Value of travel increasing in importance, while spending remains resilient

In recent months, hotels across much of the globe have achieved near-normal levels of occupancy and far higher rates compared with pre-pandemic times. While the number of heads in beds has not reached the stellar levels of 2019 for many hotels, buoyant growth in room rates has often made up for a shortfall in demand. Indeed, lower occupancy and higher rates is now a preferred operating model for many hotels. However, with a potential cost-of-living crisis looming, consumers are displaying increased cost sensitivities and scrutiny. That of course raises questions around the sustainability of current rates.

This article, based on STR’s July 2022 research, outlines key consumer attitudes and behaviors that can be beneficial for revenue managers to understand as they develop their strategy for the year ahead.

Location, location, location… and price

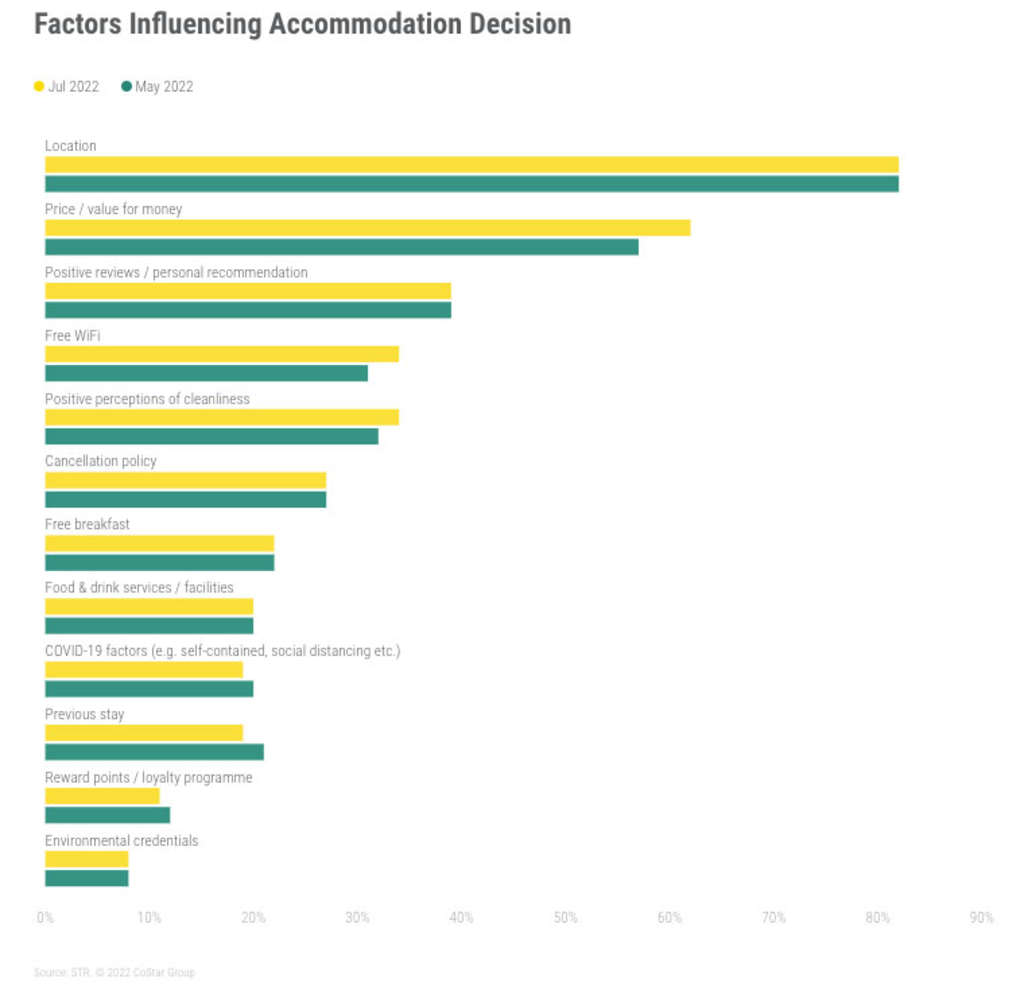

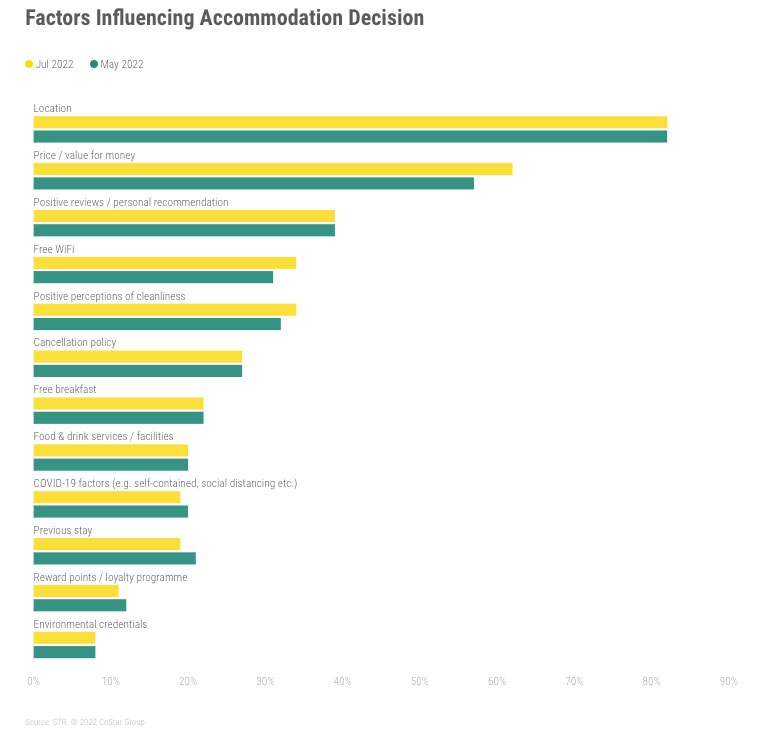

