Market Recovery Monitor - 11 December 2021

For the first time in 85 weeks, New York City led the nation in occupancy (81%) as visitors returned to partake in the city’s holiday traditions and attractions. The market reported the nation’s highest weekday occupancy (79%) and the second highest weekend level (89%)—Bergen/Passaic, NJ edged out NYC for the top weekend spot. All weekly New York City occupancy measures were at pandemic-era highs. The market’s average daily rate (ADR) also hit a pandemic high, increasing 11% week on week to US$337, the nation’s third highest level behind Maui and the Florida Keys. Both occupancy and ADR, however, remained below levels seen in the comparable week of 2019.

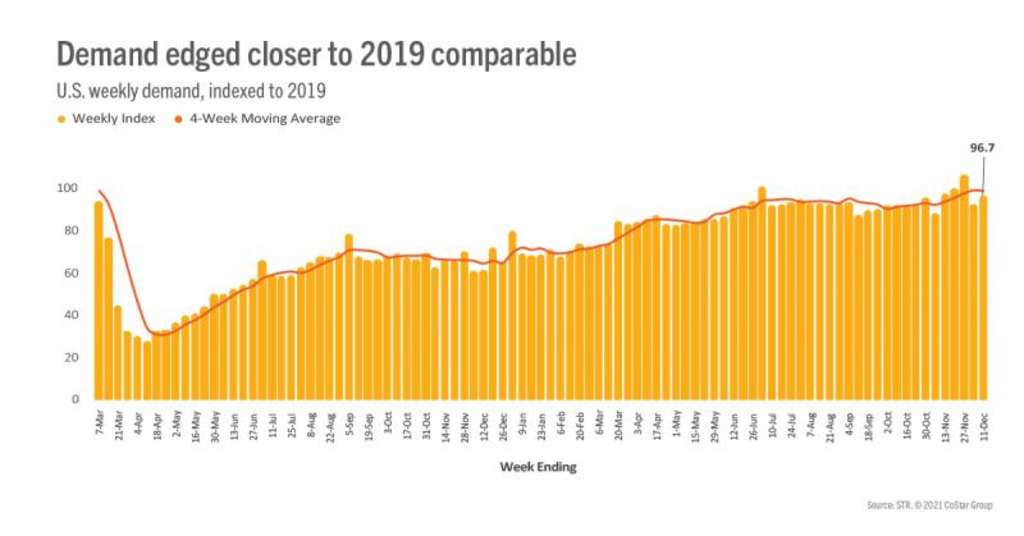

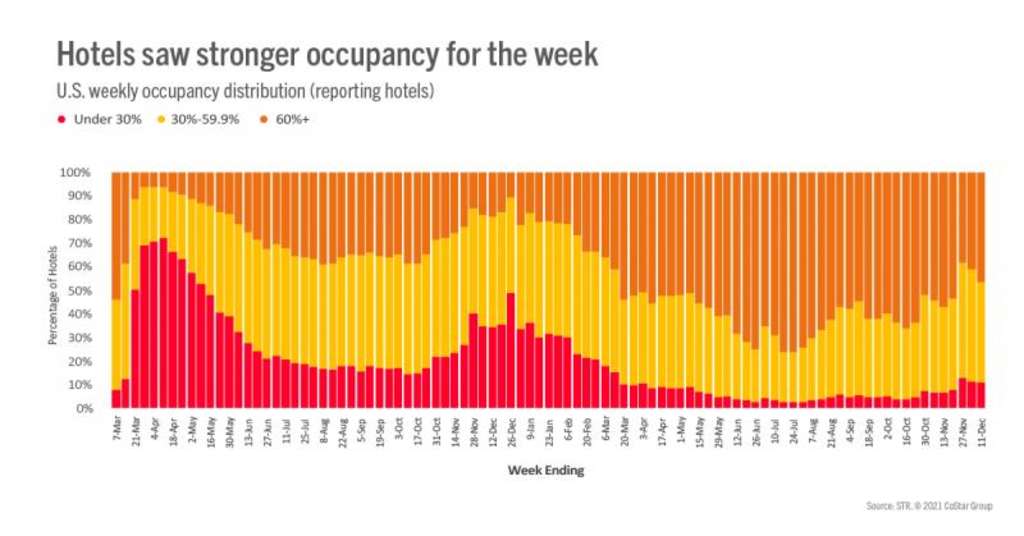

Total U.S. occupancy reached 57%, indexing at 95, meaning this week’s occupancy was five percent lower than in 2019. Since the start of the pandemic, occupancy has indexed at 95 or higher five times—most of those instances have been post-Labor Day. Forty-three percent of the 166 STR-defined markets saw weekly occupancy surpass 2019 with most of the remaining markets indexing above 90. Six markets (Boston, Oakland, San Jose, Washington D.C., Madison WI, and San Francisco) lagged the nation with an occupancy index below 80. On average, occupancy in these six markets was 18 percentage points lower than in 2019. Across the U.S., nearly half of reporting hotels had weekly occupancy above 60%, which was the most of the past three weeks and two percent less than in 2019.

