Sun is still shining on Australia’s hotel industry

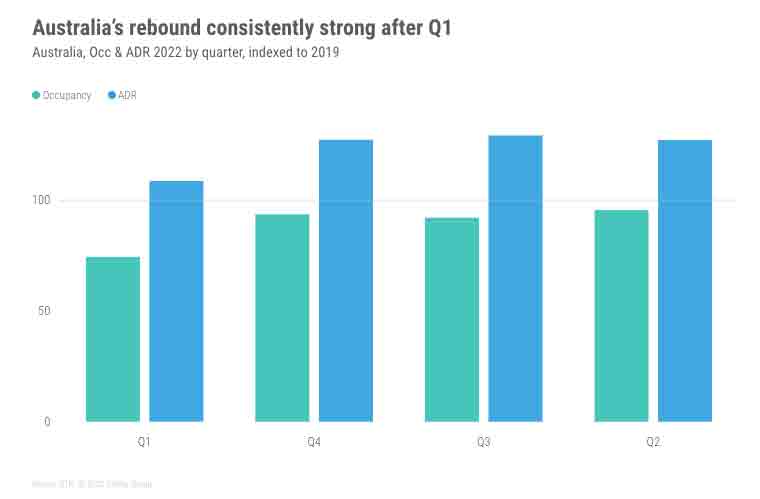

Australia’s hotel performance turned a massive corner during the first half of 2022 as the Omicron wave subsided and governments relaxed travel restrictions around the country. That freedom translated to consumer confidence, which boosted hotel occupancy for the remainder of the year and further stimulated average daily rate (ADR).

Occupancy increases, combined with labor shortages, broader inflationary pressures, a skew toward leisure demand, and consumers’ willingness to pay for experiences, pushed room rates to record highs. That leisure skew started to fade, however, as the year went on and demand broadened, giving further validity to these rates being the new normal.

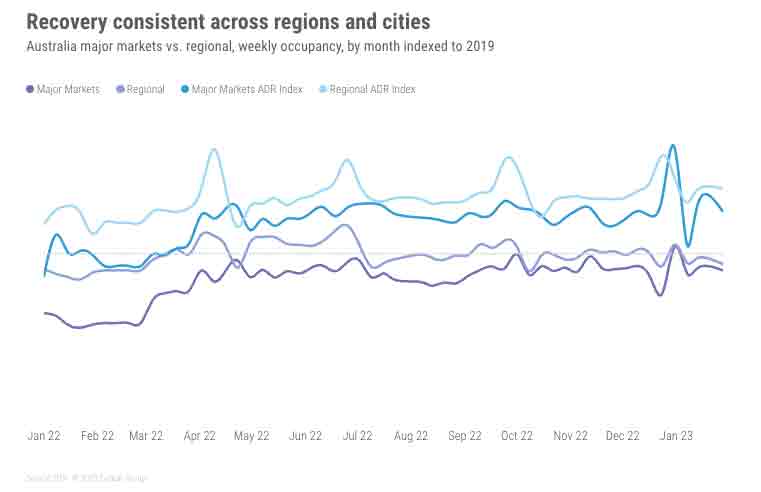

A trend during the earlier years of COVID, which continued into 2022, was the strength of regional Australia, but capital cities came back into play later in the year with more positive performance when compared to the leisure-heavy destinations. Sydney and Melbourne still lag their capital city peers, but wider demand sources have strengthened performance in these markets.

