From private investment to big capital: the professionalisation of the Dutch holiday park market

Where long-haul travel once seemed self-evident, destinations closer to home have now become more popular. Dutch travellers increasingly opt for holidays within the country, a trend that particularly benefits holiday parks. This development is expanding: international visitors are also discovering the Netherlands as an attractive and accessible holiday destination. As a result, demand for holiday parks is growing rapidly, while the development of new parks has slowed in recent years and even risks coming to a halt. This puts pressure on the market: without new investments, there is a looming shortage of suitable holiday park accommodation.

Beyond the rising demand for holiday parks, new dynamics are reshaping the playing field. First of all, there is an ongoing societal debate about allowing permanent residence in parks, which could potentially offer additional operating opportunities. Furthermore, climate change is set to play an increasingly significant role in travel behaviour. Consider the heatwaves in Southern Europe: the hotter it gets, the more tourists seek cooler holiday destinations. This is expected to strengthen the Netherlands’ position as a travel destination.

Number of overnight stays rises in the Dutch accommodation sector

The number of overnight stays in the Netherlands continues to increase, driven by tourists and leisure guests. The accommodation market is broad, with hotels traditionally holding the largest share. Holiday parks, which previously represented a smaller segment, have now become strikingly popular.

Hotels versus holiday parks: a shifting picture

Before the COVID-19 pandemic, hotel stays grew faster than overnight stays in holiday parks. This changed during the pandemic: hotel stays plummeted to a historic low, while holiday parks experienced only a slight dip. After the pandemic, holiday parks recovered quickly and continued steady growth. Hotel stays, on the other hand, picked up later, mainly due to a slower recovery among business travellers.

Hotels are now seeing a clear increase in leisure guests. Together with the structural growth of holiday parks, both segments are benefiting from changing travel patterns.

