U.S. Market Recovery Monitor – 19 June 2021

Are you tracking the Market Recovery Monitor each week? Utilizing data and benchmarking to navigate recovery will be a key focus of the 2021 Hotel Data Conference. Click here for registration, with both in-person and virtual options available for our 13th annual event in Nashville.

Previous MRM versions: 5 June | 12 June

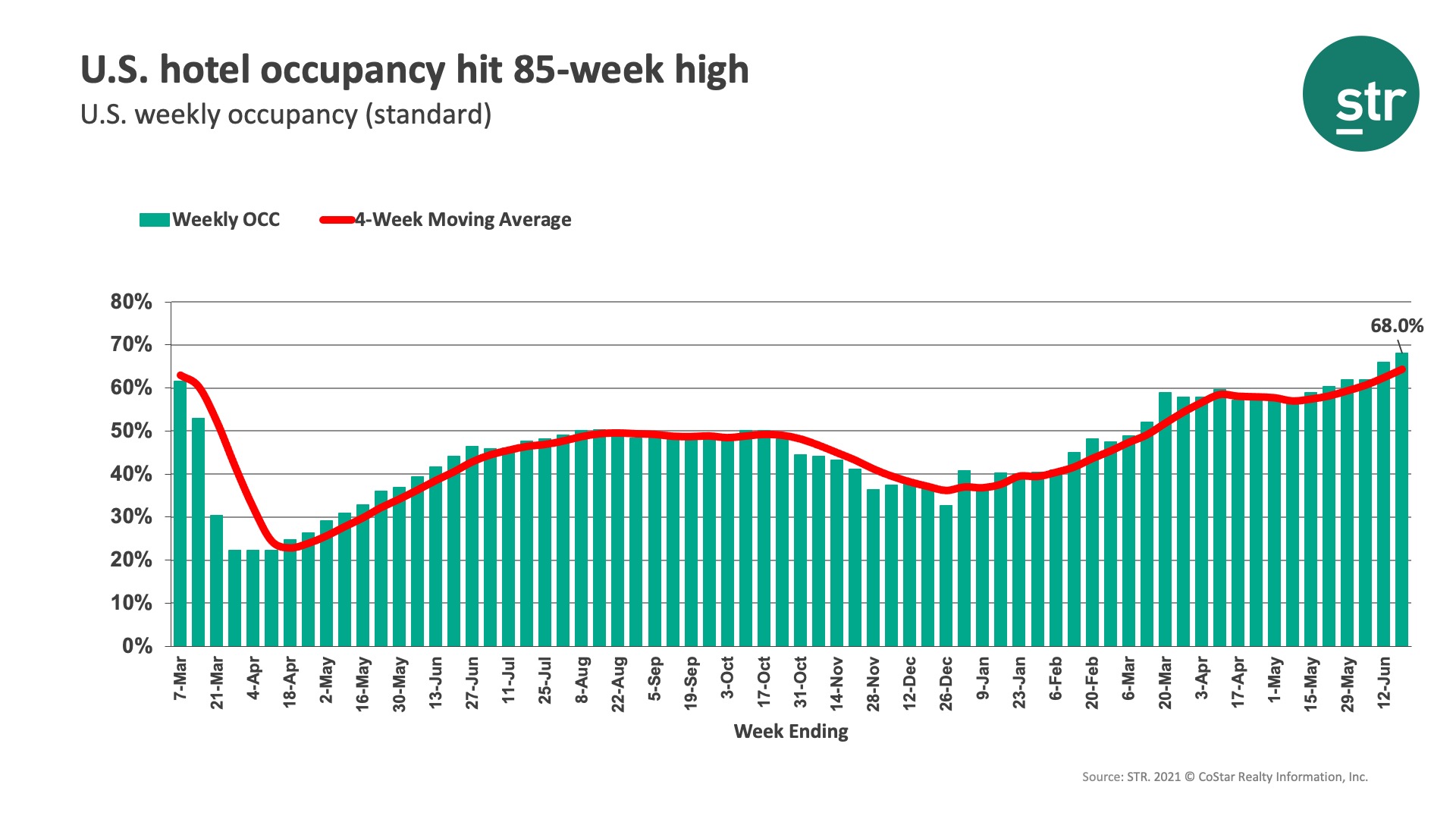

The “summer travel surge” continued this past week as U.S. hotel occupancy hit an 85-week high at 68.0% for the week ending 19 June 2021. That is the country’s highest level since the week ending 9 November 2019. The turnaround in occupancy is above expectations. Recall, at the start of the year, occupancy was 38% and has increased each month since. The increase first began with southern destinations, but this week, the states in the Pacific and Mountain regions saw the largest gains with California leading all states. On a total-room-inventory basis (TRI), which accounts for temporarily closed hotels, weekly occupancy was 65%, another pandemic-ear high. Since the week ending 5 June, TRI occupancy has increased 5.6 points.

Room demand for the week topped 26 million. An average of 3.7 million rooms were sold each day, and for a second consecutive week, demand volume was more than 90% of the level seen in the corresponding weeks from 2019. Nearly all states reported demand at 80% or more of their 2019 level, except Massachusetts, Illinois, and New York. Washington, D.C. also fell into that “except” category. Ten states, including Tennessee, South Dakota, and Utah, had weekly demand higher than what they reported during the comparable week of 2019. At the market-level, 54 showed higher demand this week than during the matching week in 2019, including Savannah, Sarasota, and the Florida Keys. San Francisco and New York City improved with demand at slightly half of what it was in 2019.

