Preview Mode

This

Press Release

has not been published yet.

Greek Hospitality Industry Performance - 4th Quarter 2025

2025 review

- Greek tourism reached a new all-time high in 2025. According to the Bank of Greece, international arrivals increased by 4.6% up to November 2025 to 37 million (excluding cruise passengers), supported by a 6.1% rise in international airport arrivals across 27 airports nationwide.

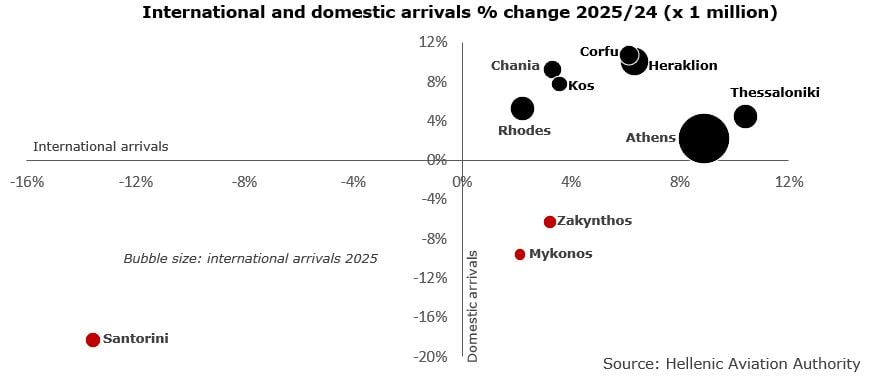

- Growth was increasingly concentrated in the two main gateways, Athens and Thessaloniki, which together outperformed regional airports. International arrivals in Athens rose by 8.9% (+9.4% for non-residents), while Thessaloniki recorded a 10.4% increase. By contrast, regional airports grew by only 3.4%, resulting in their share of total international traffic declining from 53.8% in 2024 to 52.4% in 2025.

- Seasonality also improved. During the winter months (January–March and November–December), international and domestic arrivals at Athens and Thessaloniki increased by 12.5%, compared with 4.4% at regional airports.

This indicates that recent off-season growth is primarily driven by the major urban gateways rather than leisure destinations. Road arrivals may also have contributed, but no data is available.

- Reviewing the annual performance of the complete top 10 airports of Greece responsible for 87% of all international traffic, it is noted that Heraklion and Corfu recorded solid growth in international arrivals (+6.3% and +6.1% 2025/24), followed by Kos, Chania, Zakynthos, Rhodes and Mykonos, while Santorini declined sharply (–13.6%) due to earthquake disruptions earlier in the year.

- Domestic arrivals improved significantly except at Santorini and Mykonos (-18.3% and -9.6% resp.) with incoming traffic mainly from Athens, while also in Zante domestic arrivals declined noting that the domestic volume is limited.

- In terms of main source markets at the international airports of Greece except Athens, the top 10 has not changed other than that Israel climbed from 10th in 2024 to 8th in 2025 due to an increase of arrivals of 32.8% 2025/24, while Sweden dropped one rank to 9th and Switzerland from 9th to 10th in 2025.

The United Kingdom remained for these airports the main source market with 4.4 million arrivals (+3.3%), followed by Germany with 4 million (+6.9%), Italy with 1.4 million (+5.2%) and Poland with 1.2 million (+4.6%).

Infrastructure at a breaking point

- Infrastructure strain moved from a background risk to a front-page issue in 2025, as record visitor flows collided with limited public capacity. Greece ranks among the top 20 most water-stressed countries globally, according to the World Resources Institute’s Aqueduct Water Risk Atlas, reflecting structurally low rainfall, rising temperatures and chronic network losses that in some systems exceed 40–50% of treated water. Prolonged drought drained island reservoirs to critical levels, while Attica faced its most persistent water deficit in decades, prompting 39 municipalities to declare a state of emergency. In response, the government announced a € 2.5 billion national water-security plan, including pipe replacements, leakage reduction and expanded desalination capacity.

- Similar pressures are evident across transport and environmental infrastructure. Many island ports remain undersized for peak-season passenger and cruise volumes, resulting in congestion, berthing delays and operational bottlenecks despite ongoing upgrades.