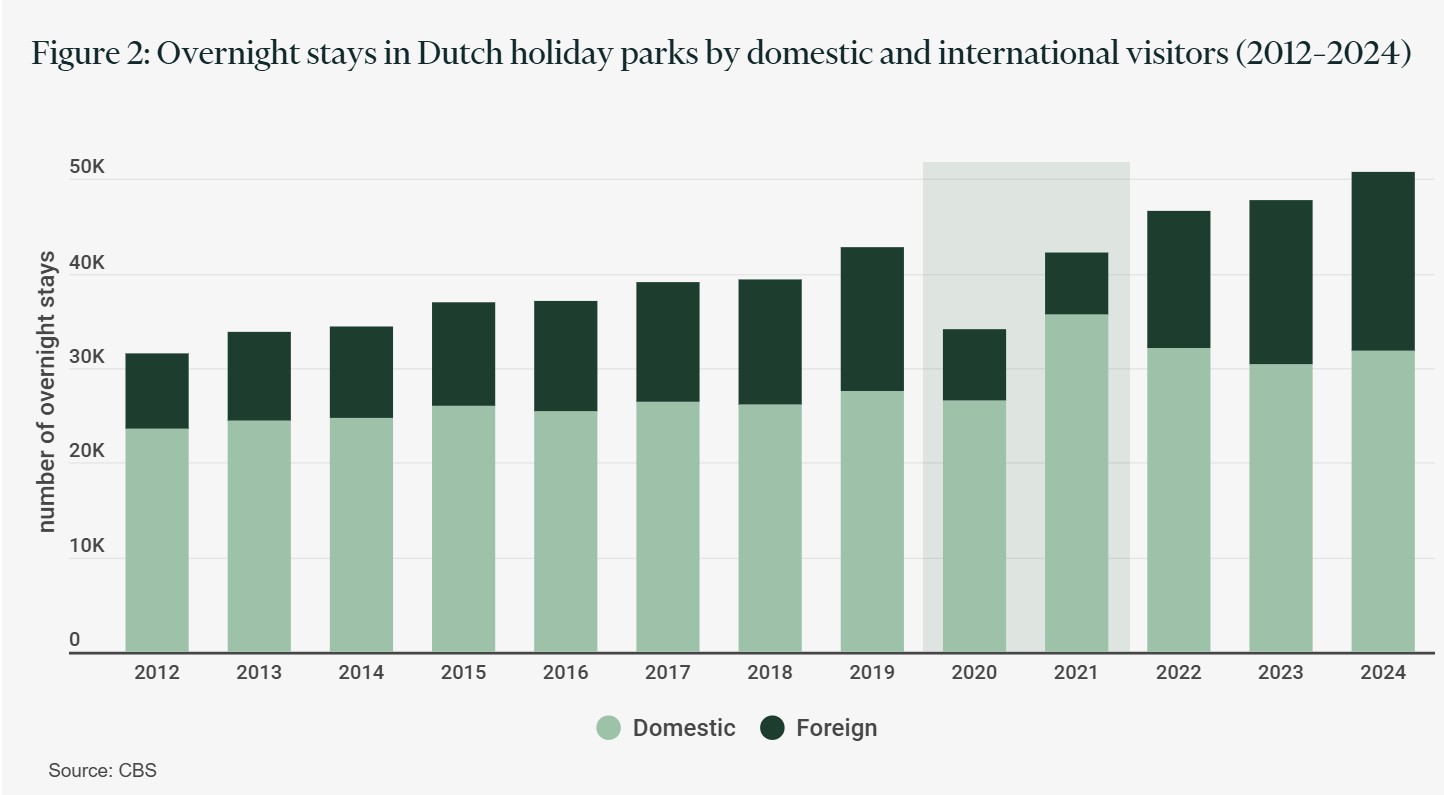

Foreign visitors drive increased demand for holiday parks

Over the past twelve years, demand for holiday parks has changed significantly. The number of international guests has grown considerably. Whereas in 2012 only a quarter of overnight stays were booked by foreign visitors, this share has risen to 37% in 2024. Moreover, the proportion of foreign guests has remained structurally higher since the COVID-19 crisis. This reflects the strong growth in demand and points to the lasting appeal of the Netherlands as a holiday destination. This trend strengthens occupancy rates and revenue potential.

Increase mainly driven by German visitors

The German market is the main engine behind the international growth in the Dutch holiday park sector. In 2012, German guests accounted for 16% of all overnight stays, rising to 27% in 2024. This makes German visitors by far the most important foreign target group.

The Eastern neighbours are drawn to the Netherlands due to the proximity of the Dutch coast – a nearby beach destination – and the comfort of language. In particular, the older generation appreciates the widespread knowledge of the German language, which makes communication easier.

No noticeable impact yet from ‘coolcation’

Although the term ‘coolcation’ is increasingly appearing in the European tourism debate, we have not yet seen any noticeable impact of this trend in the Dutch holiday park sector. The idea that vacationers from Southern Europe are choosing cooler destinations more often has so far had no effect on the share of southern countries in Dutch overnight stay figures.

The proportion of Southern European vacationers has remained consistently low since 2012, while growth has come almost entirely from Germany. In 2012, there were 205,000 overnight stays by Southern European tourists; in 2024, this number reached 433,000. Both numbers represent only 1% of total demand for overnight stays in Dutch holiday parks.

Nevertheless, climate change may change this dynamic in the medium term. As summer heatwaves in Southern Europe become more frequent, it seems likely that cooler destinations – such as the Netherlands – will increase in popularity.

