Early Effects of COVID-19 on Travelers and Their Motivations

COVID-19 and the ensuing global economic crisis have caused dramatic changes for the travel industry that may take years to fully resolve.

Over the past few months, STR has been releasing insights from research conducted during March and April 2020 about shifting consumer willingness to travel as COVID-19 spread. First we looked at how travelers from different markets reacted, then we assessed how travelers who used different accommodation types planned to adapt their travel plans.

In this piece we look at the impact on future travel plans by respondents' age and motivations for choosing destinations. As in both of our previous pieces, we are looking at data collected on either side of 11 March, when the World Health Organisation (WHO) declared COVID-19 a global pandemic.

The effects of COVID-19 have varied widely by age group and impacts on travel are no exception.

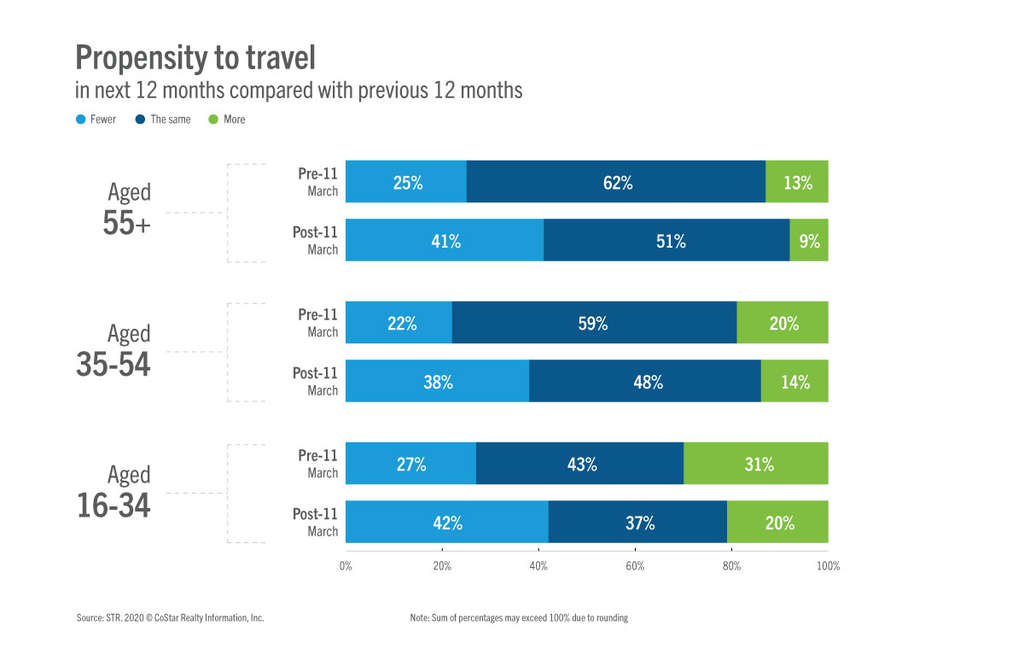

Ahead of the pandemic declaration, propensity to travel differed across age groups, with only 43% of younger travelers planning the same number of trips in the year ahead compared with the year prior. Older travelers demonstrated a more stable attitude toward future travel, with 62% of respondents aged 55+ expecting to travel the same amount in the next 12 months compared to the previous 12 months.

After the declaration of COVID-19 as a pandemic, all age groups reported a reduction in propensity to travel. Respondents aged 16-34 continued to demonstrate more polarized attitudes towards travel in the next 12 months and were least likely of the age groups to plan the same number of trips over the next 12 months as taken the prior year.

While all age segments were impacted as COVID-19 became more widespread in the second half of March, younger travelers showed the steepest decline in propensity to travel but retained the highest percentage of respondents (20%) likely to travel more over the next 12 months.

Understanding propensity to travel

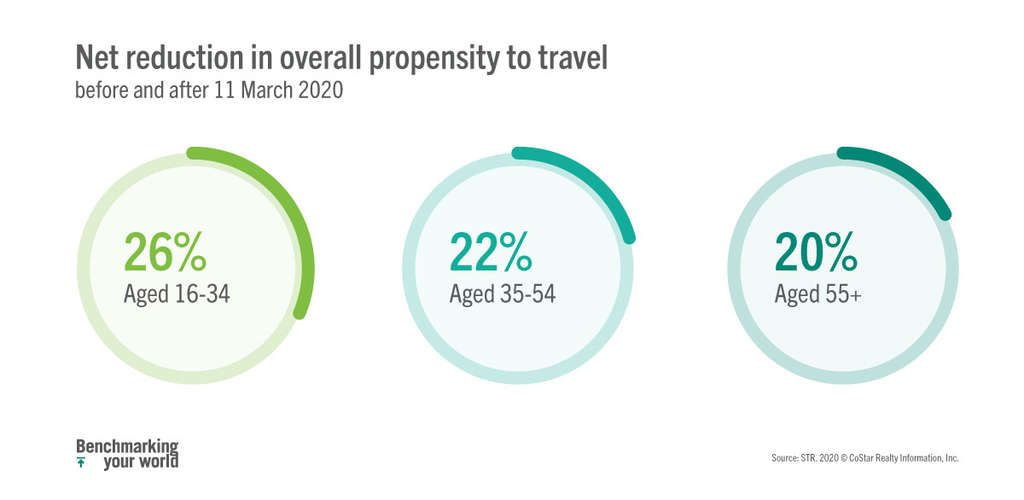

Overall propensity to travel is the difference between those who indicated that they would travel more in the next 12 months minus those who indicated they would travel less.

Net reduction in overall propensity to travel before and after March 11, 2020:

The impacts of COVID-19 on holiday decisions: Value for money is less important

There are many reasons travelers may choose a destination, including its history, a good deal or the right weather.

Travelers were asked about their top motivations when choosing leisure destinations in the past 12 months. This information overlaid with propensity to travel in the next 12 months highlights changing preferences for holiday decisions due to COVD-19.

Propensity to travel fell among most segments after 11 March, with two notable exceptions. Travel intentions increased among respondents that were motivated to travel to visit friends and relatives and who enjoy accessing nature and the outdoors.

Prior to 11 March, travelers on the lookout for a good deal expected to undertake more leisure trips in the future. However, respondents motivated to travel due to value for money were significantly less likely to be planning travel when surveyed after that date.

Respondents attracted to destinations due to regional food and drink were less impacted by COVID-19. This cohort expected to increase trips taken in the next 12 months both before and after 11 March.

COVID-19 is changing consumer behavior

Our findings show a shift in the needs and motivations of travelers due to COVID-19 and highlight changes in the consumer behavior which brands can leverage as part of their recovery strategies.

As the world adapts to COVID-19, travelers are more eager than ever for a vacation, but the realities of the global situation undercut many intentions. No hotel is untouched, but there are green shoots upon which savvy hoteliers may capitalize.

In this situation of prevailing uncertainty, STR is providing fresh insights that can help businesses across the travel industry to endure and grow. We will continue to conduct fresh research on traveler perceptions and intentions and look forward to sharing these results with you. Contact [email protected] for customized research.

About STR

STR provides premium data benchmarking, analytics and marketplace insights for the global hospitality industry. Founded in 1985, STR maintains a presence in 15 countries with a corporate North American headquarters in Hendersonville, Tennessee, an international headquarters in London, and an Asia Pacific headquarters in Singapore. STR was acquired in October 2019 by CoStar Group, Inc. (NASDAQ: CSGP), the leading provider of commercial real estate information, analytics and online marketplaces. For more information, please visit str.com and costargroup.com.