HVS Market Pulse: Colorado Springs, Colorado

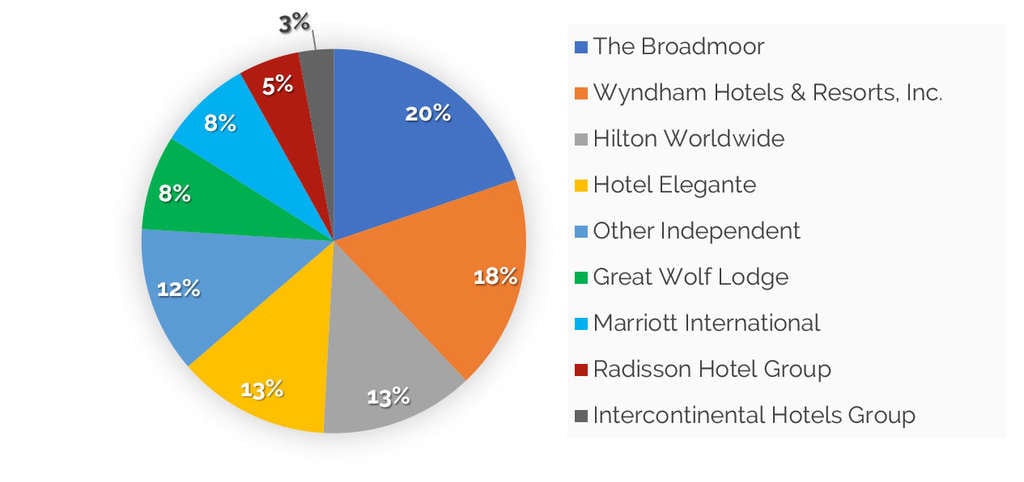

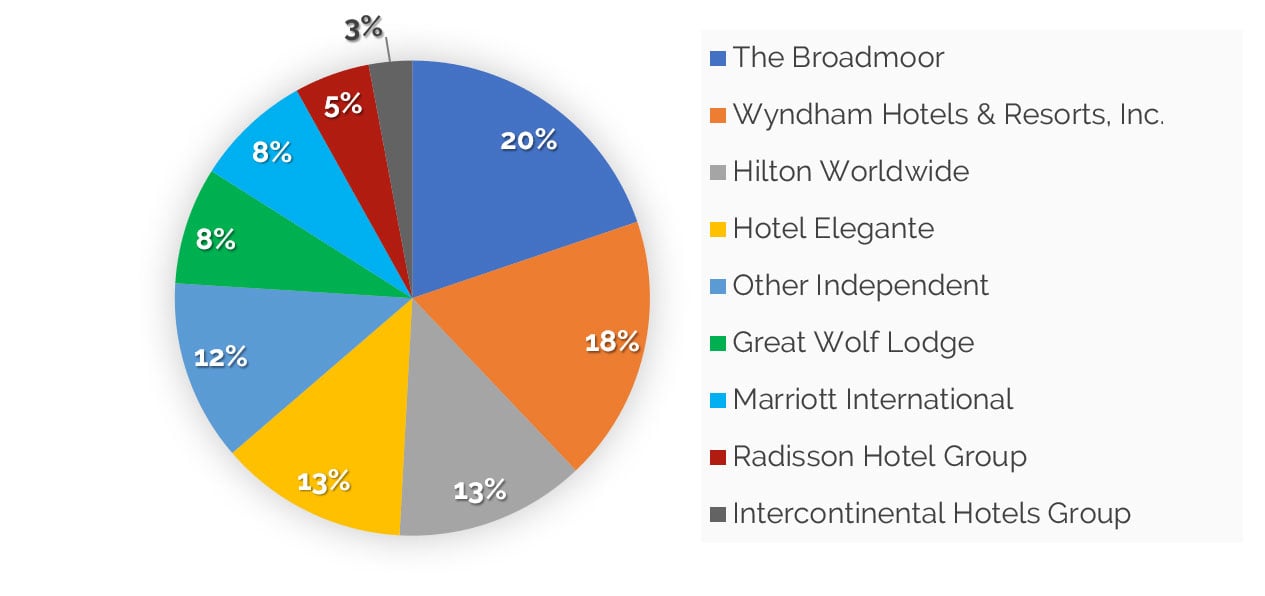

There are 15 full-service hotels in Colorado Springs representing nearly 3,900 of the 10,550 total hotel rooms in this market. Interestingly, there are three full-service hotels that are branded under the Wyndham Hotels & Resorts parent company. The Mining Exchange Hotel opened in 2012 as a Wyndham Grand, The Antlers Hotel affiliated with Wyndham in 2016 after de-flagging from a Hilton, and the Cheyenne Mountain Resort joined Wyndham under the Dolce Hotels & Resorts affiliation in September 2017. Combined, these three hotels have over 700 rooms, which is only about 70 rooms shy of The Broadmoor. Hyatt, Hilton, Marriott, Radisson, and IHG represent the other major hotel parent companies that have full-service products in Colorado Springs. The following pie chart illustrates the portion of the total full-service hotel rooms that each parent company or hotel has in this market.