Of course, demand is heavily skewed toward leisure transient as occupancy in hotels that cater to groups and meetings remained weak at 43%, up from 40% the week prior. Occupancy in central business districts (CBDs) ranged from 31% (Minneapolis CBD) to 79% (Nashville CBD). Overall, CBD occupancy for the week was 53%, well below the national average. We continue to note that full recovery will remain a way off until groups return. Fortunately, there is optimism for a pickup in groups this fall, especially when looking at convention calendars in cities like Chicago, Atlanta, and Orlando.

Overall, 72% of all sample hotels posted occupancy above 60%, and large hotels (300+ rooms) hit 54% occupancy. Taking a deeper look, 37% of all reporting hotels had occupancy at or above 80% in the week. While this is welcomed news, back during the corresponding week in 2019, 48% of hotels reached that level of occupancy. Weekday occupancy was 63%, which was also the highest since November 2019 and indexed at almost 90. Weekend occupancy has been hanging around the same level (~78%) as the comparable 2019 periods for the last month.

ADR continued to climb as well, indexing at 96 this week, just four percent off the 2019 level. Keep in mind that the index is based on non-inflation adjusted ADR. Thus, the gap to “normal” ADR is a bit wider. Non-inflation adjusted ADR for the combined Midscale & Economy class has been above its 2019 level for the past four weeks. Top 25 Market ADR has increased for the past nine weeks with Orlando, Miami, Phoenix, San Diego and several others having higher ADR this week than in the comparable week of 2019.