Time and time again, our consumer research reveals location is the most important factor when choosing an accommodation. In our July research, more than 80% of respondents who had recently undertaken or booked a trip said location was an important factor influencing their decision. This was an identical result compared with May 2022, which cements the importance of this aspect for consumers when weighing accommodation options, even with the context of growing inflationary pressures.

However, pertinent in the current times, the next most important variable is price or value for money. In our recent survey, value for money was chosen by 62% of respondents—up from 57% in May 2022.

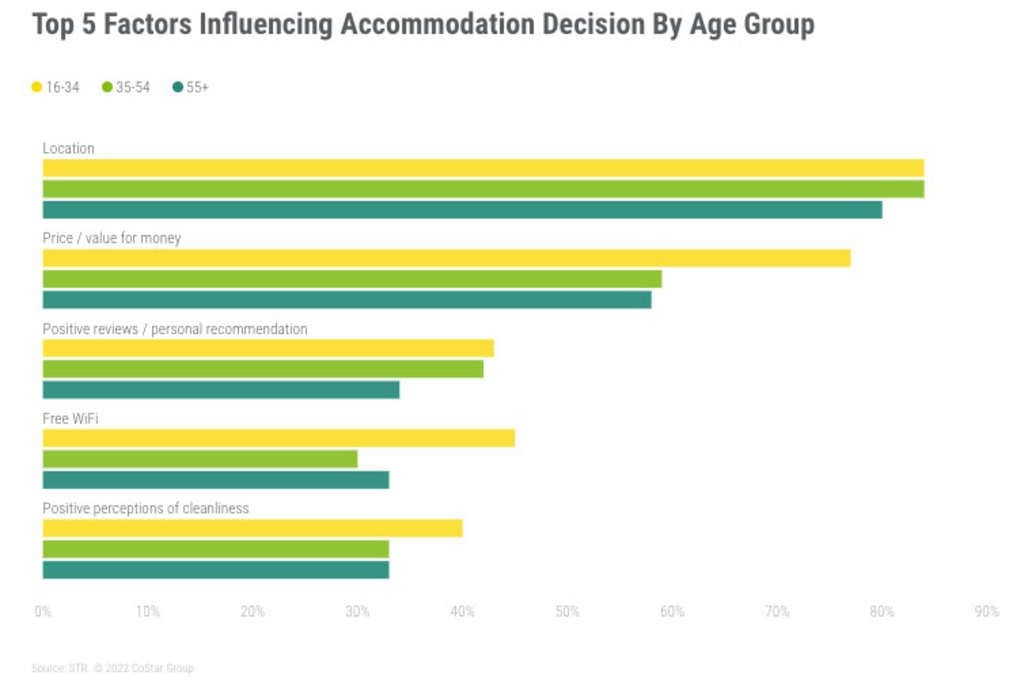

Prices are a bigger issue among younger consumers. In fact, the latest results show those younger than 35 placed almost as much importance on value as location when choosing an accommodation. Free Wi-Fi is also a greater consideration for this group. Collectively, the findings suggest these guests are particularly price savvy and sensitive. Targeting younger audiences—a key strategy for some brands in building long-term loyalty—may, therefore, require additional creativity, especially as disposable incomes may be squeezed in the future.