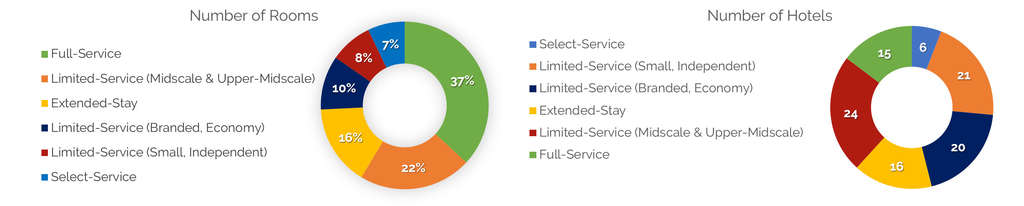

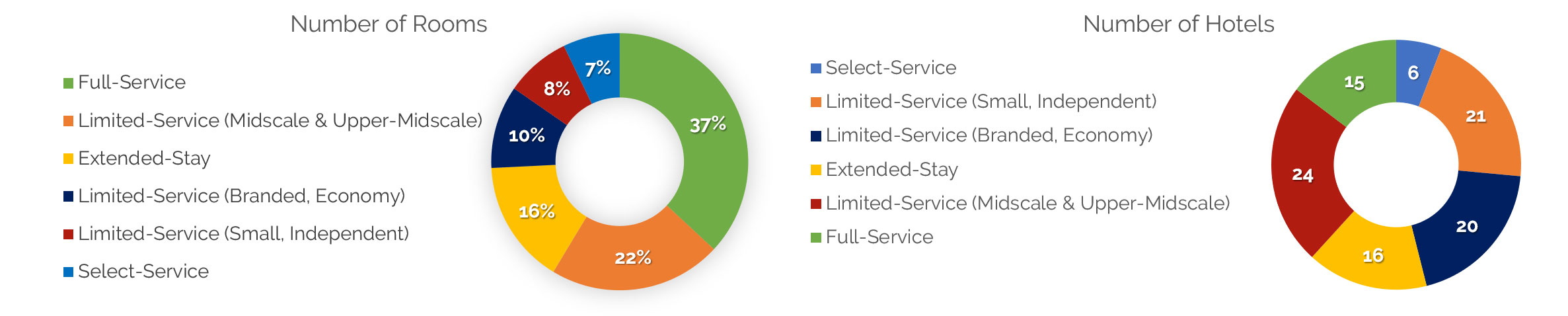

The midscale and upper-midscale hotels in Colorado Springs total approximately 2,300 rooms throughout 24 hotels, with most of the upper-midscale, nationally recognized brands well represented throughout the city. In the Springs, there are five Holiday Inn Express hotels, four Hampton by Hilton hotels, and four Fairfield Inn by Marriott hotels, one of which is under construction. Although there are three Quality Inns and one Comfort Inn, Choice Hotels International's Sleep Inn brand is not represented in the Springs. Other brands within the midscale and upper-midscale, limited-service segment that do not currently have locations in Colorado Springs include Wingate by Wyndham, Country Inn & Suites by Radisson, and newer brands, such as Tru by Hilton and IHG's avid. This segment has the highest number of hotels; however, the total room count falls below that of the full-service sector.

The extended-stay lodging market in the Springs extends from economy brands, such as Studio 6, WoodSpring Suites, HomeTowne Studios, Extended-Stay America, and InTown Suites, to upscale brands, such as Residence Inn by Marriott, Homewood Suites by Hilton, Hyatt House, and Staybridge Suites. Midscale and upper-midscale hotels, such as Best Western Plus Executive Residency, Sonesta ES Suites, TownePlace Suites by Marriott, and My Place, round out the extended-stay segment in this market. Although brands such as Home2 Suites by Hilton, Element by Westin, Candlewood Suites, and Mainstay Suites do not currently have a presence in this market, new hotels with these flags are either proposed for development or under construction. A Hawthorne Suites, Wyndham's extended-stay brand, is not currently located in Colorado Springs. Although there are 16 extended-stay hotels open and operating in this market, they total only approximately 1,650 of all of the rooms in Colorado Springs.

