Is hotel compression back in Australia?

Analysis by Hannah Smith

This year has been strong for Australia, which has outpaced many regions in hotel performance growth. More noteworthy is the way in which Australia has achieved that growth.

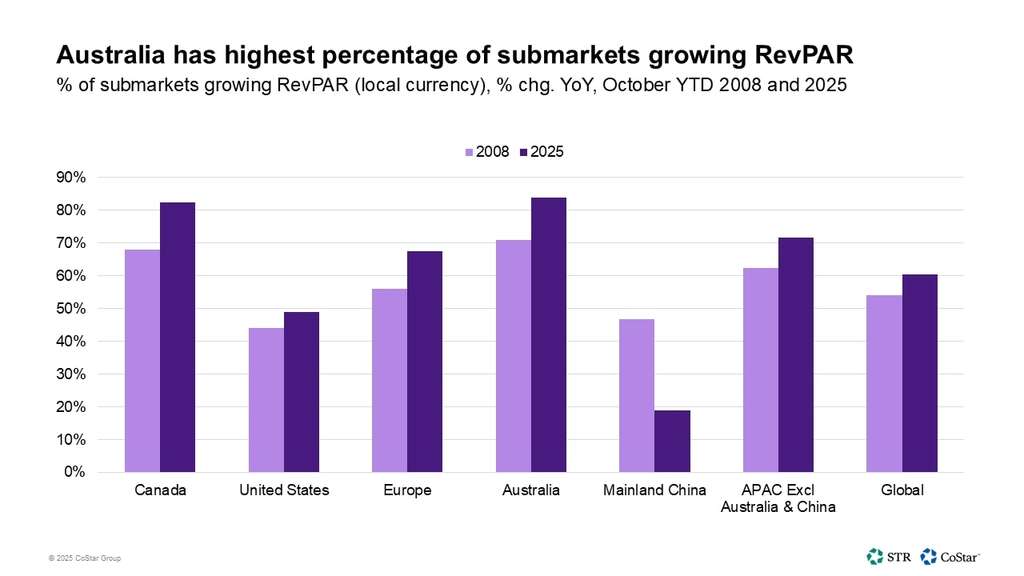

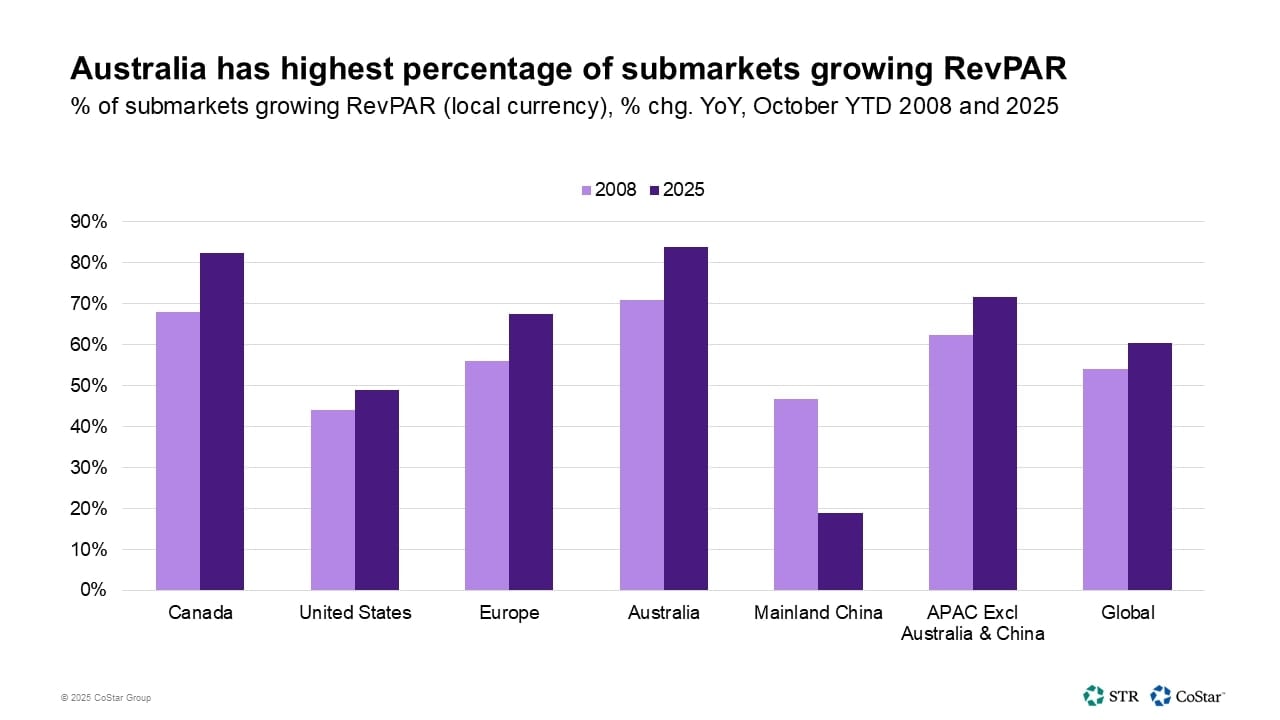

Compared to other Asia Pacific countries, Australia has reported the most widespread growth, with 84% of the country’s submarkets showing an increase in revenue per available room (RevPAR) through the first ten months of the year.

