U.S. Hotels – July 2022 Commentary

July 2022 Top-Line Metrics (percentage change from July 2019)

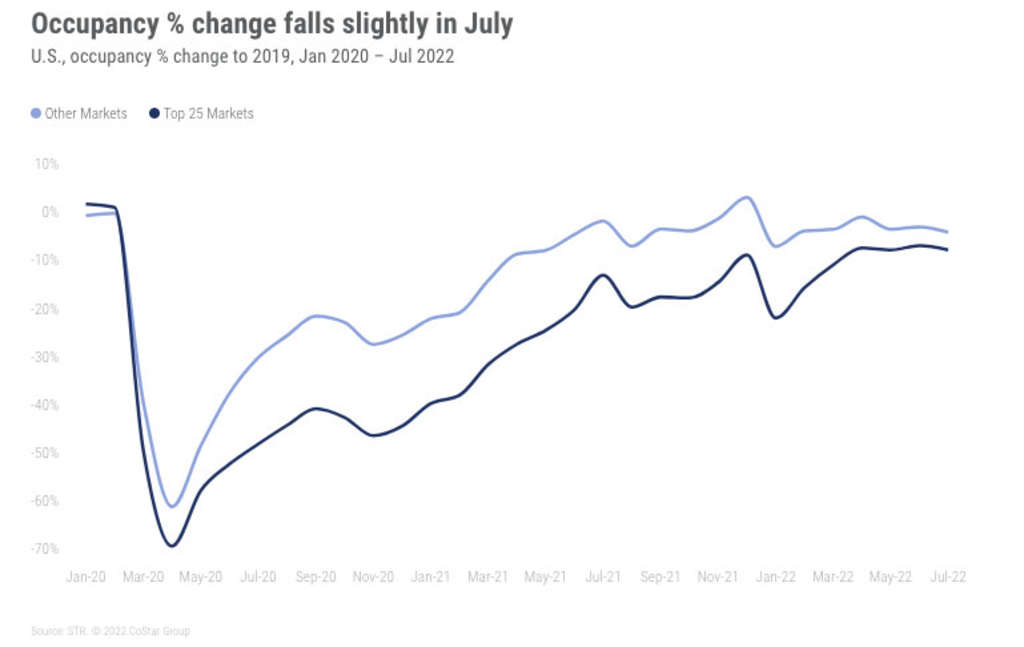

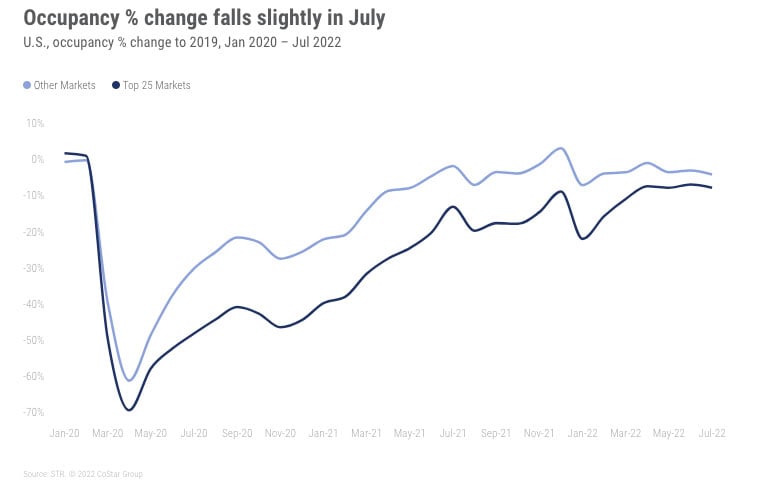

- Occupancy: 69.6% (-5.4%)

