Outside of Top 25 Markets, Hotel Rates Highest Ever

Latest Weekly Data Confirms No Change in How Holidays Impact Hotel Performance

For the week leading into the Fourth of July holiday, U.S. hotels sold more rooms this year than in 2019, and at least outside of the top 25 largest markets, commanded record-high rates.

Still, U.S. hotel demand was down from the previous week, with 1.7 million fewer room nights sold.

But that decline was less than what was experienced in the comparable week of 2019, when demand fell by 3.7 million room nights.

Holiday weeks and calendar shifts have always been a factor in hotel performance, and data for the week leading into the Fourth of July holiday confirms that impact is pretty much the same during a pandemic.

Pre-pandemic, holiday weeks tended to be lackluster due to the lack of business and group travel. That segment of hotel demand has been remarkably weak throughout the pandemic and continued to be for the week ending July 3. However, pent-up leisure demand helped to mitigate the loss as more rooms were sold this week (25.1 million) than in the comparable 2019 week (24.8 million).

Of course, the calendar shift of the Fourth of July holiday from a Thursday in 2019 to a Sunday in 2021 also contributed to the difference.

For the week ending July 3, occupancy was 65.4%, down 4.4 points from the previous week. Daily occupancy ranged from 60% on Sunday, June 27, to 76% on Saturday, July 3.

Week over week, U.S. hotel occupancy declined for every day except Sunday, when occupancy increased by the largest amount of the past four weeks. On a total-room-inventory basis, which accounts for temporarily closed hotels, weekly occupancy was 62.8%.

