Lodging Analytics Research & Consulting (LARC)’s 1Q-2022 Hotel Industry Outlook and Market Intelligence Reports

During 2022 thus far, the U.S. economy and hotel industry are facing a variety of uncertainties. We attempt to incorporate all of these risks into our national and market level outlooks. However, each of these uncertainties can have varying levels of implications.

Risks From New Covid-19 Variants- While the effects of both variants were short-lived, there is no doubt that both the Delta and Omicron variants disrupted the travel recovery during the second half of 2021 and early 2022. While there remains risk of new variants emerging, we expect any such impact should be less significant than the previous, as the U.S. attempts to move beyond the pandemic. The one exception being a vaccine resilient strain of the virus. We do not assume any new variants emerge in our outlook.

Elevated Inflation and the Response from the Federal Reserve- CPI rose 7.5% in January- the highest rate of increase since 1982. Elevated inflation is clearly having an impact as it has spurred the Fed to talk openly about multiple rate hikes this year and our outlook assumes the Fed raises rates 25 bps four different times in 2022, beginning in March. However, our outlook also points to inflation moderating as we move through the year and labor constraints easing as well. Nonetheless, rising inflation and increasing interest rates will limit economic growth and pressure hotel industry expenses.

Supply Chain Issues- It is estimated that supply chain disruption cost the global economy a full percentage point of growth in 2021. These issues are unlikely to ease in the near-term, especially with the Russian invasion of Ukraine further disrupting supply chains in Eastern Europe.

Russian Invasion of Ukraine- The good news is that Russia is the 40th largest trade partner of the U.S. As such, the economic sanctions placed on Russia are unlikely to have a significant impact on the U.S. However, Russia produces 10% of the world’s oil and 17% of the world’s natural gas and is the largest provider to Europe for both. As such, the implications on Europe will be significant and there will inevitably be some degree of secondary impact on the U.S. We expect the U.S. impact to be most significant on the East Coast gateway markets that rely more heavily on European international travel than other markets.

Despite these uncertainties, we expect corporate travel to accelerate and group travel to strengthen in 2022. While we anticipate leisure travel to remain robust, we do not expect the strength associated with this past summer’s pent-up leisure demand to persist through the year.

Overall, our forecasts remain encouraging, driven by increasing ADR. Average daily rate growth has continued to exceed our expectations, as 4Q-2021 ADR continued to recover, despite the onset of the Omicron variant. In fact, 4Q-2021 ADR was just 2.0% below 2019 levels, and January 2022 levels were also just 2.0% below prepandemic results.

We continue to expect there to be markets that materially exceed pre-pandemic levels and other areas that continue to be well behind those levels. While year-over-year growth may be strongest at some of the markets that have experienced the least amount of recovery to date, it is off a low base and many of the markets that have already recovered will still drive the best returns relative to prepandemic levels. We generally believe leisure markets will remain strong while international gateway markets may take the longest to fully recover to pre-pandemic levels. Sector participants will need accurate, transparent, and detailed data to decipher between winning and losing markets, especially if they wish to take advantage of market dislocations that may occur in the near-term.

We believe the best business decisions are based on the best information that is available at the time of making that decision. We take that approach with our forecasts; using the best available information to provide the most likely outcome. As such, we believe clarity surrounding forecasting is critical to the lodging industry, which is why we are transparent with our clients, not just on what our forecasts are, but how we arrived at them.

LARC’s industry-leading market intelligence referred to throughout this document will help all industry participants navigate the current environment and position themselves for success as the recovery progresses. Please contact us directly to learn more about our services and products and if there is any other way we may be able to serve you.

Fiscal Stimulus, Inflation, and the Return to the Office

With The Omicron variant impact waning across the country, much of the U.S. population is optimistic that the pandemic is in the rear-view mirror. While new variants may again disrupt U.S. economic growth and the lodging recovery, we also are optimistic that the pandemic’s greatest impacts are in the past.

Despite the impact from the spread of the Omicron variant the fourth quarter marked a period of continued economic recovery with Real GDP up an estimated 6.9%,. However, the greatest effects from the Omicron variant are likely to appear in 1Q-2022 economic activity. Interestingly, CPI grew by an estimated 7.1% in 4Q-2021, illustrating outsized inflationary growth. While inflation will be stubbornly high in the short-term, we continue to view it as transitory. Moody’s Analytics outlook for inflation is just 3.0% in 2022. However, one of the ways that inflation will be held in check will be through several Fed rate increases.

The fourth quarter also marked a continuation of 3Q trends, with improvement in leisure travel. Corporate and group travel also began a recovery at the start of the fourth quarter, but the rebound was quickly paused by the Omicron variant. As the country moves past the greatest impacts from the Omicron variant, some sense of normalcy should begin to emerge.

While that is positive and points to the end of the pandemic approaching and a full travel recovery, the U.S. is still part of a global ecosystem. Many experts believe that the U.S. will maintain a level of risk until the world vaccination rate approaches a 65% level, which is not likely to occur before mid-2022. As such, while the U.S. has opened its borders, it will likely take a considerable amount of time for international travel to recover to prepandemic levels.

