Market Recovery Monitor - 22 January 2022

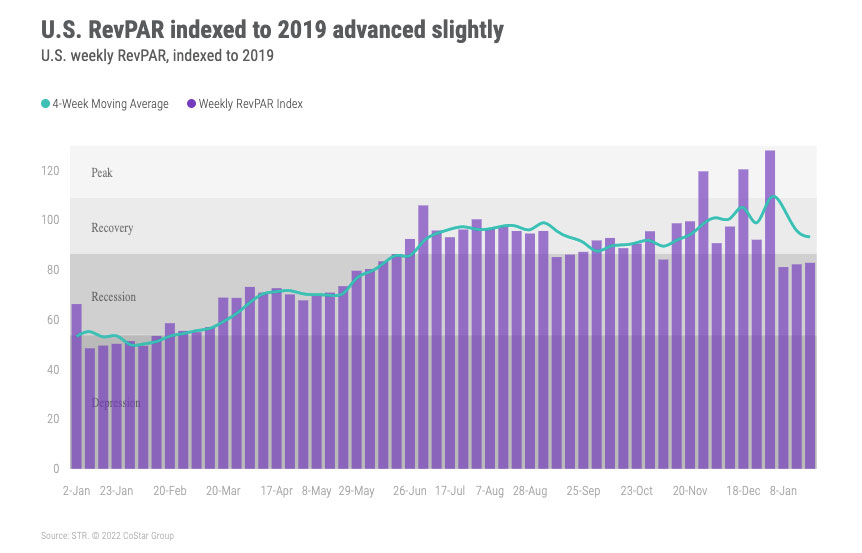

For a third consecutive week, U.S. hotel occupancy remained soft with occupancy for 16-22 January staying basically flat (-0.1 percentage point) at 48.7%. Room demand declined by 13,000 nights week on week but remained above 18 million and increased on a relative basis against 2019 with the index at 87.2, up 0.5 points week on week. Average daily rate (ADR) increased for a second week but by only 0.2% with the index to 2019 rising to 98.6. Revenue per available room (RevPAR) also moved slightly upwards (+0.1%) with the index to 2019 (82.9) the highest of the past three weeks.

While there is little doubt that Omicron has impacted travel in the month, we do see reason for optimism. The percentage of hotels with low weekly occupancy (under 30%) has not deteriorated to levels seen a year ago and was somewhat flat over the past two weeks. Three weeks ago, nearly a quarter of all U.S. hotels were reporting occupancy under 30%, but in the most recent week, the percentage was 18%.

We have seen the same trend in Urban locations, from 33% three weeks ago to 24% most recently. This trend makes sense as January is not a heavy leisure month, and it has been a strong leisure presence that has driven demand since the beginning of COVID. As the month is unfolding, leisure travel is picking up. This can be seen in the performance of resort hotels that are beginning to trend back up.

Airport hotels have done best over the past three weeks with an average occupancy of 55.3%. The top performing airport hotels have been in Miami airport locations (81%) followed by Hollywood FL (76%). Cities most likely to be impacted by winter weather also showed noteworthy airport submarket occupancy levels: Denver Airport/East (72%), La Guardia/Queens North (72%) and JFK/Jamaica (71%). Not surprising given the dearth of business and group travel, the worst performing hotels are in urban locations where occupancy has average 40% over the past three weeks. Large (300+ rooms) urban hotels have seen even lower occupancy (34%). Small urban hotels, under 75 rooms, saw better occupancy (51%) with medium sized (between 75 and 299 rooms) properties at 43%.

Hawaii had the highest occupancy of any state (66%) followed by Vermont (66%) and Florida (64%). Florida occupancy was up nearly two points from the week prior but remained about 15% below its 2019 level. Florida Keys continued to have the highest occupancy of any market (87%), joining eight other Florida markets in the top 10 for highest weekly occupancy. Overall, six of the 13 Florida markets had higher demand this past week than in the comparable week of 2019. Across the U.S., 47 markets were reporting room demand that topped 2019 this week, down from 58 a week earlier.