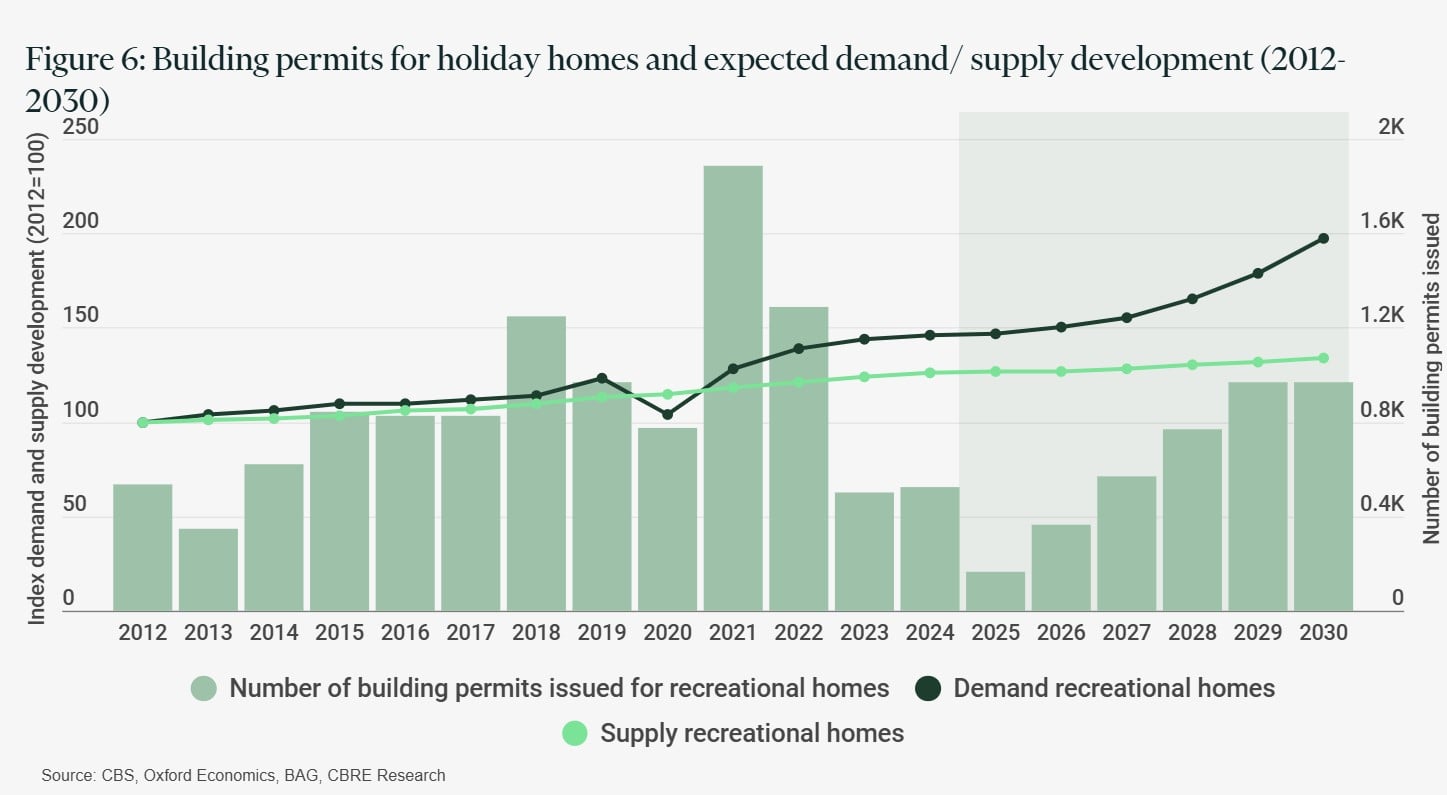

Supply development lags behind strongly increased demand

Demand for holiday parks in the Netherlands is growing rapidly, while supply is barely keeping pace. The number of overnight stays has risen sharply since 2021 and in 2024 was more than 40% above the 2012 level, whereas the number of holiday homes in the same period increased by only 26% (an average annual growth of around 2%). This means the gap between demand and supply continues to widen.

In 2023, this trend intensified as a result of a sharp decline in new park development, which further increased pressure on existing parks. This decline can be attributed to construction halts on planned developments and strain on the traditional financing model: the privatisation strategy.

Fiscal changes slow the market

In addition, from 2026 there will be an increase in VAT on accommodation. As of 1 January, VAT will no longer be 9% but 21%. This is expected to lead to higher accommodation costs and an increase in operating expenses. Despite this forecast, the impact on demand for overnight stays is likely to be minimal. The Dutch holiday park sector offers a specific type of product that cannot easily be substituted for another (cheaper) form of accommodation. Furthermore, the factors influencing the choice of the Netherlands as a holiday destination – such as the coastline and language comfort for German visitors – play a major role, meaning demand for holiday parks is unlikely to fall significantly.

