Tourism After Lockdown: The Long and Short of Long-Haul Travel

Mass COVID-19 vaccination programs are underway across the globe and providing the tourism and hospitality industry a much-needed confidence boost following 12 months or so of seismic declines. However, with lockdowns still in place for some regions and the emergence of new virus variants, predicting future travel demand remains challenging.

To track evolving consumer trends in the sector, and examine everchanging attitudes on travel, STR conducted a quantitative survey in February 2021 among 1,333 respondents from its Traveler Panel.

In this first article of our latest Tourism After Lockdown series, we look at sentiment towards international and, more specifically, long-haul travel, and take a deep dive into key trends.

Demand to resume traveling remains strong

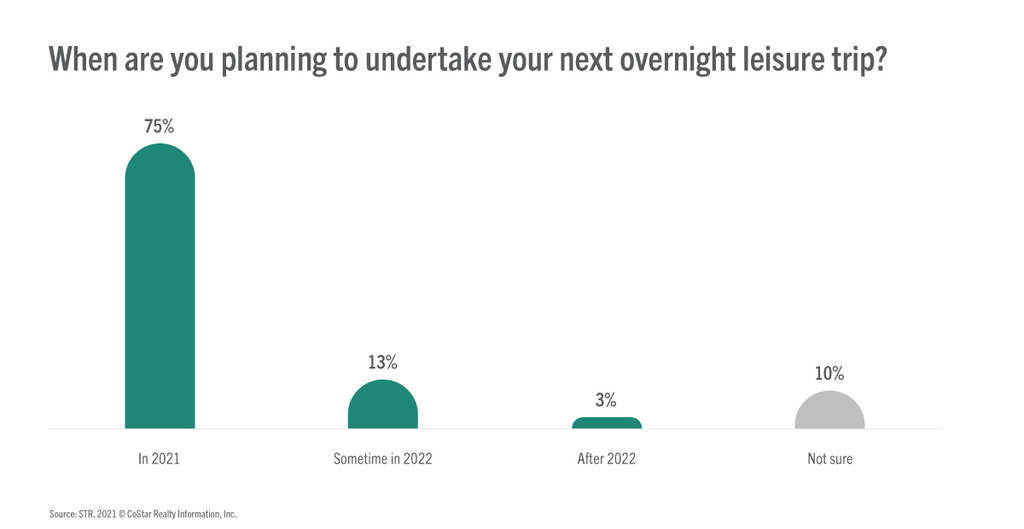

According to our latest research, consumers have not lost their appetite to travel as most (66%) had planned, booked, or undertaken travel since the start of the year. Moreover, despite national and regional lockdowns, and widespread advice to avoid non-essential travel across the globe, underlying demand for travel remains strong as three quarters of travelers intend to undertake an overnight trip by the end of 2021.

The results suggest, and align with recent hotel performance data, that domestic leisure travel is fueling the first stages of recovery as most opt to stay closer to home in the short term. Understanding the needs of local audiences and tailoring services and offers to best suit these audiences will help brands maximize the opportunity of pent-up domestic demand.