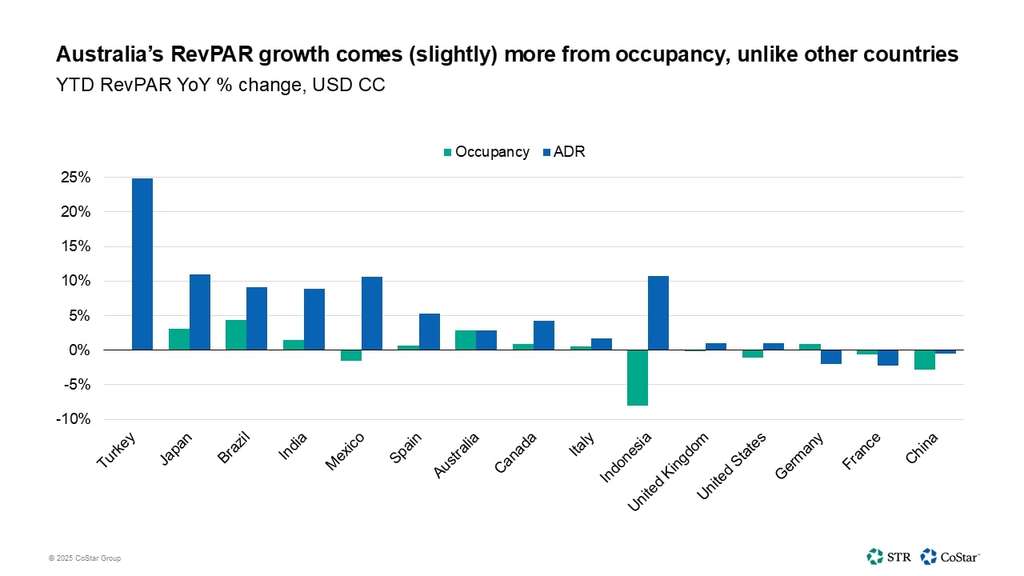

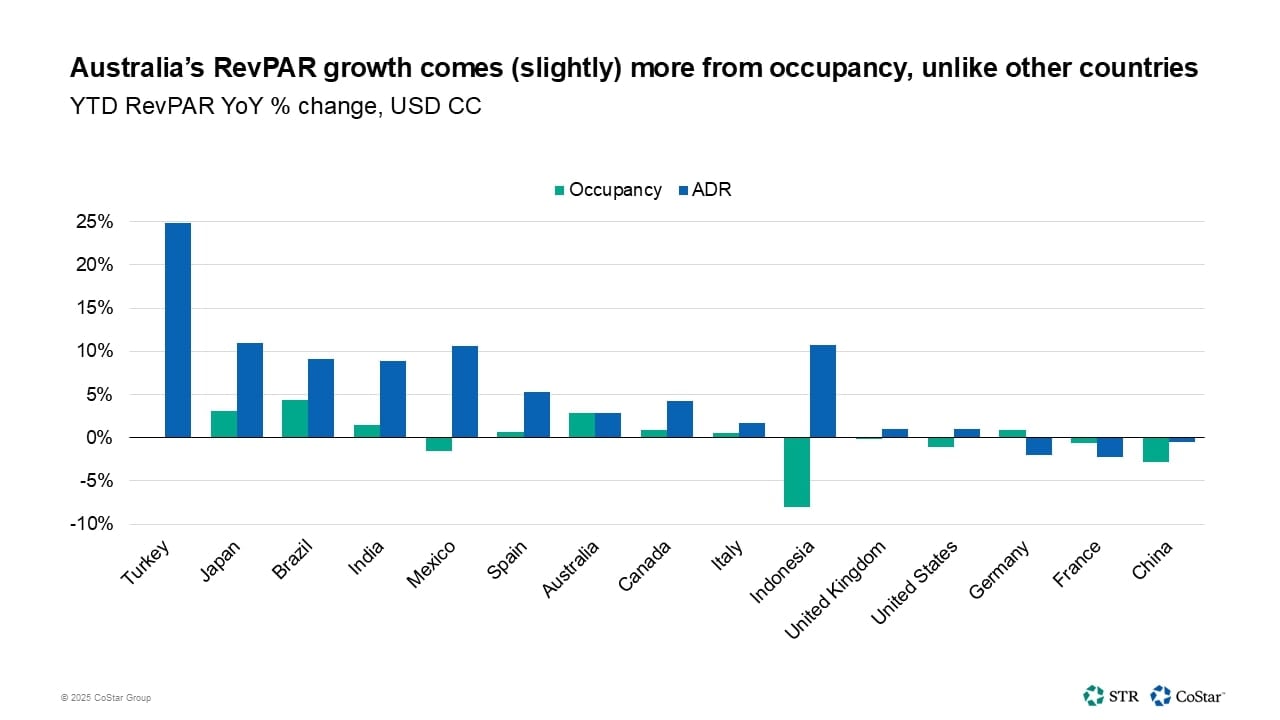

Further, among the world’s 15 largest countries based on hotel room supply, Australia ranks seventh in YTD RevPAR growth, outpacing countries such as Canada, Italy, the U.K., and the U.S.

What stands out most, however, is Australia is the only one of those countries driving RevPAR increases through occupancy as opposed to average daily rate (ADR). In nearly every world region, hotels are relying more on pricing power to bolster the top line.

Compression stories are different across markets

Historically, compression nights were important for major markets in Australia, with 20% of days in Sydney and Melbourne reporting a 90%+ occupancy in 2019.