Growing demand for holiday parks outpaces supply

The demand curve is therefore likely to accelerate further, while new supply of holiday parks remains absent and existing parks age. This creates a structural mismatch that is expected to continue increasing in the coming years.

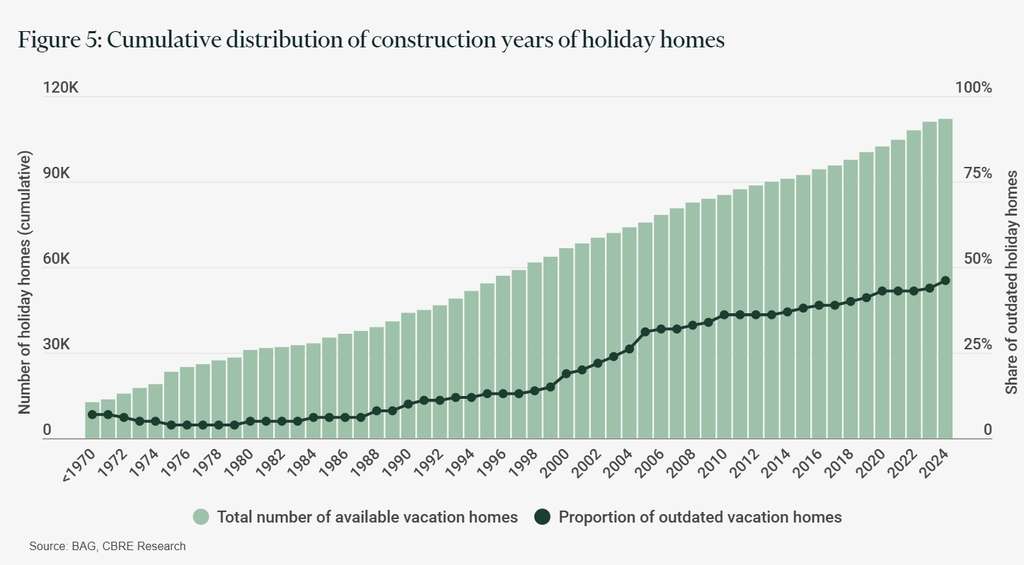

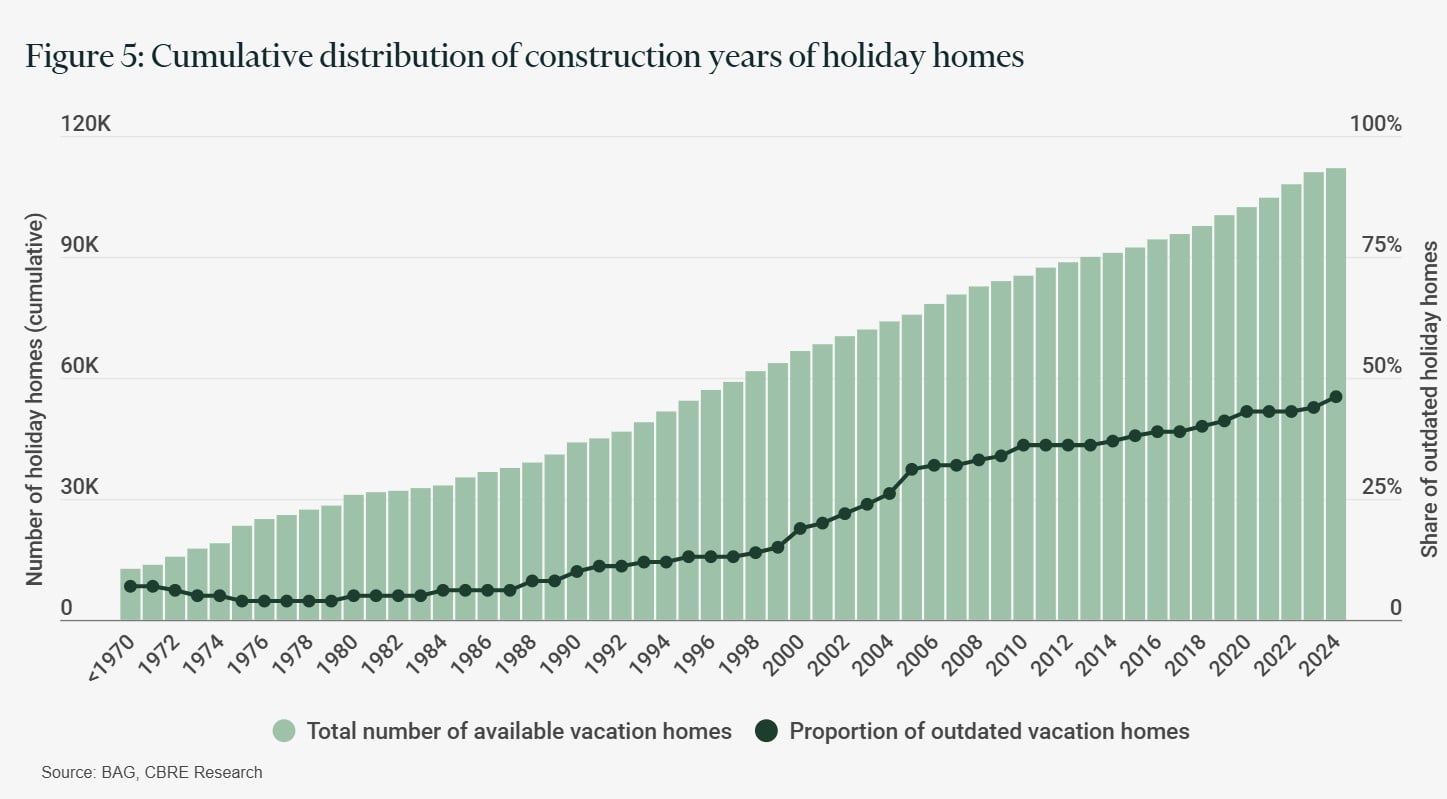

Large-scale renovation wave ahead due to ageing and ‘premiumisation’

Many holiday parks are technically and economically outdated. The average construction year is around 1994. A large part of the current stock therefore dates from the 1990s or early 2000s and is approaching the end of its lifespan. At the same time, guest expectations have changed. They seek modern, comfortable and sustainable accommodation with the quality level they are accustomed to at home. The trend of ‘premiumisation’, where guests are willing to pay more for luxury and high-end facilities, reinforces this need.

Given the structural growth and internationalisation of demand, a large-scale renovation wave is inevitable. Parks must renew themselves to remain attractive to an audience with different wishes and needs.

Further tightening due to limited building permits and increased demand

The outlook reveals a clear trend: demand for holiday homes is expected to rise steadily through 2030, while the number of building permits continues to decline sharply. New parks are scarcely being developed. Moreover, the traditional privatisation strategy is losing appeal due to recent tax changes, causing the supply of new holiday accommodation to dry up further.

The market is therefore moving towards scarcity: more demand, less supply, and a stronger focus on optimising existing holiday parks.

Private equity on the rise: from second home to big capital

Increasing scarcity is creating opportunities for larger, more professional investors. Private equity firms are focusing on existing parks and improving both the product and operations. This approach delivers economies of scale, attracts new visitors (such as young urban professionals), and raises the overall quality of the sector.

This shift marks a turning point. Where holiday parks were previously characterised by fragmented ownership – often divided among dozens of homeowners’ association members – we now see a growing trend towards consolidated, professionally managed assets. This accelerates decision-making and makes financing easier. Large-scale capital, such as private equity, is now entering the sector more frequently – something that was rare just a few years ago.

This development is also drawing institutional investors. Private investors are stepping aside more often due to rising costs and less attractive tax frameworks, leaving room for large funds to step in. Recent transactions underline this trend: Roompot and Landal under KKR, Center Parcs under Aroundtown, EuroParcs under Waterland, and RCN with Blackstone. Roundshield has also shown interest. Holiday real estate is thus evolving into a mature and strategic investment category.

