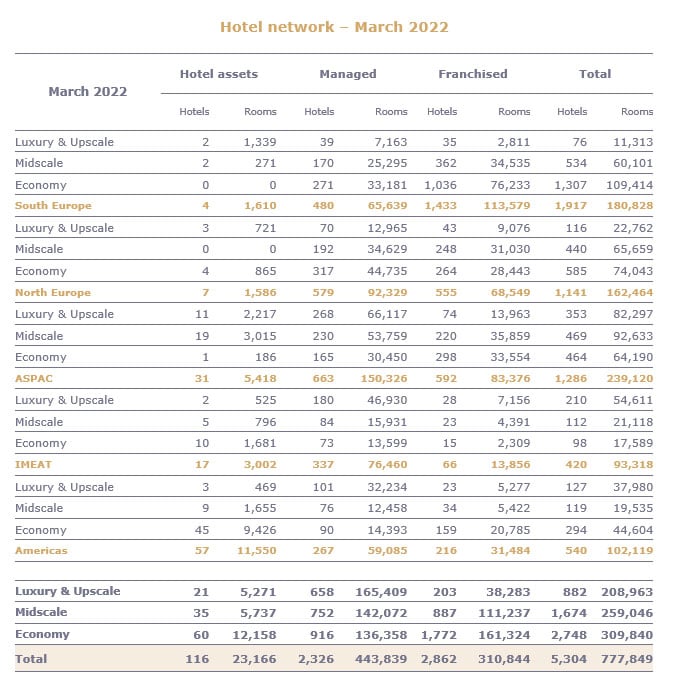

During the first quarter of 2022, Accor opened 26 hotels, representing about 3,700 rooms, for net growth in the network of 2.5% over the twelve-month period. At end-March 2022, the Group had a portfolio of 777,849 rooms (5,304 hotels) and a pipeline of about 212,000 rooms (1,212 hotels).

For 2022, the Group is confirming its forecast of net growth in the network of 3.5%.

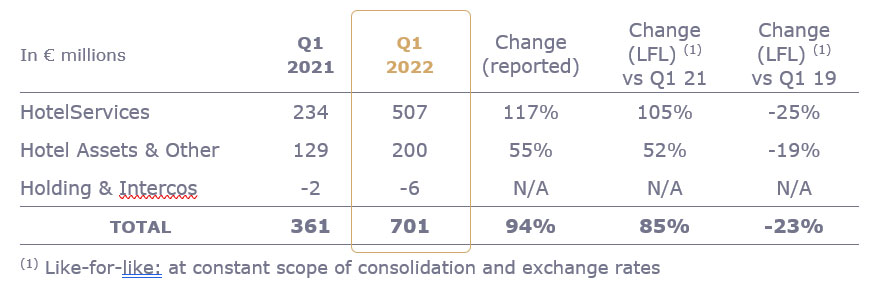

Consolidated revenue

The Group reported first-quarter 2022 revenue of €701 million, up 85% like-for-like (LFL) versus Q1 2021. By activity, this growth breaks down into a 105% increase for HotelServices and 52% for Hotel Assets & Other. To provide a comparison with the 25% decline in RevPAR (presented as the change versus FY 2019 throughout this release), the like-for-like decline in revenue versus Q1 2019 is 23%.

Changes in the scope of consolidation (acquisitions and disposals) contributed a positive

€13 million, largely due to the integration of the companies which are now part of Ennismore over 2021.

Currency effects had a positive impact of €18 million, mainly due to the US dollar (+7%).

HotelServices revenue

HotelServices, which includes fees from Management & Franchise (M&F) and Services to Owners, reported €507 million in revenue, up 105% like-for-like versus Q1 2021 (down 25% like-for-like versus Q1 2019).

Revenue in Management & Franchise (M&F) stood at €158 million, up 106% like-for-like versus Q1 2021 (down 33% like-for-like versus Q1 2019), with regional performances correlated to the business recovery in the countries considered. In general, the sharper decline in M&F revenue compared with RevPAR (down 25% versus Q1 2019) can be attributed to the larger decrease in incentive fees based on the hotel operating margin generated from management contracts.