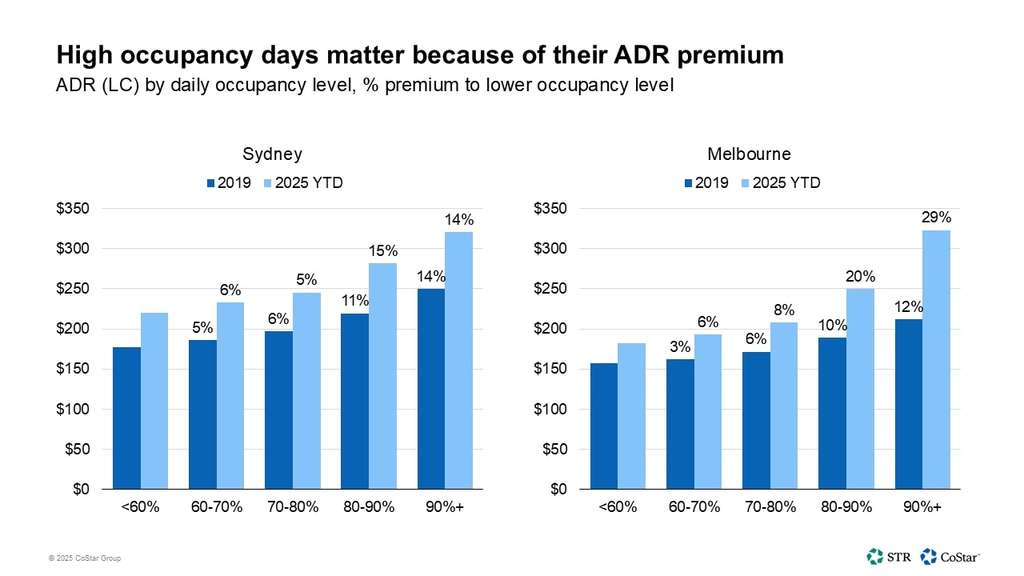

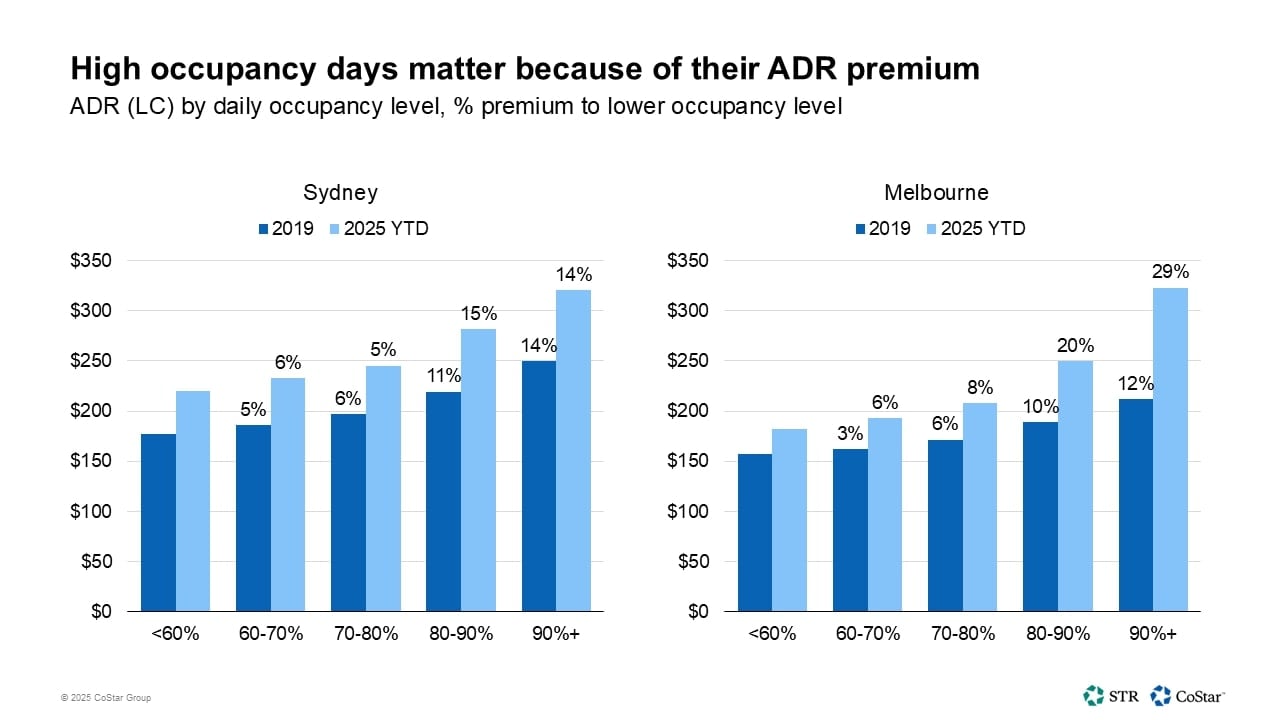

There’s been some rebound in compression in Sydney, with over half of days above an 80% occupancy and 13% of days above the 90% threshold. ADR premiums have also remained relatively stable for Sydney – when looking between 60%-80% occupancy, there’s a 5-6% jump in ADR for each 10-percentage point increase in occupancy. Above 80%, that ADR variance increases to between 12-15%.