- Meanwhile, waste management remains structurally fragile: 79% of the municipal waste in Greece is still landfilled, according to the Hellenic Association of Recycling and Energy Recovery Industries, one of the highest rates in the EU, with the Fyli Landfill handling most of metropolitan Athens’s refuse, while islands face high costs and logistical complexity in transporting waste off-site. Flood events, stormwater deficiencies and localized energy constraints further expose capacity gaps.

- Without faster investment and coordinated planning, these bottlenecks risk constraining local communities, reducing service quality for visitors, and ultimately weakening the long-term competitiveness of Greece’s tourism economy.

Performance by region

- In terms of visits, the region of Attica climbed from third place during the period 2016–2019 to first place from 2023 onward, while Central Macedonia fell from first to third. The South Aegean ranked second throughout 2016–2024, reaching first place in 2019 and 2022.

- However, in terms of receipts, the South Aegean consistently ranked first. Attica moved to second place from 2024 (up from third since 2023), while Crete ranked third (down from second). Central Macedonia has ranked fifth since 2022, reflecting shorter stays from key source markets such as Bulgaria and North Macedonia and lower average spending.

- Data up to September 2025 show significant increases for Attica, with visits up 10% and receipts up 24% compared to the same period in 2024, while the South Aegean recorded less than 1% growth in visits but a 19% increase in receipts. In Crete, receipts declined by 8%, while visits increased by 6%.

- In 2024 90% of travel receipts, 83% of arrivals and 87% of overnight stays are generated in 5 regions: Attica, Central Macedonia, Crete, Ionian Islands and South Aegean. In the other 8 regions, 83% of the hotels have less than 40 rooms.

Hotel sector performance

- Based on GBR’s hotel benchmark survey data, covering city and resort hotels across Greece, total room nights sold reached 8.0 million in 2025, compared to 7.9 million in 2024 (+0.7%) and 7.7 million in 2023 (+3.0%). Aggregate hotel revenue, consisting of room revenue for city hotels and total (all department) revenue for resort properties, rose by 7.4% to approximately € 2.0 billion, compared with € 1.8 billion in 2024 and € 1.6 billion in 2023.

- Despite this revenue growth, Greek hotels are facing substantial cost and tax pressures that erode profitability. Operating expenses have risen sharply, driven by volatile electricity prices, a tightening labour market, national wage agreements and acute sector-wide staff shortages — all of which place upward pressure on operating cost ratios.

- An INSETE study published in October 2025 highlights a pronounced structural disadvantage for Greek hotels through a “yield displacement effect.” Under a 4-star model with a € 150 gross room rate, the total tax burden, comprising VAT, the new Climate Resilience Fee (which replaced the previous stay-over tax in 2025), and social contributions, accounts for 29.8% of the gross room rate, nearly double the equivalent burden in Cyprus (16.1%). This elevated tax floor constrains pricing flexibility: hotels cannot fully recoup rising operating costs through rate increases without risking competitiveness.

- The same study reveals a stark imbalance in value distribution between hotels and the state. In Greece, hotel EBITDA corresponds to just 56.9% of the total taxes and social contributions generated for the state. By comparison, in Cyprus this ratio is 171.1%, in Portugal 111.9%, in Turkey 91.6% and in Italy 69.8%. In practical terms, this means that for every € 1 of EBITDA Greek hotels retain, they generate approximately € 1.75 in tax and contributions.

- This combination of higher labour and non-labour operating costs and a heavy tax incidence creates a double squeeze on hotels’ financial performance. The elevated cost base, combined with limited ability to shift these costs onto consumers, means that the recent revenue growth in 2025 has not translated proportionately into bottom-line expansion.

Athens

- Athens International Airport Eleftherios Venizelos remains Greece’s primary gateway, accounting for approximately 39% of all international passenger arrivals, while also functioning as the country’s main domestic transfer hub, with around 40% of non-resident arrivals connecting onward to other destinations. Long-haul connectivity continues to expand, supported by strong U.S. demand and new direct links with India following the launch of nonstop services by IndiGo and upcoming routes by Aegean Airlines. Additional Asian capacity, including new connections to Seoul, further diversifies Athens’ source markets. However, visa processing delays for certain non-EU travellers, including Indian visitors, may act as a short-term bottleneck to fully capturing incremental long-haul demand.