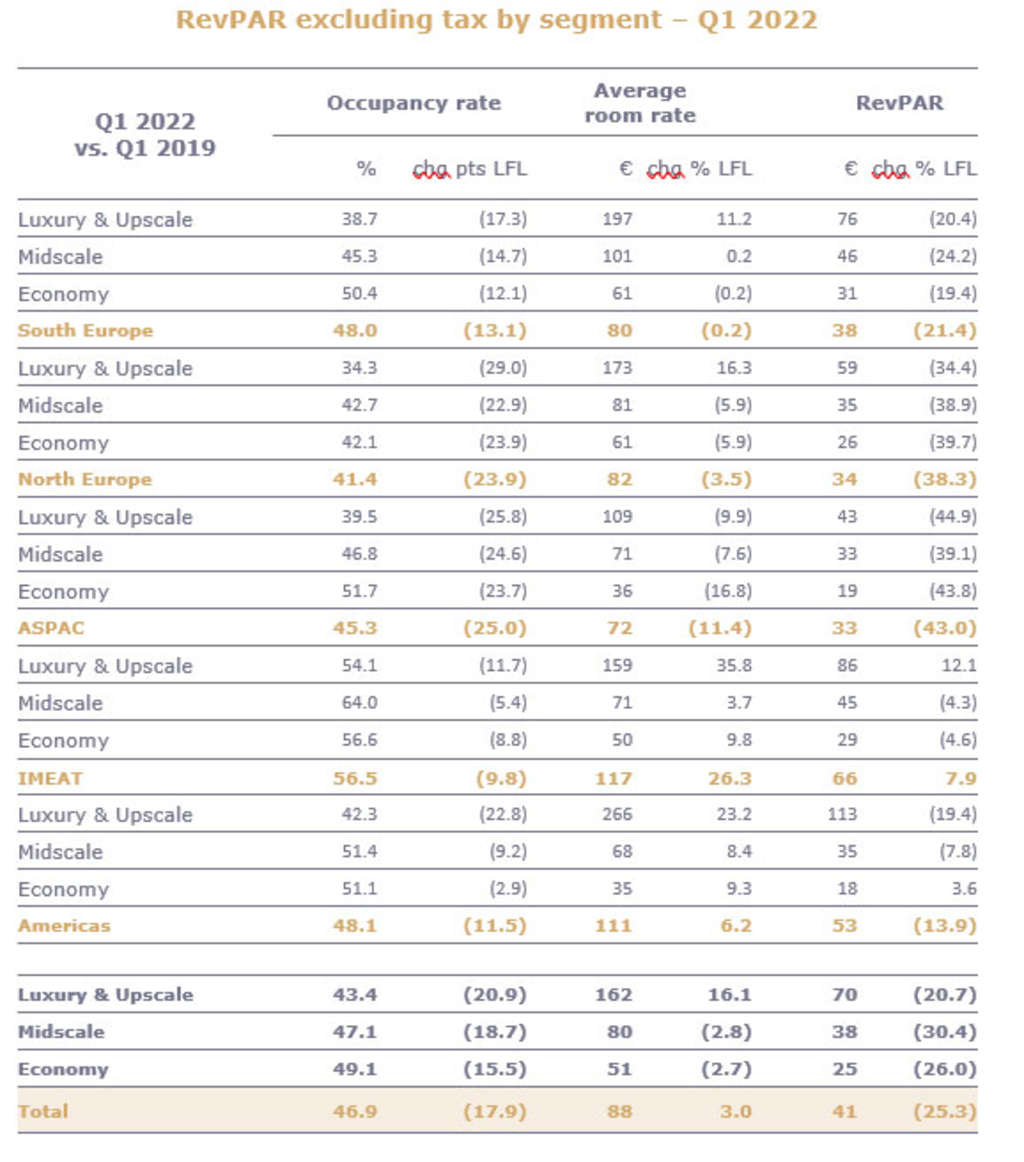

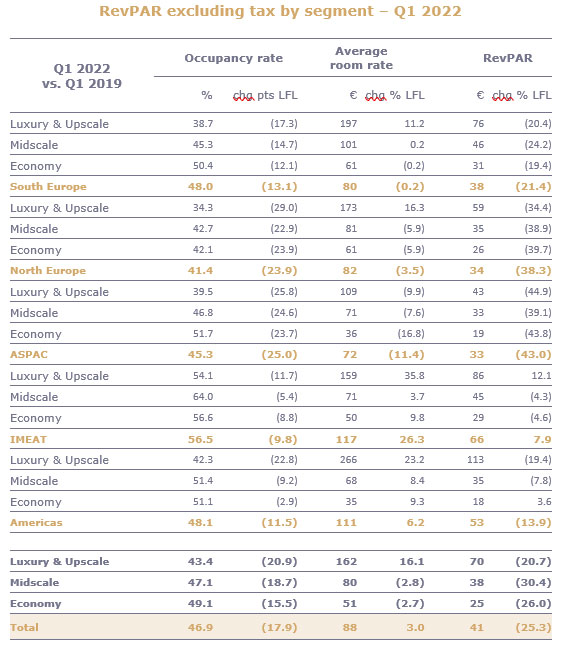

Consolidated RevPAR more than doubled in Q1 2022 (up 108% as reported) compared with Q1 2021 but was still down 25% versus Q1 2019. Compared with the same period last year, the Group was better able to optimize its pricing policy thanks to the increased visibility provided by earlier bookings.

Overall, Europe was the region the most impacted by the Omicron variant. But this impact was short-lived and remained limited to January: in March 2022, occupancy rates already exceeded their Q4 2021 levels.

South Europe reported a 21% decline in RevPAR in Q1 2022 compared with Q1 2019 i.e. a 4-percentage-point sequential decline compared with Q4.

- In France, RevPAR was down 20% from Q1 2019. As was the case in 2021, regional cities remained the most dynamic markets while the Paris region lagged. However, the performance gap between regional cities and the Paris region began to narrow due to the return of international business travelers.

- In Spain, RevPAR was down 26% compared with Q1 2019.

North Europe showed RevPAR down 38% versus Q1 2019, or a sequential decline of -1 percentage point vs. Q4 2021.

- In the United Kingdom, RevPAR was down 15% compared with Q1 2019. Similar to France, the recovery was driven by regional cities, which were almost back to their 2019 activity levels. The performance gap with London also started to close due to the pick-up in international visitors.

- In Germany, where health restrictions were tougher and longer than in neighboring countries, RevPAR was down 62% compared with Q1 2019. Nevertheless, these restrictions are now lifted since early April and an improvement is now visible.