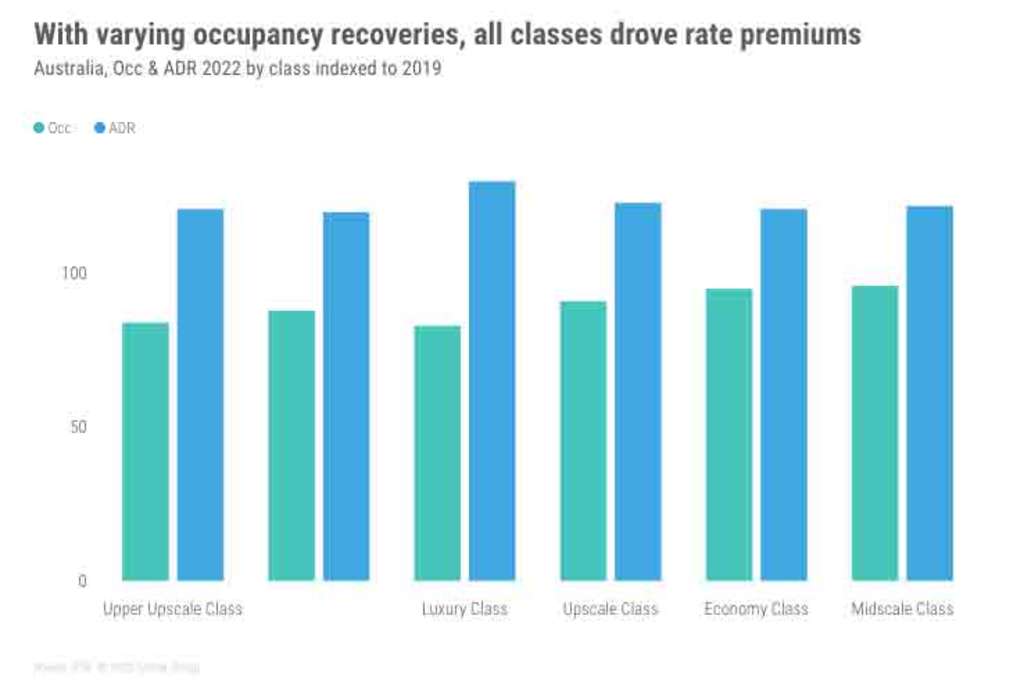

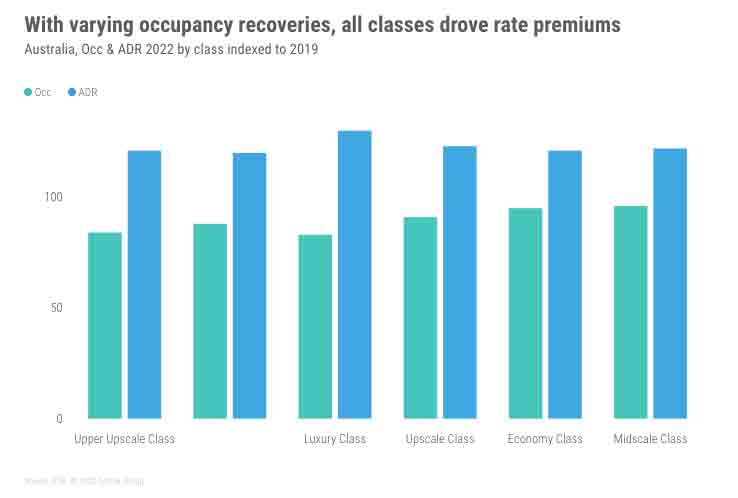

Performance across Australia’s hotel classes has been quite consistent, with a slight advantage to lower classes that benefited more throughout the year. The luxury class led ADR growth as it rode the wave of leisure staycations and regional getaways.