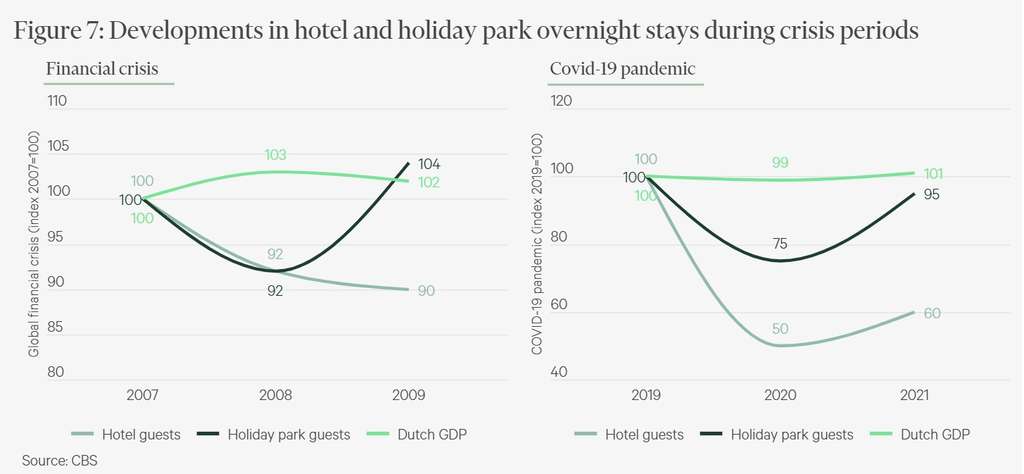

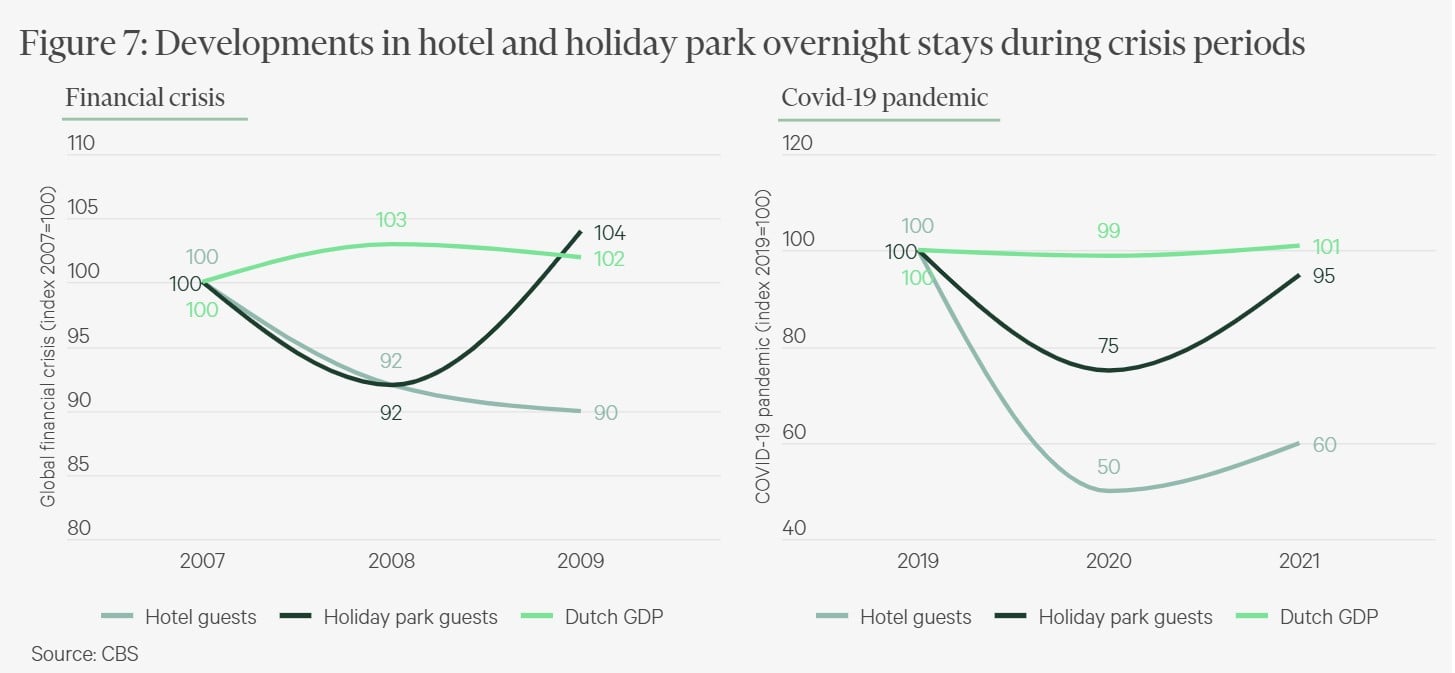

Holiday parks demonstrate resilience during economic cycles

The strong interest from institutional players is also linked to the crisis resilience of holiday parks. During both the financial crisis and the COVID-19 pandemic, hotels faced sharp declines in occupancy, while holiday parks recovered remarkably quickly. During the financial crisis, guest numbers even exceeded pre-crisis levels.

This stability gives investors confidence. The sector reacts less severely to economic shocks and therefore contributes more strongly to a predictable portfolio.

Scarcity and consolidation create return opportunities

Due to limited new construction, rising demand and further consolidation, a new investment dynamic is emerging. New parks deliver a stabilised return of around 7.5–8% by year three. This level is relatively high because the operating model is still unproven. Once the park runs smoothly and occupancy stabilises, the risk profile decreases and a steady cash flow is established.

In addition, a privitisation strategy remains available as an alternative route, offering property returns of around 5.5%. Thanks to the relatively quiet market, exit yields remain sharp, making private equity entry attractive and enabling exits under more favourable conditions later. Major players such as Blackstone use consolidation as a core strategy. They bundle fragmented parks and professionalise them, creating economies of scale and room for development – something private investors often have fewer opportunities for. This approach delivers immediate value in a market with little new supply and growing demand. It underlines the evolution of holiday parks into a mature investment category.

Two clear routes to private equity exit strategies

Rivate equity generally follows two exit strategies: sale to institutional investors and privitisation.

1. Sale to institutional investors

This route focuses on economies of scale, stability and operational quality. After redevelopment and professionalisation, the portfolio is likely to deliver strong returns and a predictable operating model. Institutional investors then step in for the long term, prioritising stable cash-on-cash returns over value growth through renovation.

