2019-2020 Restaurant Industry Performance and the JHFM Index

The Journal of Hospitality Financial Management - Atul Sheel

Restaurant industry sales continued their moderate growth between 2019 and 2020. According to the National Restaurant Association (NRA, 2020) reports, restaurant industry revenues are projected at approximately $899 billion for 2020, up 4% over 2019 (1.2% adjusted for inflation). Such projections, however, seem to have been based more on the economic trends from 2019. Regardless of such projections from the NRA, experts continue to remain cautious about the industry's growth in 2020 amidst mixed economic signals.

Table 1 summarizes the trend of stock returns for key restaurant firms until March 9, 2020.

The sudden global economic downturn in the past few weeks due to the coronavirus (COVID- 19) outbreak has wiped out all the economic gains accrued from robust economic trends in 2019. The foodservice industry continues to experience significant setbacks, with more and more event cancellations and a growing tendency of people to stock up, stay at home, and avoid public gatherings, while brands such as Clorox, Netfl ix, and Campbell keep benefiting from COVID- 19. Even though the one-year average return of restaurant stocks represented by the JHFM Restaurant Industry Index is positive (11.48%)— surpassing the one- year average S&P 500 Index return (8.32%)— the year-to-date (YTD), 1- month, and 3- month returns of restaurants (JHFM Restaurant Index returns of −5.04%, −7.59%, and −3.38%, respectively) are currently in the red. Over the last year, quick service and quick service specialty restaurants (13.51% and 13.64% annual returns, respectively) performed significantly better than the market (8.32% annual return). Quick service outlets such as Domino's, McDonald's, Wendy's, Chipotle, and Starbucks (36.31%, 11.89%, 17.62%, 17.88%, and 13.82% annual returns, respectively) contributed most toward this buoyancy. Interestingly, the quick service and quick service specialty restaurants also seem to have experienced milder shocks in the recent coronavirus-affected months relative to family dining, casual dining, and full- service restaurants.

