Is Breakfast the Most Important Meal of the Day?

Commonly, the capacity and style of hotel All Day Dining restaurants is driven by a need to accommodate breakfast demand; however as dining becomes a more compelling differentiator in key markets, this would appear to be an out-of-date metric for F&B design and programming decisions. This article explores the true need for accommodating breakfast demand and proposes an alternate approach for owners to maximize their F&B opportunities in markets where independent competition is strong.

- How strong is breakfast demand among in-house guests?

- What are the opportunity costs of building a space that is designed to prioritize in-house breakfast service?

- How can hotel owners maximize their return on investment in F&B spaces without ignoring the needs of the hotel or the local market?

Hotel Groupings

In each market, the data was segmented into three groups based on a combined evaluation of hotel facilities, positioning, chain scale, and average rate performance. Each group has a minimum of three properties of differing parent brands. The dynamics of each group are detailed later in this article.

- Group One: Economy and Select Service

- Group Two: Midscale to Upscale Full Service

- Group Three: Upper-Upscale and Luxury

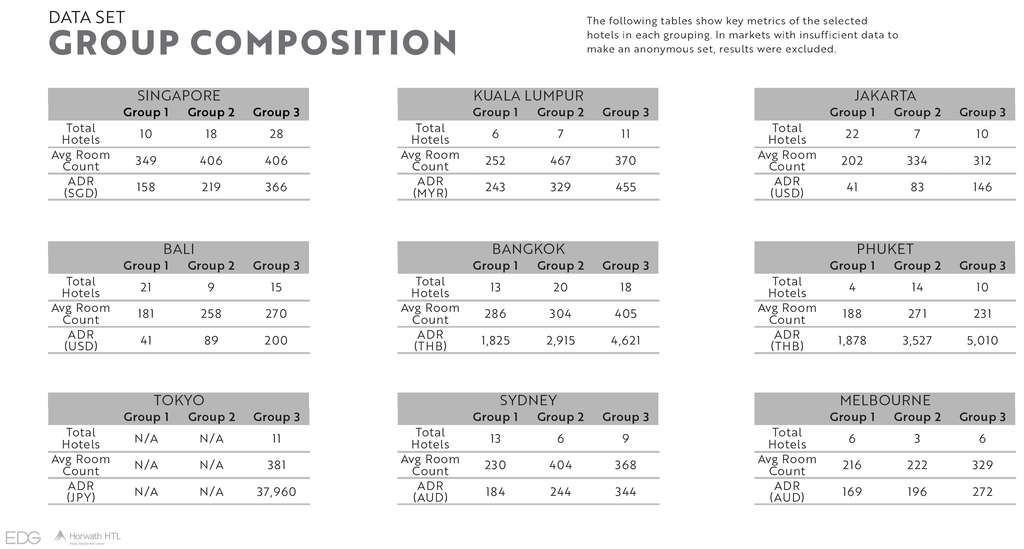

Group Composition

The following tables show key metrics of the selected hotels in each grouping. In markets with insufficient data to make an anonymous set, results were excluded.

Assumptions & Key Metrics

Data Source

Data was extracted from the Horwath HTL Annual Surveys of Operations and represents full year 2018 performance. Although market performance varies from year to year, the metrics in this article are ratios of capture and utilization which are minimally affected by market-wide room performance.

Breakfast Capture Rate

Due to availability of data, capture rate is measured as total ADD covers per guest night. Therefore, the default assumption is that breakfast capture is less than the total ADD capture shown. Horwath HTL and EDG’s combined experience in the industry and with these markets suggests that breakfast represents the single largest source of covers for these restaurants.

Utilization

Utilization is a measure of covers per available seat. The figures in this report represent an annual average utilization ratio per day. Based on interviews with restaurateurs throughout the region and the combined industry experience of Horwath HTL and EDG, average utilization ratio of 1.2 – 1.5 per service is considered a reasonable benchmark for a successful restaurant.

Source Market & Market Mix

Source market and business segment mix are assumed to influence capture and average check for any individual hotel. For example, large group or MICE hotels are likely to have higher ADD capture rates; however, the hotel groupings in this study are sufficiently large or diverse as to represent a reasonable average for each market and segment.