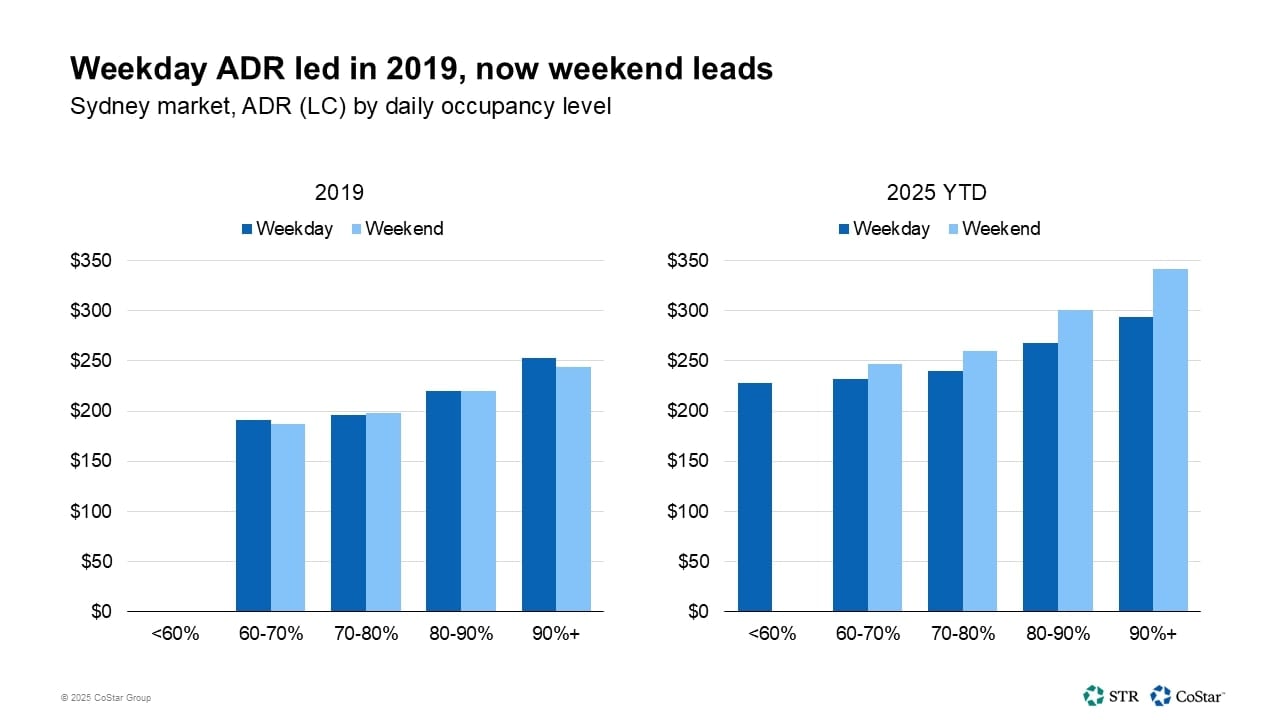

The biggest difference in compression in Sydney since 2019 is when the compression days fall – historically, 60% of compression days came between Monday and Wednesday. In 2025, that’s down to 44%, with weekends now dominating compression nights. This means that compression in the market is less likely to be dictated by convention or business travel, but rather by leisure events.

This has an impact on pricing as well. In 2019, weekdays and weekends ran a similar ADR in the market. Now, the leisure demand comes with more pricing power, and weekends now exceed weekdays by 7 to 16% across all occupancy levels.

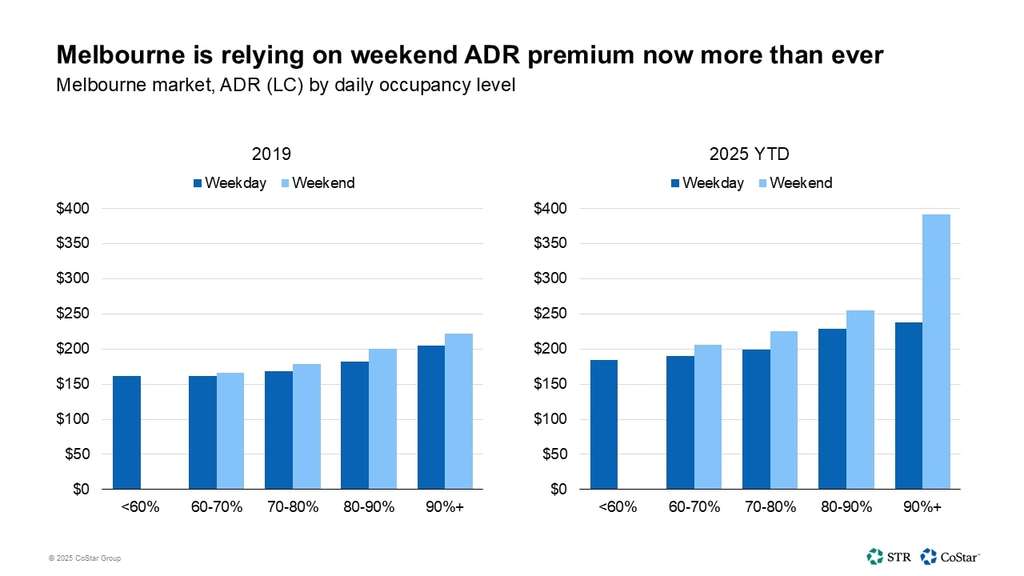

The compression story in Melbourne is a little different. In 2025, the majority of nights fell below an 80% occupancy, with only a handful of days exceeding 90%. Perhaps due to their relative rarity now in the market, these high occupancy days did come with a higher ADR premium in 2025.