- The increase of international travellers during the winter months as mentioned above is clearly reflected in hotel performance. In 2025, results were driven by strong growth during the periods of January–March and November–December, with occupancy up 5.3% and ADR up 5.4% year-on-year. In contrast, during the April–October peak period, occupancy edged down by 1.2% while ADR increased by 2.7%.

- This pattern confirms Athens’ structural evolution into a year-round destination, gradually smoothing seasonality and improving annual asset utilisation.

Thessaloniki

- Despite recording the highest growth rate in international arrivals among Greek airports (+10.7% 2025/24), the Thessaloniki hotel market captured only limited gains with occupancy increasing by just 0.9% year-on-year, noting that supply increased including the reopening of the former Nikopolis as the September Hotel Thessaloniki (99 rooms) and the launch of the NYX Hotel Thessaloniki (130 rooms).

- RevPAR improved by 5.4% in 2025 compared to 2024, driven by an increase of 4.4% in ADR.

Resort hotels

- In 2025, resort hotels recorded occupancy levels broadly in line with 2024. Although Q1 performance improved year-on-year, these months represent a limited share of annual demand and therefore had minimal impact on full-year results. Total Daily Revenue per Occupied Room (POR) increased by 8.9% (2025 vs 2024), with the strongest gains observed in April, June and September.

- Total Daily Revenue per Available Room (PAR) increased by 8.5% to € 273 (2025/24), primarily driven by rate growth, with peak levels recorded in July and August.

Selected transactions

- In January 2026, Cretan Investment Group (CIG), led by Marita Karatzi, completed the acquisition of the 4-star Hilton Garden Inn Athens Syngrou Avenue (129 rooms) in a transaction valued at approximately € 45 million. The deal was structured as a sale-and-leaseback, with operations and management remaining unchanged. The property opened in late 2024 as the first Hilton Garden Inn branded hotel in Greece following the redevelopment of the former LUX & Easy Signature Syngrou 234, marking CIG’s first investment outside its traditional Cretan and resort portfolio.

- In January 2026, Bain Capital completed the sale of the 181-room Cora Resort & Spa in Afytos, Chalkidiki to Fattal Hotel Group. The asset, previously positioned in the mid-upper segment, was upgraded to a 5-star standard following a € 24 million refurbishment and reopened in 2023. Under the new ownership, the property will be rebranded as Meravia Hotel by Leonardo Limited Edition. The transaction value was not disclosed.

- In December 2025, Brookfield Asset Management and Domes Resorts announced a joint venture under which Brookfield will acquire a majority stake in the 5-star, 105-room Domes Zeen Chania in Crete, with planned capital expenditure exceeding € 40 million to expand and enhance the resort. The transaction represents Brookfield’s first entry into the Greek hospitality market.

- Prodea Investments completed a strategic restructuring of its hospitality portfolio resulting in full ownership of the Porto Paros Resort in Paros. Under the transaction announced in December 2025, Prodea acquired the remaining 30% stake in MHV Bluekey One S.A., the property-owning vehicle, increasing its participation from 70% to 100%. The move formed part of a broader portfolio reorganisation that included asset disposals totalling € 676 million to VYP Group Ltd (Yoda Plc group). Prodea has indicated plans to redevelop the resort.

- In November 2025, the 5-star, 161-room Sitia Beach City Resort & Spa in Crete — previously acquired by Hines in 2020 — was sold through a structured sales process. The buyer and transaction value were not publicly disclosed.

- Also in November 2025, Zetland Capital Partners LLP finalised the sale of the 5-star, 188-room Lindian Village Beach Resort Rhodes to Domes Resorts. Zetland had acquired the asset in 2022 from the Svyriadis family for approximately € 27 million.

About GBR Consulting

GBR Consulting is the leading hospitality and tourism consultancy in Greece. Its experience includes market and financial feasibility studies as well as valuations and development plans for Hotels, Resorts, Spas, Marinas, Casinos & Gaming, Conference Centers & Arenas, Theme Parks, Golf Courses etc. GBR Consulting is affiliated to CBRE Atria, the Greek arm of CB Richard Ellis, providing together a specialized service for Tourism Properties Transactions. GBR Consulting possesses a database with financial data for over 1,000 hotel establishments in Greece and has a datashare agreement with STR Global, the word's largest databank of hotel operational data.

Stefan Merkenhof

Managing Consultant

GBR Consulting