Hospitality Trends for 2026: Experience as the Operating System

What becomes clear heading into 2026 is that advantage no longer comes from isolated innovation. It comes from coherence. The hotels pulling ahead are not experimenting more than their peers; they are aligning experience, operations, and technology into a single, reinforcing system. Where that alignment exists, execution accelerates. Where it does not, even strong ideas struggle to scale.

Across 2025, a recurring theme in industry discussions was the challenge of integrating new digital capabilities into established hotel operating models. As hotels explored AI use cases, expanded mobile guest interactions, and modernised core systems, questions increasingly shifted from what to adopt to how those tools should fit together in practice. The tension was not about intent or ambition, but about execution.

Takeaways

Experience now shapes operating models, not just service delivery.

Personalisation works only when it is operationally grounded.

Mobile engagement creates value through relevance, not volume.

Simplification strengthens both staff performance and guest trust.

Predictive thinking replaces reactive management.

Experience is no longer a layer, but the structure

In 2026, guest experience can no longer sit on top of operations as a corrective measure. It increasingly defines how operations are designed in the first place. Hotels that still attempt to “fix” experience after workflows are set will continue to feel friction across the guest journey.

This shift reflects a change in leadership thinking. Experience is no longer framed solely as training or service culture. It is understood as the result of structural choices: how information flows, where decisions are made, and how quickly teams can act. When those foundations are misaligned, inconsistency follows. When they are aligned, consistency becomes repeatable.

The hotels moving fastest in this direction design operations from the guest journey backward. They start with moments that matter most and work into staffing models, technology architecture, and decision rights. Experience stops being aspirational and becomes executable.

Personalisation becomes operational, not performative

Once experience is treated as structural, personalisation changes character. In 2026, it moves away from surface-level gestures and into the mechanics of daily operations. Guests no longer distinguish between “personalised” marketing and service. They experience the stay as one continuous flow.

Operational personalisation shows up in what no longer needs to happen. Guests are asked fewer repeated questions. Manual overrides become less common. Moments where the guest must adapt to the hotel’s internal process begin to disappear.

Hotels making progress here rely less on complex rules and more on simplification. They reduce journeys into a small number of recognisable stay patterns and design service logic around them. Personalisation becomes scalable because it is grounded in operations rather than promises.

Mobile engagement matures from utility to influence

This operational shift helps explain why mobile engagement is beginning to take on a different role as 2026 begins. For years, mobile tools were positioned as drivers of efficiency. Increasingly, they shape guest behaviour in more subtle and valuable ways.

Guests are comfortable using their devices to manage parts of the stay, but far less tolerant of interruption. The most effective mobile experiences respect attention. They appear when intent is present and recede when it is not.

Hotels that use mobile effectively tend to approach it with a clear sense of discipline. Rather than maximising the number of interactions, they focus on clarity, timing, and relevance. Fewer prompts, clearer choices, and better-aligned moments give guests a stronger sense of control over their stay. When mobile behaves more like a guide than a broadcast channel, engagement feels intentional, and commercial outcomes follow more naturally.

Upselling becomes embedded in the stay

Upselling does not disappear in 2026, but its execution changes. Campaign-based approaches lose effectiveness as guests grow more selective. Embedded recommendations feel different. They are perceived as guidance rather than promotion.

This shift depends on context. When systems understand timing, capacity, and intent, recommendations feel natural. A suggestion appears because it fits the moment, not because it fits a campaign schedule. Revenue teams, therefore, depend more on operational readiness than messaging volume.

Commercial growth becomes quieter, but more durable.

AI moves from insight to action

In 2025, AI was most often used to help teams make sense of growing volumes of data. As 2026 begins, some hotels are starting to explore how those insights might translate into action, carefully and incrementally. Rather than handing over control, many are testing narrowly defined use cases where AI can support routine decisions under human oversight. For most, this remains a process of learning and confidence-building, shaped by operational reality rather than technological ambition.

