Market Snapshot: Asia Pacific 2021

Transactions in the Asia Pacific

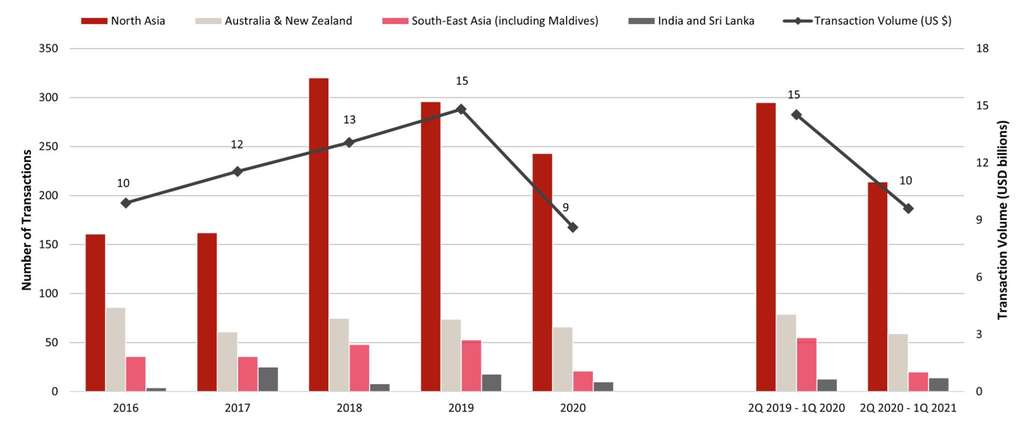

In 2020, transaction activity in the Asia Pacific took a hit from the new high in 2019, achieving a transaction volume of approximately US $8.6 billion worth of hospitality assets, indicating a 41.8% decline year on year. Similarly, from 2Q 2020 to 1Q 2021, transaction activity in the Asia Pacific has continued to slow down. Despite the slow-moving transaction activity, growing interest in hospitality assets continues to be observed in regions such as Australia & New Zealand, China, Japan, South Korea, Taiwan, and certain markets in the South-East Asia regions.

The slowdown is mainly attributed to the COVID-19 pandemic, leading to weak market performance and a cautious macro economical outlook with uncertainties. Investment interest is anticipated to pick up in late 2021 and 2022 as investors seize opportunities to tap on the gradual recovery of the tourism sector, albeit with a cautious approach.

Transaction History in the Asia Pacific (2016 - 1Q 2021)