At 62%, occupancy in the Top 25 Markets was at a four-week high with New York City adding more than a point to the level. Weekday occupancy (59%) in the Top 25 Markets achieved an 18-week high with weekend occupancy surpassing 70%. Weekday occupancy in central business districts (CBDs) within the Top 25 Markets ranged from 77% in Miami to 30% in St. Louis. Nine of the 17 CBDs saw weekday occupancy below 50%. In St. Louis, 47% of CBD hotels reported weekday occupancy under 30% for the week. In the same week of 2019, 9% of St. Louis’ CBD hotels had weekday occupancy under 30%. Indexed to 2019, weekday occupancy in the Top 25 Market CBDs was 72 but jumped to 93 for the weekend. Among all Top 25 Markets, 57% of hotels reported weekday occupancy above 60% as compared with 68% in 2019. Large hotels (more than 299 rooms) in the Top 25 Markets saw a significant pickup in the week as more than half reported weekday occupancy above 60%, the most since late July.

U.S. ADR produced little movement week over week, up 0.3%. Even with the limited growth, ADR was higher than what it was in 2019 with the index rising to 102. Weekly ADR has been above 2019 in 16 of the past 50 weeks with six of those occurrences happening after Labor Day. On an inflation-adjusted basis (real), ADR remained below 2019 levels and has only surpassed 2019 three times this year. The low gain in weekly ADR was driven by lower weekend ADR, most of which can be attributed to Miami, which hosted the Art Basel event in the prior week. Weekday ADR advanced by nearly 3% week over week, the largest such gain in 14 weeks. Top 25 Market ADR, however, declined week on week due to a sharp decrease in Miami (again, because of the Art Basel impact a week earlier). Excluding Miami, Top 25 Market ADR was up nearly 4%, driven by solid gains in San Francisco, New York, and other markets.

Weekly revenue per available room (RevPAR) produced a solid week-on-week gain, up 5% with the index to 2019 climbing to 97. Real RevPAR indexed to 2019 was 90 with the four-week average at 93. On a market-level, 69% posted weekly RevPAR at “peak” (RevPAR index to 2019 above 100) with another 24% in “recovery” (RevPAR indexed to 2019 between 80 and 100). Adjusted for inflation, 45% of markets were at “peak” and another 42% were in “recovery.” Taking a longer view using the past 28 days, 78% of markets were at “peak,” the same percentage as a week ago. On an inflation-adjusted basis, 55% of markets showed a 28-day RevPAR above the comparable period in 2019. Thirty-five percent were in “recovery” with most of the others in “recession” (RevPAR indexed to 2019 between 50 and 80). San Francisco remained in “depression” (RevPAR indexed to 2019 below 50) on both a nominal and real basis.

Outside of the U.S.