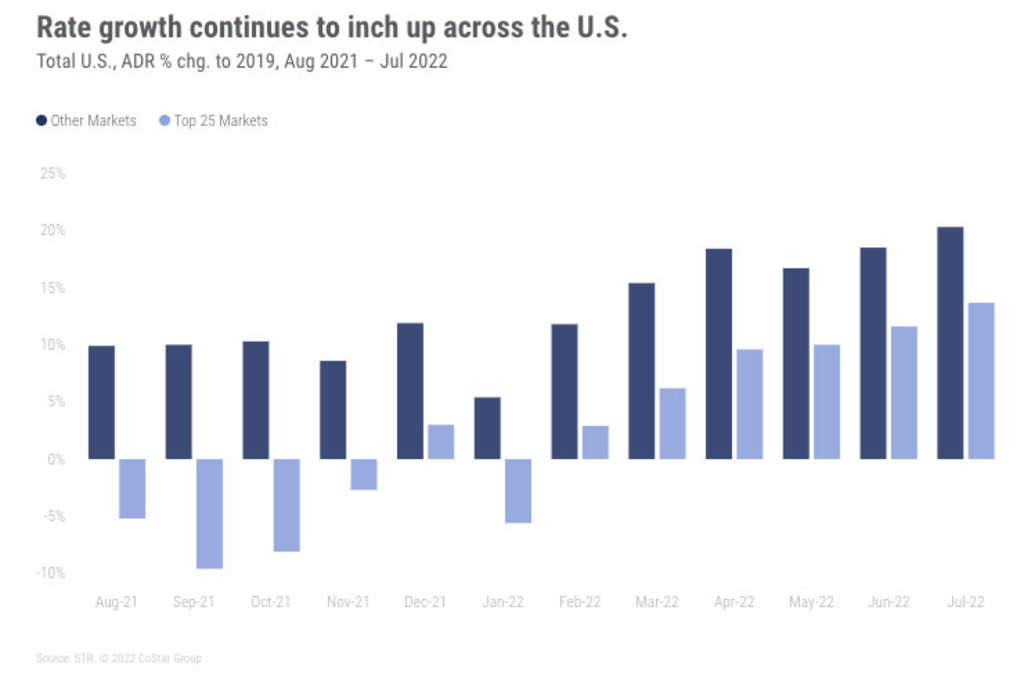

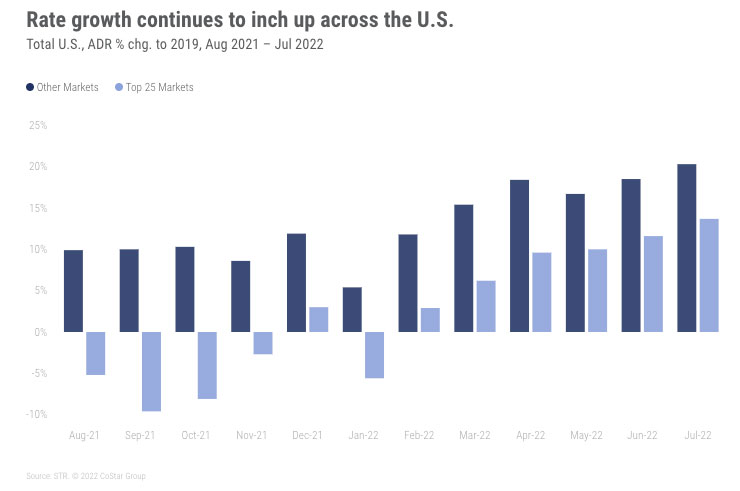

- Average daily rate (ADR): US$159.08 (+17.5%)

- Revenue per available room (RevPAR): US$110.73 (+11.2%)

Key points from the month:

- Occupancy (absolute and index) declined month over month while ADR and RevPAR continued to rise.

- Real ADR (inflation-adjusted) was nearly 2% above the pre-pandemic comparable.

- Lower weekend occupancy was the biggest contributor to softened July occupancy.

