Lodging Analytics Research & Consulting (LARC)’s 3Q-2022 Hotel Industry Outlook and Market Intelligence Reports

Lodging Analytics Research & Consulting (LARC) remains very encouraged by the U.S. lodging industry’s recent performance and our outlook for 2022 is modestly improved, while our long-term outlook is minimally altered.

While the U.S. economy has been contracting modestly through the first two quarters of the year, until now declining economic activity has had minimal impact on lodging fundamentals, which have continued to recover at a robust pace. U.S. RevPAR was up 39% in 2Q-2022 on a year-over-year basis, driven by a 27% increase in ADR and a 9% increase in occupancy. Additionally, 2Q-2022 RevPAR was 11% above 2019 levels driven by ADRs that were 14% above them.

During 2Q-2022, U.S. Real GDP declined 0.9%, marking the second consecutive quarter of economic contraction. However, as the majority of economists now believe that the Federal Reserve (Fed) has begun to get inflation under control, real GDP is forecast to resume growth in 3Q2022.

While declining economic activity has not shown a meaningful impact on the lodging recovery to date, as the lodging cycle shifts from recovery into an expansion phase, economic activity will become a primary driver of performance. Elevated inflation levels have motivated the Fed to take one of the most hawkish stances on interest rate policy in history. Year-to-date, the nation’s central bank has increased the Fed Funds Rate by 225 bps, including two consecutive 75-bp increases this summer. The good news is that inflation appears to be moderating slowly, which may cause the Fed to moderate (but not eliminate) their aggressive stance on rate increases moving forward. Our baseline assumes the Fed raises rates by another 100 bps by year-end.

While we believe the Fed’s policy has not yet and will not tip the U.S. economy into recession, it has slowed economic growth through the first half of the year and will likely reduce growth into the near future as well. Despite soft economic growth and rising inflation, leisure travel has continued to be remarkably strong. While we believe 3Q2022 leisure demand will set records for the lodging industry, it is also likely to be the peak in leisure demand for several years. Moving forward, sector growth will need to be fueled by the corporate and group segments, which will account for the lion’s share of demand after Labor Day. We remain optimistic that these segments will continue to recover, but they are sensitive to a sluggish economic environment, creating a considerable amount of uncertainty heading into 4Q-2022 and 2023.

Additionally, the corporate recovery will be somewhat dependent on the return to the office, which we expect to continue to gradually progress through 2022 and into 2023. Additionally, while group attendance may be lighter than historically, the number of events is recovering rapidly, helping generate a base level of demand that will further support pricing power.

While we remain optimistic that the greatest disruption from the Covid-19 pandemic is history, there remains risk to short-term disruption tied to spikes in infection rates. However, we expect those disruptions to be shorter and milder than experienced during the Omicron and Delta variants, unless a vaccine/therapy resilient variant emerges.

The economic forecast from Moody’s Analytics that serves as our baseline assumes the following key national assumptions:

- The Fed will raise rates by another 100 bps in 2022.

- Elevated inflation is transitory, but labor supply constraints will be slow to ease.

Moody’s Analytics forecasts U.S. GDP to increase 1.7% in 3Q-2022 and 1.6% in 2022.

We continue to expect there to be U.S. lodging markets that materially outperform and those that underperform national averages. As the industry shifts into the next stage of the lodging cycle, where pent-up leisure demand is not the driver of growth, market winners and losers will begin to shift. We generally believe leisure markets will begin to cool, while international gateway markets should experience stronger growth but take the longest to fully recover to pre-pandemic levels.