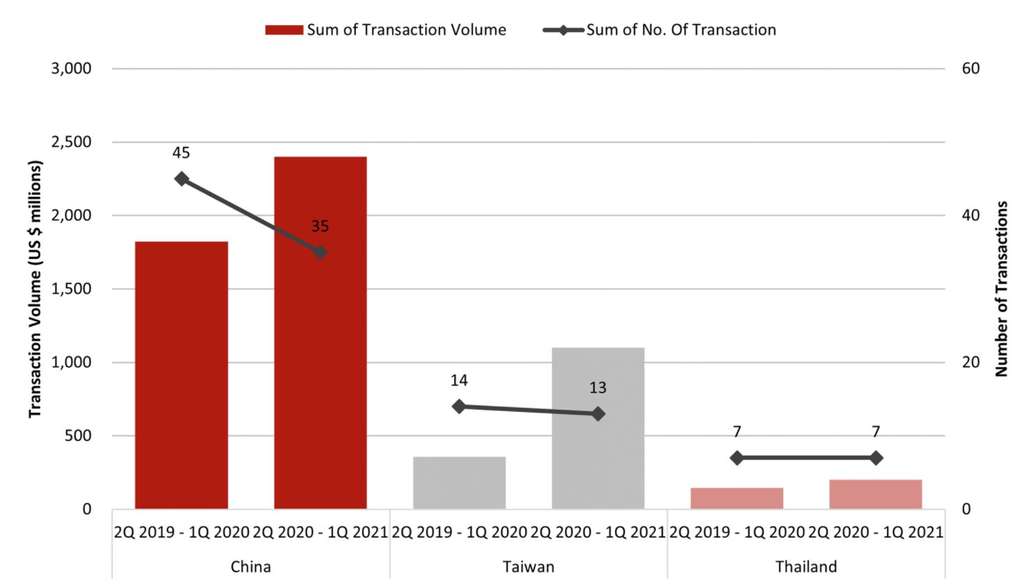

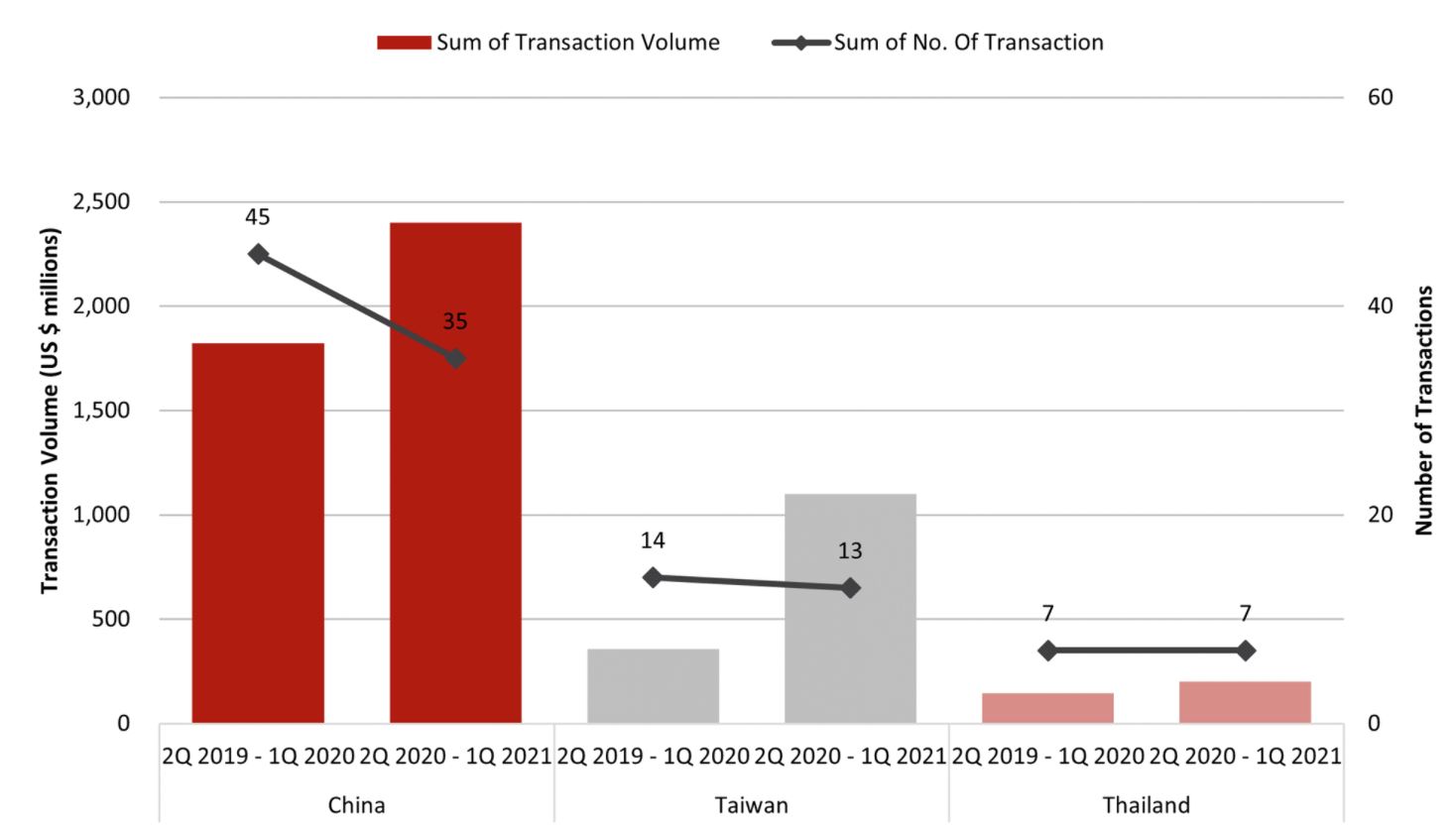

Top Three Most Active Markets (2Q 2020 to 1Q 2021)

While the transaction activity by the number of completed transactions has declined, strong transaction volume for hospitality assets is observed over the last four quarters (2Q 2020 – 1Q 2021) in China, Taiwan, and Thailand. In particular, Taiwan has seen transaction volume tripled from US $0.36 billion to US $1.1 billion with 13 hospitality assets having traded hands. The strong investor appetite is contributed by both local and Chinese investors.

