Reshaping the landscape: Corporate travel in 2022 and beyond

As health concerns and travel restrictions abate, corporate travel is making a steady, but slow, return; recovery to 2019 levels is still likely at least a couple of years away

Introduction

Travel is back—so say news stories and corporate earnings calls since the summer of 2021. There are caveats though, and they represent a large share of industry revenue. International travel still awaits an improved pandemic situation and less daunting border restrictions. Corporate travel remains below 50% of prepandemic spend and faces a more complex prognosis than leisure travel.

COVID-19 is still with us, and eradication seems unlikely. But officials and large organizations are moving away from some restrictions and requirements implemented earlier in the crisis. Hawaii ended its mask mandate on March 26, the final state to do so. Public school systems around the United States have also moved away from requiring masking.1 This spring and summer, many large companies will implement the return-to-office plans they delayed in the fall of 2021. An uptick in travel will likely accompany this shift to more office-based work.

Over the remainder of 2022, corporate travel should grow significantly from its now-small base. Team meetings that have been postponed multiple times will finally take place. More conferences will shift back from online to in-person, and those that already have will likely see attendance improve. Even international trips should grow significantly, although some regions will recover faster than others.

Many uncertainties still hover around the travel industry, from the trajectory of the war in Ukraine to the possibility of China reopening its borders, to the emergence of more COVID-19 variants. A major development in any one of these arenas could accelerate or impede corporate travel’s return. At the same time, the new shape and smaller size of corporate travel can be seen more clearly than a year ago, when Deloitte published its first look at corporate travel’s recovery, Return to a world transformed.2 As health concerns subside, companies will want to continue to bank some of the financial savings and environmentally friendly practices realized from two years of very limited travel. Corporate travel’s return has begun, but the conferencing technology that replaced nearly all of it beginning in early 2020 will likely continue to replace some of it for the foreseeable future.

Looking around the corner to see what corporate travel will look like as the world moves on from acute health crisis to living with endemic COVID-19, it appears both growth and change await.

Climbing back: Corporate travel expectations and projections

The first year of the COVID-19 pandemic walloped corporate travel spend. From April 2020 through the first half of 2021, COVID-19 halted all but the most essential trips. When Deloitte fielded its first corporate travel survey3 in June 2021, corporate travel spend sat around 10% of prepandemic levels. But a rebound appeared to be just around the corner. Vaccines had been widely available in the United States for a few months and many companies planned to bring employees back to offices by the fall.