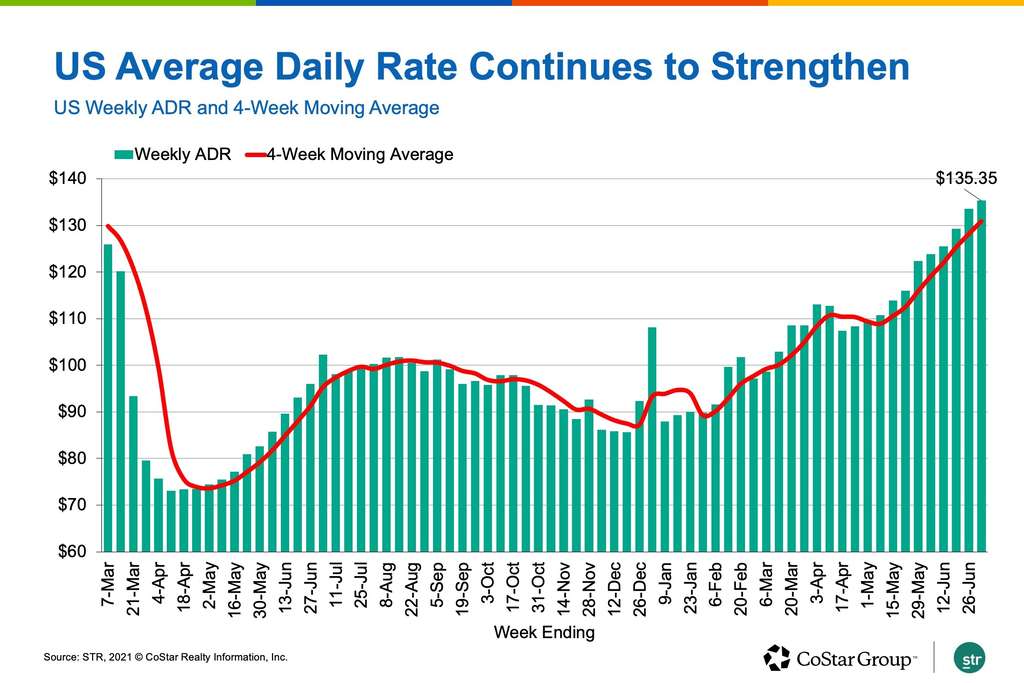

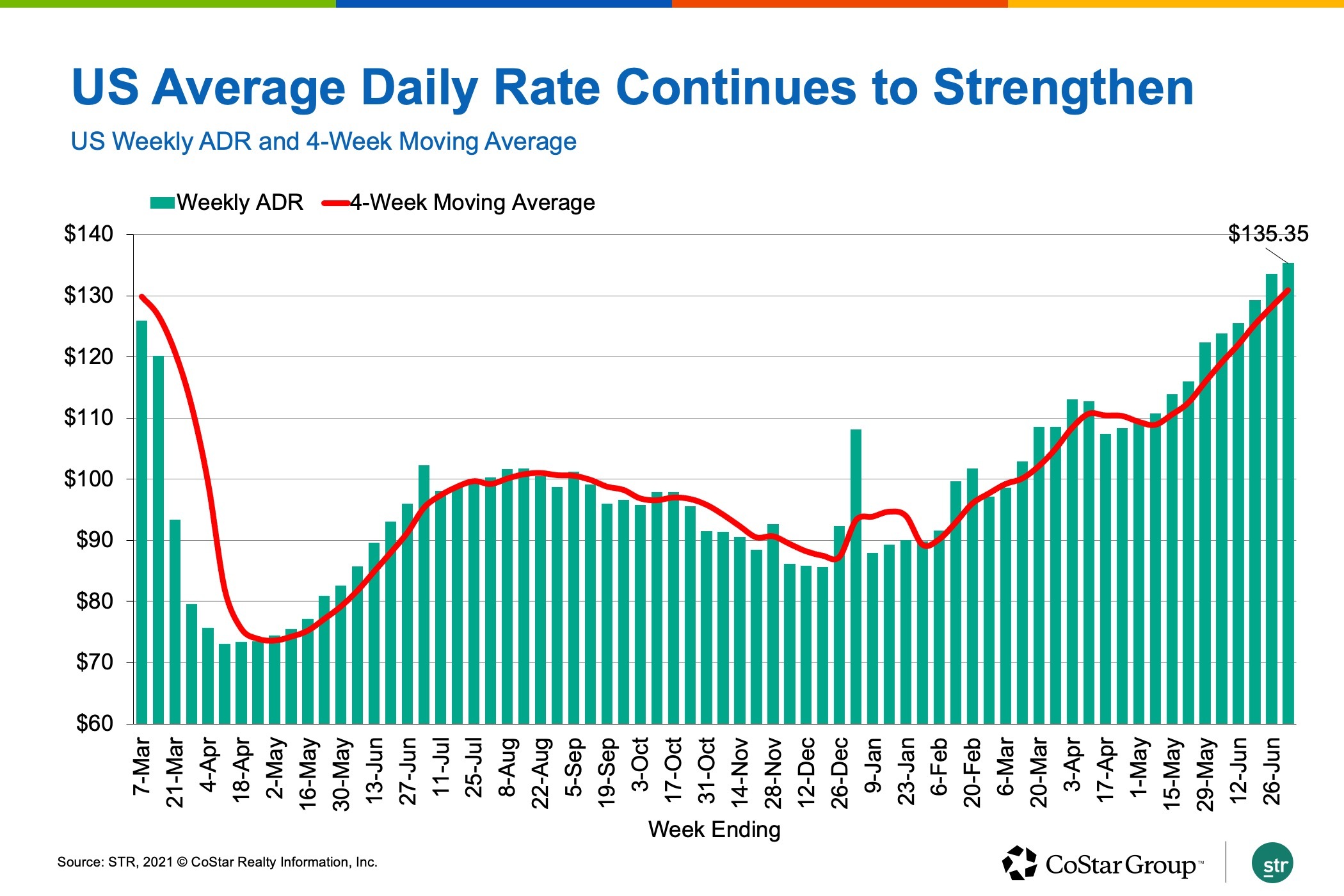

The positive news is that U.S. hotel average daily rate increased to $135, the highest weekly level since the first week of 2020 that included the New Year’s holiday.

ADR for the week was the seventh highest over the past 130 weeks. On an inflation-adjusted basis, ADR was also at its best since the beginning of 2020. And excluding the top 25 markets, ADR is the highest it has ever been. While ADR in the top 25 markets is not at a record high, it was at its highest level since March 2020.

With stronger holiday demand in the week, it’s no surprise that 69% of all U.S. markets sold more rooms this year than in 2019. More than a third of all U.S. markets had a 10% hotel demand premium over 2019 results.

However, week over week, hotel demand decreased in all but eight markets, led by Denver and Seattle and driven in part by the record-breaking heat wave that affected the Pacific Northwest.

Despite lower weekly demand, 66% of all U.S. hotels had occupancy above 60%, down from 75% a week ago. History tells us that we can expect demand and the percentage of hotels with occupancy above 60% to rebound in the week ending July 10.