RevPAR improved sequentially in Asia-Pacific (+5 percentage points between Q4 2021 and Q1 2022), driven by the Pacific region. RevPAR fell by 43% versus Q1 2019.

- The Pacific region benefited from the reopening of internal borders during the full quarter. Leisure destinations, including the country’s northeastern coast, benefited from domestic demand. RevPAR fell by 31% versus Q1 2019. The reopening of external borders in February 2022 paved the way for a pick-up in business demand.

- In China, the performance was bleak due to the emergence of the Omicron variant and the “zero-Covid” strategy. RevPAR fell by 42% versus Q1 2019.

- Southeast Asia’s RevPAR was stable at -55% but the situation is improving. Destinations such as Singapore, Bali, Vietnam and Thailand have reopened their borders with limited restrictions. The region nevertheless continues to rely heavily on international visitors (thus depending on air flight traffic capacity recovery) and some Asian countries are not yet permitted to travel to these destinations.

In the India, Africa, Middle East & Turkey region, activity continued to improve with RevPAR now above the Q1 2019 level (+8%). The United Arab Emirates benefited from demand related to the World Expo in Dubai, which has been open since October 1, 2021. The World Cup of Soccer in Qatar in Q4 2022 will help drive this recovery. In Saudi Arabia, the broader reopening of the holy cities for pilgrimages has led to a sharp rebound in activity. The Ramadan period in April and the pilgrims authorized to join the Hajj in July should confirm this rebound in the coming quarters.