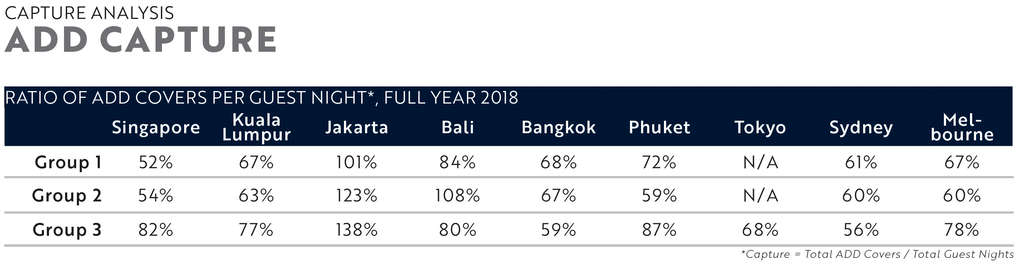

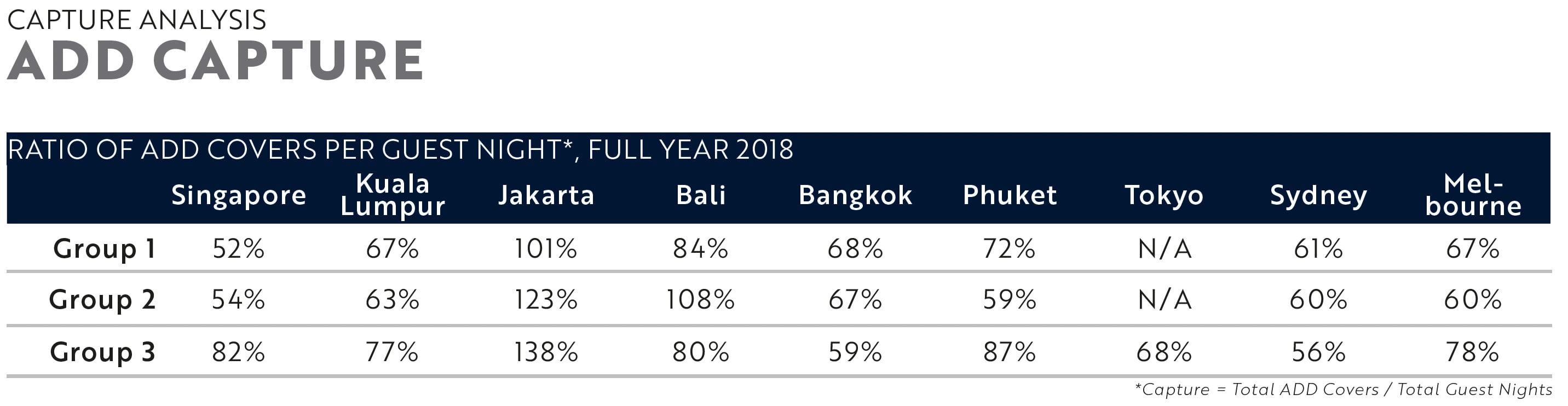

ADD Capture

Breakfast Capture

Most ADD venues struggle to capture a majority of guests

In the majority of markets, total ADD capture rate struggles to break 70%. With a conservative estimate of 10% of total covers represented by lunch demand and 10% represented by dinner, this indicates properties are only capturing about half of their in-house guests for breakfast. Even in properties with high ADD capture, rates rarely break 100%. This suggests that breakfast is not necessarily a critical part of a guest’s stay.

Independent competition

A standard ADD struggles against stand-alone venues

In these key markets, the independent restaurant scene is mature and highly competitive. Guests have plenty of reasons to eat outside the hotel for any of their meals. In many cases, independent venues offer a stronger value proposition, better quality and more variety overall than ADD restaurants. Independent competition is prolific and often easily accessible to guests in the hotels studied.

Breakfast should not drive design

Design should prioritize a market-driven concept

With a relatively low proportion of guests buying breakfast and many of those doing so as part of their room rate, there is little justification for designing a venue that actively targets breakfast demand. Brand standard programming criteria often mandates a ratio of ADD seats per room, to ensure ample breakfast capacity; however, there are opportunities to revise these expectations based on this data.

