Market Pulse: Greater Wilmington, Delaware

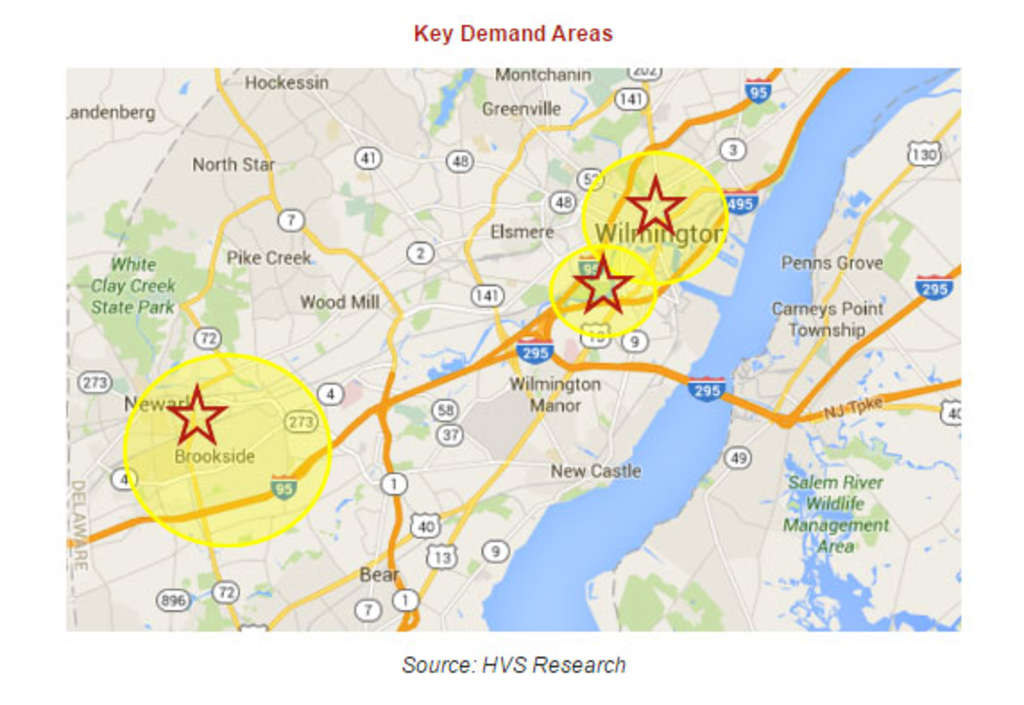

Known as the "Corporate Capital of the World," Delaware legally houses more than half of the nation's Fortune 500 companies. Apart from the corporations that belong to it on paper, Wilmington, Delaware's largest city, also houses a wealth of brick-and-mortar businesses, healthcare providers, and universities. Wilmington sits between the major metro regions of New York City and Washington, D.C., providing the city with cross-traffic in the form of business travel. The location, entrepreneurial spirit, and economic drivers of Wilmington, New Castle County, and greater northern Delaware have proven advantageous to the region's economy. The local lodging market has benefited as well from the generation of commercial and group demand.

This HVS Market Pulse report details major economic entities, hotel demand generators, and hotel performance in Greater Wilmington.

Business and Industry

The chemical and pharmaceutical industries, as well as the financial, education, and healthcare sectors, are cornerstones of the greater Wilmington economy. Just within the past year, however, some significant shifts have taken place in Wilmington's major employers.

E.I. du Pont de Nemours and Company, commonly referred to as DuPont, is one of the world's largest chemical companies. Headquartered in Wilmington, DuPont employed over 6,000 workers statewide as of mid-year 2015. In December 2015, DuPont announced a merger with Dow Chemical Company. The new $130-billion company, DowDuPont, is expected to lay off approximately 1,700 people by the end of 2016 in Delaware alone.

AstraZeneca, a British-Swedish pharmaceutical and biologics company, recently sold off a portion of its northern Wilmington offices to JPMorgan Chase; in a downsizing effort, the company also demolished another portion of its local offices. The downsizing has brought sizable layoffs for AstraZeneca since early 2014, with approximately 1,200 jobs disappearing from Delaware.

On a more encouraging note, many of the area's economicforces are more stable or growing. Financial institutions in Wilmington and Newark include Capital One 360, Barclays Bank, M&T Bank, Wilmington Savings Fund Society, JPMorgan Chase, Bank of America, and HSBC. Delaware's pro-business financial laws created a very liberal tax and interest rate structure for banking and credit card institutions, particularly with the Financial Center Development Act of 1981.

The University of Delaware, a major economic generator for Wilmington, has grown significantly over the last several years. In 2009, the University bought the former Chrysler assembly plant just south of the campus and is continuing the facility's transformation into the Science, Technology and Advanced Research (STAR) Campus. The Health Science Complex opened on the STAR Campus in February 2014, offering high-tech meeting spaces and state-of-the-art core labs for research and education in areas including muscle performance, cardiovascular disease, and orthopedic rehabilitation. The second phase of construction, which will introduce clinical research and retail tenants to the Health Science Complex, is expected to lay the foundation for the vision of a diverse mixed-use STAR Campus.