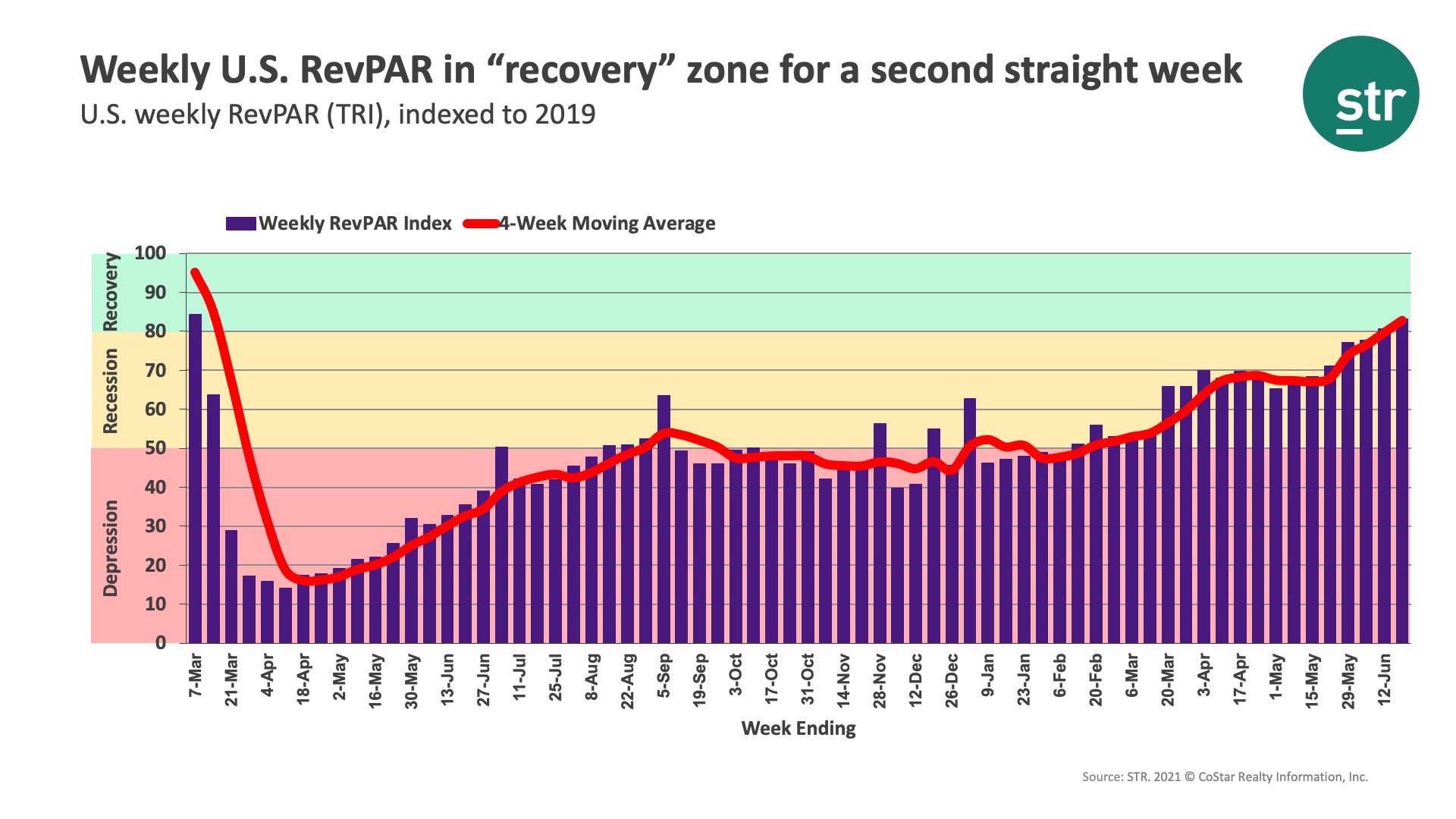

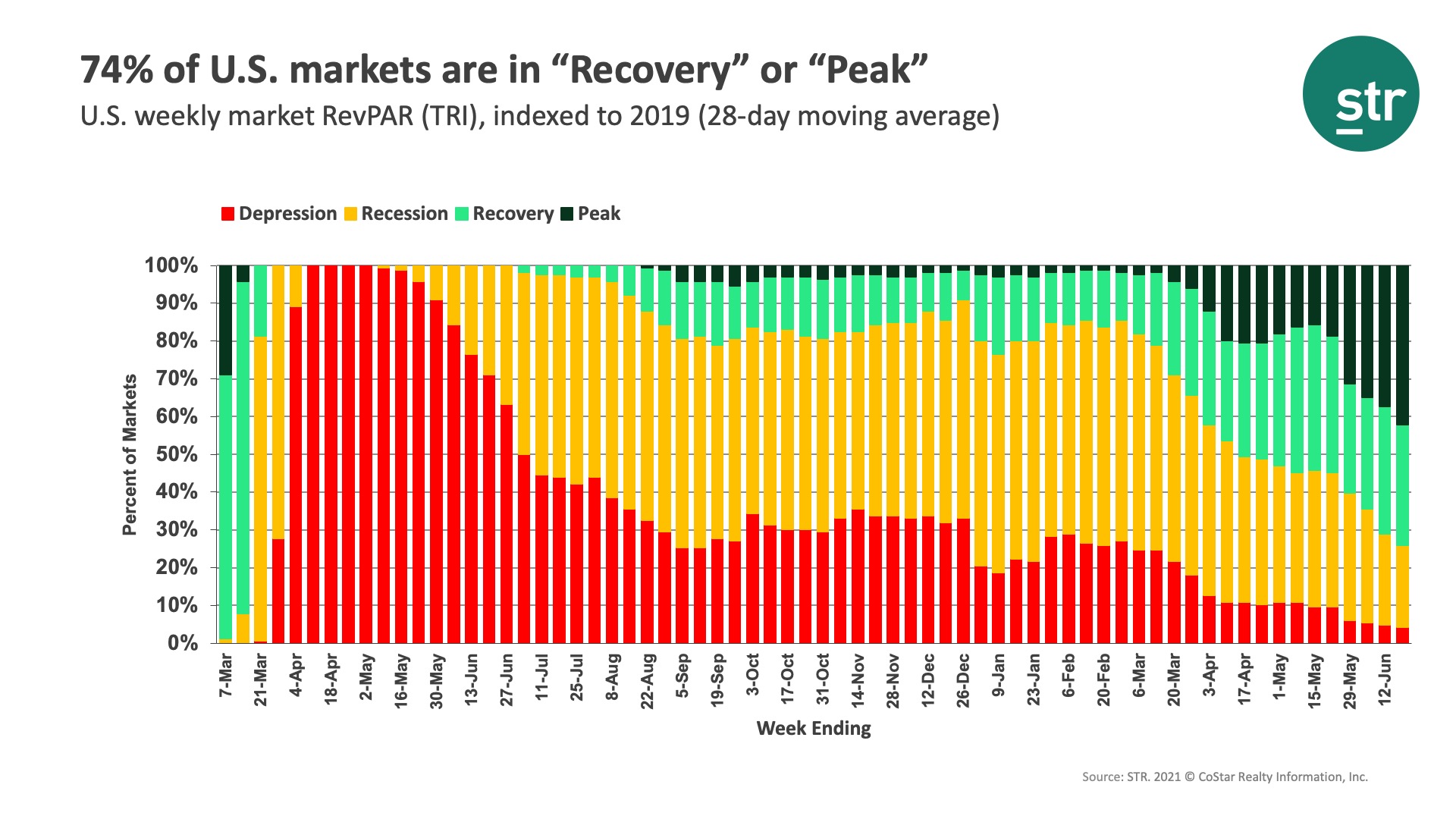

TRI RevPAR ($84) reached its highest level of the pandemic-era. Indexed to 2019, RevPAR saw its second straight week in “recovery” territory (index between 80 and 99.9) as 74% all of markets were in the recovery or peak (index 100 or greater) phases. Seventy markets had RevPAR higher than what it was in 2019. Five markets (Gatlinburg/Pigeon Forge, Palm Beach, Miami, Sarasota, and the Florida Keys) showed RevPAR 45% higher than in 2019. Five markets continued to report weekly RevPAR less than 40% of the 2019 level, including San Francisco, New York City, Boston and Washington, DC.