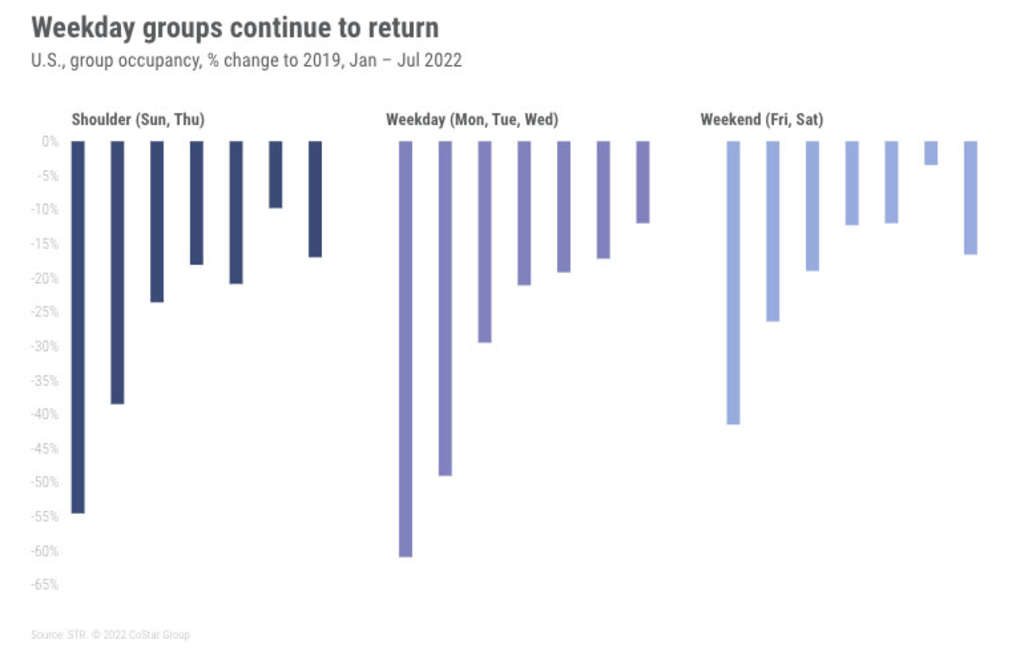

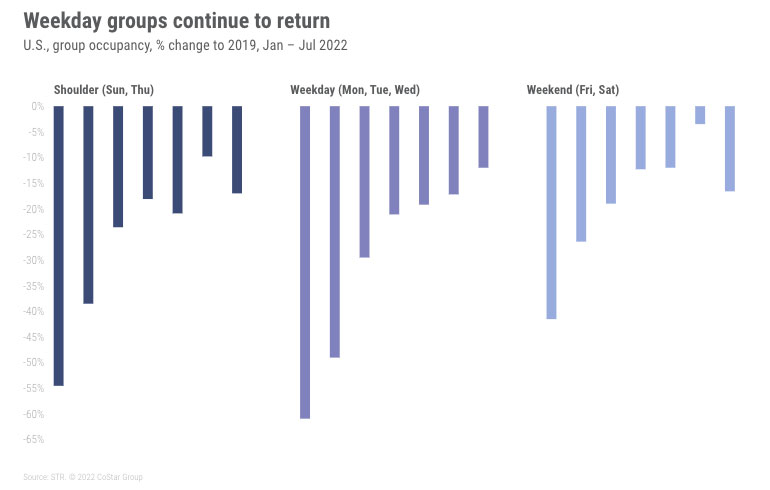

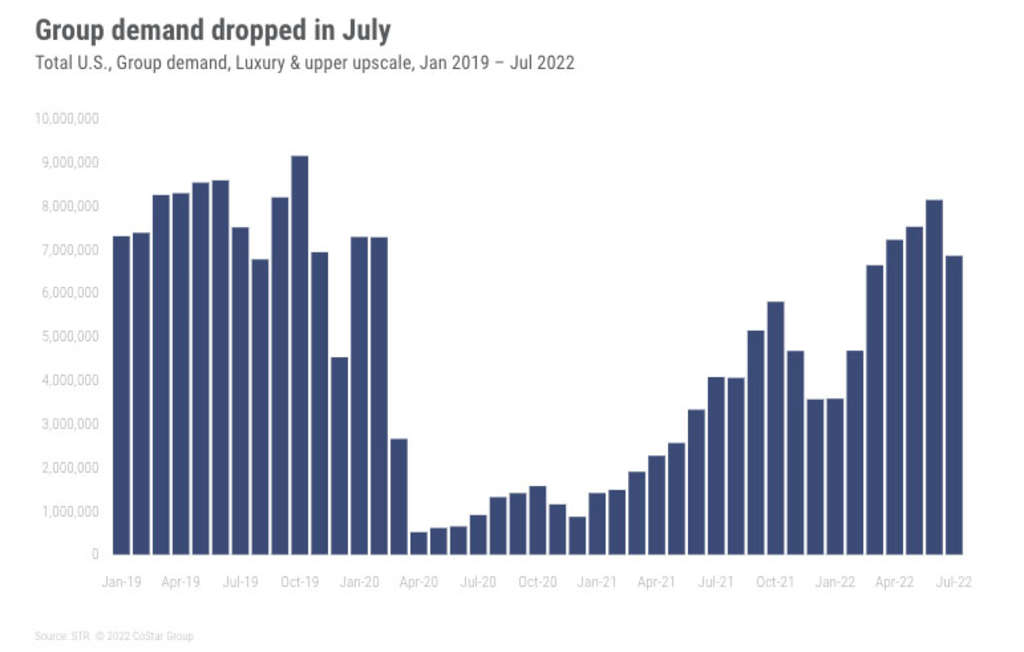

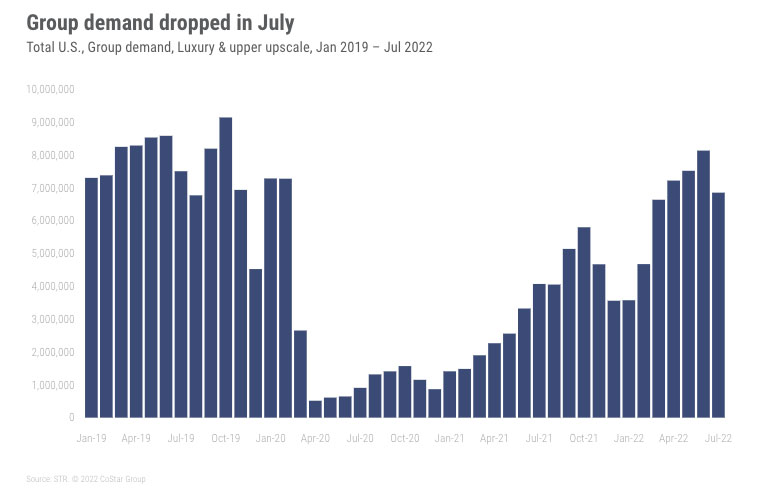

- Group demand dropped month over month because of less weekend groups, although weekday groups continued to improve.

- Despite softened weekend occupancy nationally, leisure-based markets reported the highest occupancy in the Top 25 Markets and the highest demand growth nationwide.

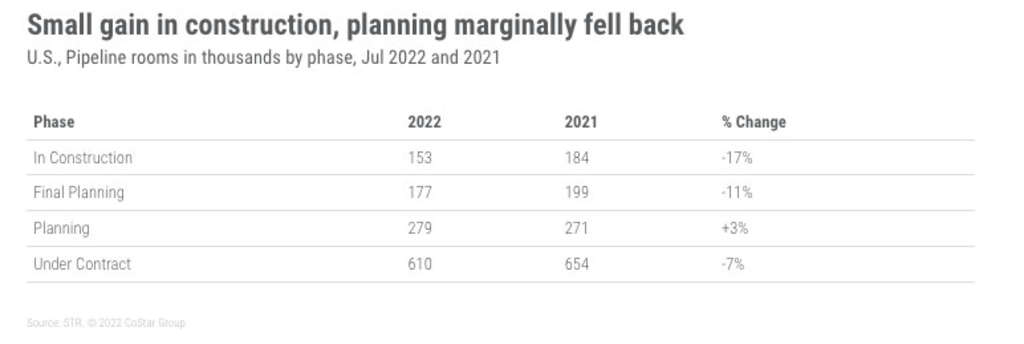

- The number of rooms in construction continued a downward trajectory.

- U.S. hotel GOPPAR exceeded the pre-pandemic comparable for a fourth consecutive month. Each of the key bottom-line metrics, however, decreased slightly from June, while total profits increased with peak summer room demand and revenues.

Segmentation

Group fell when looking at total demand and at demand indices to 2019.

Specifically, leisure-based weekend groups came in noticeably lower.

There might be some (weekend) group fatigue as calendars start clearing out all the postponed/rescheduled group events. Weekend group recovery started around this time last year, so it is possible that weekends are slowing as the calendar normalizes.