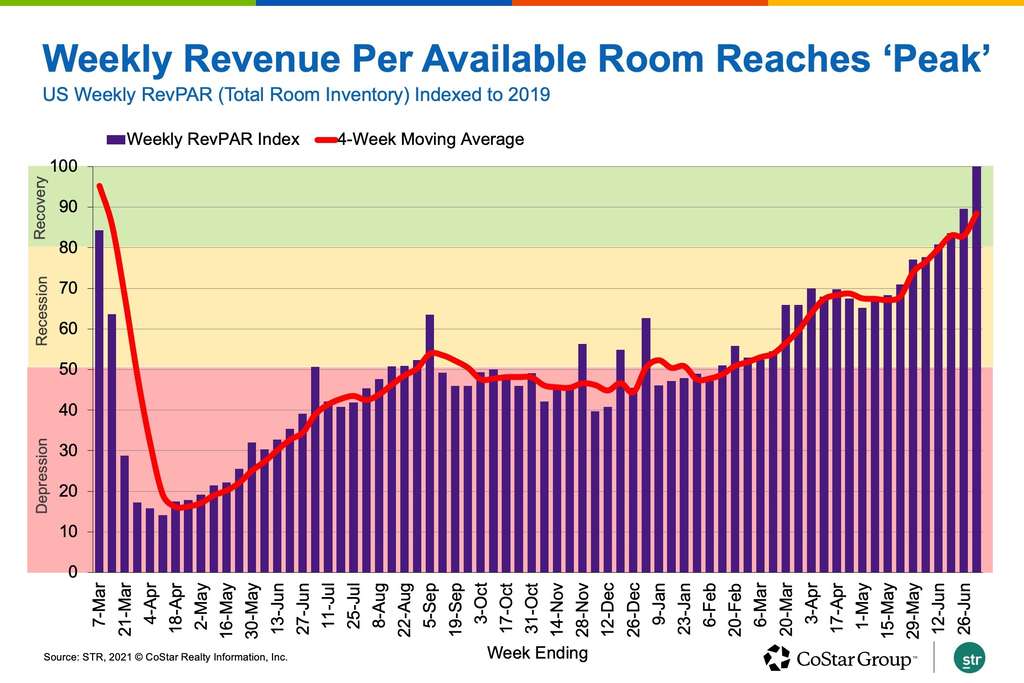

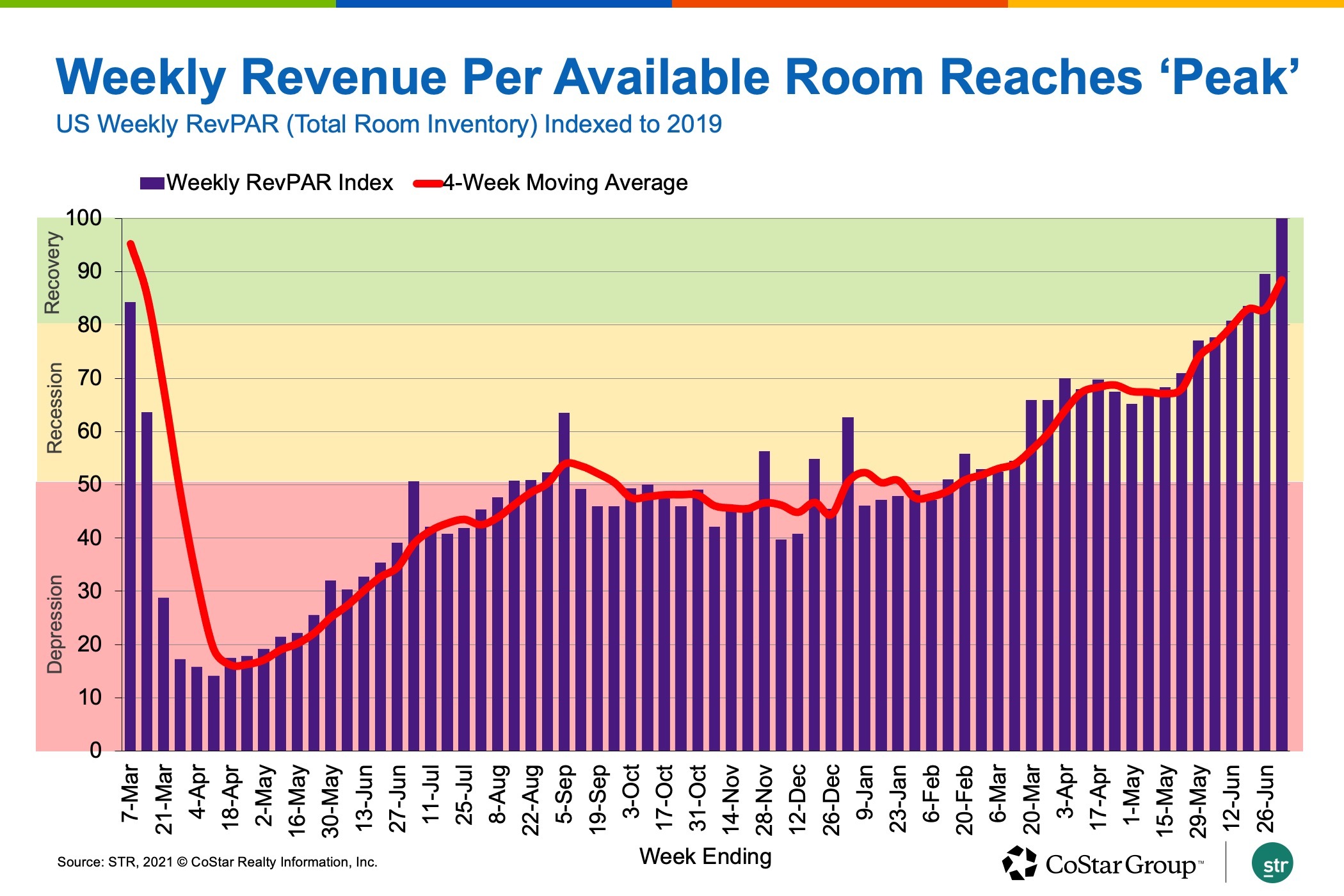

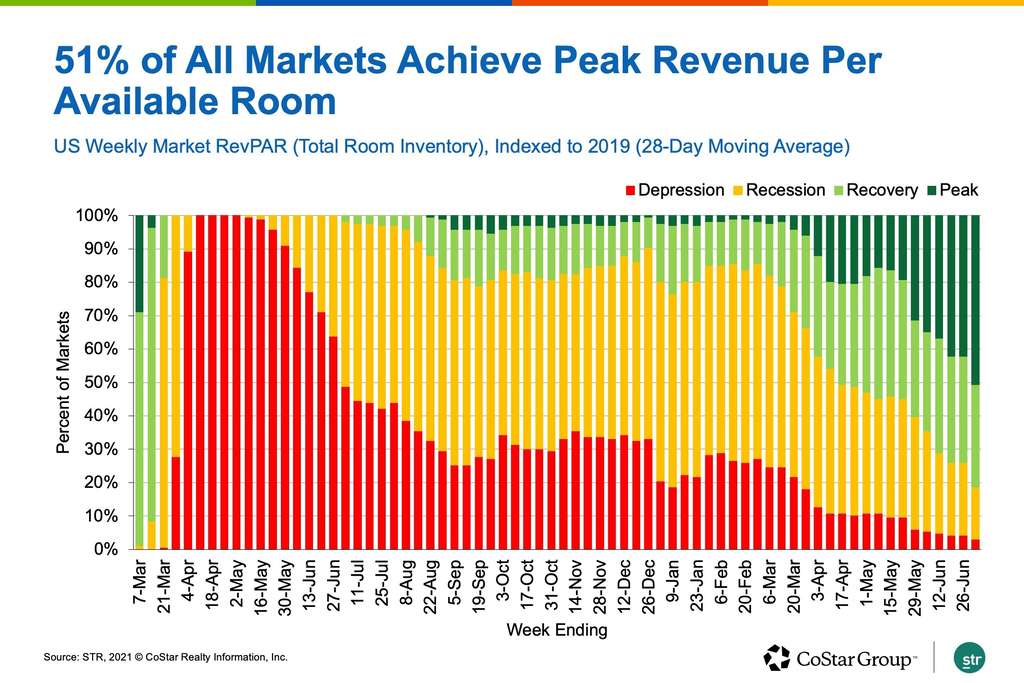

STR’s Market Recovery Monitor, which indexes performance against pre-pandemic 2019 levels, shows that U.S. hotel industry weekly revenue per available room, accounting for temporarily closed hotels, was in the “peak” category, surpassing the level achieved during the same week in 2019.

This was driven by easy comparisons to 2019, stronger leisure demand and rising ADR.

On a 28-day basis, the U.S. hotel industry remained in the “recovery” category, with total room inventory RevPAR at between 80% and 100% of 2019 levels. Weekly results are also expected to return to the “recovery” zone in the weeks ahead.

In the 28 days through July 3, 51% of U.S. markets were in “peak” performance, with total room inventory RevPAR that was higher than in the comparable 28 days of 2019. Another 31% were in “recovery,” and only 3% — five markets — remained in the “depression” category, with total room inventory RevPAR at less than 50% of the 2019 level.

Overall, weekly total room inventory RevPAR was $85, down from the previous week but still the second highest since the start of the pandemic.

The week’s declines were attention-grabbing, but not concerning when including relative comparisons. The journey to full recovery is still expected to be arduous and uneven, especially for larger, urban hotels. However, there is little doubt that we are in recovery, driven by leisure demand. The next chapter requires the return of business and groups, which we believe will happen as offices reopen, but that revival is likely to be uneven compared to what has been experienced this summer. Expect greater weekly fluctuation and keep a watch on the larger trend.

About STR

STR provides premium data benchmarking, analytics and marketplace insights for the global hospitality industry. Founded in 1985, STR maintains a presence in 15 countries with a corporate North American headquarters in Hendersonville, Tennessee, an international headquarters in London, and an Asia Pacific headquarters in Singapore. STR was acquired in October 2019 by CoStar Group, Inc. (NASDAQ: CSGP), the leading provider of commercial real estate information, analytics and online marketplaces. For more information, please visit str.com and costargroup.com.