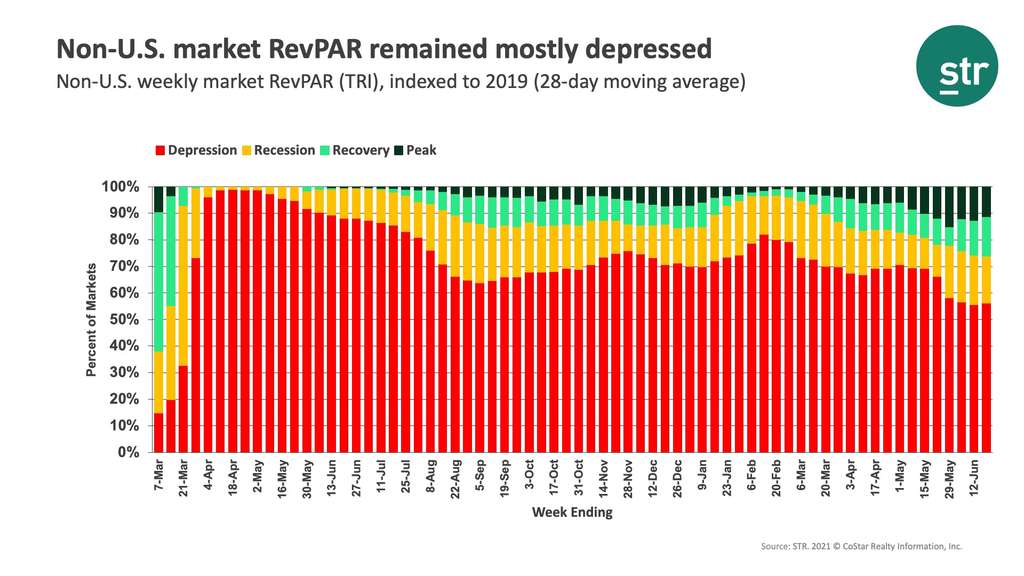

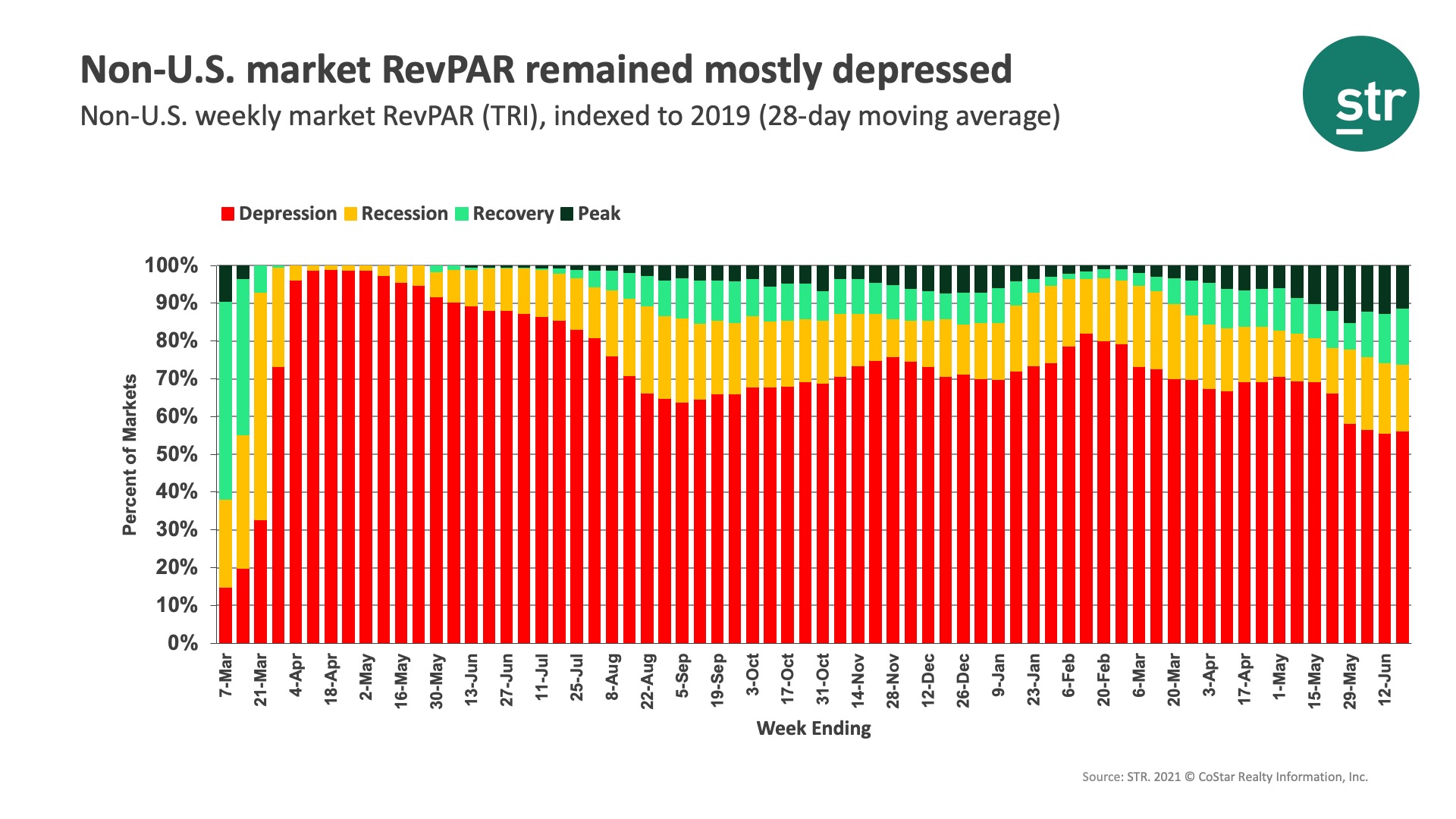

Across the remainder of countries, occupancy remained somewhat stagnant with little movement. TRI occupancy in the 10 largest countries based on supply was 36% and flat to the prior week. China fell to 48%, while the U.K. rose to that level. Japan continued to see weak occupancy at 14% with Tokyo at a similar level. Overall, 56% of the markets tracked reported RevPAR lower than 50% of the 2019 comparable with little improvement over the past four weeks.

While U.S. performance has improved dramatically over the past month, especially over the past two weeks, it’s way too early to even consider the country’s hotel industry as being recovered. We believe full recovery, from a performance metrics standpoint, is in the distant future and likely years away. Individual hotel recovery from the financial impact of the pandemic is even further way. But there is hope for a faster turnaround. Last week, Ed Bastian, CEO of Delta Airlines, stated: “I think if you take the period from July 1 forward, we’re going to see business travel at levels that were consistent with where we were pre-pandemic. There are so many businesses that need to get back out to their customers that have created new contacts they haven’t been able to serve during the pandemic period while they couldn’t travel that need to be back out with their teams…as businesses [open] this summer… you’re going to see a huge surge in business, just as we’ve seen with consumer leisure demand.”

About the MRM