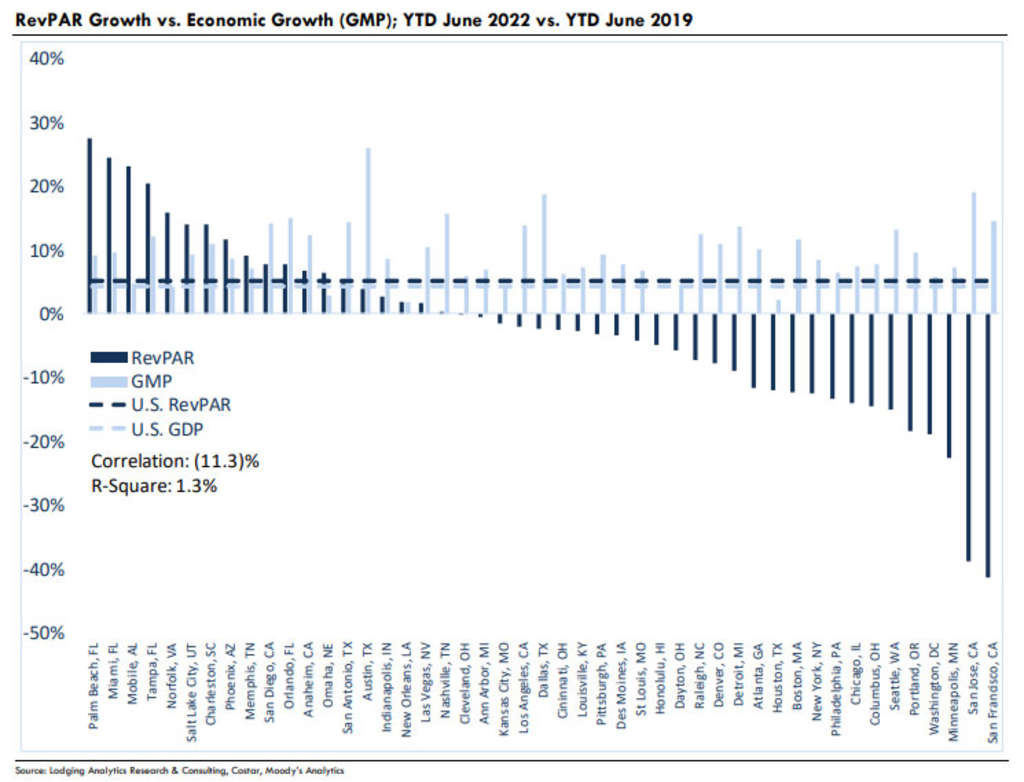

As illustrated in the chart below, this cycle has generated lodging industry winners and losers that have had no relationship with MSA-level economic output. In fact, across our 47 markets, year-to-date June RevPAR growth over 2019 levels has a negative correlation with year-todate June gross metropolitan product (GMP) growth over the same period. In other words, until now, economic growth has had little if any relationship with outperformance or underperformance across given markets. For example, comparing YTD June 2022 vs. YTD June 2019 in San Jose, CA, RevPAR Growth was (39)% while Economic Growth (GMP) was 19%.

As this cycle moves into the next phase of growth, it would be wise for sector participants not to rely on basic economic growth estimates or those factors that drove outperformance over the initial phase of the recovery. Instead, sector participants will need to deeply understand the local macro-economic drivers of lodging demand and pricing power to accurately assess market performance moving forward, especially if they wish to take advantage of market dislocations that may occur in the near-term. LARC provides accurate, transparent, and detailed data to decipher between winning and losing markets.

We believe the best business decisions are based on the best information available at the time of making that decision. We take that approach with our forecasts, using the best available information to provide the most likely outcome. As such, we believe transparency surrounding forecasting is critical to the lodging industry.

LARC’s industry-leading market intelligence referred to throughout this document will help all industry participants navigate the current environment and position themselves for success as the recovery transitions to expansion. Please contact us directly to learn more about our services and products and if there is any other way we may be able to better serve you.