Perhaps what has been most impressive in recent months is the strength in the lodging industry’s ADR recovery. The broader U.S. industry generated average daily rates in excess of 2019 levels in each month of both 3Q-2021 and 4Q-2021. The industry’s pricing power continues to exceed our expectations and is paving the way for a faster recovery.

While leisure travel has driven the recovery to date, the immense level of pent-up leisure demand experienced this summer will transfer into pent-up corporate and group demand in the coming months. As such, we expect corporate travel and group travel to accelerate off anemic levels in the coming months, supporting a robust and rapid industry recovery. We acknowledge that the corporate recovery will be dependent on the return to the office, but we expect that to gain meaningful momentum in 1H-2022. Additionally, while group attendance may be lighter than historically, the number of events is recovering rapidly, helping generate a base level of demand that will further support pricing power.

With that backdrop, our economic forecast from Moody’s Analytics makes the following key national assumptions:

- $1.2 trillion “Build Back Better” program passes in 2Q-2022 and is enacted over several years

- The Fed will raise rates by 25 bps four times in 2022, beginning in March

- Elevated inflation is transitory and labor supply constraints ease in the near-term

Moody’s Analytics forecasts U.S. GDP to increase 0.5% in 1Q-2022 and 3.7% in 2022.

LARC’s Industry Outlook

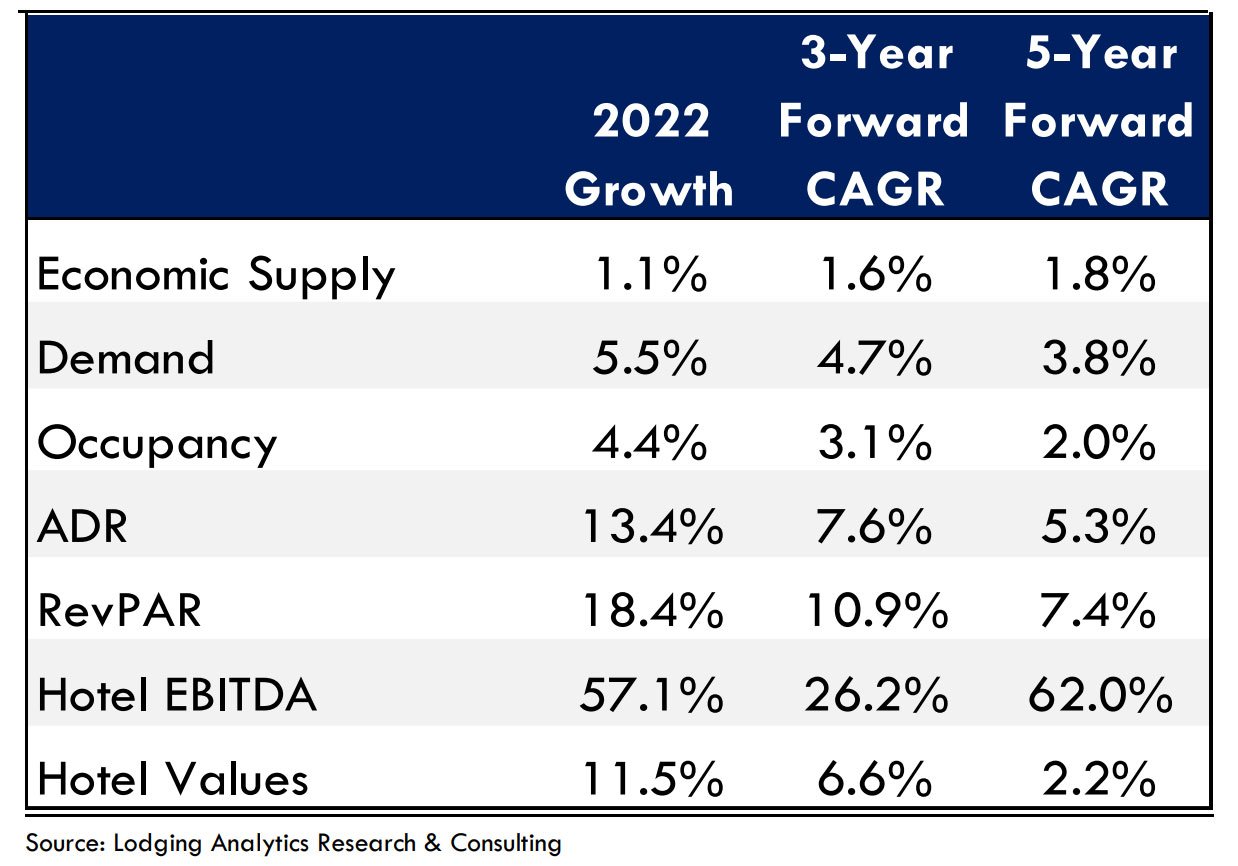

Currently, LARC expects U.S. RevPAR to increase by 18.4% in 2022, driven by a 4.4% increase in occupancy and a 13.4% increase in average daily rate. LARC also anticipates U.S. Hotel EBITDA to grow by almost 60% and hotel values to increase 12% in 2022. We continue to forecast ADR and hotel values to recover to 2019 levels in 2022, while RevPAR and Hotel EBITDA will reach 2019 levels in 2023 and occupancy stabilizes slightly below 2019 levels by 2023.