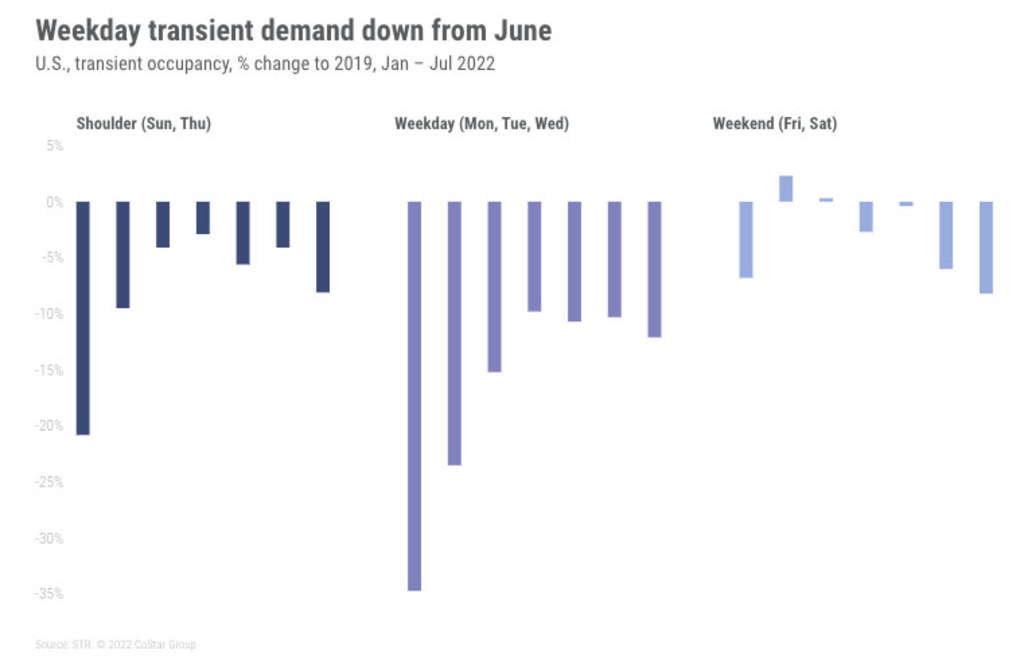

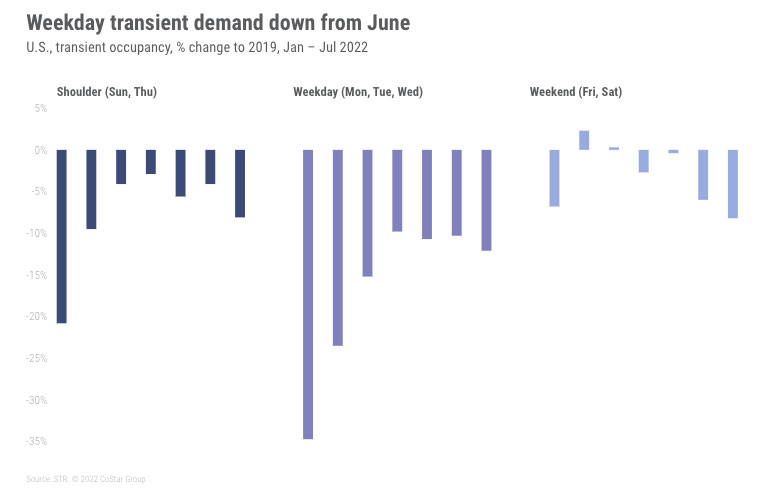

Weekend transient demand also fell, another sign pointing to diminished leisure demand. The transient weekday occupancy index dipped marginally month over month.