In the Americas, RevPAR was down 14% compared with Q1 2019 with average prices now above their 2019 levels.

-

North/Central America and the Caribbean reported a 22% decline in RevPAR

compared with Q1 2019. The return of business travelers during the quarter, combined with strong demand from leisure travelers, allowed a strong rebound of the activity after the month of January which was impacted by Omicron. - In South America, RevPAR was up 5% versus Q1 2019. This strong performance can be attributed to renewed demand from business travelers.

Services to Owners revenue, which includes the Sales, Marketing, Distribution and Loyalty division, as well as shared services and the reimbursement of hotel staff costs, came to €349 million in the first quarter of 2022, up 104% compared with 2021. This increase reflects the pick-up in activity compared with last year.

Hotel Assets & Other revenue

Revenue in the “Hotel Assets & Other” segment was up 52% like-for-like versus Q1 2021 and down 19% like-for-like versus Q1 2019. This segment, which is closely linked to business in Australia, notably benefited from a pick-up in leisure tourism demand on the northeastern coast of the country where most of the Group’s Strata activities are located (i.e. room and apartment distribution activities and managed properties).

Since early 2021, this segment has included concierge services, luxury home rentals, private sales of hotel stays and digital services for hotel owners. These activities continue to be affected in different ways, ranging from businesses directly related to the Travel segment, such as onefinestay’s private home rentals, to the digital businesses, such as D-EDGE.

At end-March 2022, this segment, which includes owned and leased hotels, represented 116 hotels and 23,166 rooms.

Outlook

Based on current reservation and price increase trends, RevPAR will continue to improve in the coming quarters.

Domestic demand is expected to return to levels comparable to 2019 by the end of the year. Recovery in international demand is catching up even if Asia lags.

Net growth in the network is forecast at 3.5% for 2022, as announced with the release of the 2021 annual results, with openings expected to accelerate as of the second quarter.

Events since January 1st, 2022

Decision made by the Board of Directors

At its meeting on February 23, 2022, and based on the recommendations of the Appointments, Compensation and CSR Committee, the Board of Directors resolved to propose the renewal of Mrs. Qionger Jiang, Mrs. Isabelle Simon, Mr. Nicolas Sarkozy and Mr. Sarmad Zok as Directors of the Company for a three-year duration.

The Board also decided to propose, in addition to the appointment of Mrs. Hélène Auriol Potier, which was already announced, the appointments of Mrs. Asma Abdulrahman Al-Khulaifi and Mr. Ugo Arzani as Directors, for the same period of three years.

Upcoming events in 2022

May 20th: Annual General Assembly

About Accor, a world-leading hospitality group

Accor is a world-leading hospitality group offering stays and experiences across more than 110 countries with over 5,600 hotels and resorts, 10,000 bars & restaurants, wellness facilities and flexible workspaces. The Group has one of the industry's most diverse hospitality ecosystems, encompassing around 45 hotel brands from luxury to economy, as well as Lifestyle with Ennismore. ALL, the booking platform and loyalty program embodies the Accor promise during and beyond the hotel stay and gives its members access to unique experiences. Accor is focused on driving positive action through business ethics, responsible tourism, environmental sustainability, community engagement, diversity, and inclusivity. Accor's mission is reflected in the Group's purpose: Pioneering the art of responsible hospitality, connecting cultures, with heartfelt care. Founded in 1967, Accor SA is headquartered in France. Included in the CAC 40 index, the Group is publicly listed on the Euronext Paris Stock Exchange (ISIN code: FR0000120404) and on the OTC Market (Ticker: ACCYY) in the United States. For more information, please visit group.accor.com or follow us on X, Facebook, LinkedIn, Instagram and TikTok.

Charlotte Thouvard

Senior Vice President Group External Communications

Accor