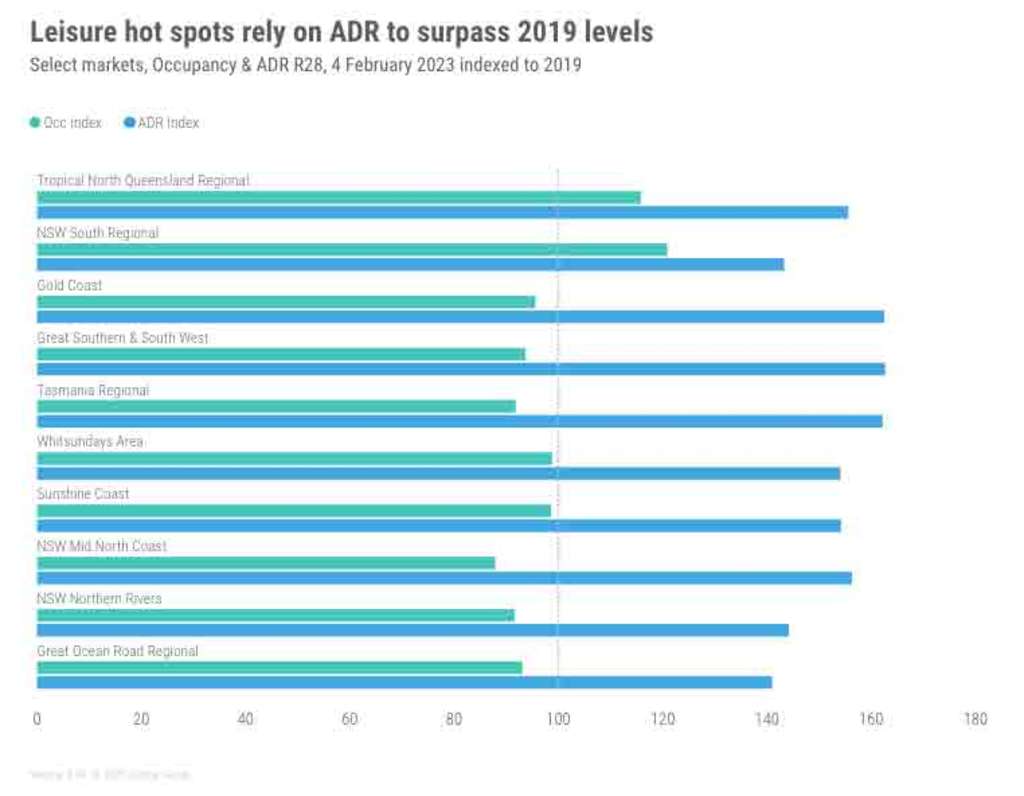

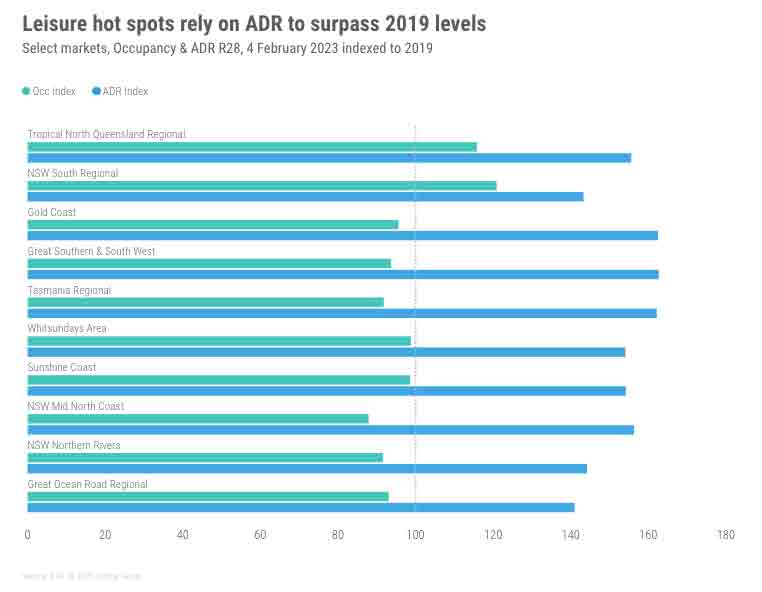

When looking at the peak summer vacation period, and some of Australia’s typical holiday spots, we saw solid occupancy that didn’t break through to 2019 levels. Each of these markets were slightly behind their pre-pandemic levels, except for NSW South Regional which saw performance comparisons severely impacted by bushfires. All destinations benefited from ADR growth, with Great Southern and South West leading the group in recovery at a room rate index of 162 (absolute value of AUD494.70). Whitsundays (index of 160, absolute of AUD528.95) and Gold Coast (index of 143, absolute of AUD441.70) ranked second and third, respectively.