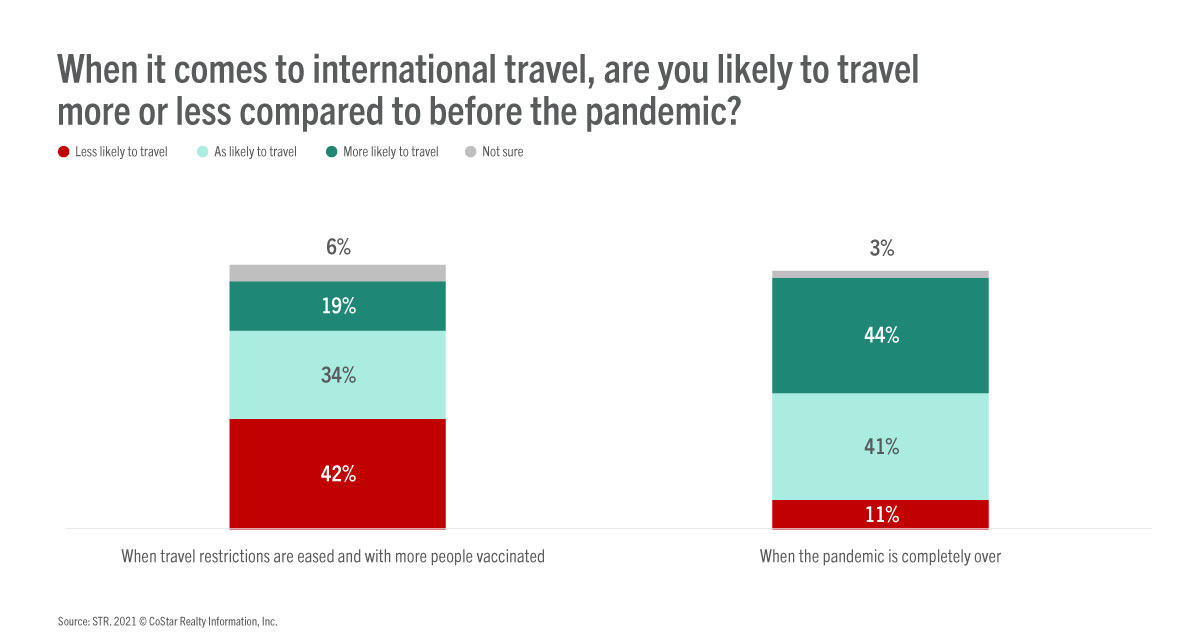

Signaling more optimism for the industry, traveler sentiment towards overseas travel is also improving. The results indicate that this is likely to significantly pick up later in the year once the pandemic is more under control and a greater proportion of the population has been vaccinated.

Likely due to the strict regulations and travel restrictions imposed by the U.K. government and continued uncertainty in the country about the likelihood of outbound travel this year, U.K. international travel recovery is likely to fall behind other European and North American international travel markets.

Consumer confidence growing for return to travel

A year after the World Health Organization declared the coronavirus outbreak a pandemic, it is apparent that consumers are regaining confidence in travel. Our research shows increased trust in cleanliness and safety. This finding is a testament to the hard work brands have put into adjusting their offerings and adapting to the current environment.

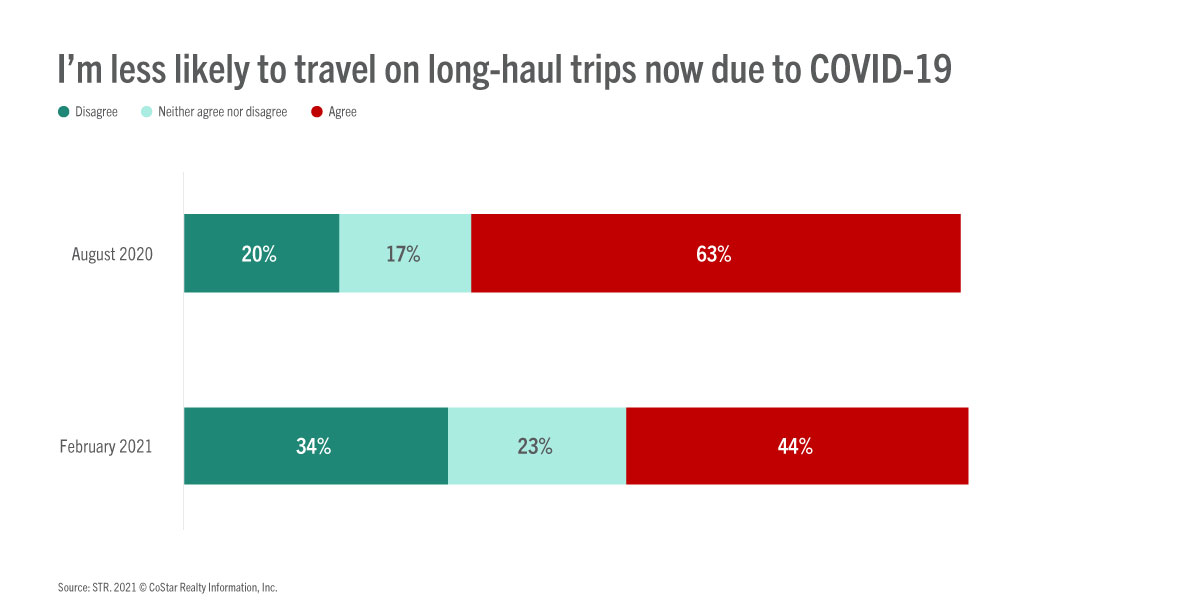

Perhaps reflecting this increased trust in brands and growing optimism about travel, there has also been a positive shift in travelers' attitudes towards long-haul travel. In our latest research, 44% of travelers agreed that they are less likely to undertake long-haul travel now than before COVID-19. This finding compares to 63% who stated the same in research we conducted in August 2020.

Who are long-haul travel enthusiasts?

While a minority of travelers are deterred by the prospect of long-haul travel currently, the remainder, some 56% of respondents in our research, are unperturbed. So, who are these consumers who may pioneer the reopening of long-haul travel?

These travelers tend to be less concerned about COVID-19 health risks and, predictably, have fewer concerns about traveling, including flying, to their desired destinations. Instead, bigger barriers to travel among this cohort are disquiets about cancellations and refunds. Providing reassurance and clear communications regarding booking policies, therefore, are important to mitigate these concerns and encourage bookings.

