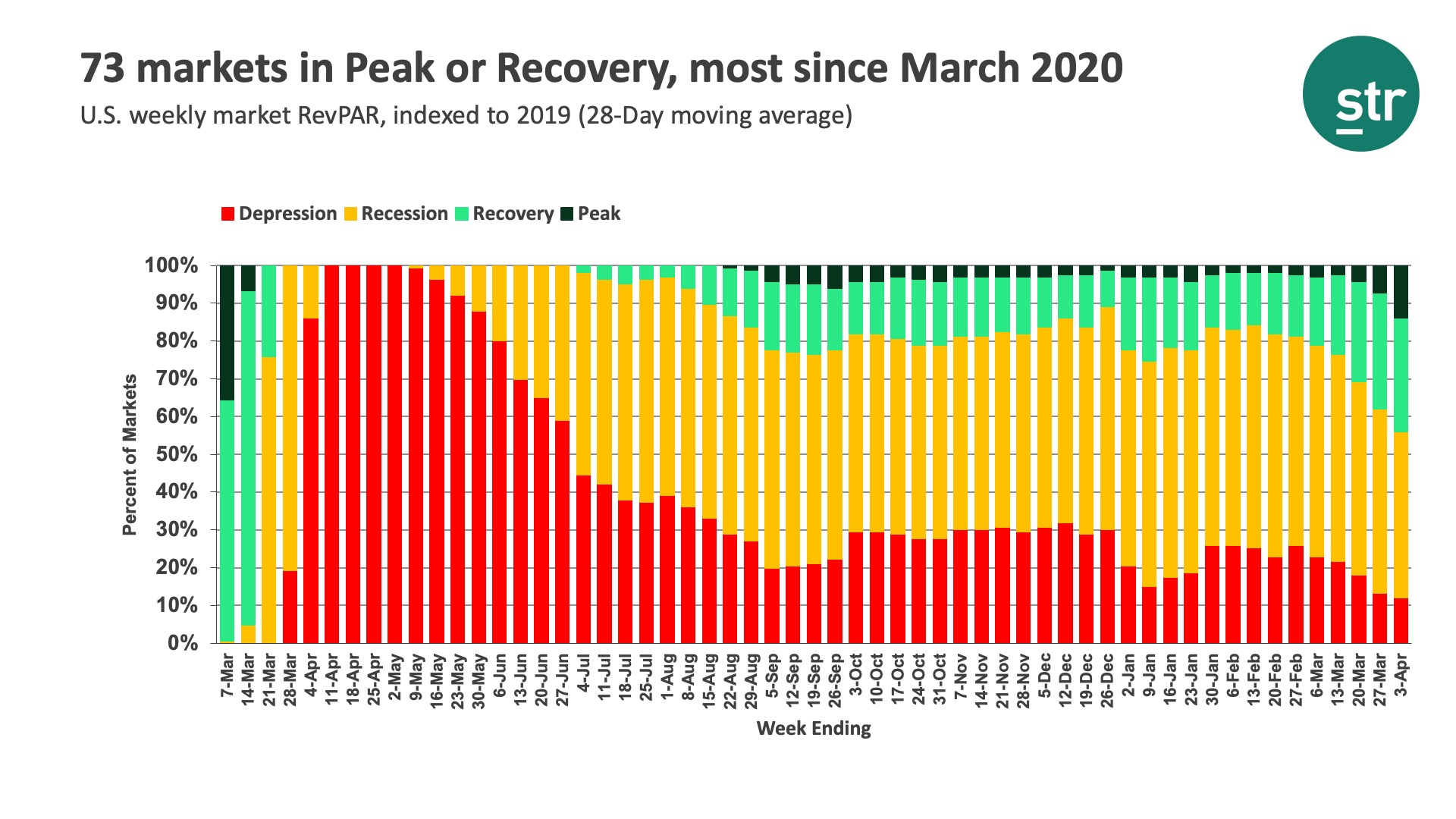

U.S. Market Recovery Monitor – 3 April 2021

Week Ending 3 April 2021: Weekly RevPAR rose to US$65.34, which was a 4.2% increase week over week and the industry's highest level of the past 56 weeks when indexed to 2019. RevPAR has increased week over week all but three times this year. STR's Market Recovery Monitor reflected the country's stronger overall RevPAR performance with 73 markets either in Recovery or Peak categories. More encouraging, only 20 markets were in the Depression category, the least of the past 53 weeks. Top 25 Markets are also improving, and as a group, entered the Recession phase for the first time. However, most of the markets that are classified as in Depression continued to be those in the Top 25, including San Francisco, Boston, Washington, D.C., New York City, and New Orleans. Of all U.S. markets, those five markets had the lowest RevPAR when indexed to their 2019 benchmark. Similar trends were noted when using STR's total-room-inventory (TRI) methodology. RevPAR on this basis was $61.76, up 3.7% with 67 markets in the Recovery or Peak categories.

Demand increased from the prior week and remained above 21 million for a third consecutive week—the weekly value was also the 10th highest of the past five quarters. The largest weekly demand gain occurred in California, whereas the largest decrease was in Texas, which was the Lone Star State's second consecutive weekly decline. Florida also saw solid growth after posting a drop in the previous week. Demand for the Top 25 Markets hit a pandemic high, led by gains in Washington, D.C., Orlando, San Diego, and others. Among all markets, the three aforementioned markets were also the largest gainers for the week.