Deals becoming more important

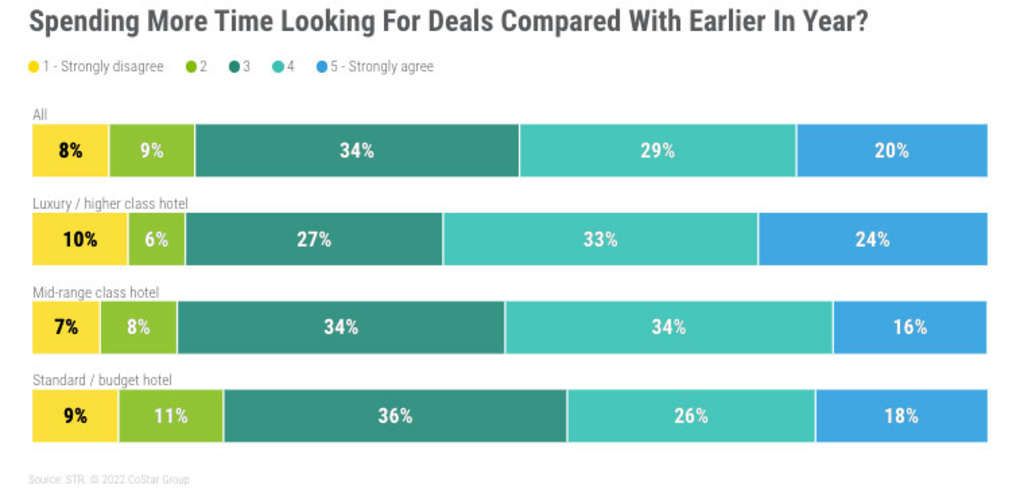

Consumer industries regularly use pricing strategies, such as discounting and special offers, to drive new business. The latest findings show that consumers may be increasingly seeking deals and special offers in the current environment. This suggests that some hotels may need to offer more promotions and provide added value to incentivise business, particularly as we move into a quieter shoulder season in the Northern Hemisphere.