In 2019, nights between 80-90% occupancy had a 10% higher ADR than those between 70-80%. Today that ADR premium is 20%. The premium for nights above 90% occupancy is even more stark, but with only a few days meeting that occupancy level, the ADR premium is being skewed by one very high-priced event (Formula 1). Of the nine days that exceeded a 90% occupancy, four came during the week, with a few conferences falling on the same days. The remaining five compression days fell on weekends and coincided with leisure events, including the Juicy music festival and the F1 Australian Grand Prix.

Like Sydney, Melbourne sees far fewer high occupancy days fall midweek, and leisure demand is the differentiator between a mid- and high-occupancy day. Unlike Sydney, Melbourne has always had a higher weekend ADR than weekday, though that has become even more important now as a source of growth.

Lower-end classes benefit more from the leisure compression days, with midscale hotels growing 70% year over year on weekend days exceeding 90%. As a result of the higher growth in the lower tier, rates are compressed on high-occupancy days, with the classes pricing more similarly to each other. The exception to that rate compression is the luxury class, which sees an even higher rate premium on high-occupancy days.

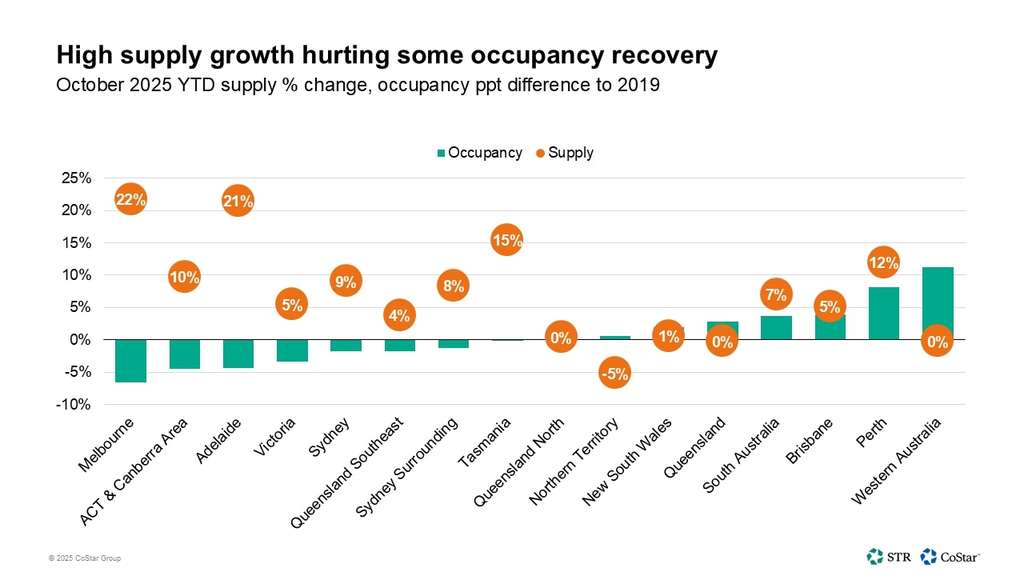

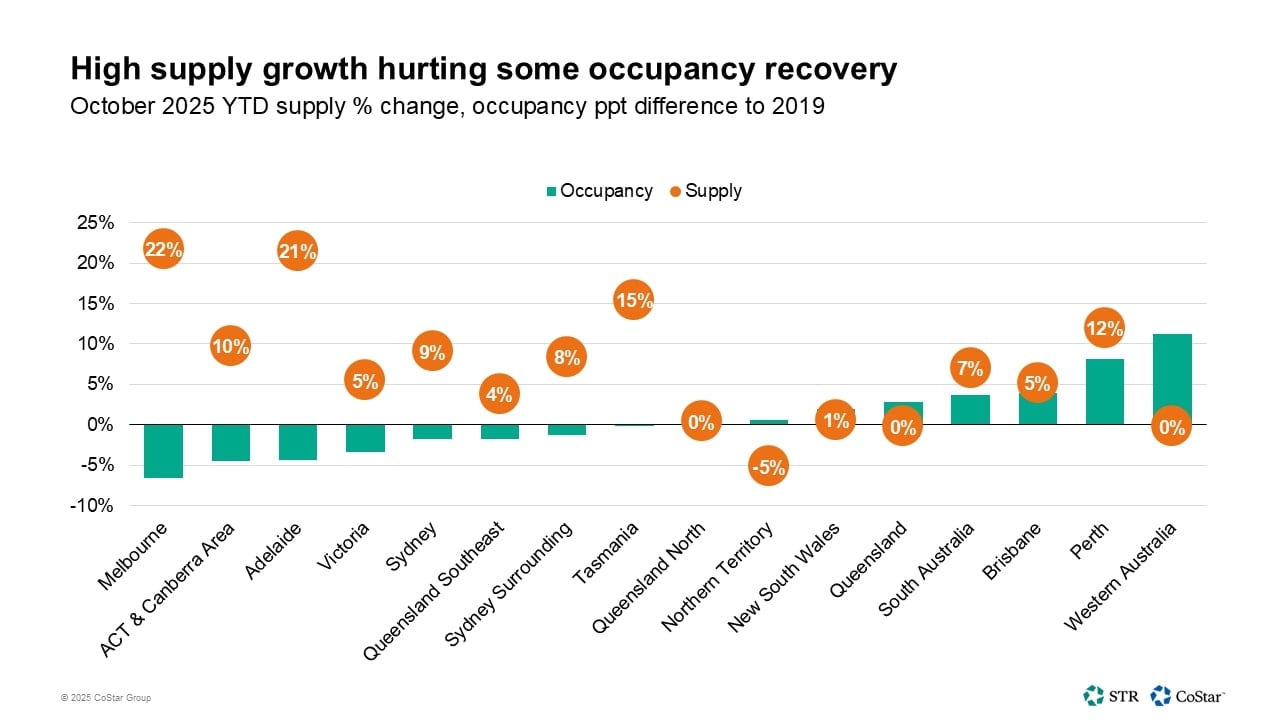

Supply growth

Some Australian markets have seen strong growth in inventory. The three highest supply growth markets lag 2019 occupancy levels, so demand hasn’t kept pace with supply. However, Perth has the fourth highest supply growth (12%) and the second highest occupancy growth to 2019.

