The Growth In Management Fee Expense

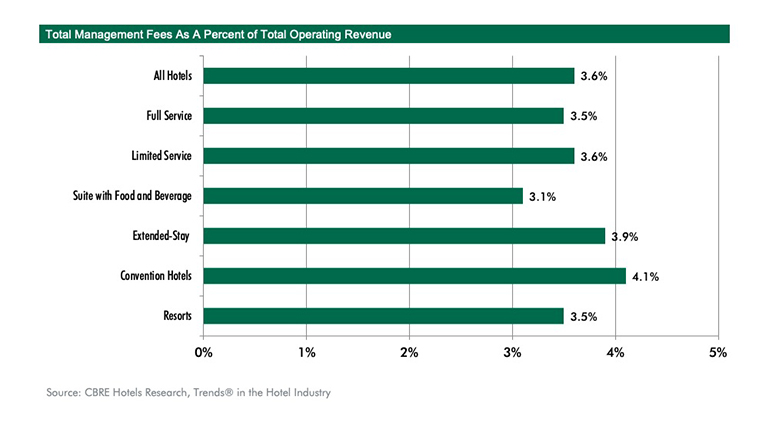

In 2019, 86% of the hotels that participated in CBRE Hotels Research's annual Trends® in the Hotel Industry survey of property-level operating statements reported the payment of a management fee. On average, these hotels paid management fees equal to 3.6% of total operating revenue. The management fee to revenue ratio was the highest for convention hotels (4.1%) and lowest for resorts and full-service hotels (3.5%). Relative to the bottom line, total management fees averaged 13.9% of profits. For this analysis, profits are defined as earnings before interest, taxes, depreciation, and amortization (EBITDA).

To gain a better understanding of this expense we analyzed the performance of 840 hotels that reported paying a management fee each year from 2009 through 2019 for CBRE's annual Trends® survey. In addition, we studied some more recent trends from CBRE's monthly survey of operating performance during 2020.

Growth

From 2009 through 2019, total operating revenue for the study sample increased at a compound annual growth rate (CAGR) of 3.7%. Concurrently, operators were able to control expense growth at 2.9%, thus allowing for a healthy CAGR of profits of 6.5%.

Management fees exceeded the overall expense growth rate. During the 10-year period, owners paid their operators, on average, management fees of 5.9%. When growth of an expense item exceeds the overall average, owners typically become concerned. However, since management fees are designed to reward operators for positive performance, excessive growth in management fees is not necessarily unwelcome.

Most management contracts include two components for compensation – a base fee and an incentive fee. The management company typically charges a base fee as a percentage of total revenue. Operators pay the management company incentive fees, on the other hand, once they reach a certain profit threshold. Incentive fees are designed to make management more conscious of the bottom line since owners achieve their returns and pay their debts from profits, not revenue. With total management fees and profits growing at a greater pace than revenues, it can be assumed that the incentive fee component had a significant impact on the growth in management fees during the past 10 years.

Incentive Fees

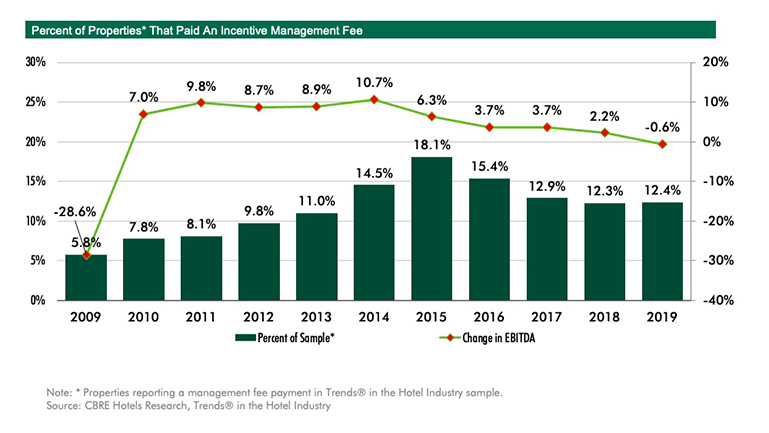

During the initial years of the recovery (2008 through 2015), the annual growth rate for profits averaged 8.6%. With such strong profit growth, it is not surprising that the share of properties in our Trends® sample reporting an incentive management fee rose from 7.8% in 2008 to 18.1% in 2015. Conversely, as the profit growth slowed down to an annual average of 2.3% the following four years, the share of hotels paying an incentive fee dropped steadily to 12.4% in 2019.