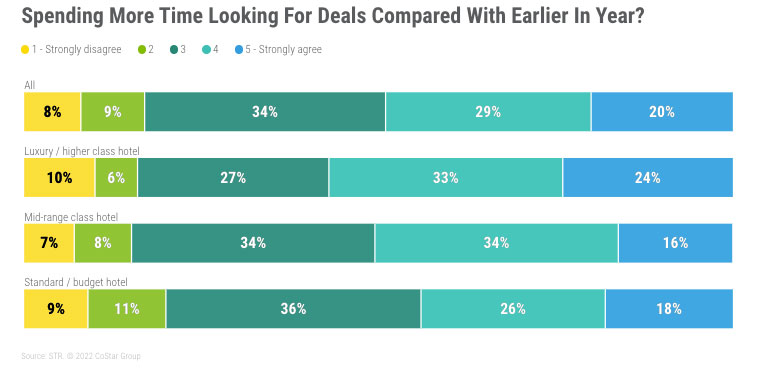

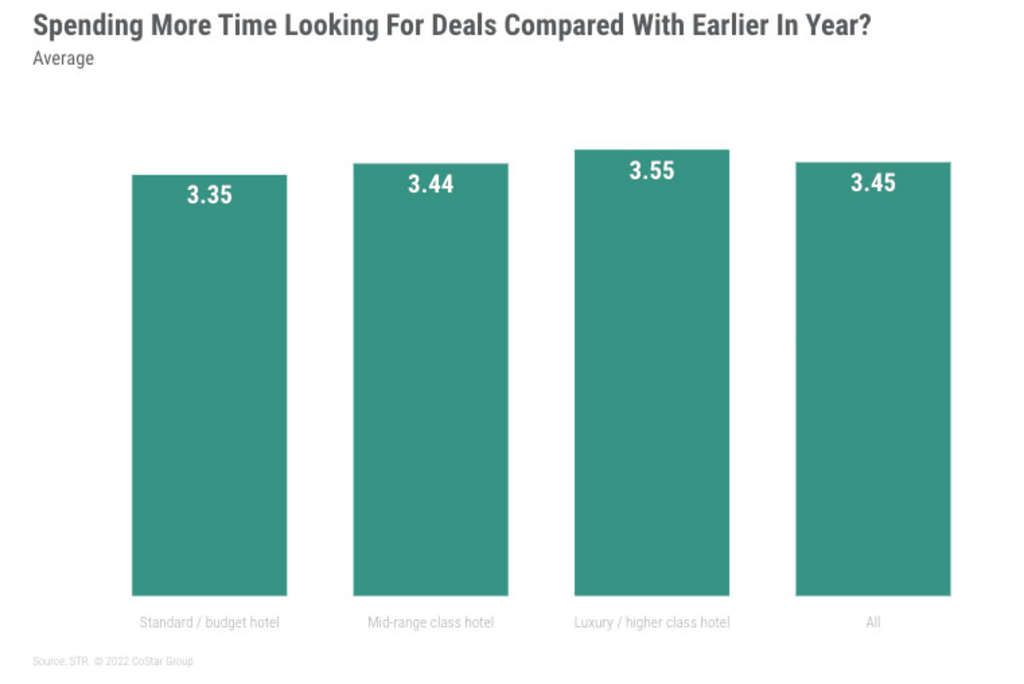

Just under half (49%) of consumers said they were spending more time looking for the best accommodation or travel option now compared with earlier in the year. This proportion increased to 56% among those who recently booked accommodation at a high-end hotel. Meanwhile, special offers may be less important for budget hotels as just 45% of guests at this type of property agreed they were spending more time looking for deals.

The results highlight again that consumers have varied criteria when choosing accommodation. For high-end hotels, discounting and special offers may be more important going forward to drive occupancy while promotions may be less relevant for budget hotels as they are already viewed more favorably from a cost perspective.

But decline in travel spend is not a foregone conclusion

While the prior insights may seem somewhat disconcerting for the hotel industry, there is limited evidence currently that travel budgets are likely to decline much, if at all, in the future.