Weekday occupancy (47%) improved for a second consecutive week, driven by a stronger Sunday occupancy due to the Martin Luther King Jr. holiday. Otherwise, weekday occupancy would have been flat week over week. However, we did see a slight improvement in Tuesday and Wednesday occupancy. Weekend occupancy fell from 58% a week ago to 53% this week, and the index to 2019 (88) was the lowest of the past four weeks.

While ADR showed little movement, there were some dramatic differences. Weekday ADR increased by 3.5% week on week with more than half of the growth coming from MLK Sunday. Solid growth was also seen on Tuesday and Wednesday, when ADR was up nearly 3% each day. Weekend ADR fell by 5% after an 8% gain during the MLK weekend. Despite the drop, weekend ADR was 6% higher than the comparable period of 2019 and has been above 2019 levels for 35 consecutive weeks. On an inflation-adjusted basis, weekend ADR indexed at 95, the third straight week below 2019 levels.

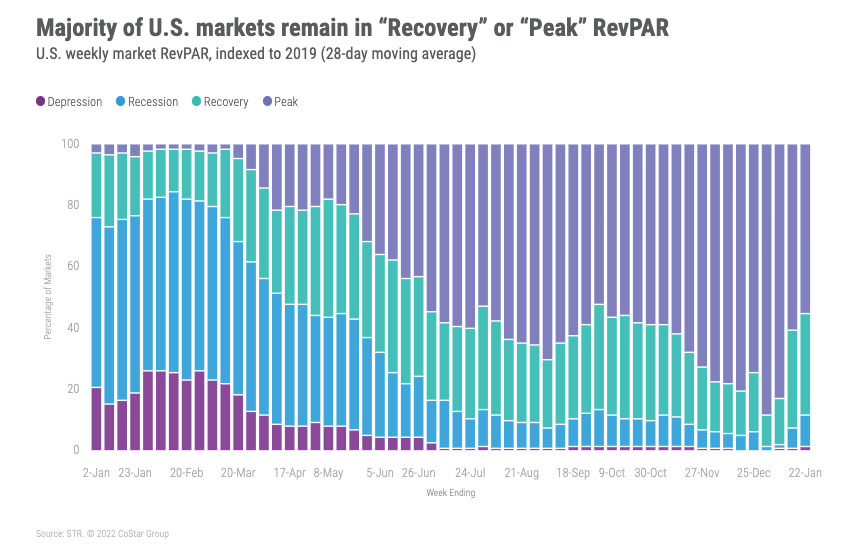

For a second consecutive week, 73% of the 166 STR-defined markets were categorized as being in “Recovery” (RevPAR indexed to 2019 between 80 and 100) or “Peak” (RevPAR indexed to 2019 above 100). On an inflation-adjusted basis, 64% of markets were in either one of those two categories. The Florida Keys had the highest weekly index (162) whereas San Francisco had the lowest (33). San Francisco and San Jose were the only two markets in the “Depression” category (RevPAR indexed to 2019 below 50). On a 28-day moving total basis, 55% of markets were at “Peak” RevPAR, the least of the past 16 weeks, and 33% were in “Recovery.” Considering inflation, 43% of markets were at “Peak” RevPAR over the past 28 days with another 37% in “Recovery.”

Outside of the U.S.

Global occupancy, excluding the U.S., ticked down for a third consecutive week to 39.1%, the lowest level of the past 37 weeks. Only six countries saw occupancy above 60%, led mostly by destinations: Curaco, the Dominican Republic, Barbados, and the Maldives. The United Arab Emirates and Singapore were the only two non-destination locations with similar occupancy as the UAE continues to see strength because of Expo 2020 in Dubai, and Singapore sees COVID quarantine-related demand.

Among the top 10 countries based on supply, Indonesia had the highest weekly occupancy (52%), followed by U.K. (50%), where occupancy increased nearly five percentage points week on week. Germany continued have the lowest occupancy of the top 10 (27%) followed by Italy (27%) and Canada (33%). China saw a six-percentage point week-over-week occupancy decline driven by Dalian (new travel restrictions), Beijing (effectively closed in prep for Beijing Winter Olympics), Guangzhou & Shanghai – all down more than 20% week-over-week. China is preparing for the Lunar New Year, which may also be driving a reduction in travel as people want to ensure they can make it home for the holidays.