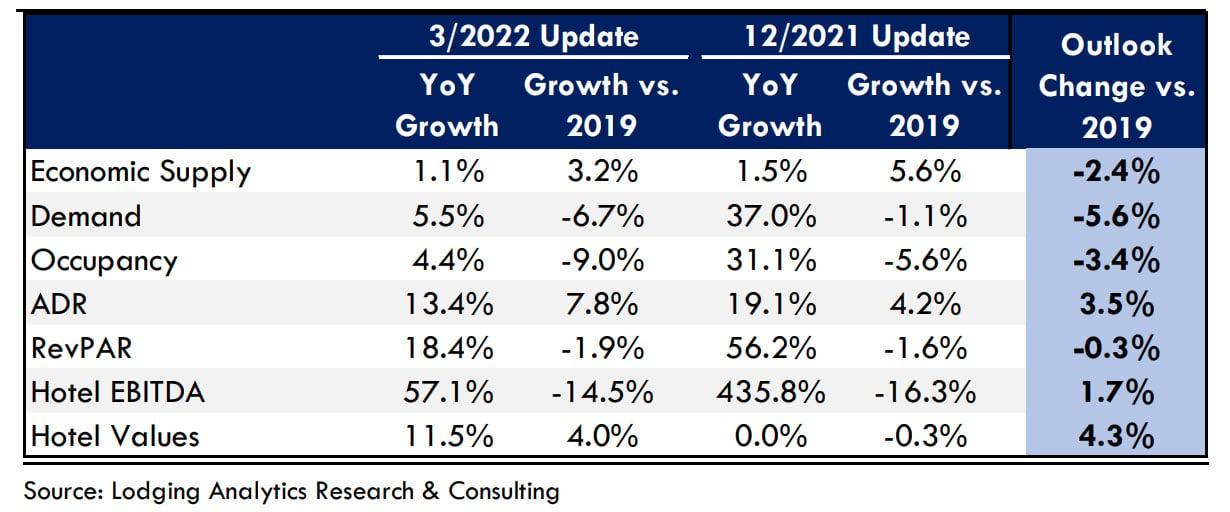

LARC’s U.S. RevPAR model has an R-squared of 99.6% with a standard error of 5.1%, back-tested to 2000. LARC’s U.S. Cap Rate model has an R-squared of 98.3% with a standard error of 27 bps, back-tested to 2005. The tables below illustrate a summary of LARC’s current U.S. Hotel Industry Outlook in contrast to last quarter’s outlook. Ultimately, our 2022 outlook for demand declined driven by the Omicron variant and its 1Q-2022 impact. However, that decline was offset by a lower supply growth outlook and an improvement in ADR growth, resulting in 2022 RevPAR that is almost unchanged from a quarter ago.

March 2022 U.S. Hotel Industry Forecast Summary

2022 U.S. Hotel Industry Forecast: March 2022 Edition vs. December 2021 Edition

Market Outlooks

We continue to expect the various demand segments of the hotel business to recover in the following order: driveto leisure, fly-to domestic leisure, domestic business travel, large citywide conventions, small in-house group, international business travel, international leisure. Therefore, markets with a greater concentration of hotel demand from the leisure segments and less from international and in-house groups are likely to recover relatively faster.

Below is a list of the best and worst performing markets based on our forecasts. Similar to our U.S. forecast, our market level forecasts are built entirely on multi-variable regression models with high historical accuracy (Rsquareds for each model seen on the next page).

More detail on our market outlooks can be found in LARC’s Market Intelligence Reports. Please contact us if you are interested in purchasing any of LARC’s offerings.

2022 (relative to 2019)

Top Markets for RevPAR Growth:

Norfolk, Tampa, Miami, Phoenix and Houston

Bottom Markets for RevPAR Growth: San Francisco, New York, Chicago, Boston and Honolulu

2022 (year-over-year)

Top Markets for RevPAR Growth:

San Francisco, Washington, D.C., Minneapolis, Seattle and Boston

Bottom Markets for RevPAR Growth:

Norfolk, Miami, Detroit, Tampa and Las Vegas

2019 - 2026 Outlook

Top Markets for RevPAR Growth:

Miami, Tampa, Las Vegas, Norfolk and Orlando

Bottom Markets for RevPAR Growth:

San Francisco, Boston, New York, Chicago and Philadelphia

Top Markets for Value Change:

Tampa, Los Angeles, Phoenix, Nashville and Denver

Bottom Markets for Value Change:

New York, San Francisco, Chicago, St. Louis and Philadelphia

Ryan Meliker

President

Lodging Analytics Research & Consulting, Inc