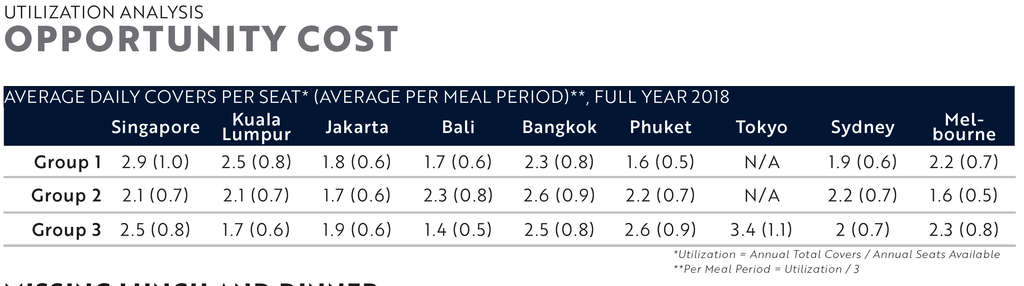

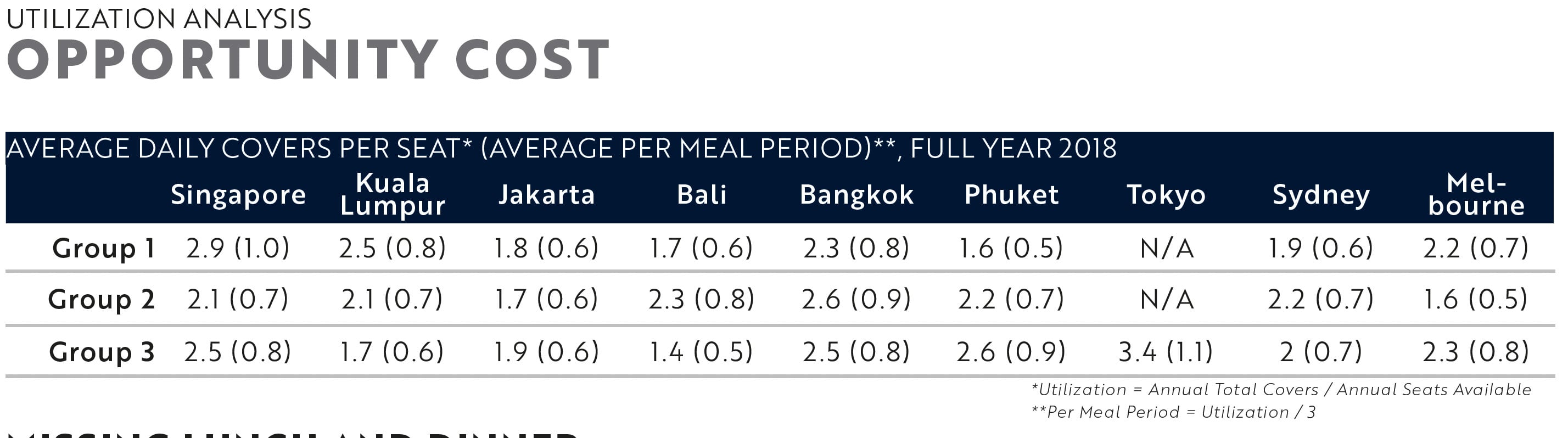

Opportunity Cost – Utilization Analysis

Missing Lunch and Dinner

Capacity comes at the cost of an engaging, stand-alone experience, so Guests go elsewhere

Utilization rates across the data set are low, by independent restaurant standards. Healthy, average utilization for an independent venue is between 1.2 and 1.5 per meal period, with peaks reaching as high as 2.0. Hotel averages fall well below those benchmarks. Assuming that a majority of ADD utilization is breakfast, the lunch and dinner utilization is even lower than the average shown.

Traditional ADD concepts and designs are clearly unable to compete in markets with a developed independent dining scene. If the strategy and drive behind three-meal restaurants focused more on maximizing other meal periods, hotel venues could increase capture and utilization, compared to a traditional model.

Independent Restaurant Utilization Benchmark

In most cases, a restaurant should be turning its seats at a weekly average rate of 1.2 - 1.5 times per meal period to be considered successful. This average will be comprised of peaks as high as 1.8 - 2.0, but it relies predominately on keeping a consistent base of demand throughout the week. A successful, independent restaurant has very few 0.4 - 0.7 turn meal periods.