Transaction Volume in Top Three Most Active Markets (2Q 2020- 1Q 2021)

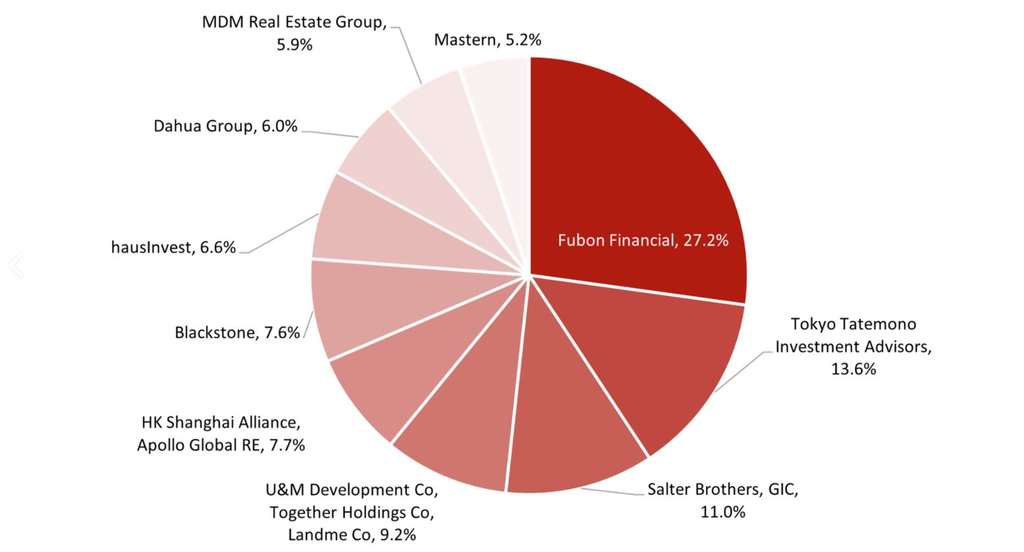

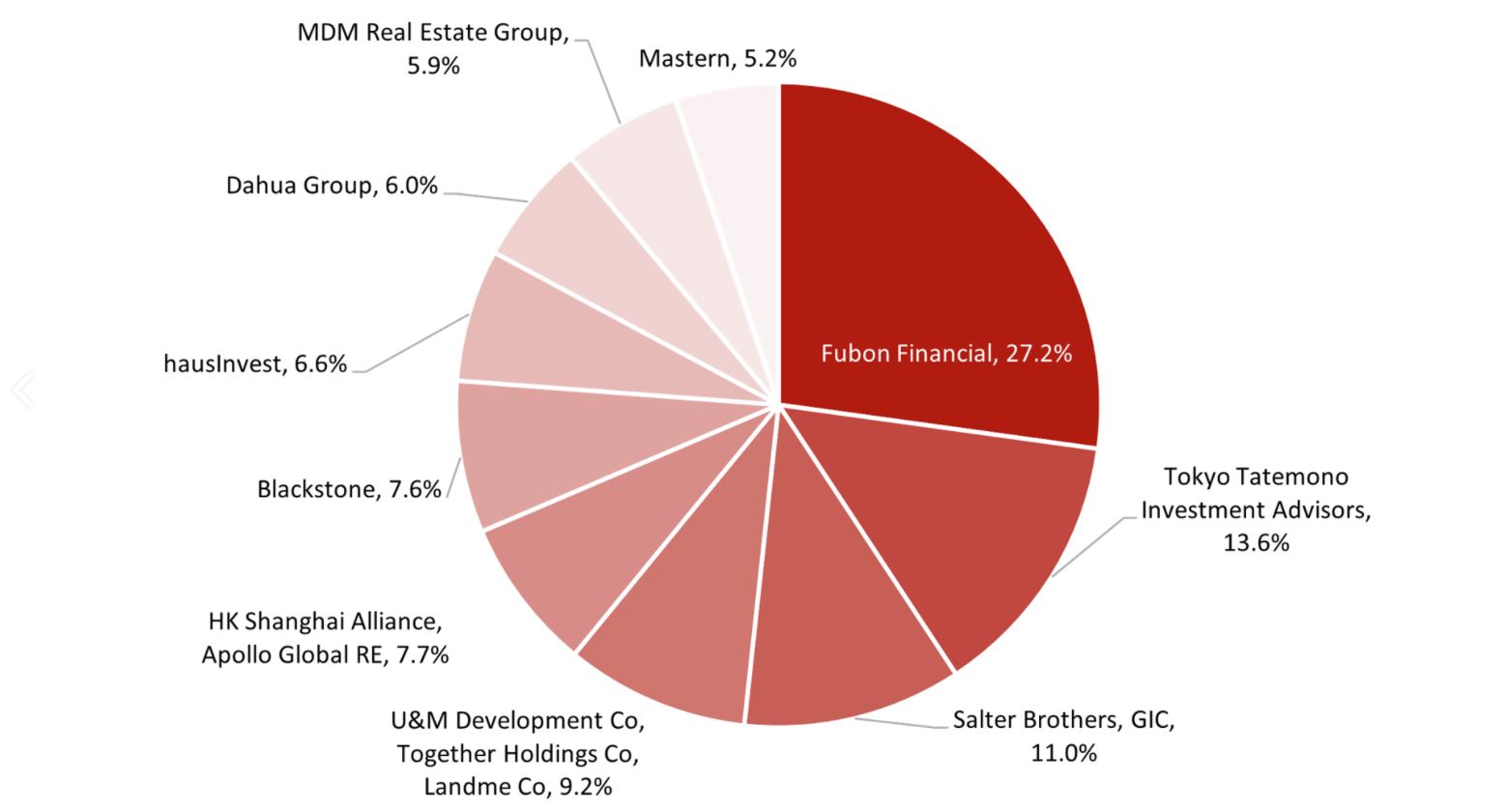

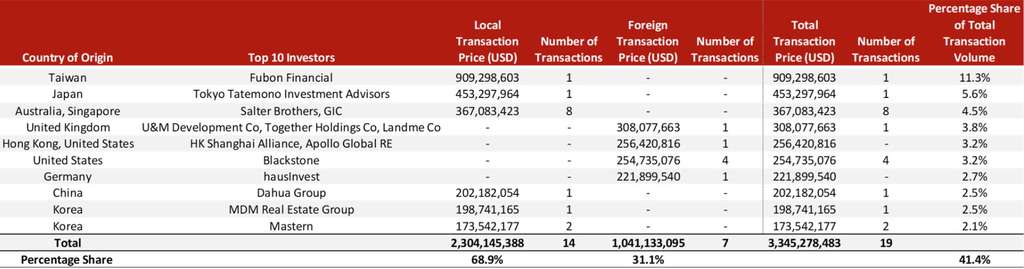

Major Investors in the Asia Pacific

In 2020, transaction activity from the top ten investors in the Asia Pacific accounted for approximately US $3.35 billion or 41.4% of total transaction volume. The majority of the transaction volume by the top ten investors are local investments (investment in the country of origin), representing approximately US $2.3 billion. Despite the coronavirus pandemic, there is an increasing interest from foreign investors. In terms of the transaction activity by the number of transactions, Australia-based Iris Capital tops the list with 17 deals in Australia while Australia-based Salter Brothers and Singapore-based GIC recorded eight in Australia. This is followed by Singapore-based CDL which recorded six in China, Malaysia, and Singapore, Japan-based Daiwa Securities recorded five in Japan, and US-based Blackstone recorded four in China and India.