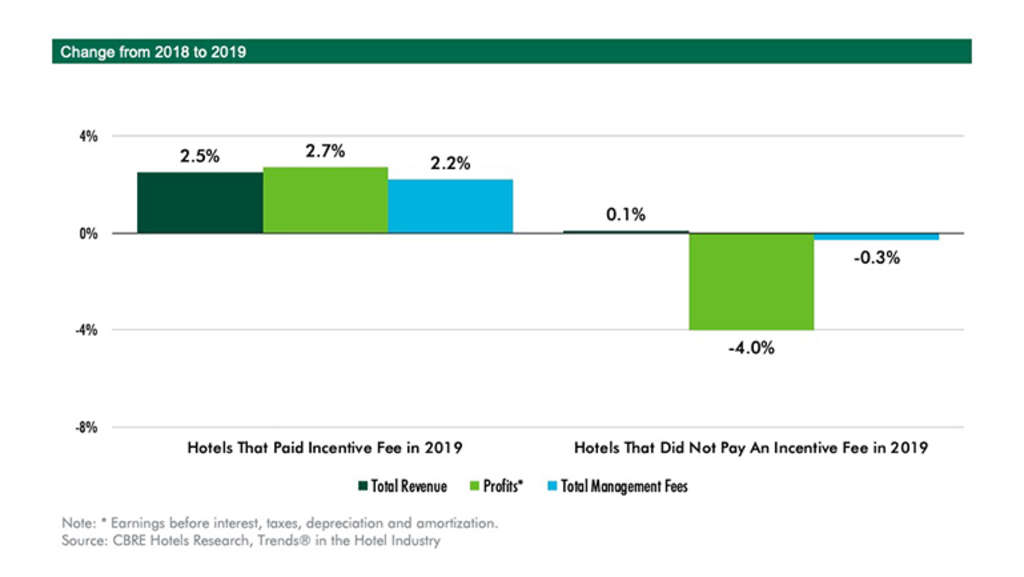

Analyzing data from 2019, it appears that incentive fees reward operators who improve profitability. Hotel operators who paid an incentive fee in 2019 enjoyed increases in both revenues (2.5%) and profits (2.7%). Conversely, operators who did not pay an incentive fee in 2019 saw an increase in revenue of just 0.1% and suffered a 4.0% decline in profits.

2020

To monitor the fluid market conditions created by COVID, CBRE began to track monthly summary operating data in 2020. That allowed us to analyze total management fee trends during the year, but not the incentive fee component.

During the year, the CBRE monthly sample suffered a decline in revenue of 57.6%, and a profit falloff of 107.6%. Therefore, it is not surprising the total management fee payments fell by 58.3%.

With management fee payments decreasing at roughly the same pace as revenues, management fees averaged 2.8% in both 2019 and 2020. This trend held true for all property types in 2020 except convention hotels. Because of the absence of group demand, convention hotels suffered the greatest declines in revenues (-70.8%) and profits (-149.0%) during the year. Accordingly, management fees as a percent of revenue dropped from 3.1% in 2019 to 2.5% in 2020. Clearly, the owners and operators of the nation's convention hotels shared in the financial stress of 2020.

Will Incentive Fees Work in 2021?

In 2020, operators did institute significant cost cutting measures that helped limit the magnitude of the profit declines during the year. Going forward, we anticipate owners will put pressure on management to maintain these operating efficiencies. Expect to see improved profit margins in the near term, but profit levels may not be sufficient to trigger the payment of incentive fees.