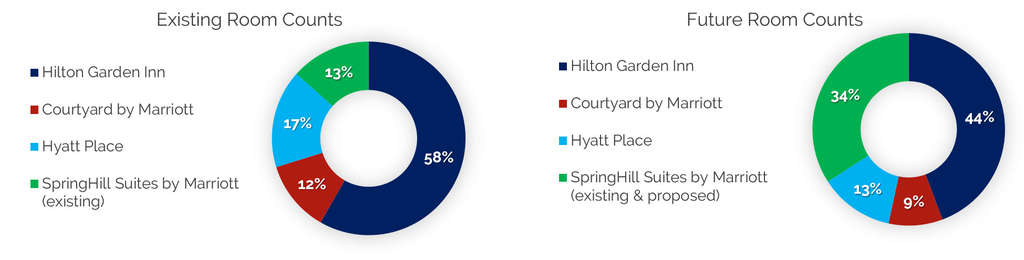

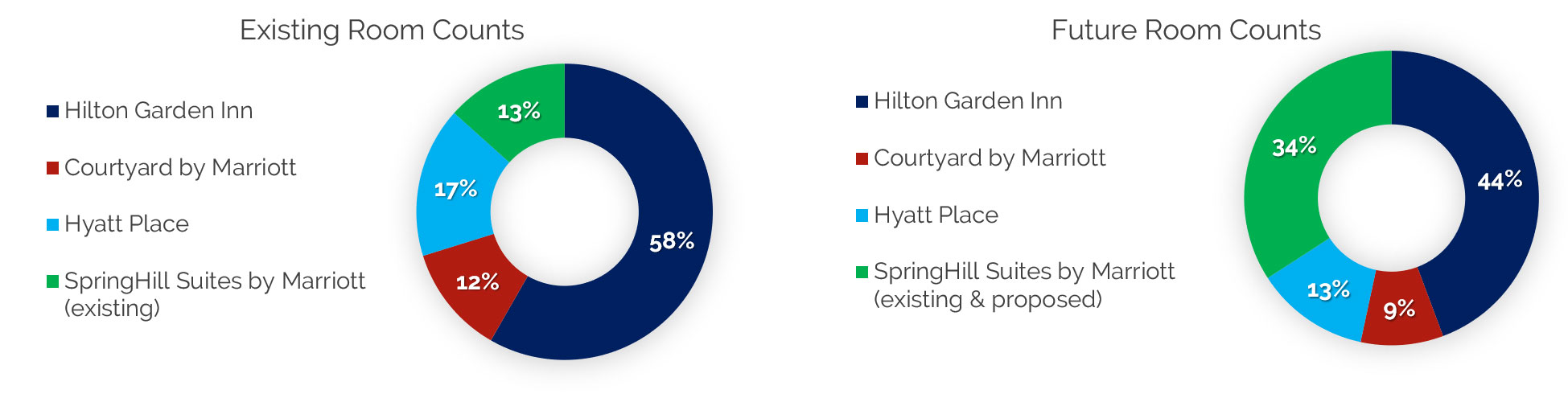

The select-service product type represents the smallest piece of the pie, with only six hotels and 755 hotel rooms. Over half of the hotel rooms (three hotels) in this segment are affiliated with the Hilton Garden Inn brand, including the recently opened Hilton Garden Inn in Downtown Colorado Springs. A Courtyard by Marriott, Hyatt Place, and a SpringHill Suites by Marriott round out this category. We note that a second SpringHill Suites by Marriott is under construction along Interquest Parkway, and ground was recently broken on a third SpringHill Suites by Marriott as part of a dual-branded hotel in Downtown Colorado Springs. Up-and-coming and lesser known, select-service hotel brands, such as Aloft, Hotel Indigo, Caption by Hyatt, AC Hotel by Marriott, EVEN, Cambria, and Moxy, are not currently in this market and do not appear to be in the pipeline. The following pie charts illustrate the room count allocations by brand. The second chart reflects both the existing and proposed SpringHill Suites by Marriott hotels.

The remainder of the 10,670 rooms in Colorado Springs includes 20 branded, economy-class hotels (1,100 rooms) and 21 independent, budget-oriented properties (865 rooms). Overall, the hotel supply in Colorado Springs is diverse, which is a function of the various sources of demand that range from leisure travelers to government employees on per-diem allowances to high-end meeting and group demand.

Considering a brand change or trying to understand how the new supply will impact your hotel or planned project? Looking to maximize RevPAR and streamline operations to maintain market share through the next cycle? HVS can provide full life-cycle consulting from the initial market study through brokerage and transaction advisory. Take advantage of our variety of services and market experience and make a connection today by contacting Katy Black at [email protected] or 970-305-2229.