Top Ten Investors

Transaction Volume by Top Ten Investors in 2020

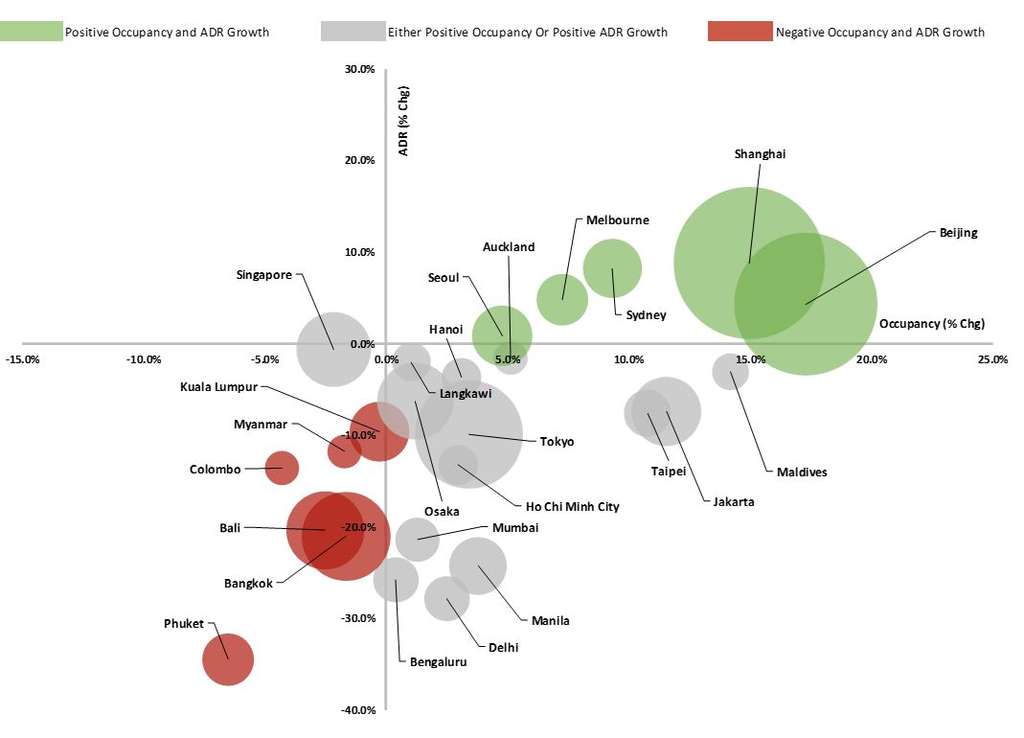

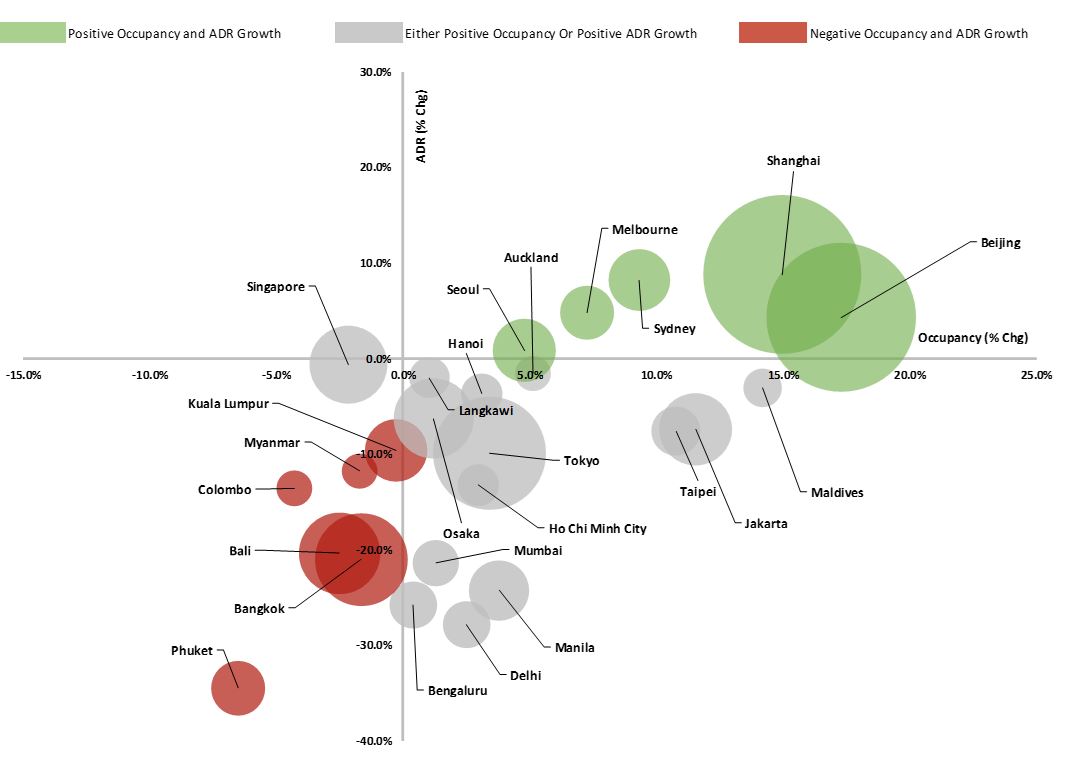

Hotel Performance in the Asia Pacific (2021)

Overall hotel performance across the tracked markets is anticipated to remain subdued from the COVID-19 pandemic impact for 2021. Despite the headwinds, certain markets emerge to be more resilient and rebound faster due to strong domestic travel demand, success in controlling the spread of the coronavirus, and extensive tourism sector support from the government. On the other hand, certain markets face more challenges including prolonging lockdown, travel restrictions, social distancing measures, reliance on international travel demand, and the spike in cases.

The top five least impacted markets are Beijing, Maldives, Shanghai, Sydney and Taipei while the most impacted markets are Bali, Bengaluru, Bangkok, Colombo and Phuket. In general, hotel performance in North Asia is forecasted to improve from the year 2020. The overall sentiment in Myanmar seems to be less bullish due to the aftermath of the military coup. Resort locations will struggle to rebound if the pandemic situation is not well handled within the country, resulting in the loss of both domestic and international travel demand.

Hotel Performance in the Asia Pacific (2021)

To see the full report, please visit : https://www.hvs.com/article/9089-market-snapshot--asia-pacific-2021

Hok Yean CHEE

Managing Partner - HVS

HVS