- 1.2 Weekly average turns per meal period, independent restaurants

- 1.8 - 2.0 Peak turns per meal period, independent restaurants

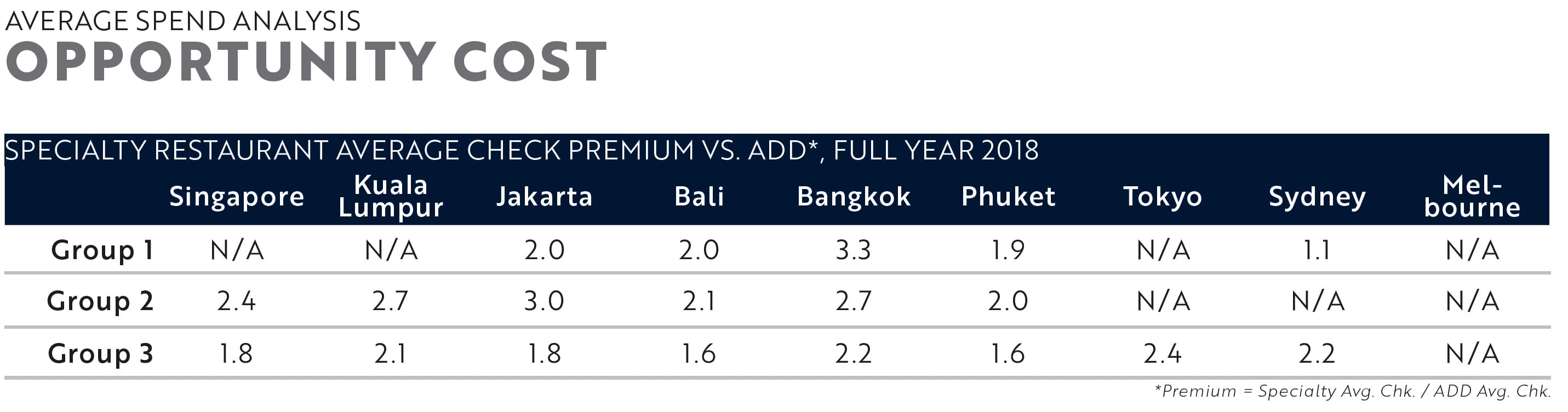

Opportunity Cost – Average Spend Analysis

Low spend, low value

Add venues do not effectively capture premium average check and beverage spend

Average check at specialty Asian and western restaurants in these same hotels is commonly between 1.5 and 3.0 times higher than in ADD venues. This difference is exaggerated by the fact that ADD averages must include breakfast; however, such a significant difference reinforces the conclusion that ADD venues cater predominantly to breakfast demand. If these venues shifted their focus to higher value meal periods, average spend would increase along with capture.

Beverage revenue also represents a significantly higher proportion of total, for specialty venues. This drives profitability for the specialty venues and represents a clearly missed opportunity to leverage value on the space and investment of a traditional ADD restaurant.

Food vs. Beverage Split, 2018 All Markets

ADD Restaurants

Flexibility is the Future

Don’t build for breakfast

A competitive, stand-alone venue can still serve breakfast

Considering the low capture, utilization, and spend, there is little commercial justification to develop restaurants that prioritize breakfast service. The strategy of building ADD restaurants based on a fixed and dated ratio to rooms consistently yields under-performing restaurants. This is costs owners in development expenses and lost opportunities to create more compelling F&B.

Overbuilt, buffet-focused restaurants will always struggle to compete with compelling, independent concepts in the market. This results in wasted investment and operating cost. Instead of focusing on peak breakfast demand, create restaurants that cater to average demand levels but can be flexible and dynamic.

Focused concepts working together

A Design and concept strategy that allows for peak demand

Many hotels have large spaces dedicated to ADD restaurants, but this doesn’t mean the whole venue must be a single dining room or concept. With the right design and strategy, multiple concepts can be joined into a single dining room to serve high volume breakfast then separate to act as unique, independent venues for lunch and dinner. This way, the complete space is not crippled by the sole needs of the least valuable meal period.

A compelling, independent concept can always serve breakfast, but a breakfast restaurant will struggle to attract lunch and dinner demand.

COVID as the Catalyst

A Lot Has Changed, Why Go Back?

Although the classic buffet may well return, especially to certain hotels and certain markets, Covid has caused the industry to ask “what’s next for buffets?” From guest preferences to health and safety concerns, there are many arguments for exploring modern, dynamic ways to address breakfast service.

The data here shows quite clearly that in key markets the traditional model is not successful for lunch and dinner. It also suggests that investing in a large restaurant just for catering to breakfast demand is not necessary or commercially appealing in these cases. This is an opportunity to shift the paradigm and start approaching hotel F&B with a stronger, independent mindset.

Design Case Study

Chinese National

Swissotel Jakarta PIK Avenue

Background

The Chinese National functions as the property’s three-meal restaurant; however, it can be functionally separated into four separate venues, each with a unique, but related, concept.

