Hotel Performance Growth Slow, Steady As Impact of Omicron Fades in Year-Over-Year Comparisons

Analysts Predict Bigger Leaps in Weekly Metrics As Spring Break Travel Season Starts

Year-over-year comparisons have largely lapped the impact of a surge in omicron cases last year, and hotel industry performance in the U.S. and in markets around the globe is improving slowly but steadily.

The continued return of hotel demand to the top 25 U.S. markets and strengthening of most global markets, which during the pandemic suffered the most, is an encouraging sign of a return to normalcy. Additionally, leisure travel does not appear to be letting up, and as the industry moves into spring break season, leisure travel should continue to be robust.

CoStar hospitality analytics firm STR predicts occupancy and average daily rate will pick up for the next week as spring break season kicks off in several markets.

Globally, strong growth is expected to continue with increasing demand across most countries, most notably China. Asian countries are currently reaping the benefit of China’s reopening, which should eventually spread to more distant countries. revenue-per-available-room growth outside the U.S. will likely show strong double-digit increases for the foreseeable future.

US Hotel Performance

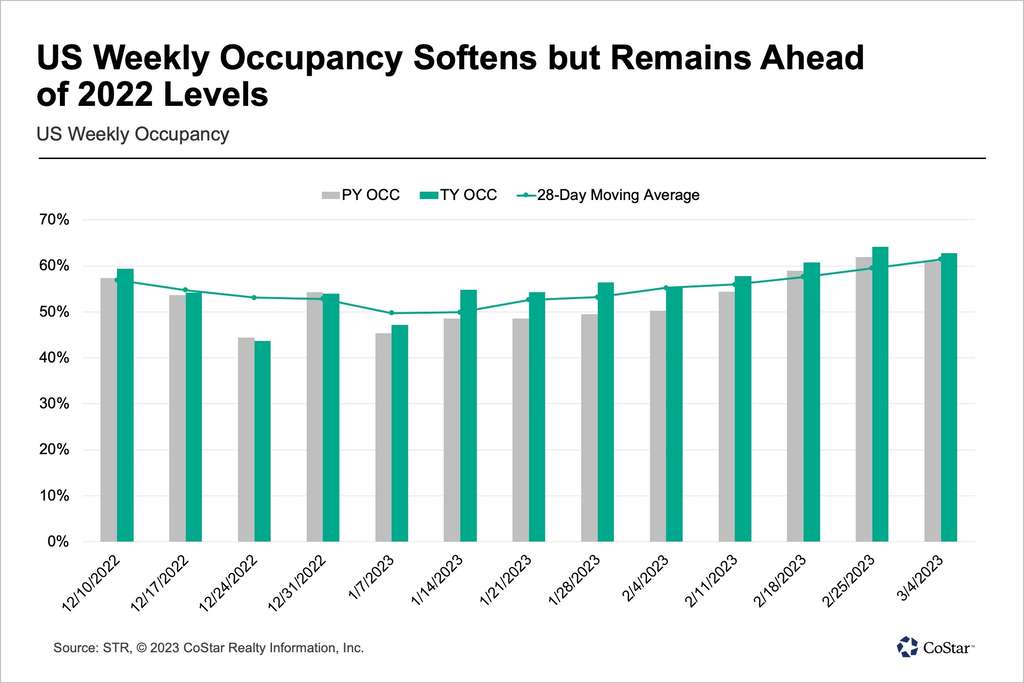

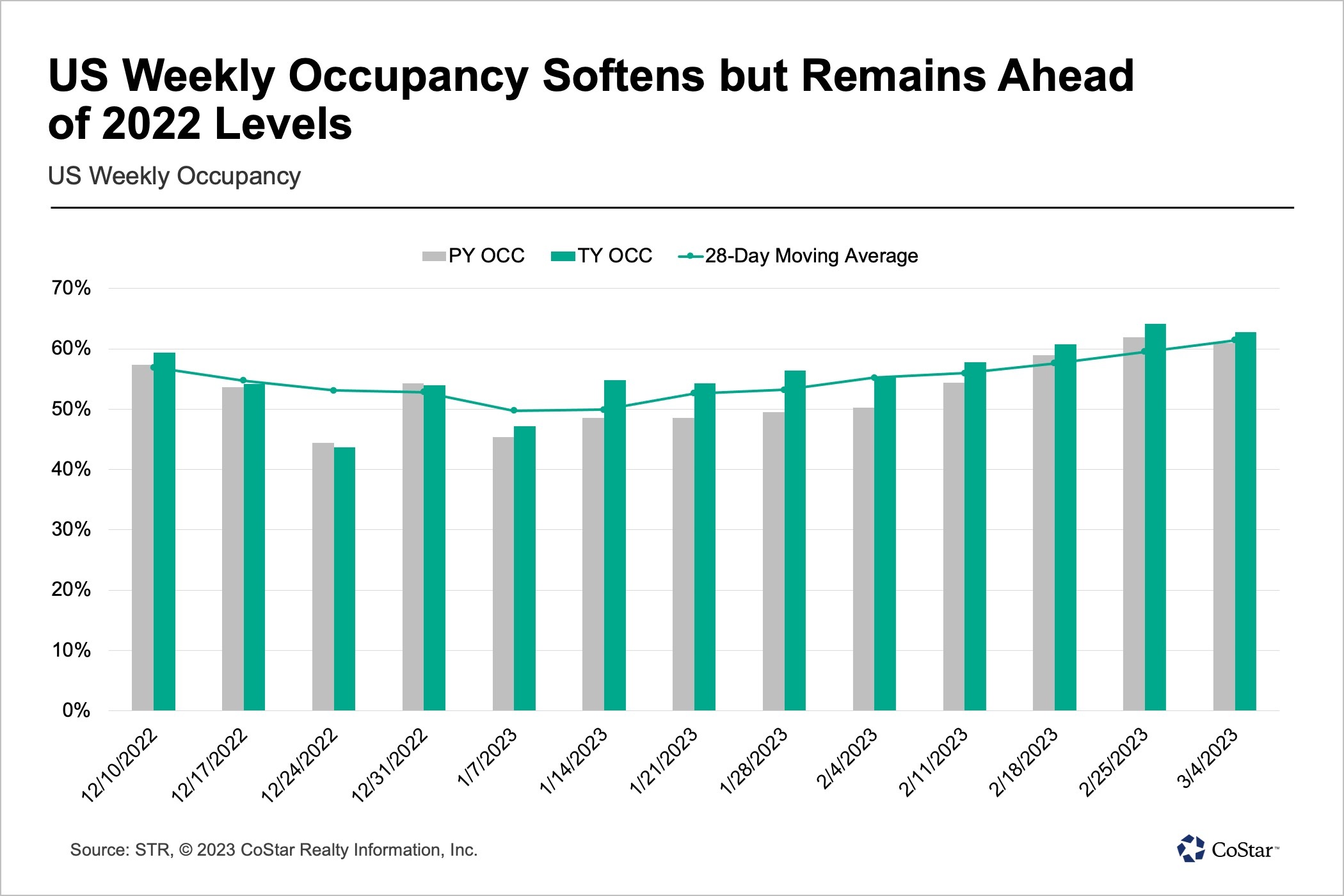

U.S. hotel occupancy came in at 62.8%, which was down from an elevated 64.2% the week prior, which included the Presidents Day holiday, but higher than all other weeks in 2023 and 3% above the 2022 comparable. Average daily rate was lower week over week as well but up 8.9% year over year to $151. As a result, revenue per available room gained 12.1% year over year to $95.

Hotel performance is resembling a more normal pattern as evidenced by improving occupancy in major markets and growing group demand.

One indication of a return to normal patterns is the strong performance in the top 25 markets, which still have ground to make up from pandemic losses.

The top 25 led the week’s year-over-year growth in occupancy, up 5.3 percentage points to 69.1%, while hotel market occupancy in the rest of the country was basically flat at 59.5%.

ADR and RevPAR also increased year over year in the top 25 markets, up 12.3% and 21.7%, respectively.

Twenty-two of the top 25 markets had weekly occupancy higher than the comparable week of 2022.