This matters because hospitality is time-sensitive. Value is often lost not because of missing information but because of a delayed response. Agent-based workflows reduce that delay. Teams move from observation to action without constant manual intervention.

Hotels that gain the most from AI are selective. They focus on areas where speed matters most and define clear guardrails for automation.

Distribution becomes invisible, but strategically critical

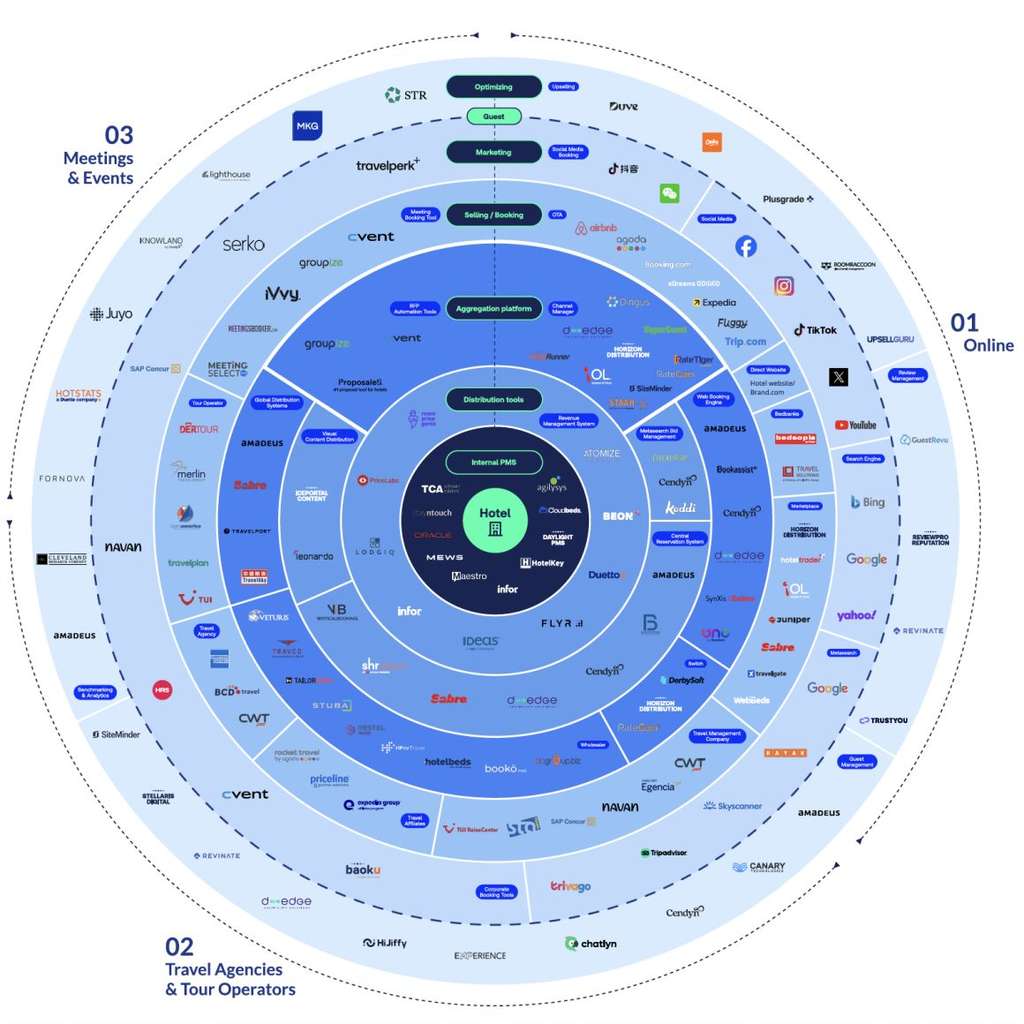

From the guest’s perspective, hotel distribution increasingly feels seamless. Discovery may begin on an OTA, a search engine, a map, or through a conversational query, but the mechanics behind that discovery are mainly invisible. For hotels, however, distribution in 2026 becomes more complex, as the number of paths into a booking continues to expand.