Occupancy advanced slightly but stayed below the pandemic-era high seen a fortnight ago when using both STR's standard and TRI methodologies. Even though occupancy was up a bit, slightly more hotels saw occupancy under 30% for the week and fewer were above 60%. After two weeks above 70%, weekend occupancy fell to 66%. Weekday occupancy, however, improved to 54.7%, the best since the start of the pandemic. The Top 25 Markets were responsible for this week's total U.S. occupancy growth. In aggregate, the major markets posted their highest occupancy of the past year with all but six markets posting weekly gains and Tampa surpassing its 2019 level. In fact, all but three Florida markets surpassed their 2019 occupancy levels. By hotel size, occupancy was flat to down for all size categories except for large hotels (300+ rooms), which saw their highest occupancy since last March. A deeper look revealed that most of this week's occupancy growth came from large hotels in the Top 25 Markets.

ADR ($112.76) also reached its highest level of the past year with room rates for the combined Luxury & Upper Upscale class nearly back to its 2019 level among open hotels. Top 25 ADR increased by 4.4% from the prior week to its highest absolute level since the pandemic began. Overall, 40 markets saw ADR surpass the level posted during the comparable week in 2019.

Globally, most markets remain in the Depression category with RevPAR at 39% of what it was during the comparable week in 2019. Occupancy was 30% on a TRI basis among the 351 markets reviewed. Most metrics have seen little change for some time.

With spring break-driven leisure travel winding down, we expect U.S. demand to be flat to down over the next several weeks until we reach the summer travel period. But the gain in Top 25 demand this week could be a signal of growing business travel. There's even talk of pent-up business demand, which if true, would mitigate the anticipated softness in leisure demand. Only time will tell if that is the case.

About the MRM

When the U.S. hotel industry reached the one-year anniversary of the earliest COVID-19 impact, year-over-year percentage changes became less actionable when analyzing performance recovery. Thus, STR introduced a weekly Market Recovery Monitor that categorizes each STR-defined market based on an indexed comparison with the same time periods in 2019. An index is simply a ratio that divides current performance by the benchmark (2019 data).

For example, during the week ending 6 March 2021, U.S. RevPAR was $48.13. In the comparable week from 2019, RevPAR was $87.75. This produces an index of 54.8 ($48.13/$87.75*100), meaning RevPAR was slightly more than half of what it was in 2019.

We use an index to place each market in one of four categories: depression (index <50), recession (index between 50 and 79.9), recovery (index between 80 and 99.9), and peak (index >=100). Additionally, we highlight other top market performances that contribute to higher levels of recovery across the U.S.

About CoStar Group, Inc.

CoStar Group (NASDAQ: CSGP) is a leading provider of online real estate marketplaces, information, and analytics in the property markets. Founded in 1987, CoStar Group conducts expansive, ongoing research to produce and maintain the largest and most comprehensive database of real estate information. CoStar is the global leader in commercial real estate information, analytics, and news, enabling clients to analyze, interpret and gain unmatched insight on property values, market conditions and availabilities. Apartments.com is the leading online marketplace for renters seeking great apartment homes, providing property managers and owners a proven platform for marketing their properties. LoopNet is the most heavily trafficked online commercial real estate marketplace with thirteen million average monthly global unique visitors. STR provides premium data benchmarking, analytics, and marketplace insights for the global hospitality industry. Ten-X offers a leading platform for conducting commercial real estate online auctions and negotiated bids. Homes.com is the fastest growing online residential marketplace that connects agents, buyers, and sellers. OnTheMarket is a leading residential property portal in the United Kingdom. BureauxLocaux is one of the largest specialized property portals for buying and leasing commercial real estate in France. Business Immo is France's leading commercial real estate news service. Thomas Daily is Germany's largest online data pool in the real estate industry. Belbex is the premier source of commercial space available to let and for sale in Spain. CoStar Group's websites attracted over 163 million average monthly unique visitors in the third quarter of 2024. Headquartered in Washington, DC, CoStar Group maintains offices throughout the U.S., Europe, Canada, and Asia. From time to time, we plan to utilize our corporate website, CoStarGroup.com, as a channel of distribution for material company information. For more information, visit CoStarGroup.com.

This news release includes "forward-looking statements" including, without limitation, statements regarding CoStar's expectations or beliefs regarding the future. These statements are based upon current beliefs and are subject to many risks and uncertainties that could cause actual results to differ materially from these statements. The following factors, among others, could cause or contribute to such differences: the risk that future media events will not sustain an increase in future occupancy rates. More information about potential factors that could cause results to differ materially from those anticipated in the forward-looking statements include, but are not limited to, those stated in CoStar's filings from time to time with the Securities and Exchange Commission, including in CoStar's Annual Report on Form 10-K for the year ended December 31, 2023 and Forms 10-Q for the quarterly periods ended March 31, 2024, June 30, 2024, and September 30, 2023, each of which is filed with the SEC, including in the "Risk Factors" section of those filings, as well as CoStar's other filings with the SEC available at the SEC's website (www.sec.gov). All forward-looking statements are based on information available to CoStar on the date hereof, and CoStar assumes no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

Haley Luther

Senior Communications Manager

+1 (216) 278 0627

CoStar