- Paperduck: A BBQ venue specializing in Peking duck

- Black Powder Red: A Sichuan specialty concept

- Iron Needle: A noodle and dimsum concept

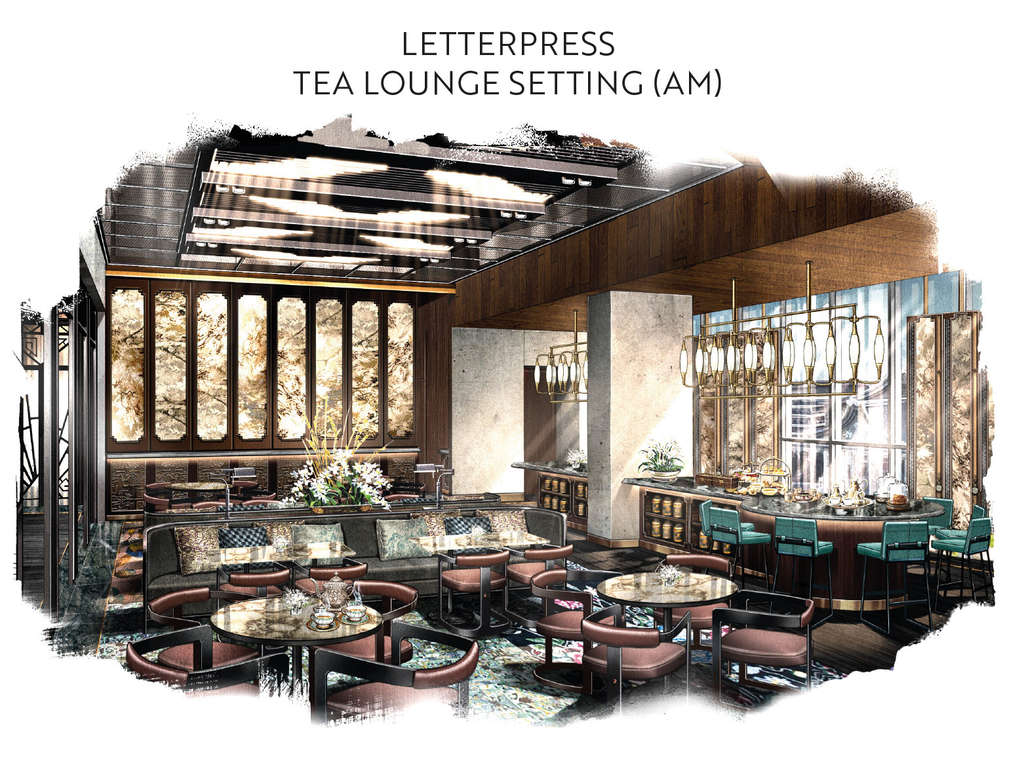

- Letterpress: A tea house that transitions to a cocktail bar

The concept and design was of each room was created with a unique identity but allows them to function as a single, cohesive venue, when necessary. Each room can flex from strong independent venue to functional ADD space.

Necessary buffet components for breakfast become specialty kitchens, allowing both functions to effectively serve throughout the space. Guests can move from one room to the next when the spaces are opened, but each concept has a dedicated entry for lunch and dinner service.

Articulated components conceal or reveal elements of the space that allow it to transition from a luxurious tea lounge to a intimate cocktail bar. The success of each concept depends on the operator’s ability to create two intimate, unique, and purposeful experiences. To simply serve new different beverages in the same space would not achieve the same effect.

Letterpress Tea Lounge setting (AM)

Letterpress Cocktail bar setting (PM)

Concept Case Study

Pastore

Hotel Chadstone Melbourne, Mgallery by Sofitel

Celebrity Chef Concept

Priority on lunch and dinner does not eliminate breakfast capability

Pastore was created in partnership with well-known Melbourne chef Scott Pickett. The venue was designed and developed with the priority of creating a beautiful and compelling space that brings the wood-fire Italian concept to life for lunch and dinner.

This approach does not preclude the hotel from effectively using the restaurant for breakfast. However, if the concept and design focused on a high-volume hotel breakfast service, the venue would not have secured a celebrity partnership or the critical acclaim it enjoys today.

During peak demand periods, the property is able to extend the breakfast seating and ambient buffet into the adjoining lobby lounge area. This keeps the size of the permanent restaurant more manageable, intimate, and focused.