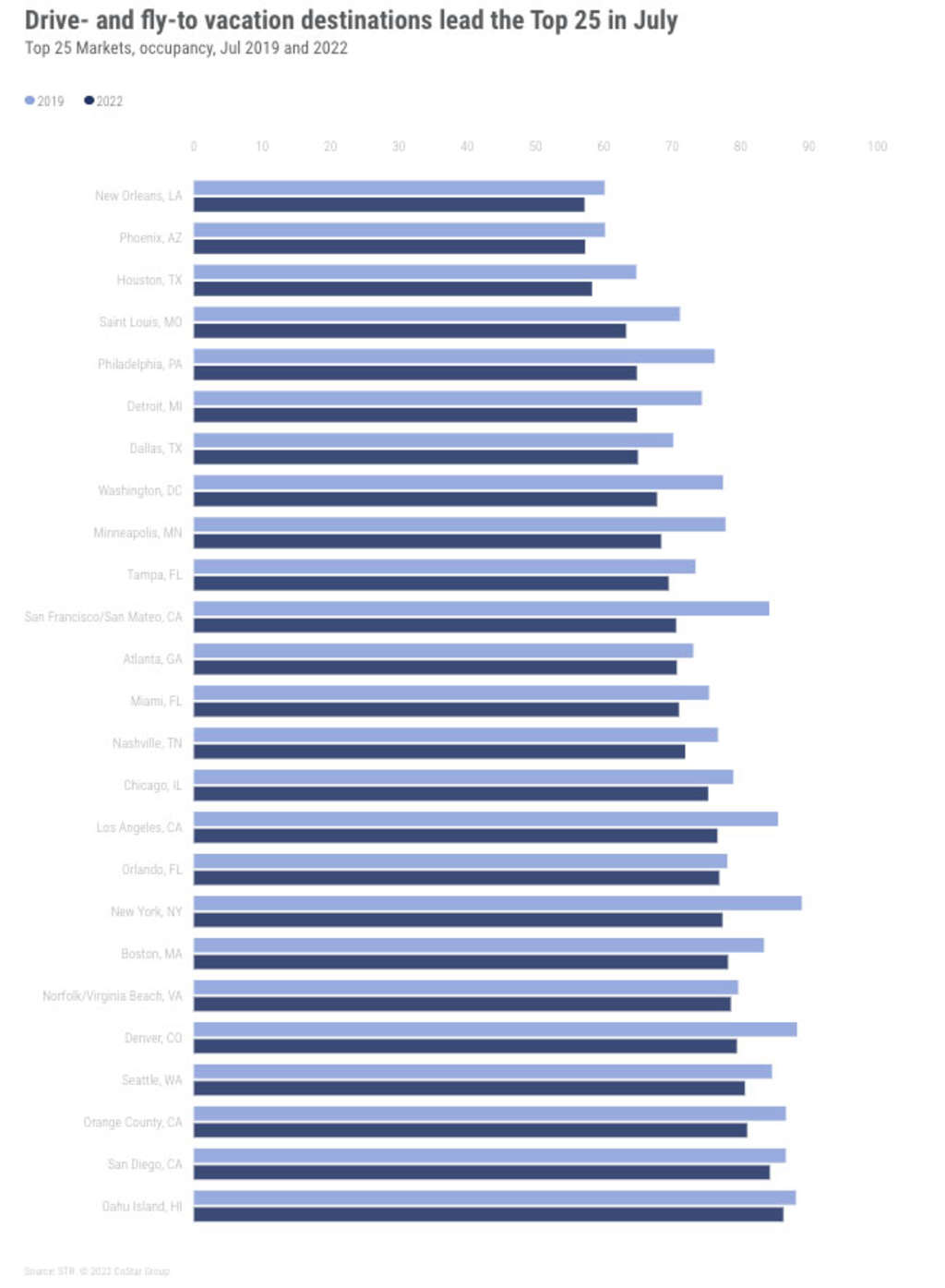

Top 25 Markets

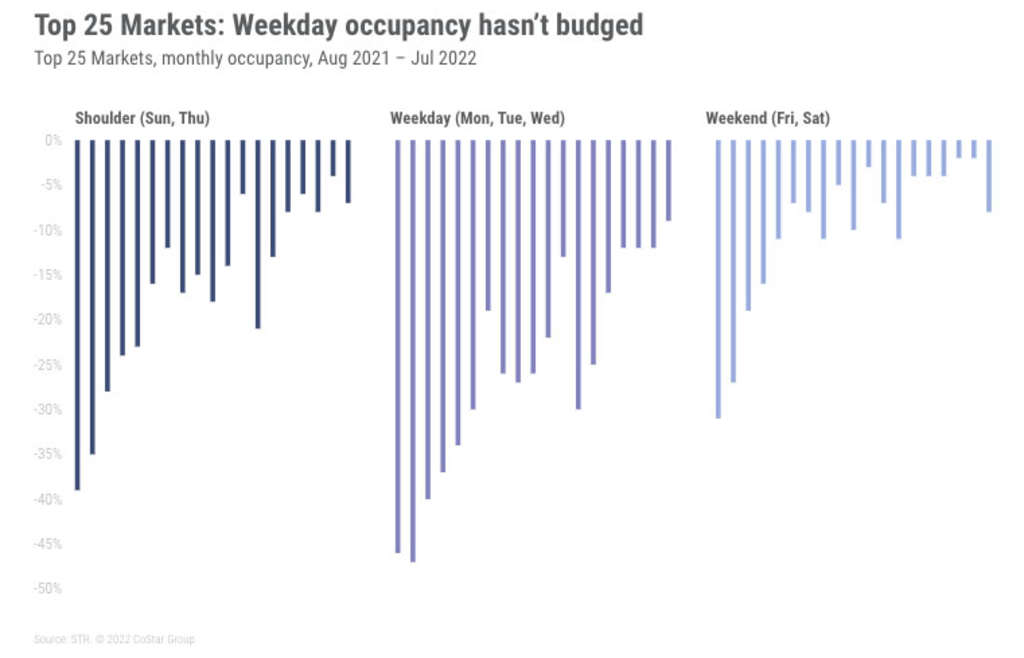

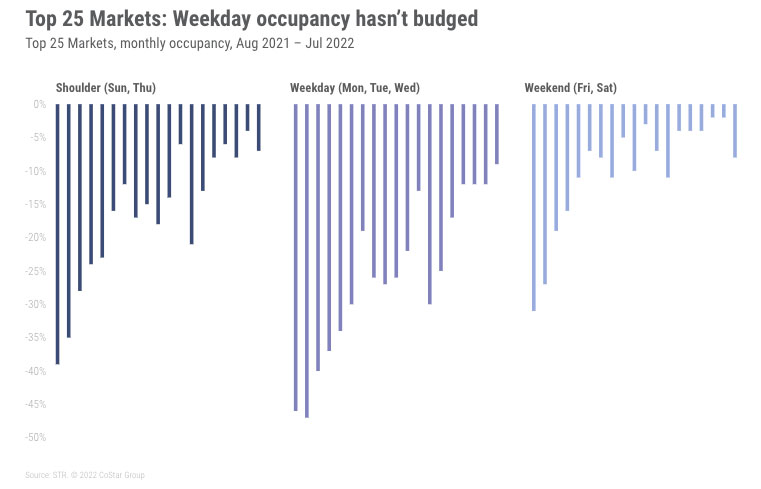

Business travel recovery remains firmly plateaued in the Top 25 Markets.

Limited business travel is more likely a result of inflation than COVID at this point.

Friday and Saturday occupancy continued to decline, and occupancy indices fell across both the Top 25 and all other markets.

Of the 166 STR-defined U.S. markets, 64, including six Top 25 Markets, reported demand above 2019 levels while 93 markets reported demand indices at or better than the national average.

Florida continues to be well-represented across the top-performing markets as well as secondary and tertiary southern cities. There is a case to be made for both business and leisure demand coming into the likes of Charleston, Charlotte, Knoxville, Austin, and Savannah.

Despite the softer weekend occupancy, summer vacationers absolutely hit the Top 25 Markets in July. Oahu, San Diego (drive-to), Orange County (Disneyland), and Norfolk (drive-to) all posted the highest occupancy months. Seattle, Denver, Boston, and New York City also gained occupancy.

Pipeline

Rooms in construction continue to decline month over month and year over year. The total of rooms in planning is growing, although at a decelerating pace. Interest rate growth may cause rooms in the planning phase to fall in the next few months.