Christiana Care Health System, based in Wilmington, is one of the largest healthcare providers in the Mid-Atlantic. The not-for-profit, privately owned company includes two hospitals, Christiana Hospital and Wilmington Hospital. Combined, these facilities offer more than 1,100 licensed hospital beds. Wilmington Hospital, located in the heart of Downtown Wilmington, is currently proposing a $260-million expansion project that is expected to add 70 single-family rooms to the hospital's neonatal intensive-care unit in an eight-story patient tower and to create a nursery for babies born with a dependency on opioids. As of March 2016, this proposal had been approved by the Delaware Certificate for Public Review Program; construction is slated to begin in April 2017, with completion scheduled in 2020. In addition, Nemours/Alfred I. duPont Hospital for Children, another major employer in Wilmington, is a world-renowned, full-service children's hospital that has also expanded over the course of the last several year.

Downton Growth and Development

Despite the reduction of chemical and pharmaceutical jobs in greater Wilmington, the revitalization of Downtown Wilmington has continued over the last several years. Buccini/Pollin Group, a privately held, full-service real estate acquisition, development, and management company, has contributed to a majority of the growth in the Downtown and Riverfront markets through the addition of commercial office space, luxury housing, and hotel development. Since 2014, Buccini/Pollin has added over 300 apartments to Downtown Wilmington and 116 apartments to the Riverfront. Another 76 apartments and 300 hotel rooms are planned for Wilmington's Riverfront in the next several years.

Delaware-based Big Fish Restaurant Group is expected to add a big-box restaurant adjacent to its existing Big Fish Grill on the Riverfront. In addition to the new restaurant, the restaurant group purchased the parcel south of Big Fish Grill with options to develop a catering facility and limited-service hotel; however, development appears to have been placed on hold given the recent announcement of Buccini/Pollin's hotel development.

Given the incoming hotel rooms, retail shops, and restaurants to the Downtown and Riverfront submarkets, Greater Wilmington is leveraged to draw increased leisure, meeting, and group demand. The addition of these businesses, along with the established Chase Center on the Riverfront and Penn Cinema Riverfront & IMAX complex, puts the local economy on a firmer foundation.

New Hotel Supply

As noted in the following chart, several projects in the greater Wilmington area have either broken ground or are in the early planning stages of development.

Construction the Residence Inn by Marriott Wilmington, which is being converted from an office building in Downtown, began in June 2015; the hotel is scheduled to open in July of this year. The structure of the proposed Candlewood Suites Newark has been completed, with the hotel expected to open by the end of the year. Cumulatively, the proposed Riverfront hotels, which are being developed by Buccini/Pollin, are anticipated to cost between $30 and $35 million and to generate approximately 200 jobs.

Hotel Market Performance and Forecast

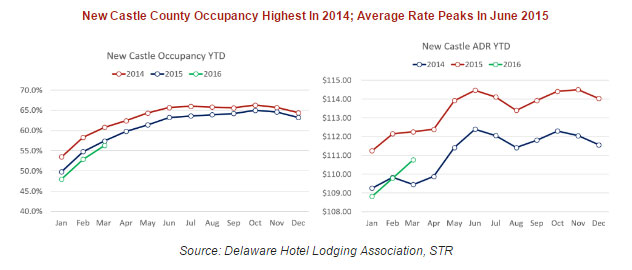

The greater Wilmington market has realized consistent growth in occupancy over the last several years, despite speculation of excess new supply in New Castle County. Year-to-date 2016 data show a decline in demand, largely attributed to the downsizing of DuPont early this year. Occupancy is trending similar to 2013 levels, and the influx of new supply in the market over the next several years is expected to offset potential occupancy gains in the near future. However, the consistent growth and revitalization of Wilmington has allowed the market to draw demand from avenues both within and outside of the market's towering financial and healthcare sectors.

Average rate increased in 2014 and 2015. Data for year-to-date 2016 illustrate a modest decline in average rate, a sign of the competitiveness of new supply during the slower months of the season. The improved overall quality of hotel product in Greater Wilmington, following property renovations and the introduction of new supply, is expected to warrant higher average rates in the near future.

Outlook

Economic growth and expansion has characterized the greater Wilmington market over the past several years, and the benefits to the area's hotel industry are evident in occupancy and average rate performance. The layoffs at DuPont and AstraZeneca defy the overall trend of growth, though the stability of the market's financial institutions and the expansion of its healthcare sector provide some assurance that the local economy stands on solid ground.

Greater Wilmington's hotel industry continues to grow, with two new hotels scheduled to open this year and several more through 2018. The increase of 645 rooms in a five-year span testifies to the increases in demand in the market, allowing room for growth and shifts in market segmentation going forward, including increased tourism, as well as meeting and group demand. As such, the outlook for the greater Wilmington hotel market would be best defined as cautiously optimistic.

Dinaker P. Mallya

Project Manager - HVS Philadelphia

+1 (484) 557-1668

HVS