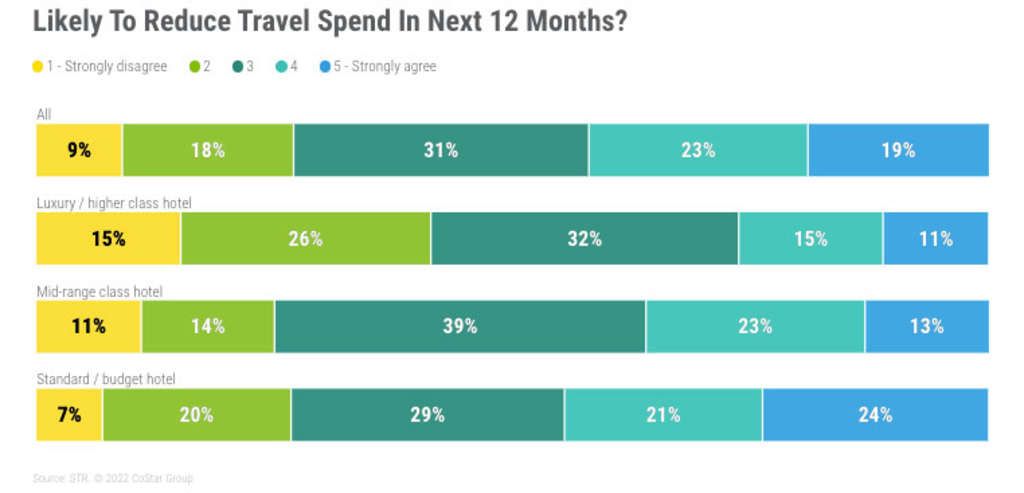

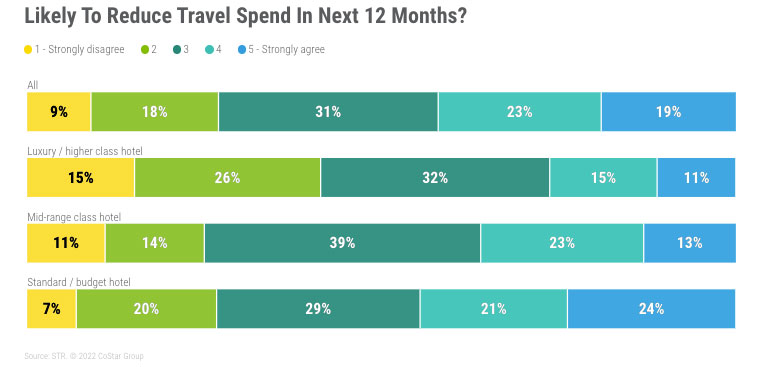

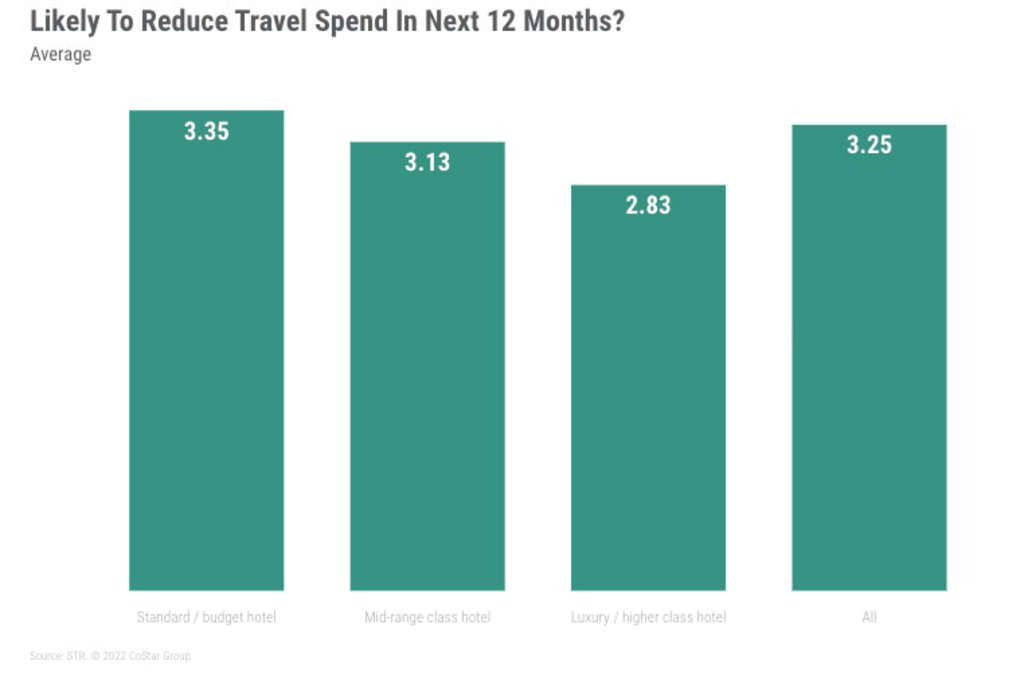

Overall, slightly more than 40% thought their spend on travel would decrease in the coming 12 months while the remainder (58%) expected to spend the same or more on travel. This deadlock indicates there is currently no immediate cause for concern regarding declining travel spend.

Perhaps in paradox to previous findings, luxury hotels appear least likely to suffer from any cuts in household travel budgets. Those who recently booked a stay at a luxury or higher class hotel were less likely to reduce their spend compared with budget hotel guests. Only 25% of high-end hotel users thought they might reduce spend in the next 12 months compared with 45% among budget hotel guests.

While high-end hotels may need to be more creative with their sales tactics to entice guests in the current situation of increasing economic uncertainty, their target markets are more optimistic about their financial future, which bodes well for the segment.

Inflation problem: spend the same or more, but get less

Hoteliers face a growing headache as inflation remains a major cause of concern across the globe. On one hand, supply-chain issues and inflationary pressures are driving up operating costs, while on the other hand, real levels of disposable income are being driven down.

Uncoupling more hotel services and features is one way travel businesses can address increasing cost challenges. The approach has already been applied in recent years as most hotels have leveraged increased demand for flexibility by offering differing rates based on cancellation policies. Commoditizing additional services may enable hotels to maintain more competitive room rates, which could be crucial if costs are increasingly put under the microscope by consumers.

About STR

STR provides premium data benchmarking, analytics and marketplace insights for the global hospitality industry. Founded in 1985, STR maintains a presence in 15 countries with a corporate North American headquarters in Hendersonville, Tennessee, an international headquarters in London, and an Asia Pacific headquarters in Singapore. STR was acquired in October 2019 by CoStar Group, Inc. (NASDAQ: CSGP), the leading provider of commercial real estate information, analytics and online marketplaces. For more information, please visit str.com and costargroup.com.