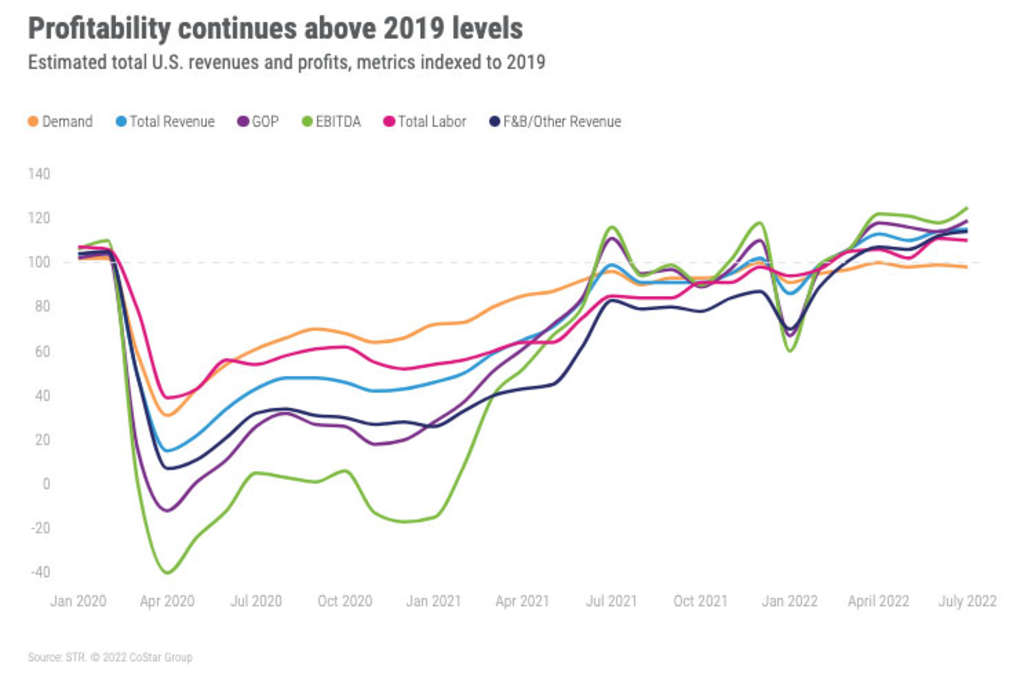

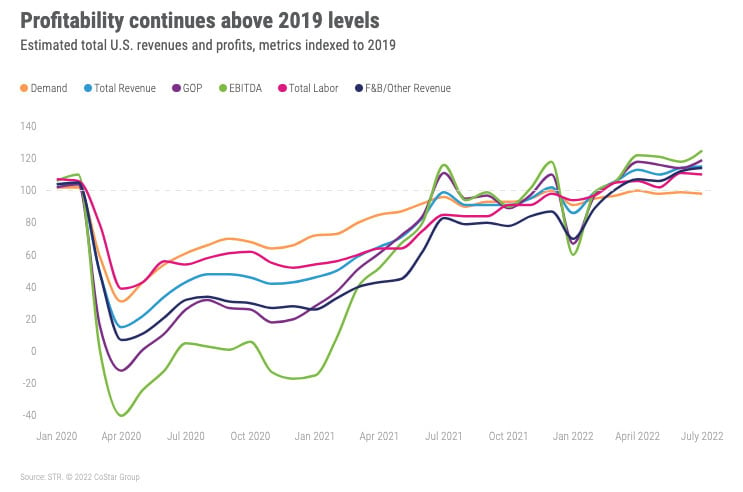

Monthly P&L

U.S. hotel gross operating profit per available room (GOPPAR) exceeded the pre-pandemic comparable for a fourth consecutive month. Each of the key bottom-line metrics, however, decreased slightly from June, while total profits increased with peak summer room demand and revenues. Profit margins were stronger than July 2019 for both full- and limited-service hotels, but GOP margins were at lower levels than the previous fourth months. The dip in margins can be attributed to higher expenses associated with more ramped-up operations as well as the general rise in costs around the industry.

Latest Weekly Data

The week of 14-20 August showed a decrease in room demand and occupancy, which is normal for this time of year. Read more in our latest Market Recovery Monitor.

About STR

STR provides premium data benchmarking, analytics and marketplace insights for the global hospitality industry. Founded in 1985, STR maintains a presence in 15 countries with a corporate North American headquarters in Hendersonville, Tennessee, an international headquarters in London, and an Asia Pacific headquarters in Singapore. STR was acquired in October 2019 by CoStar Group, Inc. (NASDAQ: CSGP), the leading provider of commercial real estate information, analytics and online marketplaces. For more information, please visit str.com and costargroup.com.