The traditional model, centred on managing OTA relationships and paid search, remains important but is no longer sufficient on its own. These channels now sit alongside AI-influenced forms of discovery, where platforms interpret traveller intent and surface options based on context rather than keywords alone. Guests are less often “searching” and more often asking, comparing, or being guided.

In this environment, AI does not replace existing channels. It sits above them. It mediates between content, availability, sentiment, and relevance to determine what is shown, where, and to whom. For hotels, this places greater emphasis on the quality, consistency, and structure of their data, as well as on systems that can support frequent updates without manual effort.

As a result, distribution management shifts away from channel-by-channel optimisation toward ecosystem thinking. Rather than reacting to each new interface or algorithm change, hotels focus on clean integrations, aligned content, and clear ownership. Distribution becomes infrastructure: largely unseen by guests, but increasingly central to commercial resilience.

Reputation data turns into an operating signal

Online reputation has long influenced demand. In 2026, it increasingly shapes internal decision-making. Review data feeds operational routines rather than quarterly summaries.

Leading hotels review sentiment frequently, identify recurring friction points, and assign responsibility for resolution. Reputation management becomes a form of quality control. Over time, response speed improves, and issues recur less often.

Small operational fixes compound into meaningful gains in perception.

F&B evolves into a journey layer

Food and beverage continues to shift from a collection of outlets into a journey layer that follows the guest. In 2026, F&B adapts to where the guest is, not where the outlet is.

Mobile ordering, flexible fulfilment, and frictionless payment support this evolution, but technology alone is not enough. Success depends on orchestration across spaces and moments.

Some hotels approach this by extending their POS environment with mobile-first capabilities such as Infrasys POS Move, while keeping the emphasis on guest flow rather than feature promotion. In these cases, mobile ordering and payment are positioned as supporting elements within the broader stay, designed to reduce friction across different spaces and moments rather than draw attention to the technology itself.

Benchmarks become predictive, not retrospective

Benchmarks once explained the past. In 2026, they will help prevent failure. Hotels combine satisfaction data, operational metrics, and sentiment signals to anticipate issues before they escalate.

This predictive mindset changes leadership conversations. Instead of reacting to problems, teams focus on early indicators and preventive action. Performance becomes more stable and less reactive.

Final words

As 2026 begins, many hoteliers find themselves balancing possibility with pressure. Expectations continue to rise, resources remain finite, and change rarely arrives in neat, predictable steps. In that context, alignment is less about perfection and more about progress. About making thoughtful choices that bring teams, systems, and guest experience into closer conversation with one another.

Hotels that move forward with confidence are not those trying to keep up with every new idea, but those willing to pause, simplify, and design with intent. When the guest journey guides decisions, technology becomes supportive rather than demanding, and operations gain clarity rather than complexity. Experience, in this sense, is not a layer to be added. It is something that quietly shapes how work gets done, day after day.

That perspective offers something reassuring. Progress does not require reinvention. It requires a connection between people, processes, and purpose. And in that connection, hospitality finds room not only to evolve, but to thrive.

About Shiji Group

Shiji is a global technology company dedicated to providing innovative solutions for the hospitality industry, ensuring seamless operations for hoteliers day and night. Built on the Shiji Platform—the only truly global hotel technology platform—Shiji's cloud-based solutions include property management system, point-of-sale, guest engagement, distribution, payments, and data intelligence for over 91,000 hotels worldwide, including the largest hotel chains. With more than 5,000 employees across the world, Shiji is a trusted partner for the world's leading hoteliers, delivering technology that works as continuously as the industry itself. That's why the best hotels run on Shiji—day and night. While its primary focus is on hospitality, Shiji also serves select customers in food service, retail, and entertainment in certain regions. For more information, visit shijigroup.com.