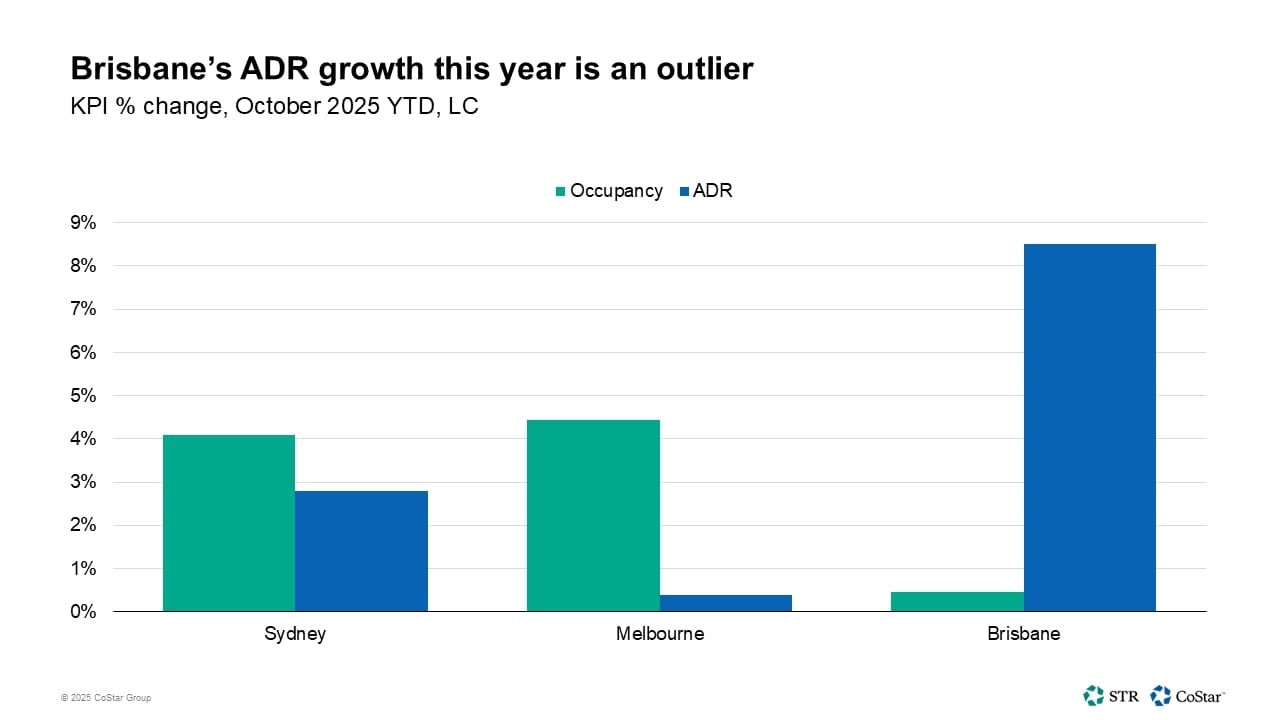

Brisbane’s popularity is growing

Of the three Australian markets that STR forecasts, Brisbane is the outlier, with nearly 9% room rate growth year to date. This growth is not new, as the market’s ADR has significantly outpaced other markets in the country since 2019.

Brisbane’s ADR is 60% higher than 2019, while Sydney and Melbourne are around 20% higher. Brisbane’s room rate hike has been helped by a shift in composition towards more luxury supply, however, every class has exceeded a 55% increase in the market since 2019.

Conclusion

Markets across Australia are finding year-over-year growth, but many have not returned to the same performance as 2019, which goes beyond just top-line numbers.

Compression nights are hugely important, especially in city center hotels, and are a useful tracker of the performance of corporate group travel. We do not anticipate a sudden resurgence in that segment next year, so hoteliers may become more and more reliant on leisure groups for high ADR premiums.

About CoStar Group, Inc.

CoStar Group (NASDAQ: CSGP) is a leading provider of online real estate marketplaces, information, and analytics in the property markets. Founded in 1987, CoStar Group conducts expansive, ongoing research to produce and maintain the largest and most comprehensive database of real estate information. CoStar is the global leader in commercial real estate information, analytics, and news, enabling clients to analyze, interpret and gain unmatched insight on property values, market conditions and availabilities. Apartments.com is the leading online marketplace for renters seeking great apartment homes, providing property managers and owners a proven platform for marketing their properties. LoopNet is the most heavily trafficked online commercial real estate marketplace with thirteen million average monthly global unique visitors. STR provides premium data benchmarking, analytics, and marketplace insights for the global hospitality industry. Ten-X offers a leading platform for conducting commercial real estate online auctions and negotiated bids. Homes.com is the fastest growing online residential marketplace that connects