When the U.S. hotel industry reached the one-year anniversary of the earliest COVID-19 impact, year-over-year percentage changes became less actionable when analyzing performance recovery. Thus, STR introduced a weekly Market Recovery Monitor that categorizes each STR-defined market based on an indexed comparison with the same time periods in 2019. An index is simply a ratio that divides current performance by the benchmark (2019 data).

For example, during the week ending 6 March 2021, U.S. RevPAR was $48.13. In the comparable week from 2019, RevPAR was $87.75. This produces an index of 54.8 ($48.13/$87.75*100), meaning RevPAR was slightly more than half of what it was in 2019.

We use an index to place each market in one of four categories: depression (index <50), recession (index between 50 and 79.9), recovery (index between 80 and 99.9), and peak (index >=100). Additionally, we highlight other top market performances that contribute to higher levels of recovery across the U.S.

About STR

STR provides premium data benchmarking, analytics and marketplace insights for the global hospitality industry. Founded in 1985, STR maintains a presence in 15 countries with a corporate North American headquarters in Hendersonville, Tennessee, an international headquarters in London, and an Asia Pacific headquarters in Singapore. STR was acquired in October 2019 by CoStar Group, Inc. (NASDAQ: CSGP), the leading provider of commercial real estate information, analytics and online marketplaces. For more information, please visit str.com and costargroup.com.