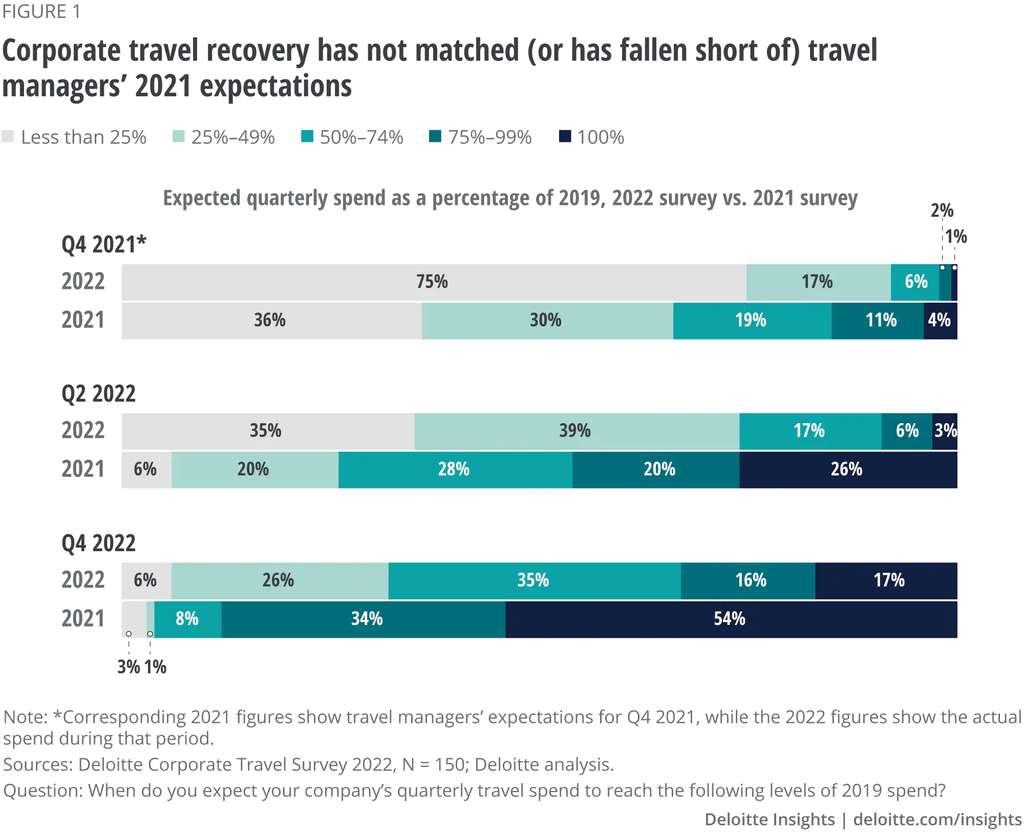

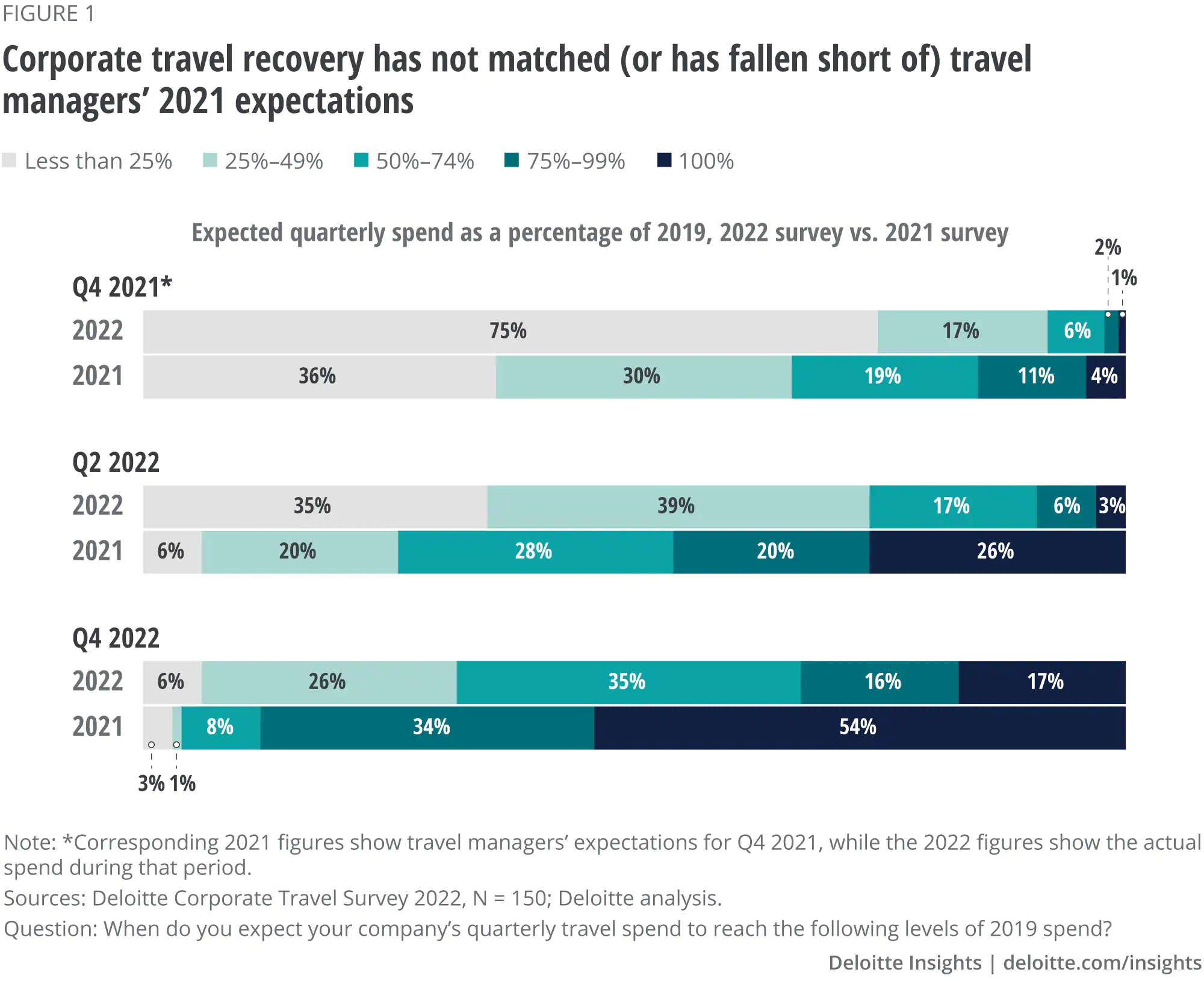

A month later, delta was named a variant of concern, and many big companies pushed back their plans. The omicron variant followed delta, bringing further disruption. Corporate travel spend increased throughout the third and fourth quarters of 2021, but not at the rate that travel managers expected. When surveyed in June 2021, 34% of corporate travel managers expected to reach half of 2019 travel spend by the end of 2021. However, only 8% did (figure 1).