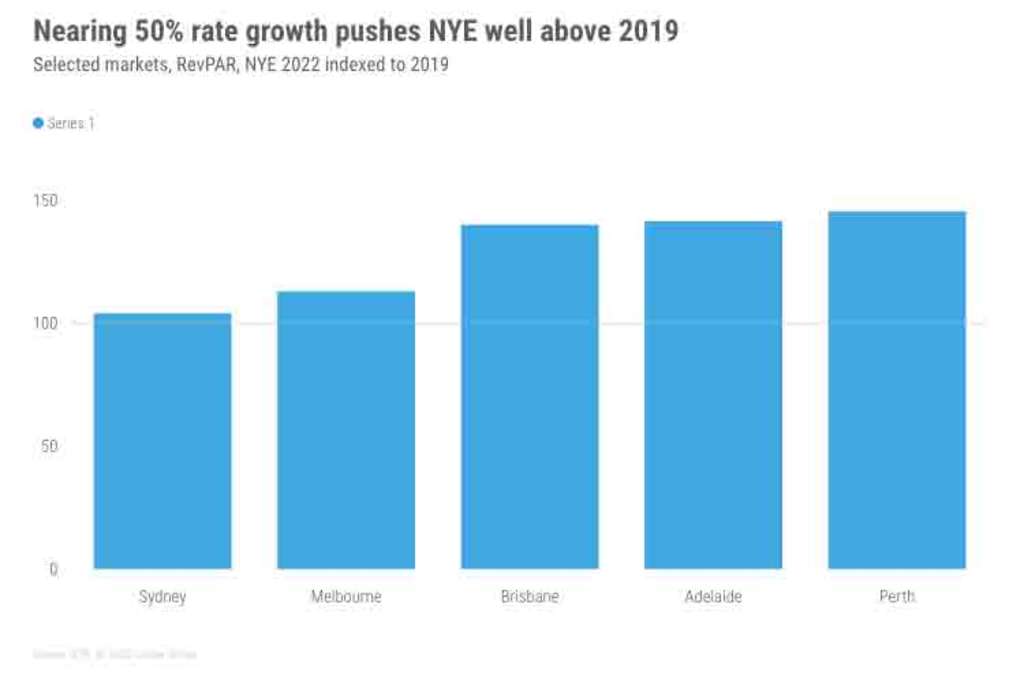

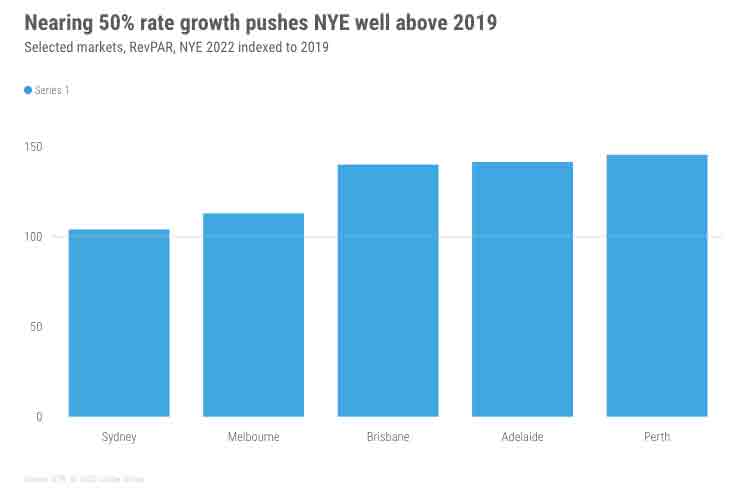

New Year’s Eve was the first celebration free of restrictions across the country since 2019 and was popular across the major cities. Occupancy was just shy of 2019 for all except Perth, but it was the near 50% lift in ADR over 2019 that saw hoteliers pop the champagne. Popular destination, Sydney, broke the AUD$700 room-rate barrier for the first time, recording and ADR of AUD709.10 and an occupancy level of 90.2% occupancy.

The focus as we move further into 2023 is whether Australia’s markets will climb further, plateau or face risk of a decline. The focus as we move further into 2023 is whether Australia’s markets will climb further, plateau or face risk of a decline. Despite economic clouds building, our view is watchfully optimistic due to the consistency of performance through three quarters of 2022, broader-based demand (groups, meetings and corporate), and occupancy on the books as of late January.

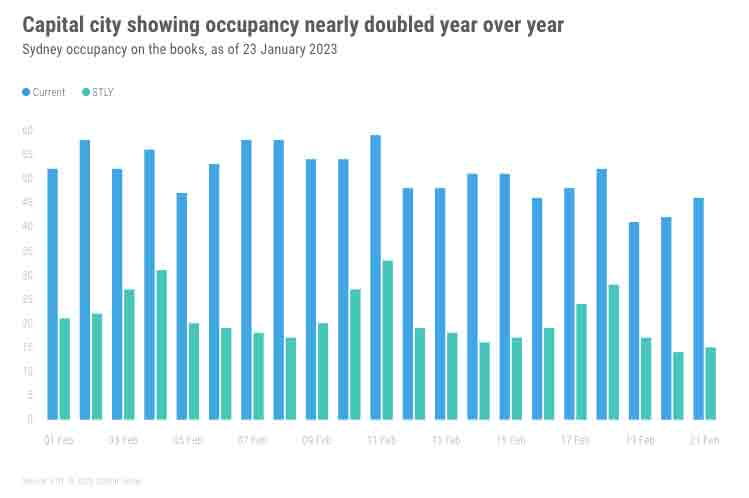

Using the Gold Coast and Sydney as our leisure and city proxies to the wider Australian market, we see an extremely strong start to the corporate travel season with occupancy on the books, as shown in Forward STAR, for the first three weeks of February double that of 2022. Yes 2022, was a poor performance year for Sydney, but with expected pickup to come, occupancy is tracking toward Q4 trends.

For the Gold Coast, the April school holiday block is the next leisure barometer and whether the wider consumer spending pressures are beginning to bite. We can’t be sure yet, but occupancy to date and reasonable year-over-year comparisons have performance tracking just beneath par.

We expect room rate growth to begin to abate when comparing over 2022, but even with small declines from the pent-up surge in some locations, ADR will remain elevated above 2019 as many of the factors and rational that drove the gains still persist – just to a lesser degree.

Just shy of three years into the pandemic and little over a year since Australia reopened to the world, the country’s recovery is well placed thanks to strong domestic demand. This year and next will be the ones to watch as Australia’s leisure and business travel resume, and how quickly air capacity and international tourists will follow.

About STR

STR provides premium data benchmarking, analytics and marketplace insights for the global hospitality industry. Founded in 1985, STR maintains a presence in 15 countries with a North American headquarters in Hendersonville, Tennessee, an international headquarters in London, and an Asia Pacific headquarters in Singapore. STR was acquired in October 2019 by CoStar Group, Inc. (NASDAQ: CSGP), the leading provider of commercial real estate information, analytics and online marketplaces. For more information, please visit str.com and costargroup.com.