These travelers are also more active when it comes to browsing and planning holidays. Moreover, a higher proportion than average had recently booked or undertaken an overnight trip. The findings highlight that these travelers are active in the market and, hence, can be targeted and converted through many existing channels.

This audience relies more on paid accommodation and, hotels, rather than friends and family. Their accommodation choice was more likely influenced by personal recommendations and reviews. High-quality experiences will, therefore, do much to attract this audience through the power of positive word of mouth and online reviews.

Unsurprisingly, this audience also tends to be younger, typically between 16 and 54 years old. In terms of origin, North American consumers are slightly more predisposed to long-haul travel than Europeans and, more so, Brits.

Most are keen to resume long-haul travel by the end of 2022

But when can tourism and hospitality businesses expect long-haul travel to commence again?

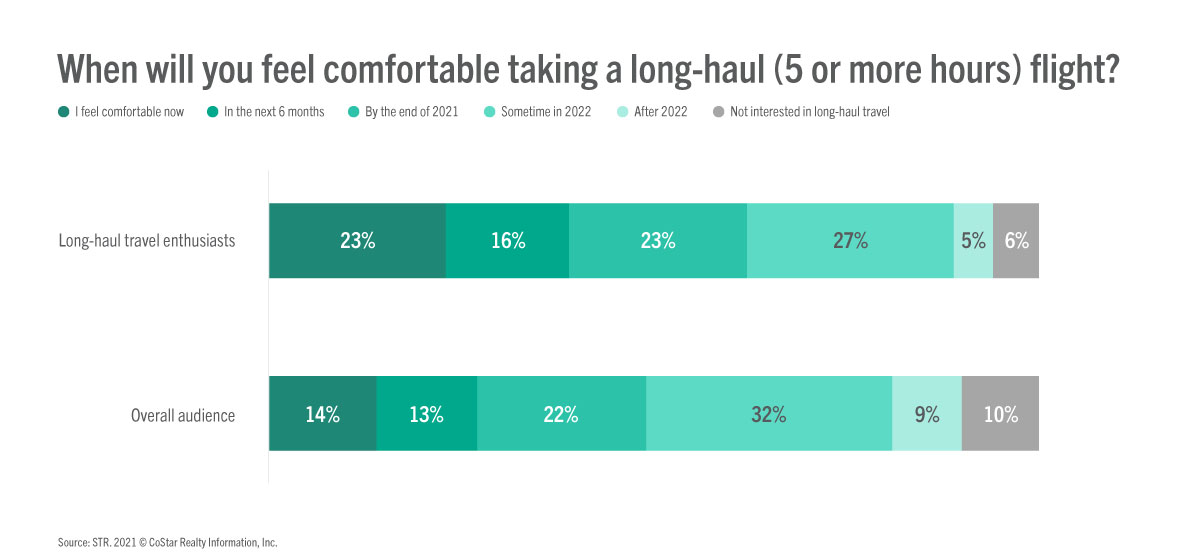

Nearly half of all respondents stated they will feel comfortable undertaking a long-haul trip by the end of this year.

Meanwhile, confidence in undertaking a long-haul trip was noticeably higher among long-haul travel enthusiasts with 62% feeling comfortable doing so by the end of 2021. Moreover, nearly a quarter of this group stated they feel comfortable traveling long-haul now.

Bright future on the horizon?

Despite the challenges that the industry continues to face, there is increased hope on the horizon. A year into the pandemic, travelers are increasingly keen to venture out as their confidence in and appetite toward travel has grown.

Dubai is an encouraging example of a destination that adopted the highest levels of COVID-Safe measures, including an extensive testing and sanitization campaign, and launched a series of marketing campaigns to communicate its readiness to welcome visitors back. Since the reopening of the city to international tourists on 7 July 2020, the tourism and hospitality industry has experienced tremendous improvement in demand.

These are all positive indications that once restrictions are lifted and countries reopen their borders, demand is likely to soar and the journey – both short and long-haul – toward recovery will begin in earnest.

Measuring current sentiments and behavioral changes can help you navigate the current market climate. Click here to learn more about how STR can help you gain a rich understanding of your target audience.

About STR

STR provides premium data benchmarking, analytics and marketplace insights for the global hospitality industry. Founded in 1985, STR maintains a presence in 15 countries with a corporate North American headquarters in Hendersonville, Tennessee, an international headquarters in London, and an Asia Pacific headquarters in Singapore. STR was acquired in October 2019 by CoStar Group, Inc. (NASDAQ: CSGP), the leading provider of commercial real estate information, analytics and online marketplaces. For more information, please visit str.com and costargroup.com.