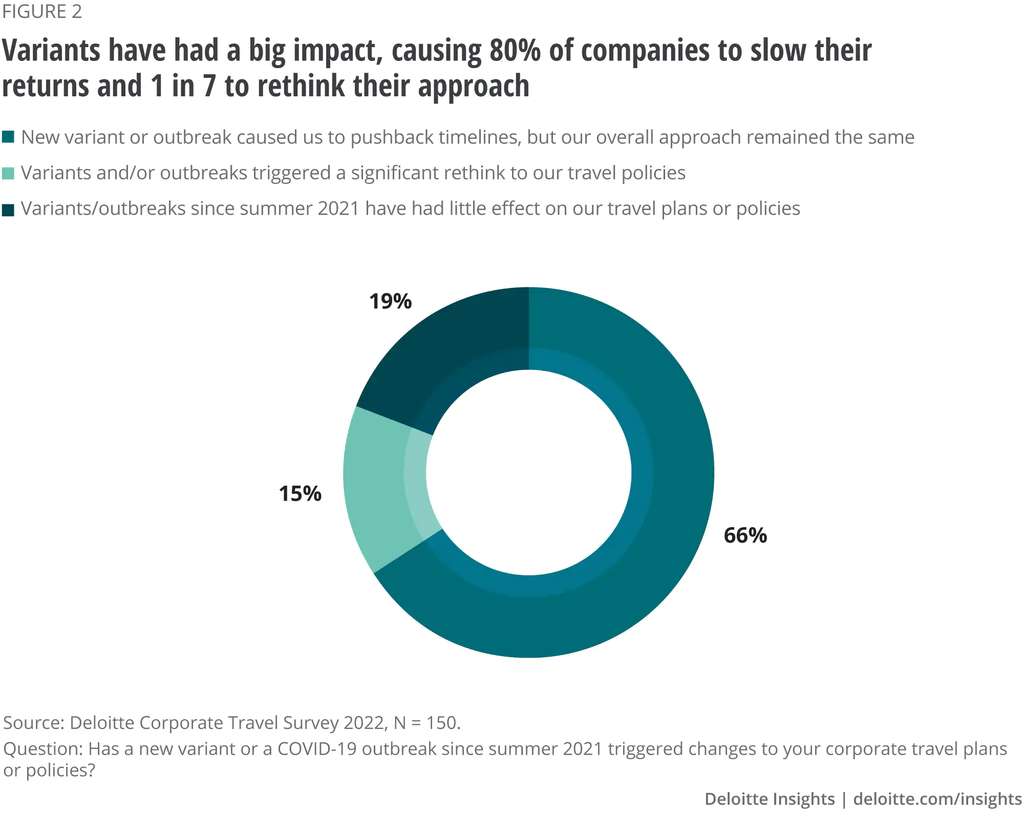

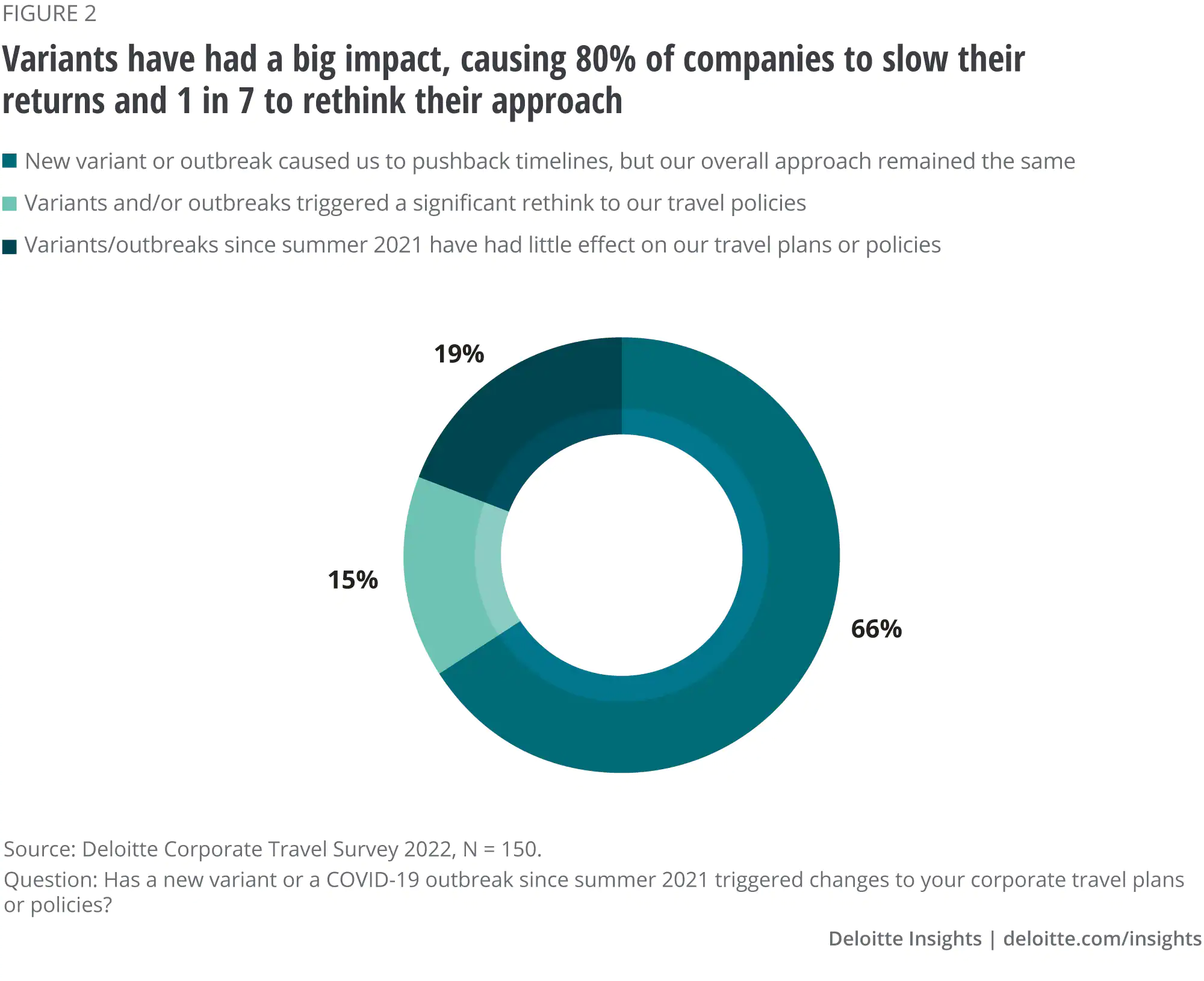

Travel managers have also reduced their expectations for recovery in 2022. Only 17% expect a full recovery by the end of 2022, versus more than half of the respondents to the 2021 survey. The experience of the delta and omicron variants partly explains this less optimistic outlook. Two-thirds of respondents say that new variants and outbreaks since summer 2021 caused them to push back their travel timelines. One in seven reported a significant rethink of their travel plans (figure 2).