LARC’s Industry Outlook

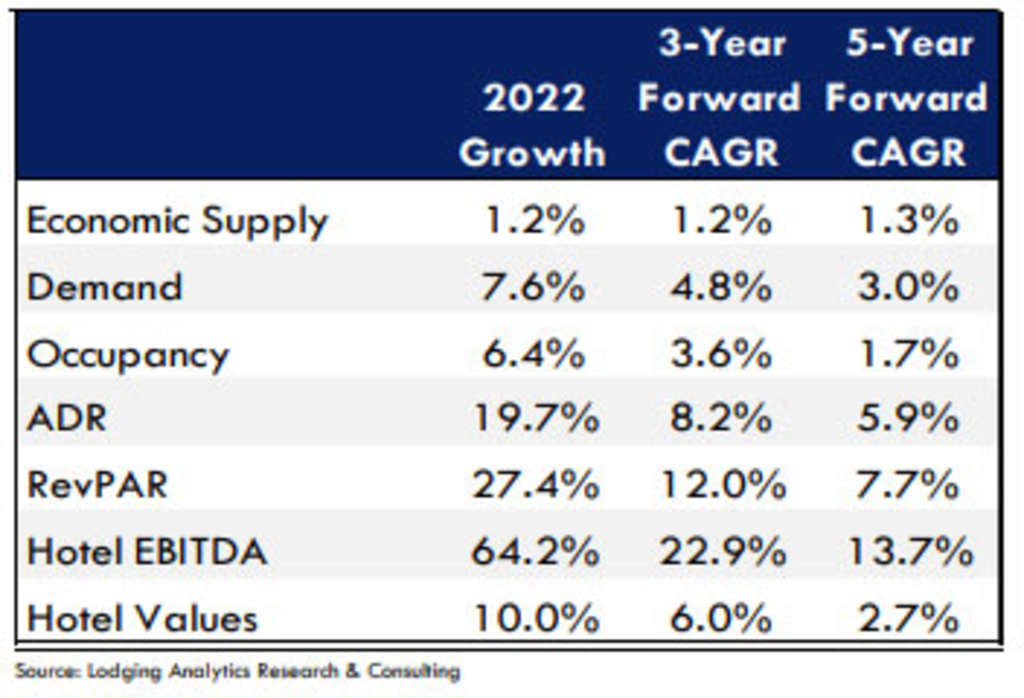

Currently, Lodging Analytics Research & Consulting (LARC) expects U.S. RevPAR to increase by 27.4% to $91.53 in 2022, resulting in an annual RevPAR 6% above 2019 levels. The recovery is driven by continued strength in ADR. LARC anticipates ADR to rise by 19.7% this year to $149.23, or 14% above 2019 levels. With occupancy expected to increase 6.4% in 2022 to 61.3%, LARC has a more conservative view of the demand recovery. LARC expects occupancy to peak this cycle in 2024 at 64.0%, well below 2019 levels of 66.1%.

For 2022, LARC also anticipates U.S. Hotel EBITDA to grow by nearly 65% and hotel values to increase 10%. We believe values will recover to 2019 levels this year and Hotel EBITDA by 2023.

LARC’s U.S. RevPAR model has an R-squared of 99.5% with a standard error of 4.9%, back-tested to 2000. LARC’s U.S. Cap Rate model has an R-squared of 98.4% with a standard error of 23 bps, back-tested to 2005.

The tables below illustrate a summary of LARC’s current U.S. Hotel Industry Outlook in contrast to last quarter’s outlook. Ultimately, our 2022 outlook for supply increased slightly, while our outlook for demand moderated slightly, resulting in a decline in our 2022 occupancy projection. However, that was offset by an improvement in our ADR outlook, which led to almost no change in our 2022 RevPAR forecast. Our improved ADR outlook is driving a higher Hotel EBITDA projection which is driving a slightly higher outlook for hotel values.

September 2022 U.S. Hotel Industry Forecast Summary

2022 U.S. Hotel Industry Forecast: September 2022 Edition vs. June 2022 Edition

Market Outlooks

Below is a list of the best and worst performing markets based on our forecasts. Similar to our U.S. forecast, our market level forecasts are built entirely on multi-variable regression models with high historical accuracy (Rsquareds for each model seen on the next page).

More detail on our market outlooks can be found in LARC’s Market Intelligence Reports. Please contact us if you are interested in purchasing any of LARC’s offerings.

2022 (relative to 2019)

Top Markets for RevPAR Growth:

Mobile, Palm Beach, Charleston, Tampa and Norfolk

Bottom Markets for RevPAR Growth:

San Jose, San Francisco, Washington, D.C., Minneapolis and Portland

2022 (year-over-year)

Top Markets for RevPAR Growth:

San Jose, San Francisco, Minneapolis, Washington, D.C. and Boston

Bottom Markets for RevPAR Growth:

Tampa, Norfolk, Memphis, Palm Beach and Miami

2019 - 2026 Outlook

Top Markets for RevPAR Growth:

Las Vegas, Charleston, Palm Beach, Memphis and Mobile

Bottom Markets for RevPAR Growth:

San Francisco, Boston, Kansas City, Portland and Louisville

Top Markets for Value Change:

Tampa, Los Angeles, Houston, Nashville and Phoenix

Bottom Markets for Value Change:

San Francisco, Boston, San Antonio, New York and Portland

Ryan Meliker

President

Lodging Analytics Research & Consulting, Inc