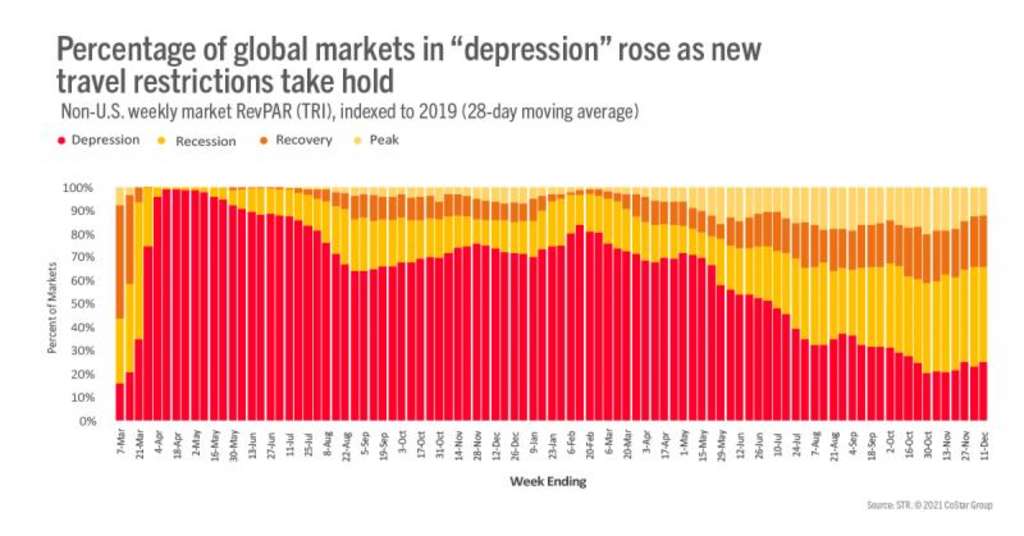

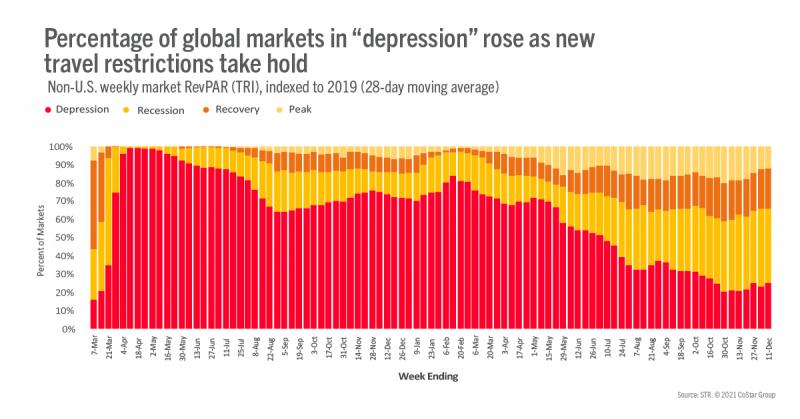

Occupancy outside of the U.S. fell by nearly half a percentage point to just below 50%, but the index to 2019 rose slightly from the previous week to 75. ADR produced a similar outcome as it dropped by 1.3% week on week with the 2019 index increasing to 104 from 101 the week prior.

Among the 10 largest countries based on hotel supply, weekly occupancy ranged from 68% in Indonesia to 33% in Germany. Weekly occupancy in Mexico rose to 60% and was the same as in 2019, whereas in Canada, occupancy dipped to 49%—compared with 57% in the matching week of 2019. U.K. occupancy fell by two percentage points, which was in line with seasonal declines. London saw a slightly larger weekly decrease. Declines in the U.K. are expected to worsen as new restrictions arise from the Omicron variant.

Several other countries saw drops in week-over-week performance, including Israel, which reported a 14-percentage point decline in occupancy due to numerous travel bans. Occupancy in Italy fell 9 percentage points from increased COVID cases and new restrictions for unvaccinated individuals, and Austria saw occupancy fall to just 9% as lockdowns continue. On the flip side, several leisure destinations, including Puerto Rico (79%) and the Dominican Republic (75%), are doing well as end-of-year travel season kicks into gear.

United Arab Emirates’ occupancy remained strong at 78% as Expo 2020 continued in Dubai along with the final round of the 2021 Formula One World Championship in Abu Dhabi. With the event, ADR and occupancy in Abu Dhabi rose to a pandemic-era high. Most other non-U.S. markets continued to suffer as 66% reported RevPAR categorized as being in in “recession” or “depression,” unchanged from the previous week.

Big Picture

It was good to see New York City take the top spot this week and set pandemic-era highs. Yes, there is still much uncertainty and increasing fear due to the emergence of the Omicron variant, but it’s wonderful to report a continuation of the recovery, especially in the Top 25 Markets. The next two weeks are expected to see stronger than usual performance for this time of year. Thereafter, we anticipate a slower period as individuals and businesses adjust and react to the new COVID strain.

*Note: Due to the holidays, the next edition of the Market Recovery Monitor will not be published until 6 January.

About STR

STR provides premium data benchmarking, analytics and marketplace insights for the global hospitality industry. Founded in 1985, STR maintains a presence in 15 countries with a corporate North American headquarters in Hendersonville, Tennessee, an international headquarters in London, and an Asia Pacific headquarters in Singapore. STR was acquired in October 2019 by CoStar Group, Inc. (NASDAQ: CSGP), the leading provider of commercial real estate information, analytics and online marketplaces. For more information, please visit str.com and costargroup.com.