2. Privitisation

The second route involves selling individual holiday homes to private buyers. In the current market, this requires rapid pre-sales: around 70% of the homes must be sold within 18 months to secure financing. Due to rising costs and a less attractive tax framework, many private investors are pulling back, making this route challenging at present. Private equity firms have an advantage: they have sufficient capital reserves to fully develop a park without relying on pre-sales. In the end, a complete and operational product sells faster than an ongoing project.

Room for distinctive holiday concepts in the premium segment

Despite increasing professionalisation, the premium segment remains relatively underdeveloped. This creates opportunities for investors to develop innovative, distinctive concepts. These do not have to be traditionally luxurious concepts. Examples include small-scale parks on the outskirts of cities featuring timber construction, sustainable installations, high-quality hospitality, a strong design identity and home-grown ingredients.

Glamping is also on the rise, as in Southern Europe. It offers a premium experience at relatively low development costs and attractive rental prices.

Due to changing holiday trends and limited new supply, the market remains dynamic. For investors considering long-term development, this is an interesting moment to step in.

About CBRE Group, Inc.

CBRE Group, Inc. (NYSE:CBRE), a Fortune 500 and S&P 500 company headquartered in Dallas, is the world's largest commercial real estate services and investment firm (based on 2023 revenue). The company has more than 130,000 employees (including Turner & Townsend employees) serving clients in more than 100 countries. CBRE serves a diverse range of clients with an integrated suite of services, including facilities, transaction and project management; property management; investment management; appraisal and valuation; property leasing; strategic consulting; property sales; mortgage services and development services. Please visit our website at www.cbre.com.