Master your hotel commercial strategy - Predicting demand & pricing correctly

The hospitality industry has changed and hoteliers need to adapt - efficiency is now vital. It is shortsighted at best - damaging at worst - to think that commercial teams can continue to work in silos.

To knit commercial teams together for optimal efficiency you need a holistic commercial strategy that is supported by the four pillars of: predict, price, distribute and analyse.

With such uncertainty hanging over the market, being able to accurately predict and act on demand signals will give you a head start on your competition.

Accurately predicting demand in your market

The hotelier playbook has been torn up and historical data has had to take a back seat. It is mission critical for hoteliers to invest in technology that can discover new and changing patterns of customer behaviour. This enables commercial teams to convert early demand signals - taking potential guests from lookers to bookers.

Hoteliers have long struggled to fully understand the guest journey before booking. Now, with market intelligence tools you can look at pre-booking, forward looking data points, to view unconstrained demand and move ahead of the booking curve.

Uncovering new revenue opportunities with forward looking data

Markets are still changing in the blink of an eye. A predictive market intelligence solution can help you create accurate forecasts for more informed revenue decisions, based on real-time, forward-looking demand projections, 365 days in advance.

You can more precisely predict demand levels in your market with early demand signals for flights, hotel searches, stay patterns, domestic/international travel, and leisure/business, collected from multiple data sources.

By better anticipating future demand levels you can spot and take advantage of short, mid and long-term revenue opportunities and capture your target audience ahead of your competition, with the correct pricing, discounting and promotional strategies.

Identifying and capturing demand with a sales and marketing strategy driven by forward looking data

With a predictive market intelligence tool, you can now see in real time where demand for your market is originating from and how it develops. This can be viewed at a granular level, looking at sub-location/airport of origin, geo-search, stay pattern, and accommodation types, including alternative accommodation (private rental sites).

Armed with insights on the booking window, stay pattern and demand origin, you can create marketing campaigns that target precise dates, LOS and source country, when guests are still in the inspiration phase of the customer journey.

By personalising your digital advertising and rolling it out where you know demand already exists delivers improved ROI and increased revenue.

With this data-first approach to marketing, teams can better allocate budget to markets which show the highest demand signals, while restricting budget for markets and segments that won’t bring the desired ROI.

Both revenue management and marketing can utilise future demand data by being the first to release targeted incentives, offers and packages, and new pricing strategies. Understanding booking intent is the essential component needed to align revenue management and marketing and improve business performance.

Once you've identified demand patterns in your market, how do you build a suitable pricing and promotional strategy that mirrors demand?

Capturing demand with an effective pricing and promotional strategy

Getting room prices right is the bedrock of revenue management. But there are so many factors to consider when devising an effective pricing strategy for your business, it can be hard to know where to begin.

In this dynamic landscape it’s time to re-evaluate to find real success. The key to gaining control of the situation and making confident decisions is real-time, actionable data.

It’s an incredibly fine balance of filling your rooms, while making sure they are being sold at the right price to the right guests – maximising RevPar. Ultimately, pricing hinges on supply and demand, but the difficulty is demand varies frequently depending on events, timing, trends and competition.

To complicate matters, in the current situation demand is still reduced and supply is the same – forming a highly competitive environment.

Start by automatically monitoring your rates

Data is the answer to shaping your pricing strategy. However, there’s a huge amount of data to harvest and interpret before setting rates, and it would be nigh impossible to manually monitor all market fluctuations.

To make informed and confident decisions when setting and adjusting your pricing strategy, the best way forward is using real-time rate and market data that is refreshed live.

A rate intelligence tool displays an accurate view of your competitors’ current, past and future rates in an easy-to-read format across all key OTAs, brand.com and GDS.

With real time rate changes at your fingertips the process of analysing your compset’s rates and then setting rates is simplified. Revenue managers can react within seconds, by simply examining the data and responding. Efficiency improves and time is saved to work on key tasks.

With this data available in one dashboard, with simple reporting, accessible to all teams – not only do revenue managers benefit but all commercial departments have a bird’s eye view of the rate environment to inform their own strategy.