After dropping last week, occupancy in Russia increased to 47% due to strong growth in Russia Provincial and Saint Petersburg.

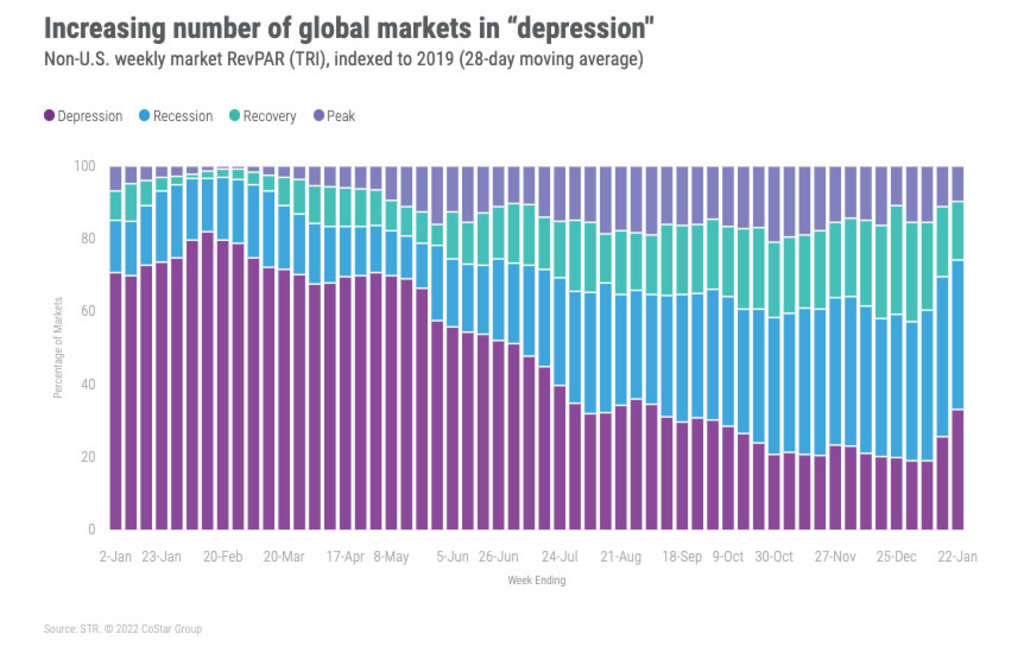

Most markets (74%) outside the U.S. remain in “Depression” or “Recession” (RevPAR indexed to 2019 between 50 and 80). Of note, Madrid was up significantly week over week as occupancy increased to 41% with ADR advancing 13%. The city played host to FITUR 2022 (an international tourism fair) from 19-23 January. Even with improved weekly performance, Madrid remained in the “Recession” category.

Big Picture

Optimism for a strong 2022 was heard on and off stage at this week’s American Lodging Investment Summit (ALIS) in Los Angeles. Most expect weakness in corporate transient and groups to persist for some time to come with strengthening as the year progresses. While this week’s data continued to show weakness, better days are ahead as Omicron lessens and leisure travels returns. STR’s latest forecast, released at ALIS, predicts that the U.S. will achieve full recovery to 2019 levels in 2023 with occupancy and ADR surpassing 2019 levels consistently from the summer of 2022 onwards.

About STR

STR provides premium data benchmarking, analytics and marketplace insights for the global hospitality industry. Founded in 1985, STR maintains a presence in 15 countries with a corporate North American headquarters in Hendersonville, Tennessee, an international headquarters in London, and an Asia Pacific headquarters in Singapore. STR was acquired in October 2019 by CoStar Group, Inc. (NASDAQ: CSGP), the leading provider of commercial real estate information, analytics and online marketplaces. For more information, please visit str.com and costargroup.com.