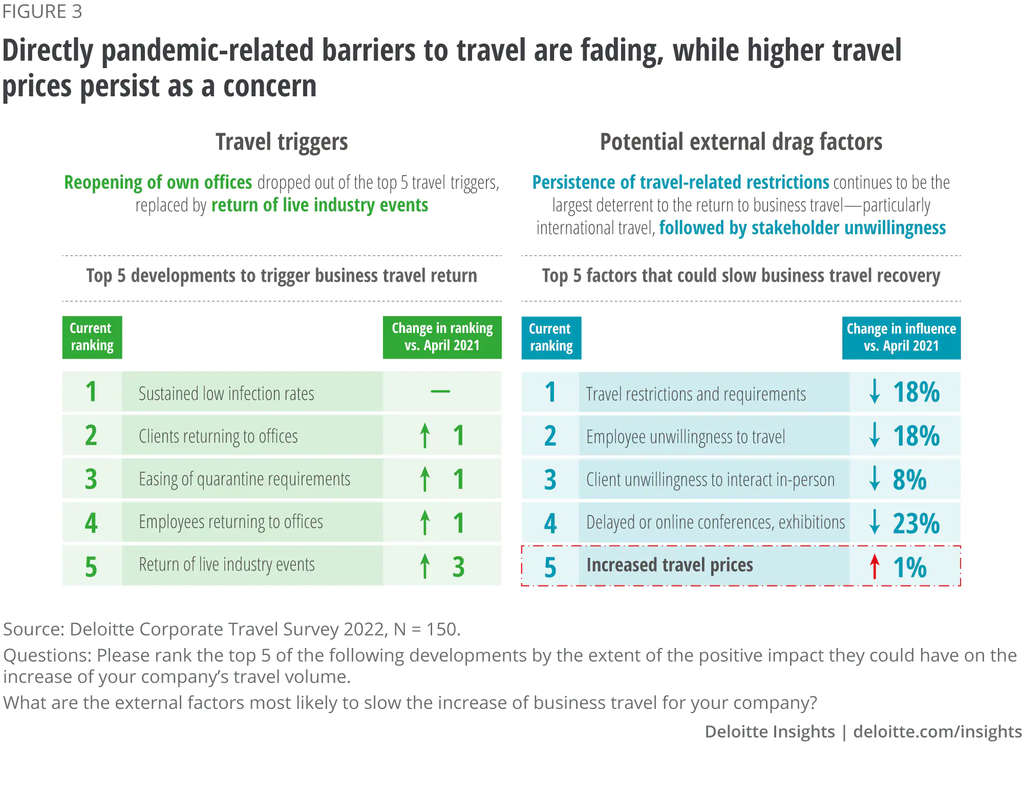

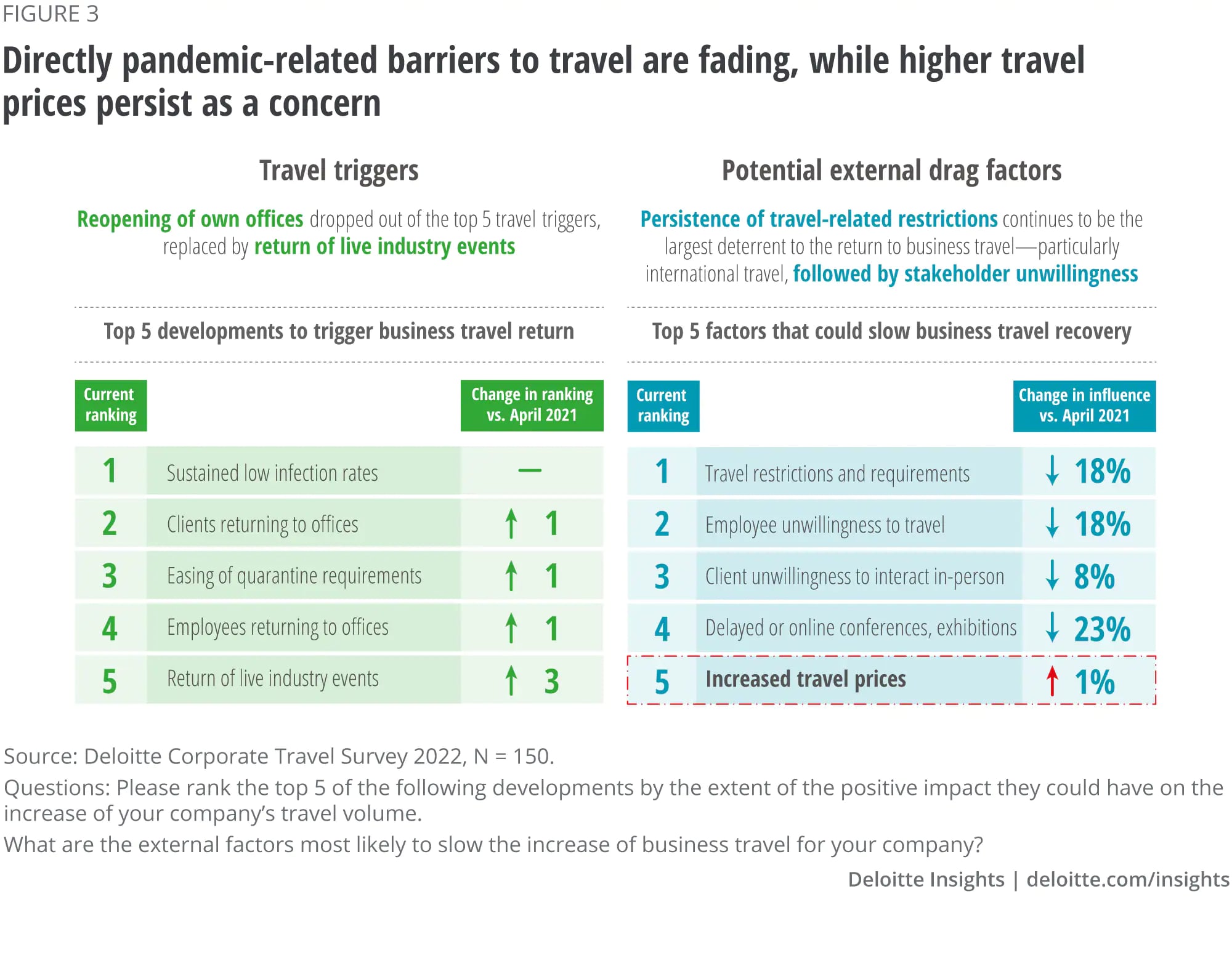

Corporate travel leaders continue to watch the trajectory of the pandemic and related regulations, but their emphasis is shifting from the disease toward the bottom line. Sustained low infection rates remain the top development that will trigger an increase in trips, and the persistence of travel-related restrictions continues to be the biggest drag on travel (figure 3). But the relative importance of drag factors has changed. Concerns about restrictions, employee willingness to travel, and in-person events have reduced significantly. As they decline, concerns about increased travel prices have increased from 2021 to 2022, indicating it could be a long-term issue.

COVID-19 appears to be fading as a primary daily concern. Return-to-office is expected to accelerate this spring, making it easier to ask employees to travel and easier to set up in-person client meetings. The spring 2022 season of live industry events, without the specter of concerning variants, should reap better attendance than in fall 2021. Still, corporate travel is not expected to snap back to prepandemic levels this year, or even reach that milestone in 2023 (figure 4).

Click here to read the full article

About Deloitte

Deloitte refers to one or more of Deloitte Touche Tohmatsu Limited, a UK private company limited by guarantee ("DTTL"), its network of member firms, and their related entities. DTTL and each of its member firms are legally separate and independent entities. DTTL (also referred to as "Deloitte Global") does not provide services to clients. In the United States, Deloitte refers to one or more of the US member firms of DTTL, their related entities that operate using the "Deloitte" name in the United States and their respective affiliates. Certain services may not be available to attest clients under the rules and regulations of public accounting. Please see www.deloitte.com/us/about to learn more about our global network of member firms.

Deloitte provides industry-leading audit, consulting, tax and advisory services to many of the world's most admired brands, including nearly 90% of the Fortune 500® and more than 8,500 U.S.-based private companies. At Deloitte, we strive to live our purpose of making an impact that matters for our people, clients, and communities. We leverage our unique blend of business acumen, command of technology, and strategic technology alliances to advise our clients across industries as they build their future. Deloitte is proud to be part of the largest global professional services network serving our clients in the markets that are most important to them. Bringing 180 years of service, our network of member firms spans more than 150 countries and territories. Learn how Deloitte's approximately 460,000 people worldwide connect for impact at www.deloitte.com/us.