Marketers stand to gain from the analysis provided by a rate intelligence tool by using data such as compset monitoring and your hotel’s competitive price positioning to fine-tune and improve the performance of marketing campaigns.

It is knowledge sharing like this that unlocks new opportunities and efficiencies.

How to construct a bulletproof pricing and promotional strategy?

In order to make the right decision with absolute confidence, you need advanced rate intelligence.

Without accurate data on discounting and promotional activity in your market, the ability to construct a long-term pricing strategy that is adaptable to market conditions is highly challenging.

There is now greater variety in cancellation policies, ancillary bundles, length of stay discounts, and discounts for mobile bookers. Further complicating the pricing process for revenue managers. This level of complexity requires a simpler way to view data.

The new Rate Strategy feature, within Rate Insight (enterprise subscription), provides a high-level overview of pricing and promotional strategies – showing multiple insights regarding competitor, market and own-property information.

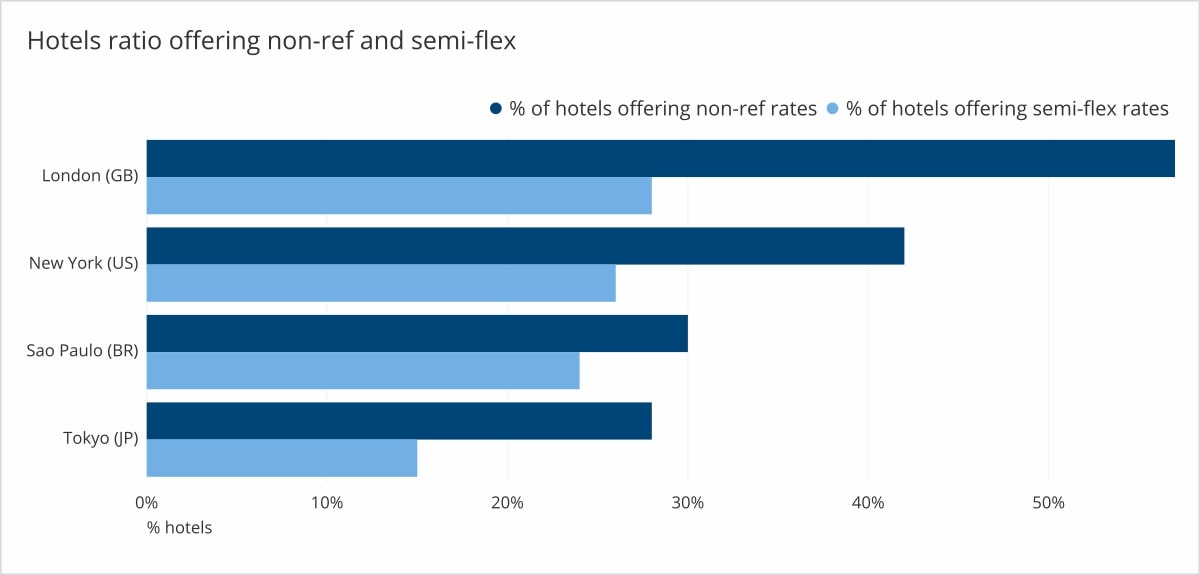

With key promotional insights from median breakfast cost, length of stay discounts, the percentage of hotels with mobile discounts, to semi-flex and non-refundable rates – all in one dashboard – you are now able to immediately spot patterns to help make informed pricing, discounting and promotional decisions.

You can uncover the underlying reason behind changes in your rate position – reveal the long-term promotional and discounting strategies of your competitors – then benchmark your own strategy and discount levels against your compset.

These types of insights can help drive interdepartmental decision making. Do the food and beverage (F&B) department need to further investigate meal type offerings? Should e-commerce consider altering the mobile discounts in play? Should marketing incorporate non-price offers to convert potential guests?

Conclusion

Embracing new market intelligence tools, powered by forward looking data is the first step to breaking the silo effect at your hotel and implementing a holistic commercial strategy.

With simple and actionable demand insights, available from one centralised dashboard, teams can work cross-functionally and make more informed decisions to achieve overall business goals.

Revenue managers and their fellow commercial teams then need to to be more data-centric when it comes to pricing – while pairing this with an approach that compresses analysis, decision-making and application into much shorter time frames.