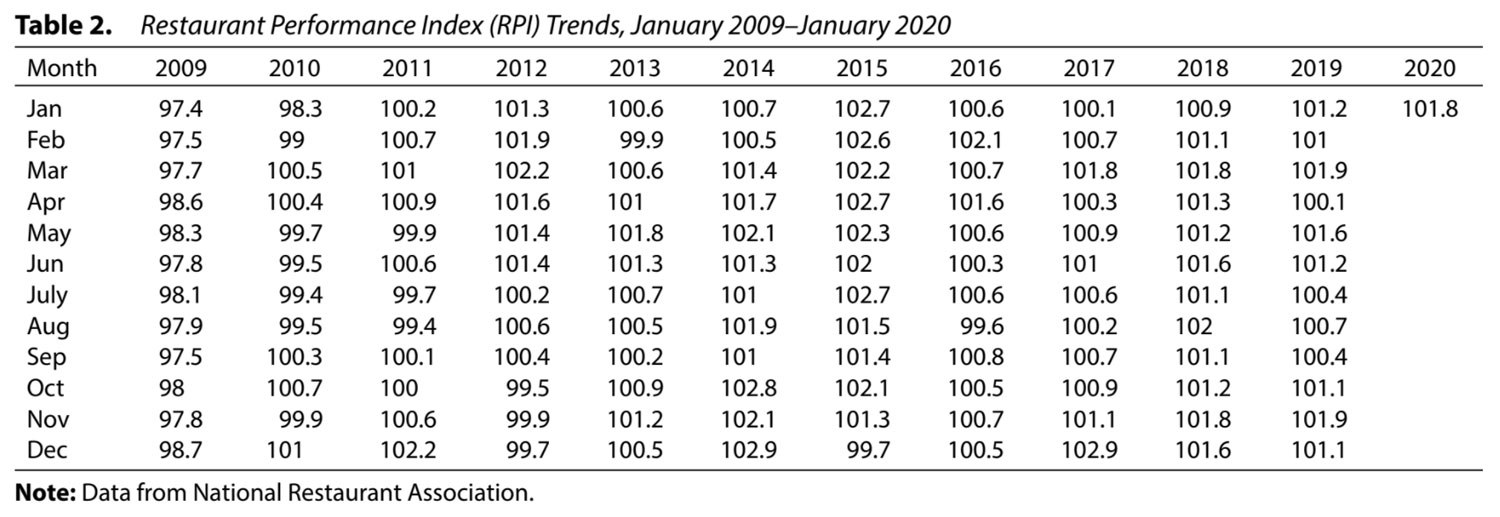

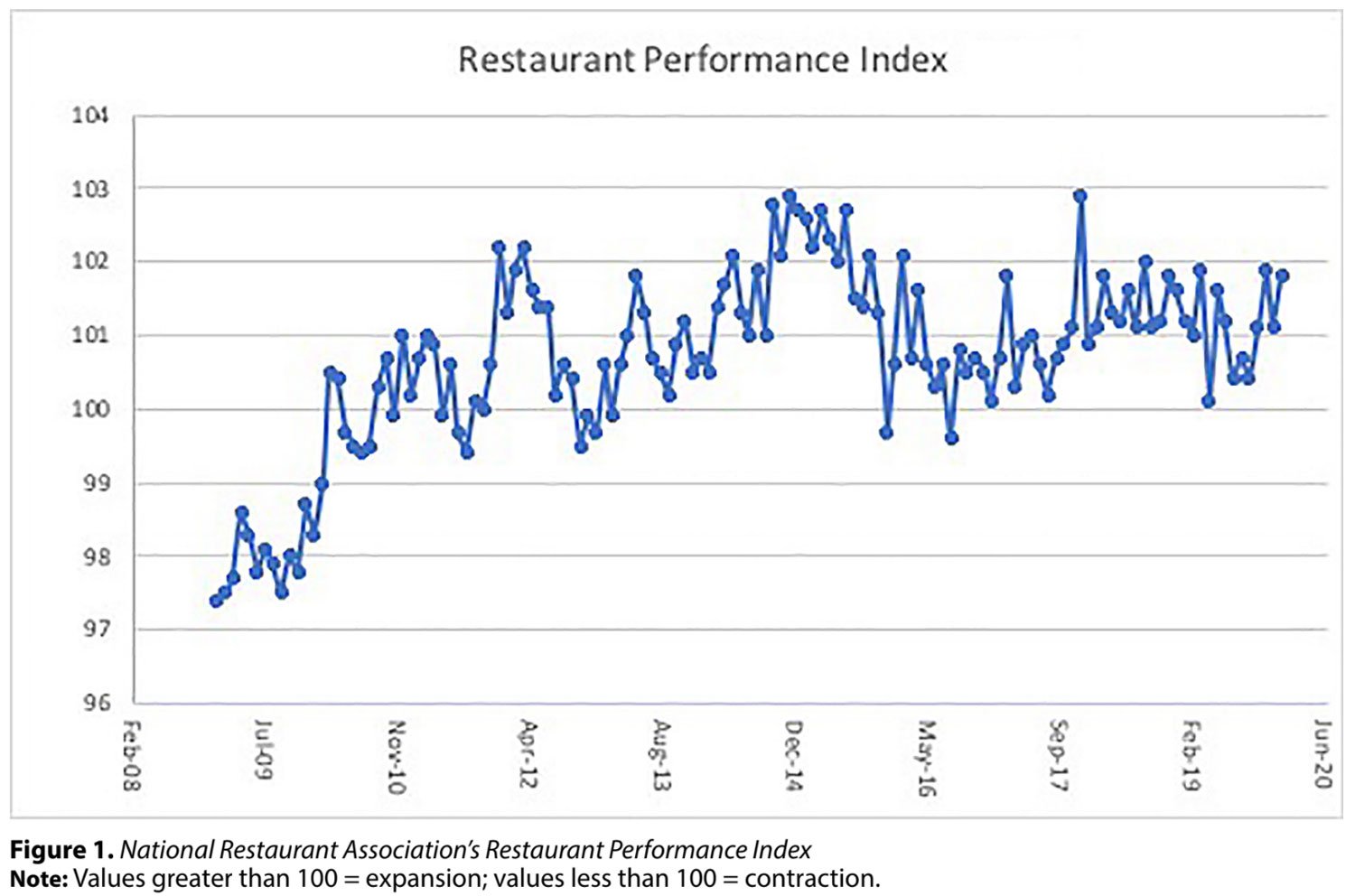

Current trends in the NRA's Restaurant Performance Index (RPI) support the steady growth in restaurant performance in 2019 and a cautious outlook for restaurant performance in the near future. The RPI is a combination of the current situation index (derived from recent-period restaurant industry indicators such as same-store sales traffic and labor and capital expenditures) and the expectations index (derived from a forward-looking or six-month outlook for restaurant industry indicators) and is based on the NRA's monthly survey of U.S. restauranteurs. RPI values greater than 100 indicate expansion, while values less than 100 suggest a period of contraction for key restaurant industry indicators. Table 2 summarizes recent trends in the NRA's statistical barometer, the RPI for the January 2009 - January 2020 period. Figure 1 presents a graph for RPI trends until January 2020.

The RPI values in Figure 1 illustrate a positive yet stagnating trend for restaurant industry indicators since the second half of 2019. In January 2020, the performance index was at 101.8, barely up 0.7% from its performance in December. The current situation index stood at 101.6, and the expectations index stood at 102.0 in January 2020. Even though these indices suggest an expansionary mode for the restaurant business, the slow expansion rate is yet to help the industry's RPI climb back to its original post-summer levels seen in August 2018 (102). Further, given that these indices move in tandem with economic expansions and contractions, it seems unlikely that the RPI will rise further in the near future, at least until the middle of the second quarter of 2020.

The current state of our limping coronavirus-affected economy does not bode well at all for the restaurant sector. Experts agree that the major U.S. market indices are experiencing their worst levels since 2008 and that the U.S. economy has already slumped into a recession. With broken supply chains all over the world, this economy is expected to shrink further in the near future and probably start recovering during the third quarter this year. Given such an economic scenario, with recent legislative mandates and shut-downs requiring social isolation to curb the coronavirus outbreak and consequent restaurant closures and bulk layoff s of restaurant employees, we have yet to see the debilitating effects of this pandemic on the restaurant industry in the months to come.

https://scholarworks.umass.edu/jhfm/vol28/iss1/1

Atul Sheel

University of Massachusetts, Amherst

National Restaurant Association. (2020). Restaurant Performance Index. https://Restaurant.org/News-Research/Research/RPI

Garber, J. (2020, March 19). Coronavirus will hit US economy harder than 2008 fi nancial crisis: J.P. Morgan. Fox Business. https://www.foxbusiness.com/markets/coronavirus-gdp-impact-bigger-than-financial-crisis-j-p-morgan