agents, buyers, and sellers. OnTheMarket is a leading residential property portal in the United Kingdom. BureauxLocaux is one of the largest specialized property portals for buying and leasing commercial real estate in France. Business Immo is France's leading commercial real estate news service. Thomas Daily is Germany's largest online data pool in the real estate industry. Belbex is the premier source of commercial space available to let and for sale in Spain. CoStar Group's websites attracted over 163 million average monthly unique visitors in the third quarter of 2024. Headquartered in Washington, DC, CoStar Group maintains offices throughout the U.S., Europe, Canada, and Asia. From time to time, we plan to utilize our corporate website, CoStarGroup.com, as a channel of distribution for material company information. For more information, visit CoStarGroup.com.

This news release includes "forward-looking statements" including, without limitation, statements regarding CoStar's expectations or beliefs regarding the future. These statements are based upon current beliefs and are subject to many risks and uncertainties that could cause actual results to differ materially from these statements. The following factors, among others, could cause or contribute to such differences: the risk that future media events will not sustain an increase in future occupancy rates. More information about potential factors that could cause results to differ materially from those anticipated in the forward-looking statements include, but are not limited to, those stated in CoStar's filings from time to time with the Securities and Exchange Commission, including in CoStar's Annual Report on Form 10-K for the year ended December 31, 2023 and Forms 10-Q for the quarterly periods ended March 31, 2024, June 30, 2024, and September 30, 2023, each of which is filed with the SEC, including in the "Risk Factors" section of those filings, as well as CoStar's other filings with the SEC available at the SEC's website (www.sec.gov). All forward-looking statements are based on information available to CoStar on the date hereof, and CoStar assumes no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.